Global Petrochemical Market Size, Share, and COVID-19 Impact Analysis, By Type (Ethylene, Propylene, Methanol, Xylene, and Others), By End-Use Industry (Packaging, Electronics, Construction, Automotive, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Petrochemical Market Insights Forecasts to 2033

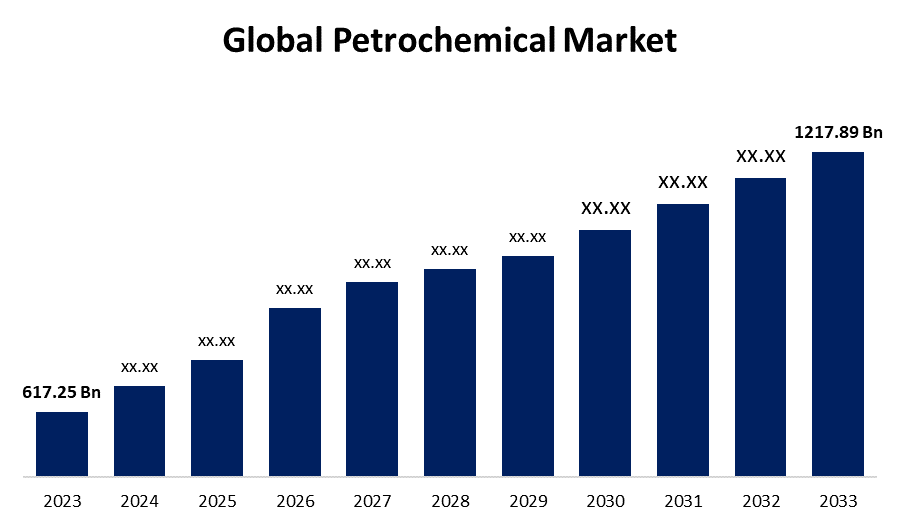

- The Global Petrochemical Market Size was Valued at USD 617.25 Billion in 2023

- The Market Size is Growing at a CAGR of 7.03% from 2023 to 2033

- The Worldwide Petrochemical Market Size is Expected to Reach USD 1217.89 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Petrochemical Market Size is Anticipated to Exceed USD 1217.89 Billion by 2033, Growing at a CAGR of 7.03% from 2023 to 2033.

Market Overview

Petrochemicals are chemicals made from petroleum gas or natural gas. They are an important aspect of the chemical industry since they drive up demand for synthetic materials and play a significant role in today's society and economy. Petrochemicals produce regular products such as furniture, appliances, electronics, solar power panels, plastics, medications, cosmetics, and wind turbines. The petrochemical sector is an essential component of many industrial processes since it supplies raw ingredients for a wide range of consumer products used in automobile, construction, and manufacturing. Petrochemical-derived categories include tires, detergents, industrial oil, fertilizers, plastics, and medical devices. Petrochemical-derived basic chemicals and polymers serve as the foundation for a wide range of non-durable and long-lasting consumer products. Petrochemical products include benzene, ethylene, propylene, and monomers used to make synthetic rubber. They also incorporate technological carbon inputs. Those products have become popular over the years due to their economic stability and affordability. The electrical and electronics industries depend significantly on petrochemical materials to create a wide range of products, including CD players, telephones, radios, computers, and televisions. Petrochemical products provide superior electrical insulation and safety, safer design, data storage, ease of assembling, and a high potential for downsizing. Additionally, In April 2007, the Government of India (GoI) launched the Petroleum, Chemicals, and Petrochemicals Investment Region (PCPIR) program to promote investment in the CPC industry and position India as a manufacturing powerhouse for domestic as well as international markets.

Report Coverage

This research report categorizes the market for the petrochemical market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the petrochemical market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the petrochemical market.

Global Petrochemical Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 617.25 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.03% |

| 2033 Value Projection: | USD 1217.89 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 254 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End-Use , By Region |

| Companies covered:: | Dow, BASF SE, Mitsubishi Chemical Holding Corporation, Chevron Corporation, ExxonMobil Corporation, Royal Dutch Shell PLC, DuPont de Nemours, Inc., Reliance Industries Limited, Indian Oil Corporation Limited, INEOS, Total Energies S.A., SABIC, LyondellBasell Industries Holdings B.V, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving factors

The main driving factors of petrochemicals that are leading to the drop include ongoing technological advancements, linked and shared automobiles, renewable energy substitution, driverless vehicles, and shifting demographics. Increasing demand for polypropylene is expected to propel the petrochemicals market. Polypropylene is used in a wide range of products, including furnishings, autos, and medical equipment. Polypropylene is a common material in the fabrication of various products, including automotive parts, because of its exceptional mechanical properties and moldability.

Restraining Factors

The petrochemical industry is under increasing attention due to environmental concerns such as greenhouse gas emissions, air pollution, and plastic waste. Strict laws and carbon reduction targets may necessitate large investments in emission control systems, sustainability practices, and waste management, and also potentially higher production costs.

Market Segmentation

The petrochemical market share is classified into type and end-use industry.

- The ethylene segment dominated the market with the largest revenue share over the forecast period.

Based on the type, the petrochemical market is categorized into ethylene, propylene, methanol, xylene, and others. Among these, the ethylene segment dominated the market with the largest revenue share over the forecast period. The primary process for generating ethylene is the steam cracking of hydrocarbons generated from natural gas or crude oil, such as ethane, propane, and naphtha. Ethylene is a versatile chemical that has multiple uses. It is a necessary raw material that is utilized in the production of industrial chemicals, textiles, resins, and polymers.

- The packaging segment accounted for the largest revenue share through the forecast period.

The petrochemical market is categorized by end-use industry into packaging, electronics, construction, automotive, and others. Among these, the packaging segment accounted for the largest revenue share through the forecast period. Product demand in the packaging space is driven by the expanding consumer products sector, the rapidly expanding e-commerce market, and the need for robust, lightweight packaging materials. Rising demand for plastic packaging, particularly in food and non-food packaging is accelerating the segment's expansion.

Regional Segment Analysis of the Petrochemical Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

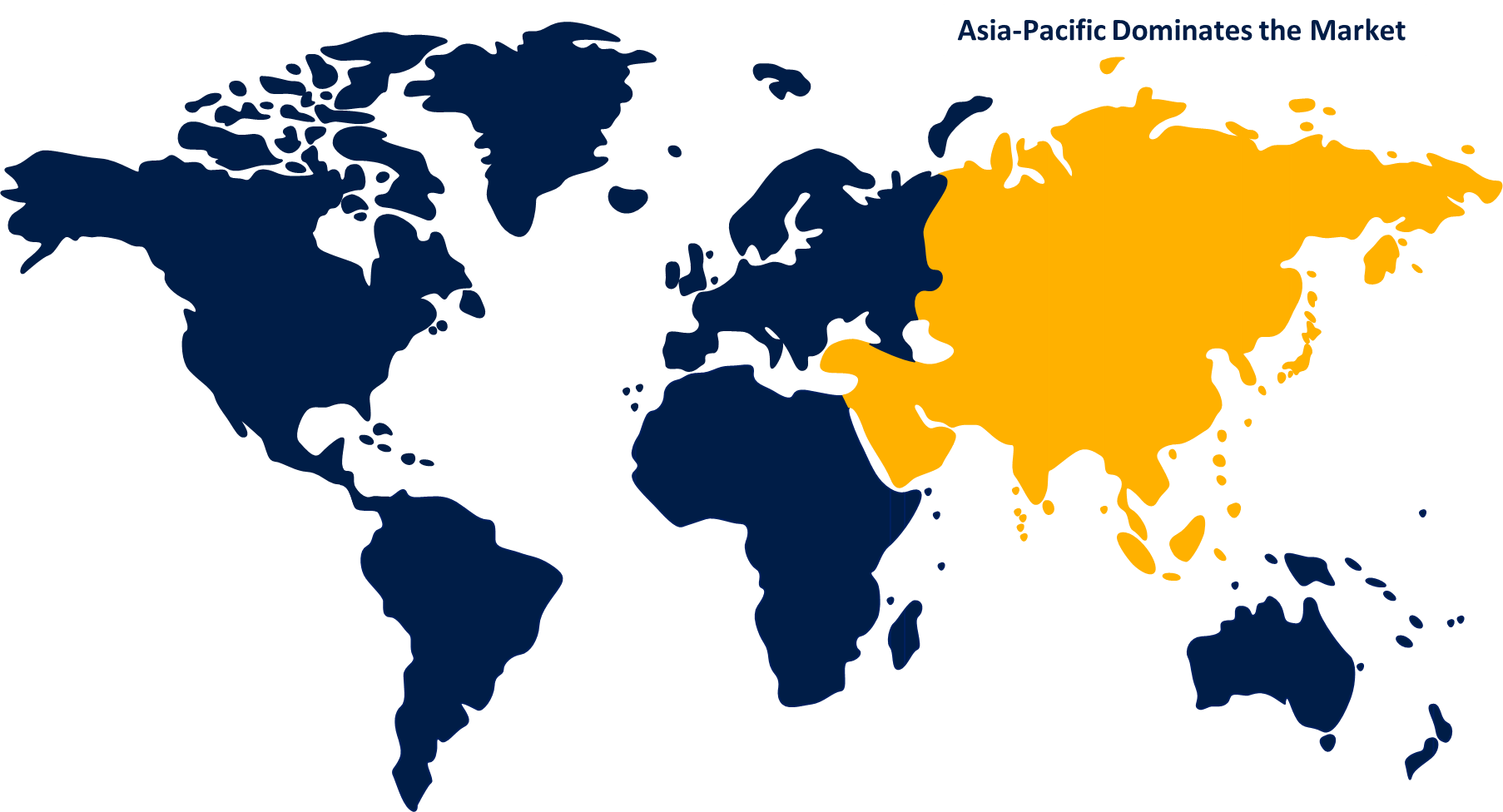

Asia Pacific is anticipated to hold the largest share of the petrochemical market over the predicted timeframe.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the petrochemical market over the forecast period. The segment market's rise can be attributable primarily to the rising chemical industry and an associated increase in polymer demand. Corporations in the Asia Pacific region are focused on non-oil feedstock and gas liquids found naturally. The region's massive market expansion for petrochemicals can be expected by focusing on cost-effectiveness, as the petrochemicals business is too capital-intensive, and pricing can be strategized, resulting in an exponential rise in product sales. The Indian petrochemicals market is experiencing tremendous growth as a result of the country's development and robust expansion in the manufacturing and business sectors, with massive petrochemical corporations deploying capital to improve capacity and technology through private ventures and public sector undertakings.

North America is expected to grow at the fastest CAGR growth in the petrochemical market during the forecast period. Rising shale gas extraction activities in the United States and Canada have had a substantial impact on North America's petrochemicals sector. Shale gas extraction has resulted in an abundant and low-cost supply of feedstock for petrochemical manufacture. This invention opens up the possibility of using shale gas instead of traditional feedstocks such as crude oil and natural gas in the production of various petrochemicals. Petrochemical businesses can lessen their reliance on traditional feedstocks while reaping economic gains from shale gas production. The abundance of shale gas resources in North America has provided favorable conditions for petrochemical producers to increase production capacity and pursue new prospects.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the petrochemical market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dow

- BASF SE

- Mitsubishi Chemical Holding Corporation

- Chevron Corporation

- ExxonMobil Corporation

- Royal Dutch Shell PLC

- DuPont de Nemours, Inc.

- Reliance Industries Limited

- Indian Oil Corporation Limited

- INEOS

- Total Energies S.A.

- SABIC

- LyondellBasell Industries Holdings B.V

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, SABIC Fujian Petrochemicals Co. Ltd, a joint venture of Fujian Fuhua Gulei Petrochemical Co., Ltd. and SABIC Industrial Investment Company, disclosed the establishment of a complex in Fujian's Gulei Industrial Park. SABIC's investment strategy in China has reached another milestone, with a projected investment of USD 6.4 billion.

- In February 2024, BASF introduced ChemCycling in the United States, which converts plastic waste into innovative recyclable building blocks for sustainable products.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the petrochemical market based on the below-mentioned segments:

Global Petrochemical Market, By Type

- Ethylene

- Propylene

- Methanol

- Xylene

- Others

Global Petrochemical Market, By End-Use Industry

- Packaging

- Electronics

- Construction

- Automotive

- Others

Global Petrochemical Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global petrochemical market over the forecast period?The global petrochemical market is to expand at 7.03% during the forecast period.

-

2. Which region is expected to hold the highest share of the global petrochemical market?The Asia Pacific region is expected to hold the largest share of the global petrochemical market.

-

3. Who are the top key players in the petrochemical market?The key players in the global petrochemical market are Dow, BASF SE, Mitsubishi Chemical Holding Corporation, Chevron Corporation, ExxonMobil Corporation, Royal Dutch Shell PLC, DuPont de Nemours, Inc., Reliance Industries Limited, Indian Oil Corporation Limited, INEOS, Total Energies S.A., SABIC, LyondellBasell Industries Holdings B.V.

Need help to buy this report?