Global Pigment Dispersion Market Size, Share, Growth, and Industry Analysis, By Product (Inorganic Pigment, Organic Pigment), By Application (Plastics, Inks, Coatings), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal Pigment Dispersion Market Insights Forecasts to 2033

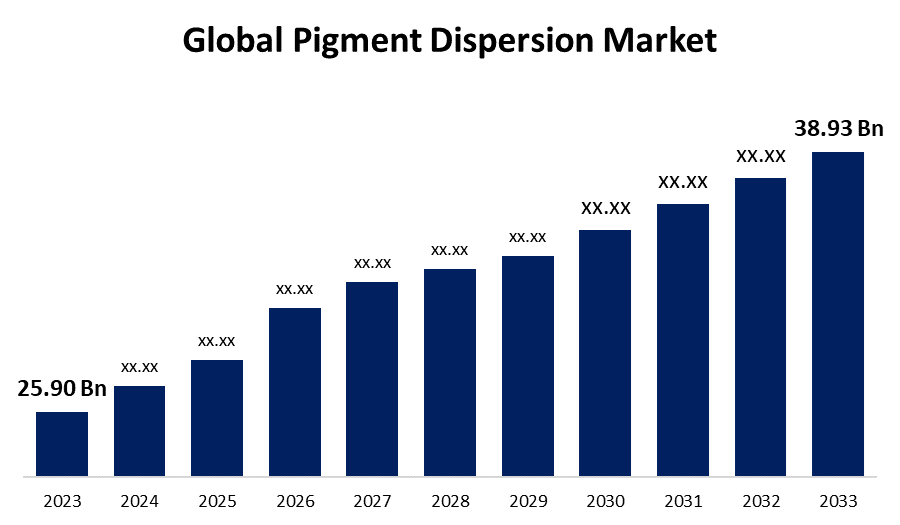

- The Global Pigment Dispersion Market Size was Valued at USD 25.90 Billion in 2023

- The Market Size is Growing at a CAGR of 4.16 % from 2023 to 2033

- The Worldwide Pigment Dispersion Market Size is Expected to Reach USD 38.93 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Pigment Dispersion Market Size is Anticipated to Exceed USD 38.93 Billion by 2033, Growing at a CAGR of 4.16 % from 2023 to 2033.

PIGMENT DISPERSION MARKET REPORT OVERVIEW

The market for pigment dispersions is the industry that produces and distributes vital substances, which are used to add color to a variety of products. Plastics, cosmetics, paints, coatings, and inks are the main industries served by this market. To guarantee consistent color and stability in finished products, pigment dispersions are compositions of finely dispersed pigments in a liquid or paste. The market for pigment dispersion is known for its fast development, which is fueled by rising demand in several industrial sectors, including personal care, construction, and automotive. The primary driver of the market is the demand for long-lasting, premium pigments that provide excellent color stability and consistency across a range of applications. The performance qualities of these dispersions have been greatly improved by advancements in pigment science and formulation, making them indispensable for the manufacturing of paints, coatings, inks, and polymers. The packaging industry's steady growth, which includes the printing of labels and packaging for both food and non-food items, is expected to be a major factor in the need for pigment dispersions in the upcoming period. The market for pigment dispersions is anticipated to rise over the projected period due to changing consumer purchasing trends, especially the inclination for eye-catching packaging colors.

Report Coverage

This research report categorizes the market for the global pigment dispersion market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global pigment dispersion market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global pigment dispersion market.

Global Pigment Dispersion Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 25.90 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.16 % |

| 2033 Value Projection: | USD 38.93 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 272 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, By Region |

| Companies covered:: | Clariant Ltd., Decorative Color & Chemical, Inc., DyStar Singapore Pte. Ltd, Ferro Corporation, Flint Group, Heubach GmbH, Kama Pigments, Organic Dyes and Pigments, Pidilite Industries Ltd., Reitech Corporation, Sudarshan Chemical Industries Limited, Sun Chemical, Trust Chem Co., Ltd, BASF SE, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

DRIVING FACTORS:

The growing consumer demand for environmentally friendly pigments for single-use food packaging could fuel market expansion.

In the single-service food packaging market, polyethylene terephthalate (PET), polypropylene (PP), and polystyrene (PS) are the most popular polymers. The overall demand for pigments is anticipated to be driven by the growing use of plastic, paper, and paperboard materials as well as the application of different colorants to make aesthetically pleasing packaging. Currently, the majority of the world's pigment needs are met by titanium dioxide, iron oxide, and zinc oxide combined, which is utilized in plastic, paper, and paperboard used in food packaging.

RESTRAINING FACTORS

The rigorous environmental laws could limit the market expansion.

The market for pigment dispersions is greatly impacted by strict environmental laws. Regulations are designed to lessen the risks to the environment and human health that come with using specific pigments and dispersants. Regional variations in these laws make compliance difficult and increase production costs.

Market Segmentation

The pigment dispersion market share is classified into product and application.

The inorganic pigment holds the highest share of the market over the forecast period.

Based on product, the pigment dispersion is classified into inorganic pigment and organic pigment. Among these, the inorganic pigment holds the highest share of the market over the forecast period. In general, inorganic pigment dispersion is lighter than organic pigment dispersion. On the other hand, inorganic pigment dispersion is preferred over organic dispersion in situations when increased durability is required. One important difference is that in contrast to its inorganic cousin, organic pigment dispersion can fade with prolonged exposure to sunshine. Three polymorphs of calcium carbonate are present: aragonite, calcite, and vaterite. It is present as a white powder. It is found naturally in a variety of materials, including chalk, marble, limestone, and seashells. The color of the material varies, from gray to yellow, depending on how much impurity is present. Interestingly, it turns out that inorganic pigment dispersion is more affordable than organic. It’s easier dispersion across a variety of substrates is made possible by its lower particle size. Two of the most well-known and commonly used inorganic pigment dispersions are titanium dioxide and iron oxide.

The coatings segment holds the largest share of the market during the forecast period.

Based on application, the pigment dispersion is classified into plastics, inks, coatings. Among these, the coatings segment holds the largest share of the market during the forecast period. The demand for coatings is expected to be sustained throughout the projected period by the growth of the building and construction sector, which is being driven by the development of infrastructure in various economies. It is anticipated that this would further contribute to the general growth. Furthermore, the market for organic pigments used in coatings is expected to rise dramatically due to the growing trend for green building development. Pigment dispersion has gained popularity as a dye alternative in printing ink applications since it provides better coloring and produces the required results for printing ink makers.

Regional Segment Analysis of the Global Pigment Dispersion Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific holds the highest share of the pigment dispersion market throughout the forecast period.

Get more details on this report -

The high market share can be attributed to the quantity of raw materials and the low cost of labor in the region, which draw firms from different industries to establish their production facilities in the Asia Pacific region to reap greater benefits. During the projected period, the coatings application segment in South Korea is anticipated to provide the largest proportion of the overall market growth. China is expected to lead the Asia Pacific market in the future years, having emerged as a significant contributor to the industry. The ability to export manufactured products to other nations at competitive costs and in a safe manner is made possible by the accessibility of labor and raw materials, as well as the ease of supply chain facilities. Market expansion is anticipated in several end-use industries, including automotive, construction, consumer goods, electrical and electronics, utility, packaging, food and beverage, and others, as a result of rising disposable income and shifting consumer behavior.

Europe is fastest growing region over the projected timeframe.

Germany held the fastest revenue and volume share in the European pigment dispersion sector. Factors such as expanding industrial facilities and favorable macroeconomic conditions in a number of European nations are anticipated to propel pigment dispersion market growth in the region. In addition, it is projected that the region will see a growth in organic pigment dispersion due to the rapidly increasing trend of green technology.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global pigment dispersion market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Clariant Ltd.

- Decorative Color & Chemical, Inc.

- DyStar Singapore Pte. Ltd

- Ferro Corporation

- Flint Group

- Heubach GmbH

- Kama Pigments

- Organic Dyes and Pigments

- Pidilite Industries Ltd.

- Reitech Corporation

- Sudarshan Chemical Industries Limited

- Sun Chemical

- Trust Chem Co., Ltd

- BASF SE

- Others

Key Market Developments

- In February 2023, Reitech Corp., a producer of pigment dispersions, was bought by Vivify Specialty Ingredients, a supplier of specialty colorants, additives, and ingredients for the food and beverage, personal care and cosmetics, and industrial end industries. Vivify received legal representation from Kirkland & Ellis. Reitech was represented by Reger Rizzo & Darnall LLP in legal matters.

- In March 2022, the parent company of Fujifilm, FUJIFILM Imaging Colorants, Inc., a prominent worldwide inkjet ink technology partner to equipment manufacturers, integrators, and ink formulators, today announced that it will invest $28 million to add a new facility for the production of aqueous inkjet dispersions in New Castle, Delaware.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global pigment dispersion market based on the below-mentioned segments:

Global Pigment Dispersion Market, By Product

- Inorganic Pigment

- Organic Pigment

Global Pigment Dispersion Market, By Application

- Plastics

- Inks

- Coatings

Global Pigment Dispersion Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the global pigment dispersion market over the forecast period?The global pigment dispersion market size is expected to grow from USD 25.90 Billion in 2023 to USD 38.93 Billion by 2033, at a CAGR of 4.16 % during the forecast period 2023-2033.

-

2.Which region is expected to hold the highest share in the global pigment dispersion market?Asia-Pacific is projected to hold the largest share of the global pigment dispersion market over the forecast period.

-

3.Who are the top key players in the pigment dispersion market?Clariant Ltd, Decorative Color & Chemical, Inc, DyStar Singapore Pte. Ltd, Ferro Corporation, Flint Group, Heubach GmbH, Kama Pigments, Organic Dyes and Pigments, Pidilite Industries Ltd, Reitech Corporation, Sudarshan Chemical Industries Limited, Sun Chemical, Trust Chem Co., Ltd, BASF SE, and Others.

Need help to buy this report?