Global Personal Gadget Insurance Market Size, Share, and COVID-19 Impact Analysis, By Gadget Type (Smartphones, Tablets, Laptops, and Wearable Devices), By Distribution Channel (Online, Retail, and Agent/Broker), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Personal Gadget Insurance Market Insights Forecasts to 2033

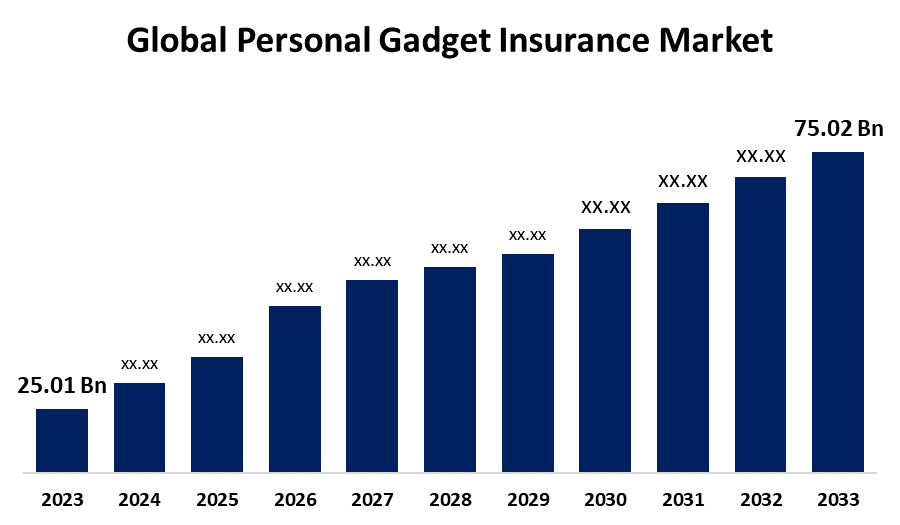

- The Global Personal Gadget Insurance Market Size was Valued at USD 25.01 Billion in 2023

- The Market Size is Growing at a CAGR of 11.61% from 2023 to 2033

- The Worldwide Personal Gadget Insurance Market Size is Expected to Reach USD 75.02 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Personal Gadget Insurance Market Size is anticipated to exceed USD 75.02 Billion by 2033, growing at a CAGR of 11.61% from 2023 to 2033.

Market Overview

Personal Gadget Insurance is a sort of insurance policy that secures or protects policyholder's devices such as laptops, cameras, tablets, and watches or wearables in response to accident-related damages such as theft, accident, and loss, allowing customers to get them repaired or replaced. Coverage for electronic devices is crucial for consumers and companies that depend on technology because it protects against monetary losses brought on by a range of risks, including unintentional damage, malfunctions, and other unforeseen hazards that could affect how well electronic devices work. To meet the growing demand from consumers for portable tech security, major players in the personal gadget insurance market are implementing coverage for software issues, which refers to protection against problems with mobile phone software, such as viruses and malware. This is by the most recent trends in the market. Additionally, people around the world are becoming more concerned about the protection of their key personal gadgets from many forms of threats such as unauthorized use, liquid damage, physical damage, software-related issues, virus assaults, theft, and unintentional harm. The frequency of occurrences such as theft, loss, and device hacking has increased in recent years, increasing the necessity for personal device coverage and mobile device insurance.

Report Coverage

This research report categorizes the global personal gadget insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global personal gadget insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global personal gadget insurance market.

Global Personal Gadget Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 25.01 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 11.61% |

| 2033 Value Projection: | USD 75.02 Billion |

| Historical Data for: | 2021-2022 |

| No. of Pages: | 256 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Gadget Type, By Distribution Channel, By Regional |

| Companies covered:: | Liberty Mutual, SquareTrade, Markel, AIG, Assurant, Travelers, Allianz, Chubb, CNA Financial, MetLife, Hiscox, Nationwide, Zurich, Berkshire Hathaway, Others, and |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The global personal device insurance market is therefore expected to grow over the projected period due to a rise in initiatives by international mobile insurance firms as well as an increase in unintentional damage and phone theft events worldwide. Mobile devices were the target of a startling 9% of all cyberattacks worldwide in 2022. More than 2.2 million of these attacks had affected users globally by December of that year. Approximately 440,000 malicious installation packages were found on mobile devices worldwide in the final quarter of 2023. These alarming figures highlight the growing demand for personal device insurance. Protecting personal devices from harm, loss, and illegal access has never been more important due to the surge in cyber dangers, which has increased demand for comprehensive gadget insurance plans. Additionally, 5.52 billion people worldwide, or 67.5 percent of the world's population, were internet users as of the beginning of October 2024. Physical and technical problems impacting personal gadgets are on the rise in tandem with the growing number of internet and smartphone users worldwide. The need for personal gadget insurance has increased dramatically as a result of this usage boom, as people look to safeguard their priceless gadgets against possible losses and damages.

Restraints & Challenges

Excessively strict regulations may frustrate lawful policyholders by making the claims process difficult. To remain ahead of changing fraudulent practices and provide their clients with a seamless and effective claims experience, insurers must constantly improve their fraud prevention strategies.

Market Segmentation

The global personal gadget insurance market share is classified into gadget type and distribution channel.

- The smartphone segment is expected to hold the largest share of the global personal gadget insurance market during the forecast period.

Based on gadget type, the global personal gadget insurance market is categorized as smartphones, tablets, laptops, and wearable devices. Among these, the smartphone segment is expected to hold the largest share of the global personal gadget insurance market during the forecast period. Smartphones have a prominent role because of their widespread use and high replacement costs, which greatly increase market income. Additionally, tablets are becoming more and more popular, particularly for remote work and in educational settings, which emphasizes the necessity for insurance as their use increases.

- The online segment is expected to grow at the fastest CAGR during the forecast period.

Based on the distribution channel, the global personal gadget insurance market is categorized as online, retail, and agent/broker. Among these, the online segment is expected to grow at the fastest CAGR during the forecast period. The convenience that online distribution provides to customers has led to its significant growth, which is indicative of the insurance industry's shift to digital solutions.

Regional Segment Analysis of the Global Personal Gadget Insurance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global personal gadget insurance market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global personal gadget insurance market over the forecast period. Growing disposable income, shifting lifestyles, increased knowledge of the advantages of device insurance, and the existence of several major players in the market are all predicted to contribute to the growth of the personal gadget insurance market share in the area. For example, Amtrust, Assurant Inc., Apple Inc., and Asurion Group Inc. are launching cutting-edge and reasonably priced protection plans for their clients. A multi-year extension of Assurant Inc.'s long-standing partnership with T-Mobile to continue offering complete mobile device protection solutions was announced in September 2022.

Asia Pacific is expected to grow at the fastest CAGR growth of the global personal gadget insurance market during the forecast period. A large percentage of the world's population lives in the Asia-Pacific area, and smartphone adoption rates have been rising in nations like China, India, and Korea. To safeguard these priceless gadgets against potential hazards like theft, loss, and accidental damage, the demand for insurance coverage has increased as more people in the area purchase smartphones. Additionally, the area has seen a rise in the middle class and quick economic development, which has increased discretionary incomes. As a result, more people now buy expensive smartphones, which are more likely to require replacement and repair. As a result, Asia-Pacific customers are realizing how important it is to have gadget insurance to protect their large investments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global personal gadget insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Liberty Mutual

- SquareTrade

- Markel

- AIG

- Assurant

- Travelers

- Allianz

- Chubb

- CNA Financial

- MetLife

- Hiscox

- Nationwide

- Zurich

- Berkshire Hathaway

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In October 2022, AppleCare+ was introduced to reduce the financial risks associated with incidents involving devices and to provide consumers with safety in a world that is becoming more and more digitally oriented. It offers a one-year guarantee and 90 days of technical support along with the option to purchase extended-term service plans.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global personal gadget insurance market based on the below-mentioned segments:

Global Personal Gadget Insurance Market, By Gadget Type

- Smartphones

- Tablets

- Laptops

- Wearable Devices

Global Personal Gadget Insurance Market, By Distribution Channel

- Online

- Retail

- Agent/Broker

Global Personal Gadget Insurance Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global personal gadget insurance market over the forecast period?The global personal gadget insurance market size is expected to grow from USD 25.01 billion in 2023 to USD 75.02 billion by 2033, at a CAGR of 11.61% during the forecast period 2023-2033. \

-

2. Which region is expected to hold the highest share of the global personal gadget insurance market?North America is projected to hold the largest share of the global personal gadget insurance market over the forecast period.

-

3. Who are the top key players in the global personal gadget insurance market?Liberty Mutual, SquareTrade, Markel, AIG, Assurant, Travelers, Allianz, Chubb, CNA Financial, MetLife, Hiscox, Nationwide, Zurich, Berkshire Hathaway, and others.

Need help to buy this report?