Global Phenolic Resin Market Size, By Product (Novolac, Resol), By Application (Wood Adhesives, Molding, Insulations, Laminates), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Chemicals & MaterialsGlobal Phenolic Resin Market Insights Forecasts to 2033

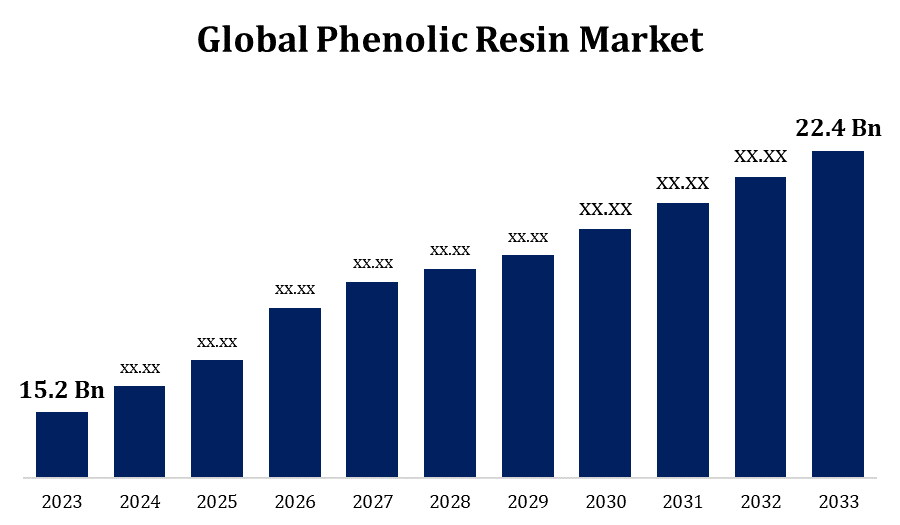

- The Global Phenolic Resin Market Size was valued at USD 15.2 Billion in 2023.

- The Market is Growing at a CAGR of 3.95% from 2023 to 2033

- The Worldwide Phenolic Resin Market Size is expected to reach USD 22.4 Billion By 2033

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Phenolic Resin Market Size is expected to reach USD 22.4 Billion by 2033, at a CAGR of 3.95% during the forecast period 2023 to 2033.

The phenolic resin market has grown steadily over the years, owing to its diverse applications in a variety of industries. It is a popular choice because to its outstanding heat resistance, mechanical strength, and electrical qualities. Automotive, construction, electronics, and aerospace all contribute significantly to demand. With the increased emphasis on lightweight and high-performance materials, phenolic resins have discovered new applications. The desire for environmentally friendly and sustainable materials has also resulted in the development of bio-based phenolic resins, which has added a new dimension to the industry. Factors such as urbanisation, infrastructure development, and technological developments are expected to propel additional growth.

Phenolic Resin Market Value Chain Analysis

The extraction or synthesis of raw materials is the first step in the trip. Key components of phenolic resins are phenol and formaldehyde. These are primarily obtained from petrochemical sources, while bio-based alternatives are being explored. A chemical interaction between phenol and formaldehyde produces phenolic resins. Polymerization is used to make a thermosetting resin with desirable characteristics. Depending on the intended purpose, the synthesised resin is next processed and manufactured into various forms such as liquid resins, powder resins, or moulded goods. Once manufactured, phenolic resins are disseminated to numerous industries via a network of suppliers, distributors, and logistics providers. Phenolic resins are used in many industries, including automotive, construction, electronics, and aerospace.

Phenolic Resin Market Opportunity Analysis

The automobile, construction, electronics, and aerospace industries all have a high demand for phenolic resins. As these industries expand, the demand for high-performance materials, such as phenolic resins, is expected to rise. With a growing emphasis on lightweight materials for fuel efficiency in automotive and aerospace applications, phenolic resins have a considerable opportunity. Because of their lightweight yet strong and lasting qualities, they are appealing for replacing heavier materials. Phenolic resins are essential in composite materials. There is room for creativity in the development of new composite materials with enhanced qualities such as improved fire resistance, thermal stability, or strength. Exploring prospects in emerging markets and industrialising regions might be a strategic decision.

Global Phenolic Resin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 15.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.95% |

| 2033 Value Projection: | USD 22.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Application, By Region. |

| Companies covered:: | DIC CORPORATION, Kolon Industries, Inc., Sumitomo Bakelite Co. Ltd., Hexcel Corporation, Georgia-Pacific Chemicals, KRATON CORPORATION, Hexion, Bostik, Inc., SI Group, Inc. and Other Key Vendors. |

| Growth Drivers: | Increasing demand from the automotive sector |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Phenolic Resin Market Dynamics

Increasing demand from the automotive sector

Vehicle manufacturers are increasingly focused on lowering vehicle weight in order to enhance fuel efficiency and meet tough pollution rules. Phenolic resins, which are lightweight but robust and durable, are employed in a variety of applications, including composites and lightweight components. Thermal insulation is provided by phenolic resins. They are frequently used in the automobile industry to manufacture components that require heat resistance, like as brake components. In the automotive sector, phenolic resins are frequently employed as adhesives and bonding agents. They have high bonding properties, which contribute to vehicle structural integrity. As vehicles become more electrified, there is a greater demand for phenolic resins in the fabrication of electrical components.

Restraints & Challenges

The manufacture of phenolic resins is dependent on raw ingredients such as phenol and formaldehyde, the cost of which might fluctuate due to variables such as fluctuations in oil prices. This can have an impact on phenolic resin manufacturers' overall manufacturing costs and profit margins. Alternative materials and resins with similar or improved characteristics are competing on the market. To preserve a competitive advantage, manufacturers must remain innovative and consistently improve the performance of phenolic resins. Despite its diverse qualities, end-users may be unaware of the benefits and applications of phenolic resins. Educating potential consumers on the benefits of phenolic resins and advertising their capabilities could help boost demand. Like many other industries, the phenolic resin industry is prone to supply chain disruptions.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Phenolic Resin Market from 2023 to 2033. North America is a major player in the global phenolic resin industry. The market in the region has grown steadily, fueled by demand from important industries such as automotive, construction, electronics, and aerospace. The strong automobile industry in North America has contributed significantly to the need for phenolic resins. Lightweighting measures, combined with the necessity for heat-resistant and long-lasting materials, have boosted the use of phenolic resins in the manufacture of numerous automobile components. The North American building industry has also contributed to the demand for phenolic resins. These resins find use in laminates, insulating materials, and adhesives used in building projects.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia Pacific region's phenolic resin market has grown rapidly. Industrialization, infrastructure expansion, and economic growth in nations such as China, India, Japan, and South Korea have increased demand for phenolic resins. Asia Pacific is a manufacturing powerhouse for a wide range of industries, including automotive, electronics, construction, and consumer goods. Demand for phenolic resins in these industries for applications such as adhesives, coatings, and composite materials has been a major driver of market expansion. The Asia Pacific region's growing urbanisation and infrastructural development have boosted demand for phenolic resins in the building sector. These resins are utilised in a variety of construction applications such as laminates, insulating materials, and adhesives.

Segmentation Analysis

Insights by Product

The novolac segment accounted for the largest market share over the forecast period 2023 to 2033. The thermal and chemical resilience of Novolac phenolic resins is well recognised. This feature qualifies them for use in industries requiring resistance to heat and strong chemicals, such as paints, adhesives, and moulding compounds. Novolac resins are frequently used in adhesives and coatings that require excellent temperature resistance and durability. These applications can be found in a variety of industries, including aerospace and automobile manufacturing. The expansion of end-user sectors such as automotive, aerospace, and electronics has boosted demand for novolac phenolic resins. The demand for specialised materials with tailored qualities is projected to rise as these sectors evolve and expand.

Insights by Application

The molding segment accounted for the largest market share over the forecast period 2023 to 2033. Phenolic resins lend themselves nicely to moulding methods such as compression moulding and injection moulding. This adaptability enables producers to make a diverse range of moulded components for a variety of sectors. Electrical insulation qualities are well recognised for phenolic resins. Phenolic resins are preferred in moulding applications for electrical components such as connections, switches, and insulators because they can provide excellent electrical insulation. The automotive industry contributes significantly to the growth of the phenolic moulding segment. Phenolic resins are used to mould numerous automotive components such as brake components, engine parts, and interior components. Phenolic resins are used in the production of consumer items such as handles, knobs, and other components.

Recent Market Developments

- In July 2022, Guangdong TOD New Material Co., Ltd., a Chinese coated resin manufacturer, was bought by DIC Corporation.

Competitive Landscape

Major players in the market

- DIC CORPORATION

- Kolon Industries, Inc.

- Sumitomo Bakelite Co. Ltd.

- Hexcel Corporation

- Georgia-Pacific Chemicals

- KRATON CORPORATION

- Hexion

- Bostik, Inc.

- SI Group, Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Phenolic Resin Market, Product Analysis

- Novolac

- Resol

Phenolic Resin Market, Application Analysis

- Wood Adhesives

- Molding

- Insulations

- Laminates

Phenolic Resin Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Phenolic Resin Market?The global Phenolic Resin Market is expected to grow from USD 15.2 billion in 2023 to USD 22.4 billion by 2033, at a CAGR of 3.95% during the forecast period 2023-2033.

-

2. Who are the key market players of the Phenolic Resin Market?Some of the key market players of market are DIC CORPORATION; Kolon Industries, Inc.; Sumitomo Bakelite Co. Ltd.; Hexcel Corporation; Georgia-Pacific Chemicals; KRATON CORPORATION; Hexion; Bostik, Inc.; SI Group, Inc.

-

3. Which segment holds the largest market share?The novolac segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Phenolic Resin Market?North America is dominating the Phenolic Resin Market with the highest market share.

Need help to buy this report?