Global Pet Food Packaging Market Size By Material (Paper & Paperboard, Plastic, Metal, Others), By Product (Cans, Bags & Pouches, Folding Cartons, Plastic Bottles & Jars, Others), By Region, And Segment Forecasts, By Geographic Scope And Forecast 2022 to 2032

Industry: Food & BeveragesGlobal Pet Food Packaging Market Insights Forecasts to 2032

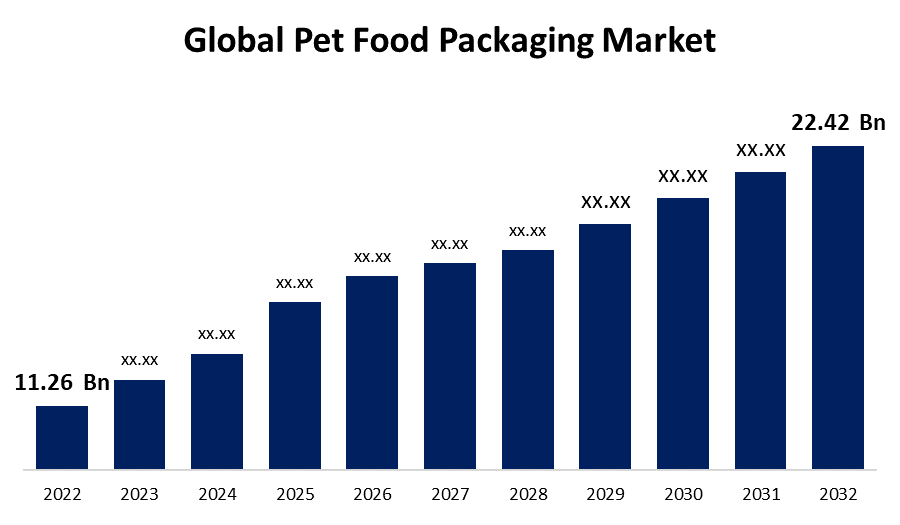

- The Pet Food Packaging Market Size was valued at USD 11.26 Billion in 2022.

- The Market is growing at a CAGR of 6.3% from 2022 to 2032

- The Global Pet Food Packaging Market Size is expected to reach USD 22.42 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Pet Food Packaging Market Size is expected to reach USD 22.42 Billion by 2032, at a CAGR of 6.3% during the forecast period 2022 to 2032.

More people are willing to spend more money on premium and high-quality pet food products. As a result, there is now a desire for packaging that accurately reflects the high quality of the content. Packaging frequently highlights aspects like freshness, nutritional information, and specific health benefits of the pet food as a result of the increased focus on pet health. Like many other industries, the pet food sector is reacting to the pressure for sustainability on a worldwide scale. The use of environmentally friendly materials, recyclable packaging, and minimal environmental effect are examples of this. Demands for packaging have changed as a result of the surge in online pet food sales, with a stronger emphasis now being placed on robustness to resist shipping and eye-catching designs to stand out in a digital marketplace. Key market drivers include improvements in packaging materials, such as barrier technologies that preserve freshness and increase shelf life.

Pet Food Packaging Market Price Analysis

Costs are heavily impacted by the material choice for packing. Eco-friendly or specialised materials can also have an impact on overall costs. Traditional materials like plastic, paper, and metal may come in a variety of pricing ranges. Although the initial expenses of packaging with sustainable or eco-friendly elements may be slightly higher, firms may view them as an investment in satisfying consumer demand for products that care about the environment. Brands frequently spend money on personalised packaging to set themselves apart. Branded graphics, logos, and other components may be included in this, raising the entire cost. The competition in the market might affect pricing. Brands may modify their packaging strategies in a highly competitive market to maintain their competitiveness. Fluctuations in the price of raw materials, transportation expenses, and other aspects of the supply chain might affect overall pricing.

Pet Food Packaging Market Opportunity Analysis

Consider prospects in e-commerce packaging as the demand for pet food online increases. Durable and practical packing, for example, could be in demand as a solution to improve the shipping and delivery experience. Calculate the pet food industry's overall growth. Examine the buying patterns for pet items, the trends in pet ownership, and the demand for specialised or luxury pet feeds. Market expansion suggests possible business prospects for packaging vendors. Look at packaging options for pet food that reflect current trends in health and wellness. This might involve packaging that places an emphasis on freshness, nutritional details, and features that improve pets' general wellbeing. Opportunities might be found in offering packaging options that assist brands in adhering to changing legal requirements. Innovative labelling and safety features may be part of this.

Global Pet Food Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 11.26 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.3% |

| 2032 Value Projection: | USD 22.42 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Material, By Product, By Region, And Segment Forecasts, By Geographic Scope |

| Companies covered:: | Amcor Limited, American Packaging Corporation, Berry Plastics, Constantia Flexibles, Crown Holdings, Huhtamaki Flexible Packaging, Mondi Group, ProAmpac, Sonoco Products, WINPAK LTD, and Other key vendors |

| Growth Drivers: | Growth in pet population has increased pet dietary choices |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Pet Food Packaging Market Dynamics

Growth in pet population has increased pet dietary choices

There is an increasing need for pet food that meets specialised nutritional needs as the pet population grows and becomes more diversified. This contains specific diets for various breeds, stages of life, and medical issues. Clear communication of these special qualities and advantages must be made on packaging. Pet owners are prepared to spend more on luxury pet food because they consider their animals to be members of the family. This tendency of premiumization extends to packaging, where there is a need for visually appealing, educational, and frequently creative packaging solutions. The desire for pet food that not only tastes good but also improves the wellbeing of pets has grown as pet health and wellness have come to the forefront of public consciousness. Nutritional information and ingredient quality are communicated through packaging in an essential way. Packaging standards have changed in response to the growth of online pet food sales. To stand out in the digital marketplace, firms frequently spend in aesthetically appealing designs for their packaging, which must be durable enough to withstand shipment and storage.

Restraints & Challenges

Stringent food packaging regulation by governments

To prevent contamination and ensure that packaging does not pose any health risks to pets, governments adopt safety guidelines for pet food packaging materials. Regulations governing the acceptable sorts of materials and how well they adhere to safety standards are part of this. There are approval procedures in place by several governments for packaging materials used in pet food. This guarantees that the materials adhere to strict safety and quality standards and do not leak dangerous elements into the food. Governments may require pet food packaging to follow quality control and testing protocols. This includes the need to put packaging materials through safety and standard compliance tests. Inspections and audits are carried out by regulatory bodies to make sure pet food producers and packaging suppliers adhere to the rules.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Pet Food Packaging market from 2023 to 2032. Pet humanization, the practise of treating animals as members of the family, has raised demand for premium pet food and, as a result, creative packaging techniques. North American pet owners are willing to spend money on high-end and specialised pet food products. This trend also applies to packaging, where there is a need for aesthetically pleasing, practical, and educational packaging that conveys the high quality of the pet food. In North America, there is a big emphasis on pet wellness and health. Pet food packaging is crucial in informing the health-conscious pet owner about the nutritional value, health advantages, and compatibility for particular medical problems.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. Due to urbanisation, changing lifestyles, and a rising middle class, pet ownership has significantly increased in the Asia Pacific region. Pet food products are now in greater demand, which has also increased demand for pet food packaging. The different demands for pet food items and packaging are influenced by the various cultures and consumer preferences found throughout Asia Pacific countries. Packaging solutions must take into account the distinct preferences and needs of various markets within the region. The market for pet food packaging in Asia Pacific has been significantly impacted by the growth of e-commerce. Changes in packing regulations have resulted from the ease of online buying, with an emphasis on strong, appealing packaging that maintains product integrity during shipping.

Segmentation Analysis

Insights by Material

The Plastic segment accounted for the largest market share over the forecast period 2023 to 2032. The rising demand for pet food, which inevitably results in a need for effective and affordable packaging, is one factor contributing to the expansion in the plastic market. Customers frequently seek out packaging that keeps pet food fresh, and plastic offers a decent barrier to moisture and air. Additionally, it is lightweight, making handling and transportation simpler. There is a push for more environmentally friendly packaging solutions as environmental challenges are becoming more widely known. Innovations in the plastic industry, such the use of recycled resources or the creation of biodegradable plastics, may result from this.

Insights by Product

Cans application segment is witnessing the fastest market growth over the forecast period 2023 to 2032. Cans are renowned for their outstanding ability to preserve the nutritional value and freshness of pet food. By establishing a sealed environment, they shield the contents from outside influences like air and light. This is particularly important for preserving the standard of pet food and making sure that our furry friends receive the optimum nutrients. Convenience is important. Cans are a popular choice for pet owners since they are simple to open and use. Another benefit is the ability to reseal cans, which enables portion control and maintains the freshness of the remaining food for subsequent servings. A number of factors, including their effectiveness in storing pet food, convenience for pet owners, and their association with premium goods, have contributed to the expansion of the cans market.

Recent Market Developments

- In November 2022, Sonoco, a leader in diversified packaging on a global scale, has increased Sonopost cornerpost production in Europe.

Competitive Landscape

Major players in the market

- Amcor Limited

- American Packaging Corporation

- Berry Plastics

- Constantia Flexibles

- Crown Holdings

- Huhtamaki Flexible Packaging

- Mondi Group

- ProAmpac

- Sonoco Products

- WINPAK LTD

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Pet Food Packaging Market, Material Analysis

- Paper & Paperboard

- Plastic

- Metal

- Others

Pet Food Packaging Market, Product Analysis

- Cans

- Bags & Pouches

- Folding Cartons

- Plastic Bottles & Jars

- Others

Pet Food Packaging Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Pet Food Packaging Market?The global Pet Food Packaging Market is expected to grow from USD 11.26 Billion in 2023 to USD 22.42 Billion by 2032, at a CAGR of 6.3% during the forecast period 2023-2032.

-

Who are the key market players of the Pet Food Packaging Market?Some of the key market players of market are Amcor Limited, American Packaging Corporation, Berry Plastics, Constantia Flexibles, Crown Holdings, Huhtamaki Flexible Packaging, Mondi Group, ProAmpac, Sonoco Products and WINPAK LTD.

-

Which segment holds the largest market share?Plastic segment holds the largest market share and is going to continue its dominance.

-

Which region is dominating the Pet Food Packaging Market?North America is dominating the Pet Food Packaging Market with the highest market share.

Need help to buy this report?