Global Pharmaceutical Market Size, Share, and COVID-19 Impact Analysis, By Molecule Type (Conventional Drugs (Small Molecules), Biologics & Biosimilars (Large Molecules), and Others), By Product (Branded and Generics), By Type (Prescription and OTC), By Disease (Cancer, Cardiovascular Diseases, Diabetes, Infectious Diseases, Neurological Disorders, Respiratory Diseases, Autoimmune Diseases, Mental Health Disorders, Gastrointestinal Disorders, Women’s Health Issues, Genetic and Rare Genetic Diseases, Dermatological Conditions, Obesity, Renal Diseases, Liver Conditions, Hematological Disorders, Eye Conditions, Infertility, Allergies, and Others), By Route Of Administration (Oral, Parenteral, Topical, Inhalations, and Others), By Formulation (Tablets, Sprays, Injectable, Capsules, and Others), By Age Group (Adults, Children & Adolescents, and Geriatric), By End-User (Hospitals, Clinics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: HealthcareGlobal Pharmaceutical Market Insights Forecasts to 2035

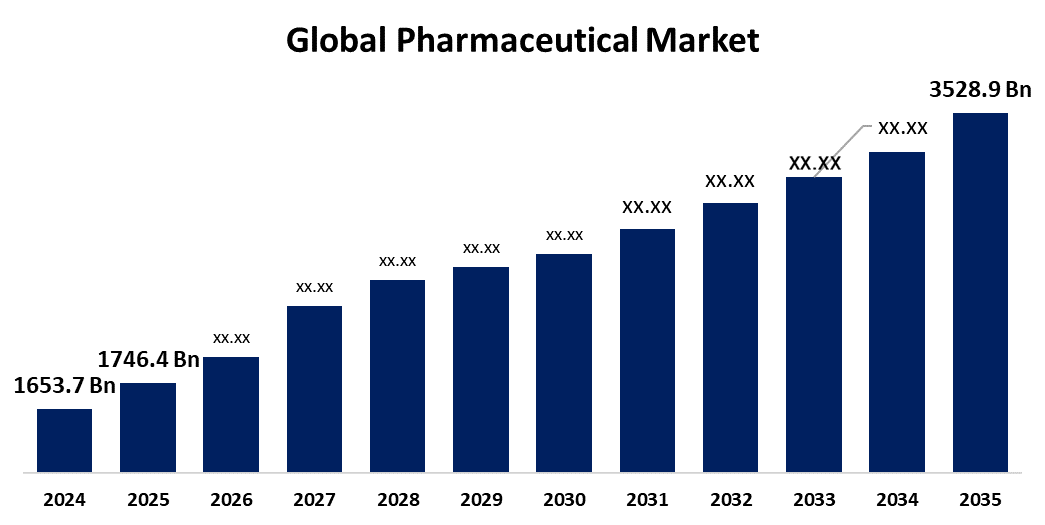

- The Global Pharmaceutical Market Size was estimated at USD 1,653.7 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.49% from 2025 to 2035

- The Worldwide Pharmaceutical Market Size is Expected to Reach USD 3,528.9 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Pharmaceutical Market Size was Estimated at USD 1,653.7 Billion in 2024 Expected to Grow from USD 1,746.4 Billion in 2025 to USD 3,528.9 Billion by 2035, at a CAGR of 6.49% during the forecast period 2025-2035.

Market Overview

The industry that develops, produces, and distributes pharmaceuticals and remedies is known as the pharmaceutical market. Prescription pharmaceuticals, over-the-counter (OTC) medications, vaccines, and other therapeutic items are among the pharmaceutical products that are manufactured, marketed, and sold by these businesses, organizations, and entities. One of the most tightly regulated industries, the pharmaceutical market has a long history of producing high-quality pharmaceutical products for human use that have the intended pharmacotherapeutic effects for the treatment of a wide range of illnesses. The pharmaceutical business, one of the most strictly controlled sectors, has continuously developed high-quality pharmaceutical products for human use that have the desired pharmacotherapeutic effects for the treatment of a variety of diseases. Major factors are working harder to create and introduce new medications for a variety of uncommon conditions as a result of the growing prevalence and knowledge of chronic diseases and the treatment choices available these elements are expected to drive the growth of the pharmaceutical market. The launch of sophisticated products and the rising incidence of diseases like diabetes, cancer, and infectious disorders are the main factors driving the growth of the pharmaceutical market.

Report Coverage

This research report categorizes the pharmaceutical market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the pharmaceutical market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the pharmaceutical market.

Global Pharmaceutical Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,653.7 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.49% |

| 2035 Value Projection: | USD 3,528.9 Billion |

| Historical Data for: | 2020-2025 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product, By Type, By Disease, By Route of Administration, By Formulation, By Age Group, By End-User, By Regional Analysis |

| Companies covered:: | AstraZeneca, AbbVie Inc., Sanofi, F. Hoffmann-La Roche Ltd., Johnson & Johnson Services, Inc., GSK plc, Bristol-Myers Squibb Company, Merck & Co., Inc., OPKO Health, Inc., Pfizer Inc., Novartis AG, Takeda Pharmaceutical Company Limited, Others, and |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The aging population, increased chronic disease prevalence, expanding government spending on healthcare worldwide, and massive attempts to make medications more affordable are all driving the expansion of the pharmaceutical market. Rising underdiagnosis rates and emerging countries' increased need for efficient products are anticipated to drive product adoption in the market. Furthermore, introducing OTC medications at reasonable costs is expected to drive market expansion. The aging population, greater government spending on healthcare, the prevalence of chronic diseases, and massive efforts to lower the cost of drugs are all contributing factors to the growth of the pharmaceutical market.

Restraining Factors

The lack of qualified workers for creating medications requiring certain skill sets restricted market expansion. Only a few research institutions and medical devices have these skill sets. Further, one of the factors restricting the growth of the global pharmaceuticals market is the volatility of raw material costs.

Market Segmentation

The pharmaceutical market share is classified into molecule type, product, type, disease, route of administration, formulation, age group, and end user.

- The conventional drugs segment hold the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the molecule type, the pharmaceutical market is divided into conventional drugs (small molecules), biologics & biosimilars (large molecules), and others. Among these, the conventional drugs segment hold the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The established manufacturing process, consistent pharmacokinetics, and oral bioavailability of conventional drugs are the reasons for their supremacy.

- The branded segment hold the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the product, the pharmaceutical market is divided into branded and generics. Among these, the branded segment hold the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing demand for the creation of novel therapies to address a variety of ailments, the increasing R&D and approval of novel pharmaceuticals, and the rising prevalence of chronic diseases are all factors driving to the branded segment.

- The prescription segment hold the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the pharmaceutical market is divided into prescription and OTC. Among these, the prescription segment hold the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The prescription type is the result of leading companies in the market investing more in research and development (R&D) to create new medications, which are primarily used to treat chronic illnesses.

- The cancer segment hold the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the disease, the pharmaceutical market is divided into cancer, cardiovascular diseases, diabetes, infectious diseases, neurological disorders, respiratory diseases, autoimmune diseases, mental health disorders, gastrointestinal disorders, women’s health issues, genetic and rare genetic diseases, dermatological conditions, obesity, renal diseases, liver conditions, hematological disorders, eye conditions, infertility, allergies, and others. Among these, the cancer segment hold the largest share in 2025 and is expected to grow at a significant CAGR during the forecast period. The increasing prevalence of cancer worldwide has raised the demand for novel and efficient treatments, spurring substantial investment and research in this area.

- The oral segment hold the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the route of administration, the pharmaceutical market is divided into oral, parenteral, topical, inhalations, and others. Among these, the oral segment hold the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The oral route segment was ascribed to several important variables, including the convenience of oral drugs and patient compliance due to its noninvasive nature, which results in greater adherence rates.

- The tablets segment hold the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the formulation, the pharmaceutical market is divided into tablets, sprays, injectable, capsules, and others. Among these, the tablets segment hold the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Tablets are produced and sold in large quantities due to they are the most popular oral solid dosage form for drug administration.

- The adults segment hold the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the age group, the pharmaceutical market is divided into adults, children & adolescents, and geriatric. Among these, the adults segment hold the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The majority of prescription medication users are adults between the ages of 15 and 64. ACE inhibitors, analgesics, antidepressants, and lipid-lowering medications are the most often used medications in the adult population.

- The hospitals segment hold the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-user, the pharmaceutical market is divided into hospitals, clinics, and others. Among these, the hospitals segment hold the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Growing healthcare demands brought on by the aging population, the rise in chronic illnesses, and improvements in medical treatments highlight the hospitals segment.

Regional Segment Analysis of the Pharmaceutical Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the pharmaceutical market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the pharmaceutical market over the predicted timeframe. North America's market is growing due to its strong GDP, high per capita healthcare spending, availability of high-value pharmaceuticals, and significant healthcare knowledge. In addition, several strategic initiatives created in the area by both existing and startup pharmaceutical companies are significant driver of regional growth. Numerous variables, including improvements in clinical trials and drug production in the United States and Canada, are responsible for this region's dominance.

Asia Pacific is expected to grow at the fastest CAGR growth of the pharmaceutical market during the forecast period. The region's growing elderly population and the speed at which research is being conducted to introduce and develop new treatments are the main drivers of the pharmaceutical market's expansion. The nations like Japan, South Korea, Taiwan, Singapore, and Australia alongside rapidly expanding economies like China and India, Thailand, Indonesia, Malaysia, Vietnam, Bangladesh, and the Philippines, the region's population is diverse.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the pharmaceutical market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AstraZeneca

- AbbVie Inc.

- Sanofi

- F. Hoffmann-La Roche Ltd.

- Johnson & Johnson Services, Inc.

- GSK plc

- Bristol-Myers Squibb Company

- Merck & Co., Inc.

- OPKO Health, Inc.

- Pfizer Inc.

- Novartis AG

- Takeda Pharmaceutical Company Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2023, AstraZeneca announced that IMJUDO (tremelimumab), their ground-breaking cancer treatment, now available in the United Arab Emirates. With the launch, the UAE becomes one of the first nations in the Middle East to get access to the drug, which represents a breakthrough in cancer therapy. IMJUDO has been shown in clinical trials to be both effective and tolerable when used in conjunction with a variety of cancer types, including hepatobiliary and metastatic non-small cell lung tumors.

- In February 2022, Pfizer Inc. and OPKO Health, Inc. announced that the European Commission has authorized the marketing of NGENLATM (somatrogon), a once-weekly injection of next-generation long-acting recombinant human growth hormone, to treat children and adolescents with growth disturbances resulting from inadequate growth hormone secretion starting at age 3.

Market Segment

- This study forecasts revenue at global, regional, and country levels from 2025 to 2035. Spherical Insights has segmented the pharmaceutical market based on the below-mentioned segments:

Global Pharmaceutical Market, By Molecule Type

- Conventional Drugs (Small Molecules)

- Biologics & Biosimilars (Large Molecules)

- Others

Global Pharmaceutical Market, By Product

- Branded

- Generics

Global Pharmaceutical Market, By Type

- Prescription

- OTC

Global Pharmaceutical Market, By Disease

- Cardiovascular diseases

- Cancer

- Diabetes

- Infectious diseases

- Neurological disorders

- Respiratory diseases

- Autoimmune diseases

- Mental health disorders

- Gastrointestinal disorders

- Women’s Health Diseases

- Genetic and rare genetic diseases

- Dermatological conditions

- Obesity

- Renal diseases

- Liver conditions

- Hematological disorders

- Eye conditions

- Infertility conditions

- Endocrine disorders

- Allergies

- Others

Global Pharmaceutical Market, By Route of Administration

- Oral

- Parenteral

- Topical

- Inhalations

- Others

Global Pharmaceutical Market, By Formulation

- Tablets

- Sprays

- Injectable

- Capsules

- Others

Global Pharmaceutical Market, By Age Group

- Adults

- Children & Adolescents

- Geriatric

Global Pharmaceutical Market, By End-User

- Hospitals

- Clinics

- Others

Global Pharmaceutical Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the pharmaceutical market over the forecast period?The pharmaceutical market is projected to expand at a CAGR of 6.49% during the forecast period.

-

2. What is the market size of the pharmaceutical market?The Global Pharmaceutical Market Size was Estimated at USD 1,653.7 Billion in 2024 Expected to Grow from USD 1,746.4 Billion in 2025 to USD 3,528.9 Billion by 2035, at a CAGR of 6.49% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the pharmaceutical market?North America is anticipated to hold the largest share of the pharmaceutical market over the predicted timeframe.

Need help to buy this report?