Global Physical Security Market Size, Share, and COVID-19 Impact Analysis, By Component (Systems and Services), By Organization Size (Large Enterprises and SMEs), End-User (Transportation, Government, Banking & Finance, Utility & Energy, Residential, Industrial, Retail, Commercial, Hospitality, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Semiconductors & ElectronicsGlobal Physical Security Market Insights Forecasts to 2032

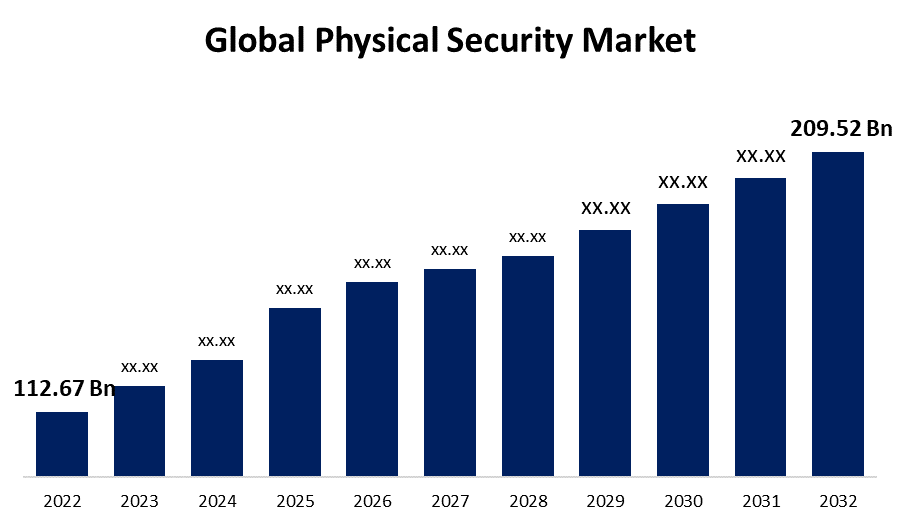

- The Physical Security Market Size was valued at USD 112.67 Billion in 2022.

- The Market is Growing at a CAGR of 6.4% from 2022 to 2032.

- The Worldwide Physical Security Market Size is expected to reach USD 209.52 Billion by 2032.

- Asia-Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Physical Security Market is expected to reach USD 209.52 Billion by 2032, at a CAGR of 6.4% during the forecast period 2022 to 2032.

Market Overview

Physical security refers to the measures and practices used to protect physical assets, people, and information from unauthorized access, theft, damage, or destruction. This type of security involves the use of physical barriers, access controls, surveillance systems, and security personnel to prevent and deter potential threats. Physical security measures can include locks, security cameras, fences, alarms, biometric authentication, and security guards. It is an essential aspect of overall security and risk management, as it helps to ensure the safety and protection of a facility, organization, or individual. Effective physical security can help to minimize the impact of potential threats and maintain the integrity of the environment and its assets.

Report Coverage

This research report categorizes the market for physical security market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the physical security market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the physical security market.

Global Physical Security Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 112.67 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.4% |

| 2032 Value Projection: | USD 209.52 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Component, By Organization Size, By End-User, By Region. |

| Companies covered:: | Bosch Security Systems, Honeywell International, Johnson Controls, Axis Communications, Pelco by Schneider Electric, Genetec, Avigilon Corporation, Hanwha Techwin, FLIR Systems, Assa Abloy AB, Tyco International, Hikvision Digital Technology, Dahua Technology, Siemens AG, NEC Corporation. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The drivers of the physical security market include increasing security concerns due to rising crime rates and terrorist activities, government regulations and compliance requirements, technological advancements in security systems, growing adoption of cloud-based security solutions, and the need to protect critical infrastructure and assets. Additionally, the emergence of smart cities and the Internet of Things (IoT) has increased the demand for integrated physical security solutions that can be centrally managed and monitored. The shift towards a more data-driven approach to physical security has also led to the adoption of analytics and artificial intelligence-based solutions, further driving the growth of the physical security market.

Restraining Factors

The restraints of the physical security market include high implementation costs, lack of skilled workforce and expertise in managing complex security systems, concerns over data privacy and security, and the prevalence of legacy systems that are difficult to integrate with newer technologies. Moreover, the COVID-19 pandemic has negatively impacted the market due to supply chain disruptions, project delays, and budget cuts. The market also faces challenges such as the potential for system failure or breaches that could compromise security, as well as legal and ethical issues surrounding the use of certain technologies, such as facial recognition.

Market Segmentation

- In 2022, the system segment accounted for around 66.4% market share

On the basis of components, the global physical security market is segmented into systems and services. The system segment is dominating with the largest market share in 2022, due to the high adoption rate of access control systems, video surveillance systems, intrusion detection and prevention systems, and other physical security systems. The increasing need for centralized management, real-time monitoring, and analytics-based insights is driving the growth of this segment. Furthermore, the integration of physical security systems with other technologies such as IoT and artificial intelligence is enhancing the capabilities and functionalities of these systems, making them more efficient and effective. These factors are contributing to the dominance of the system segment in the physical security market.

- In 2022, the large enterprise segment dominated with more than 58.6% market share

Based on organization size, the global physical security market is segmented into large enterprises and SMEs. Out of this, the large enterprise is dominating the market with the largest market share in 2022, due to its significant investment capacity and requirement for high-end security solutions. These enterprises have vast infrastructure and high-value assets that need to be secured, making them highly vulnerable to security breaches. Large enterprises are also subject to regulatory compliance, which further drives the demand for physical security solutions. Additionally, large enterprises have the resources to invest in advanced technologies such as artificial intelligence, analytics, and cloud-based solutions, which are driving the growth of the physical security market. All these factors contribute to the large enterprise segment's dominance in the physical security market.

Regional Segment Analysis of the Physical Security Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 37.6% revenue share in 2022.

Get more details on this report -

Based on region, North America dominates the physical security market due to its highly developed economy, advanced technology infrastructure, and stringent government regulations on security and privacy. The region has a large number of key players in the market, as well as significant investments in research and development, driving innovation in security technologies. Additionally, the region has a high awareness and adoption of security solutions, particularly in sectors such as banking and finance, healthcare, and government. The increasing prevalence of cyber threats and the need for integrated security systems have further propelled the growth of the physical security market in this region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global physical security market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Bosch Security Systems

- Honeywell International

- Johnson Controls

- Axis Communications

- Pelco by Schneider Electric

- Genetec

- Avigilon Corporation

- Hanwha Techwin

- FLIR Systems

- Assa Abloy AB

- Tyco International

- Hikvision Digital Technology

- Dahua Technology

- Siemens AG

- NEC Corporation

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2022, Hikvision Digital Technology, a provider of video surveillance equipment, recently introduced a new product - the Hikvision AX PRO wireless external Tri-tech detector and a dedicated camera. The modular design of this product ensures precise detection and clear imaging, enhancing the safety of small businesses and remote workers. Moreover, it is intended to be utilized in smart cities for comprehensive security purposes throughout China.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global physical security market based on the below-mentioned segments:

Physical Security Market, By Component

- Systems

- Services

Physical Security Market, By Organization Size

- Large Enterprises

- SMEs

Physical Security Market, By End-User

- Transportation

- Government

- Banking & Finance

- Utility & Energy

- Residential

- Industrial

- Retail

- Commercial

- Hospitality

- Others

Physical Security Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?