Global Pilot Training Market Size, Share, and COVID-19 Impact Analysis, By Aircraft Type (Airplane (Airbus 320, Boeing 737, and Others) and Helicopter), By License Type (Commercial Pilot License, Private Pilot License, Airline Transport Pilot License, and Others), By Training Mode (Flight Training, Simulator Training, Ground Training, and Recurrent Training), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Pilot Training Market Insights Forecasts to 2033

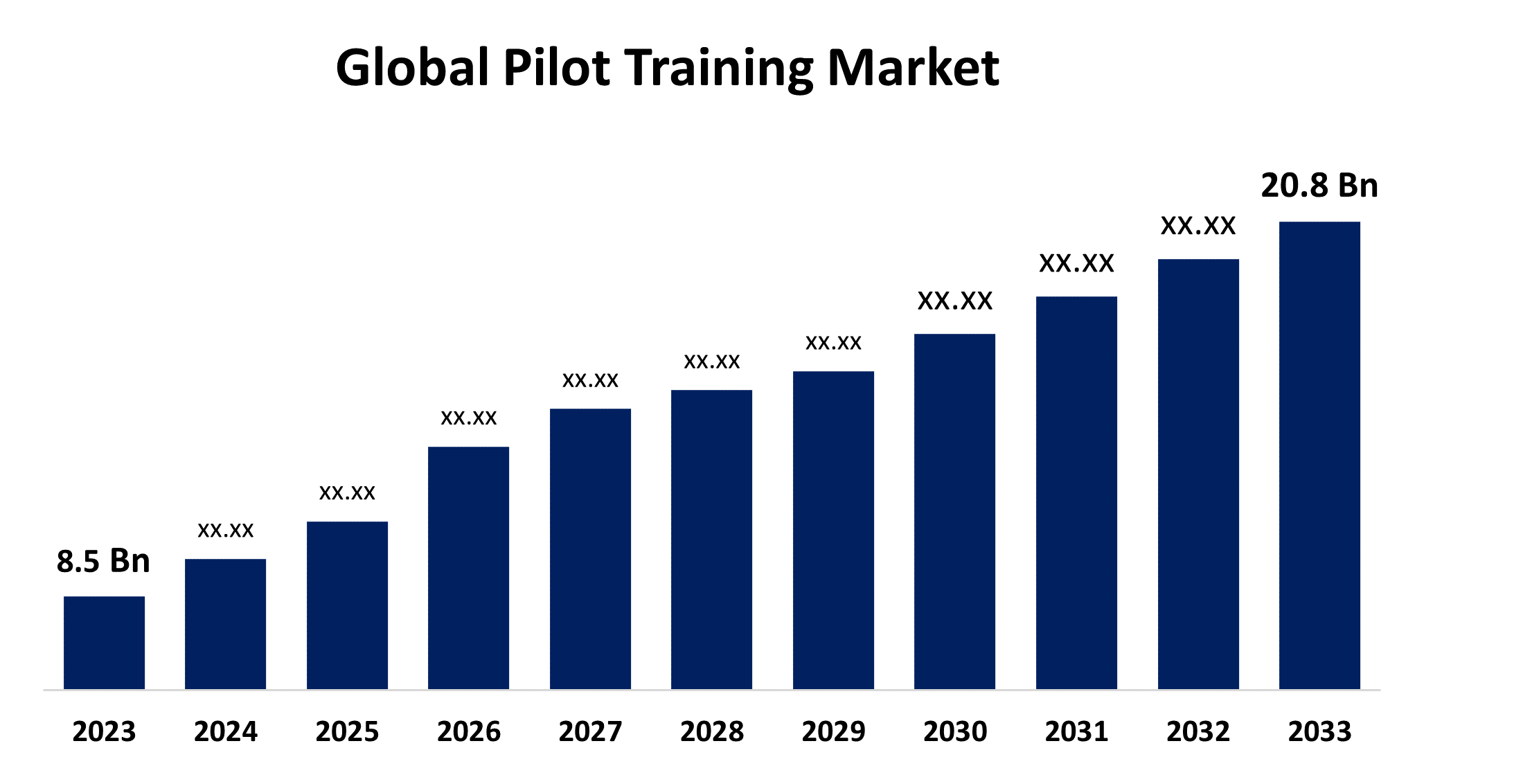

- The Global Pilot Training Market Size was valued at USD 8.5 Billion in 2023.

- The Market Size is Growing at a CAGR of 9.36% from 2023 to 2033

- The Worldwide Pilot Training Market Size is Expected to reach USD 20.8 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Pilot Training Market is Expected to reach USD 20.8 billion by 2033, at a CAGR of 9.36% during the forecast period 2023 to 2033.

The pilot training market is experiencing significant growth, driven by the increasing demand for commercial pilots due to the expansion of the aviation industry and rising air travel. Advanced training technologies, such as virtual reality (VR) and artificial intelligence (AI), are revolutionizing pilot education, enhancing simulation experiences, and improving safety standards. The market is also benefiting from government initiatives and investments in aviation infrastructure. Key players are focusing on strategic collaborations and acquisitions to strengthen their market presence. However, challenges such as high training costs and stringent regulatory requirements may hinder market growth. Despite these obstacles, the pilot training market is poised for robust expansion, supported by continuous technological advancements and the growing need for skilled pilots worldwide.

Global Pilot Training Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.36% |

| 2033 Value Projection: | USD 20.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 207 |

| Tables, Charts & Figures: | 65 |

| Segments covered: | By Aircraft Type,By License Type, By Training Mode, By Region |

| Companies covered:: | ATP Flight School LLC, Airways Aviation, CAE Inc., ELITE Simulation Solutions AG, FlightSafety International Inc., Indra Sistemas SA, L3Harris Technologies Inc., Lockheed Martin, Phoenix East Aviation, Raytheon Technologies Corporation, Thales Group, Upper Limit Aviation Inc. and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Pilot Training Market Value Chain Analysis

The pilot training market value chain encompasses several critical stages, beginning with the development of training programs and curricula by educational institutions and training organizations. These programs are designed to meet regulatory standards and industry requirements. The next stage involves the provision of advanced training equipment and technologies, such as flight simulators, VR systems, and AI-driven tools, supplied by specialized manufacturers. Training providers, including flight schools and airlines, then utilize these resources to deliver comprehensive training to aspiring pilots. Additionally, regulatory bodies play a crucial role in certifying training programs and ensuring compliance with safety standards. The value chain is further supported by continuous research and development, aimed at improving training methodologies and equipment. This integrated process ensures the efficient production of highly skilled pilots ready to meet the industry's growing demands.

Pilot Training Market Opportunity Analysis

The pilot training market presents substantial growth opportunities driven by the rising global demand for commercial pilots amid expanding air travel. Emerging markets, particularly in Asia-Pacific and the Middle East, are witnessing a surge in aviation activity, creating a need for extensive pilot training programs. Technological advancements, such as VR, AI, and enhanced flight simulation technologies, offer new avenues for innovative training solutions that can reduce costs and improve safety. Furthermore, government initiatives to bolster aviation infrastructure and support training programs are opening up new prospects. Collaborations between training institutions and airlines can lead to customized training modules, enhancing efficiency. Despite challenges like high training costs and stringent regulations, the market is poised for expansion through continuous innovation and strategic investments.

Market Dynamics

Pilot Training Market Dynamics

The emergence of new airlines around the world will catalyse the market growth

As new airlines enter the market, they drive demand for a larger pool of qualified pilots, necessitating extensive training programs. This increase in airline startups, particularly in rapidly growing regions such as Asia-Pacific, Latin America, and Africa, contributes significantly to the demand for both initial pilot training and recurrent training for existing pilots. Furthermore, new airlines often seek to differentiate themselves through superior safety and service standards, further emphasizing the need for high-quality pilot training. Consequently, flight schools and training organizations will see expanded opportunities, leading to increased investments in advanced training technologies and infrastructure to meet this burgeoning demand.

Restraints & Challenges

High training costs remain a significant barrier, deterring many potential candidates from pursuing pilot careers. Additionally, stringent regulatory requirements and certification processes can delay training program approvals and add to operational complexities for training providers. The market also grapples with a shortage of experienced flight instructors, which can impact the quality and availability of training. Technological advancements, while beneficial, require substantial investment, making it difficult for smaller training centers to compete. Moreover, fluctuating economic conditions and varying demand for air travel can lead to inconsistent enrollment rates. Despite these obstacles, ongoing innovation and strategic investments are crucial to overcoming these challenges and supporting the market's long-term growth.

Regional Forecasts

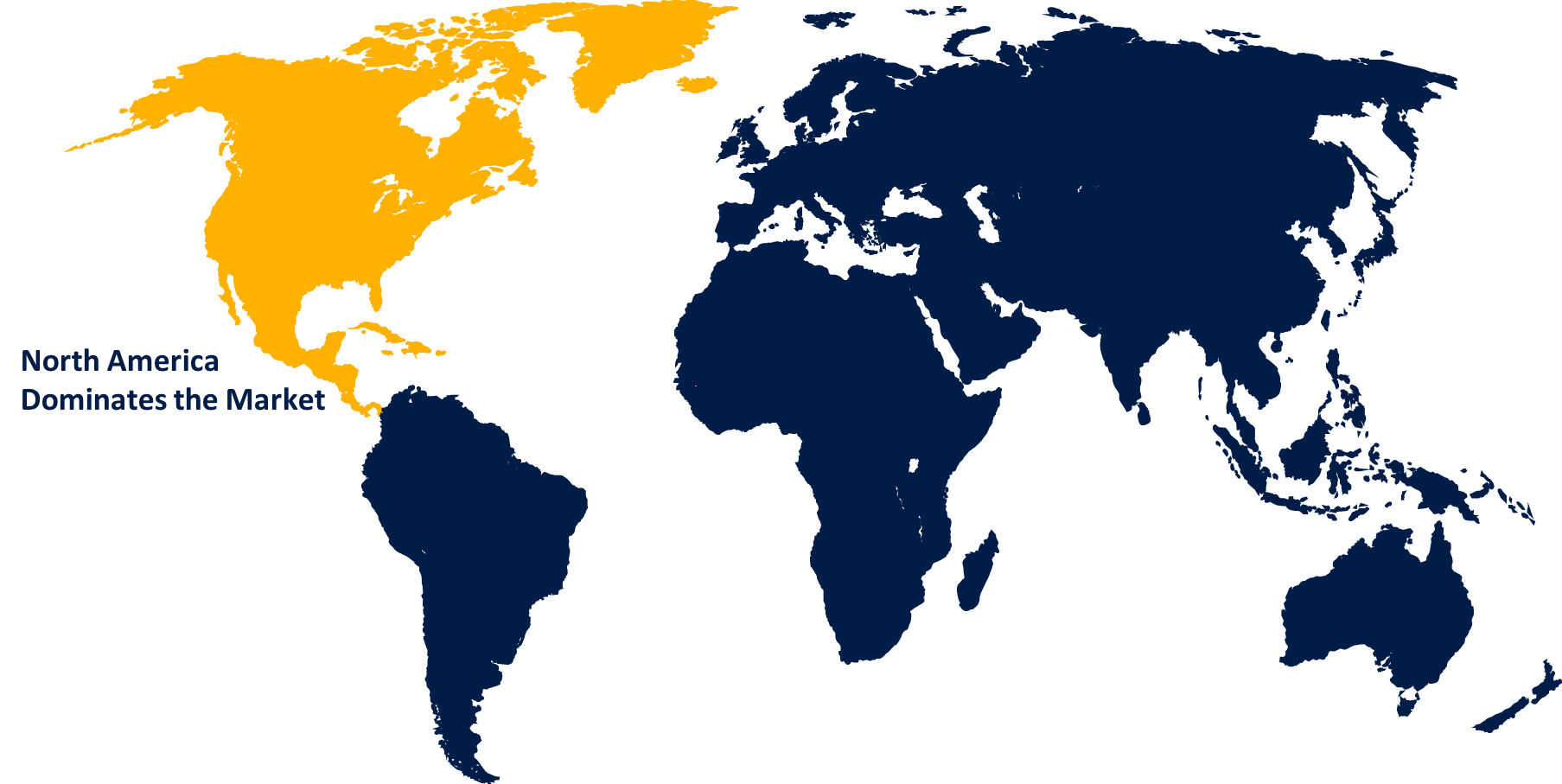

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Pilot Training Market from 2023 to 2033. The United States and Canada, with their extensive airline networks and advanced aviation infrastructure, are key contributors to market growth. The adoption of cutting-edge technologies such as virtual reality (VR) and artificial intelligence (AI) in training programs enhances the quality and effectiveness of pilot education. Additionally, strong regulatory frameworks ensure high safety and training standards. The presence of leading aviation training institutions and strategic partnerships between airlines and training providers further bolster the market. However, challenges like high training costs and a shortage of qualified instructors persist. Despite these issues, North America remains a pivotal region for pilot training, continually evolving to meet industry demands.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. This growth necessitates a significant increase in the number of trained pilots. Investments in advanced training technologies, such as flight simulators and virtual reality (VR), are enhancing training efficiency and safety. Government initiatives and partnerships with international training organizations are also boosting market development. Despite challenges like high training costs and regulatory complexities, the Asia-Pacific region offers vast opportunities. Continuous economic growth and a burgeoning middle class with greater disposable income further propel the demand for pilot training in this dynamic market.

Segmentation Analysis

Insights by Aircraft Type

The airplane segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by the increasing demand for commercial air travel and the expansion of airline fleets worldwide. Airlines are investing heavily in training programs to address the global pilot shortage and ensure a steady pipeline of qualified pilots. Technological advancements, such as next-generation flight simulators and virtual reality (VR) training modules, are enhancing the effectiveness and safety of pilot training. The rise of low-cost carriers and the launch of new airlines, especially in emerging markets, further boost demand for trained airplane pilots. Additionally, stringent regulatory requirements for pilot certification and recurrent training contribute to the segment's growth.

Insights by License Type

The Commercial Pilot License (CPL) segment dominates the market and has the largest market share over the forecast period 2023 to 2033. As airlines increase their fleets and launch new routes, the need for CPL holders intensifies, particularly in fast-growing regions such as Asia-Pacific and the Middle East. Advanced training technologies, including flight simulators and virtual reality (VR), are improving training efficiency and accessibility. Government initiatives and scholarships aimed at supporting aviation careers further boost enrollment in CPL programs. Despite high training costs and stringent regulatory requirements, the market for CPL training is thriving due to continuous investments in aviation infrastructure and the relentless demand for skilled pilots, ensuring a steady growth trajectory for this crucial segment.

Insights by Training Mode

The flight training mode segment accounted for the largest market share over the forecast period 2023 to 2033. Traditional on-ground flight training is increasingly supplemented by sophisticated flight simulators and virtual reality (VR) systems, enhancing the realism and safety of training experiences. These technologies allow for more efficient training schedules and lower operational costs, making pilot education more accessible. The growing adoption of e-learning and online theoretical courses further supports flexible and comprehensive training programs. As airlines and training institutions strive to meet the rising demand for pilots, particularly in expanding markets like Asia-Pacific, investment in innovative training modes continues to increase.

Recent Market Developments

- In March 2023, Airways Aviation, a flight training provider based in the UAE, cooperated with Asia Pacific Flight Training Academy Limited (APFT), headquartered in India, to offer an innovative pilot pathway programme to prospective Indian students and airline cadets.

Competitive Landscape

Major players in the market

- ATP Flight School LLC

- Airways Aviation

- CAE Inc.

- ELITE Simulation Solutions AG

- FlightSafety International Inc.

- Indra Sistemas SA

- L3Harris Technologies Inc.

- Lockheed Martin

- Phoenix East Aviation

- Raytheon Technologies Corporation

- Thales Group

- Upper Limit Aviation Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Pilot Training Market, Aircraft Type Analysis

- Airplane

- Helicopter

Pilot Training Market, License Type Analysis

- Commercial Pilot License

- Private Pilot License

- Airline Transport Pilot License

- Others

Pilot Training Market, Training Mode Analysis

- Flight Training

- Simulator Training

- Ground Training

- Recurrent Training

Pilot Training Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Pilot Training Market?The Global Pilot Training Market is expected to grow from USD 8.5 billion in 2023 to USD 20.8 billion by 2033, at a CAGR of 9.36% during the forecast period 2023-2033.

-

2. Who are the key market players of the Pilot Training Market?Some of the key market players of the market are ATP Flight School LLC, Airways Aviation, CAE Inc., ELITE Simulation Solutions AG, FlightSafety International Inc., Indra Sistemas SA, L3Harris Technologies Inc., Lockheed Martin, Phoenix East Aviation, Raytheon Technologies Corporation, Thales Group, and Upper Limit Aviation Inc.

-

3. Which segment holds the largest market share?The airplane segment holds the largest market share and is going to continue its dominance.

-

4.Which region dominates the Pilot Training market?North America dominates the Pilot Training market and has the highest market share.

Need help to buy this report?