Global Pipeline Anti Corrosion Tapes Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Polyethylene Tapes, Polypropylene Tapes, PVC Tapes, and Others), By Application (Oil & Gas, Water Treatment, Chemical Processing, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal Pipeline Anti Corrosion Tapes Market Insights Forecasts to 2033

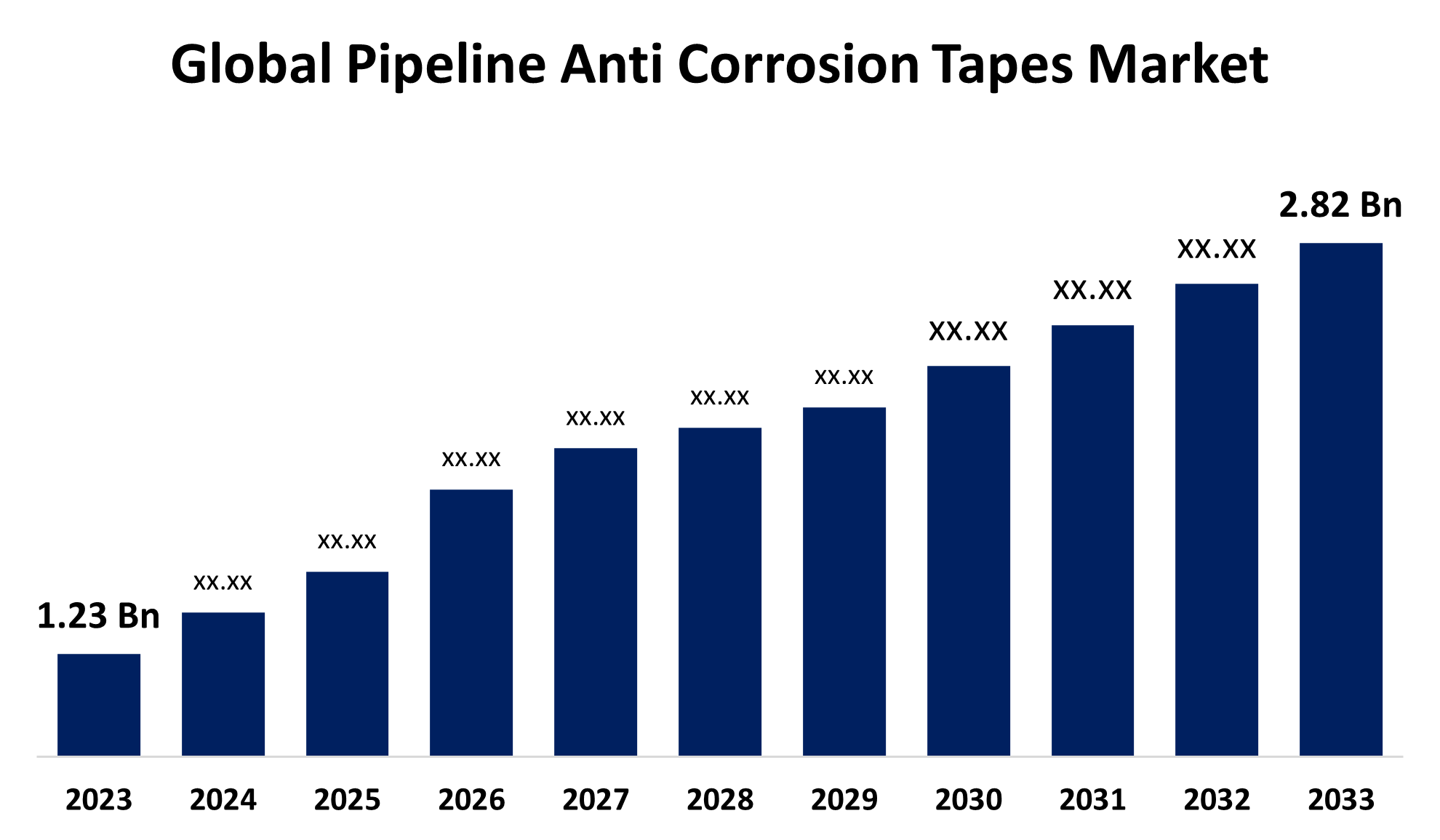

- The Global Pipeline Anti Corrosion Tapes Market Size was estimated at USD 1.23 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 8.65% from 2023 to 2033

- The Worldwide Pipeline Anti Corrosion Tapes Market Size is Expected to Reach USD 2.82 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Pipeline Anti Corrosion Tapes Market Size is expected to cross USD 2.82 Billion by 2033, growing at a CAGR of 8.65% from 2023 to 2033.

Market Overview

The global pipeline anti-corrosion tapes market refers to the industry that manufactures, distributes, and applies protective tapes to prevent pipeline corrosion. These tapes are frequently utilized in industries like as oil and gas, water supply, chemical processing, and infrastructure, where pipelines are subjected to extreme temperatures, dampness, and corrosive substances. The pipeline anti-corrosion tapes market offers several prospects for growth and innovation. One of the most significant potentials is to develop improved materials and technologies. As businesses expand, there is an increase in need for corrosion protection solutions that are more durable, efficient, and ecologically friendly. Manufacturers can take advantage of this trend by investing in R&D to create novel goods that address these developing needs. For example, the utilization of nanotechnology and sophisticated polymers may result in the production of tapes with higher performance characteristics.

Report Coverage

This research report categorizes the pipeline anti corrosion tapes market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the pipeline anti corrosion tapes market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the pipeline anti corrosion tapes market.

Global Pipeline Anti Corrosion Tapes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.23 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.65% |

| 2033 Value Projection: | USD 2.82 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application, By Region |

| Companies covered:: | Nitto Denko Corporation, Denso Group Germany, 3M Company, Avery Dennison Corporation, Scapa Group plc, Polyken (Berry Global Inc.), Berry Global Inc., Jining Xunda Pipe Coating Materials Co., Ltd., Plymouth Rubber Europa S.A., Coroplast Fritz Müller GmbH & Co. KG, Shurtape Technologies, LLC, Covestro AG, Chase Corporation, H.B. Fuller Company, DEHN SE + Co KG, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expansion of the oil and gas industry is the primary driver of the pipeline anti-corrosion tapes market. As global energy demands rise, there is a greater need for substantial pipeline networks to carry oil, gas, and other hydrocarbons over long distances. These pipelines are frequently exposed to extreme climatic conditions, rendering them prone to corrosion. Anti-corrosion tapes offer a low-cost and efficient way to protect these important infrastructures, increasing their lifespan and assuring continued operations. Furthermore, the chemical processing industry makes a substantial contribution to market growth. Pipelines in chemical facilities frequently transport highly corrosive compounds, demanding extensive protection measures. Anti-corrosion tapes are highly resistant to chemicals and extreme weather conditions, making them a perfect choice for such applications. The expanding chemical sector, particularly in emerging economies, is likely to drive up demand for these cassettes in the future years.

Restraining Factors

One of the key constraints is the variable cost of raw materials used in the production of anticorrosion tapes. The pricing of materials like polyethylene, polypropylene, and PVC can vary greatly due to supply chain interruptions, geopolitical conflicts, and regulatory policy changes. These changes might have an impact on producer profitability and market price volatility.

Market Segmentation

The pipeline anti corrosion tapes market share is classified into product type and application.

- The polyethylene tapes segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the pipeline anti corrosion tapes market is divided into polyethylene tapes, polypropylene tapes, PVC tapes, and others. Among these, the polyethylene tapes segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is due to its high corrosion resistance, durability, and cost-effectiveness. PE tapes, which are widely used in pipeline infrastructure for oil and gas, water, and wastewater, have good moisture, chemical, and UV resistance, ensuring long-term durability. Their ease of use and minimal maintenance costs make them a popular choice for pipeline repair operations.

- The oil & gas segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe.

Based on the application, the pipeline anti corrosion tapes market is divided into oil & gas, water treatment, chemical processing, and others. Among these, the oil & gas segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe. This significant share is primarily due to the extensive use of pipelines in transporting oil and gas, which necessitates robust corrosion protection to ensure operational efficiency and safety. The harsh environments in which these pipelines frequently travel make them susceptible to corrosion, increasing the reliance on anti-corrosion tapes.

Regional Segment Analysis of the Pipeline Anti Corrosion Tapes Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

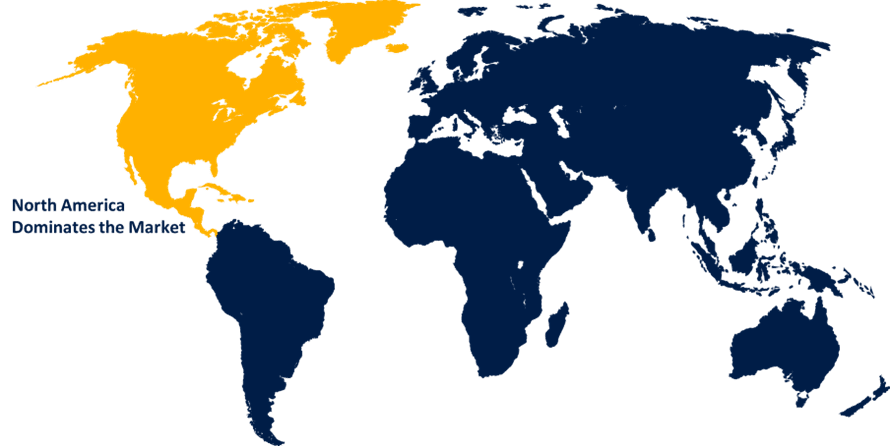

North America is anticipated to hold the largest share of the pipeline anti corrosion tapes market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the pipeline anti corrosion tapes market over the predicted timeframe. The United States, in particular, is a major player in this region, with extensive pipeline networks that transport hydrocarbons. The emphasis on energy security and the development of new oil and gas projects are expected to drive up demand for anti-corrosion tapes. Additionally, stringent environmental regulations and standards are compelling industries to adopt advanced corrosion protection solutions, further boosting the market growth.

Asia Pacific is expected to grow at the fastest CAGR growth of the pipeline anti corrosion tapes market during the forecast period. Countries like China and India are experiencing fast urbanization and industrialization, which is resulting in greater investment in infrastructure development. The requirement for secure and efficient water transportation systems, together with the growth of the chemical processing industry, is boosting the use of anti-corrosion tapes in this region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the pipeline anti corrosion tapes market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nitto Denko Corporation

- Denso Group Germany

- 3M Company

- Avery Dennison Corporation

- Scapa Group plc

- Polyken (Berry Global Inc.)

- Berry Global Inc.

- Jining Xunda Pipe Coating Materials Co., Ltd.

- Plymouth Rubber Europa S.A.

- Coroplast Fritz Müller GmbH & Co. KG

- Shurtape Technologies, LLC

- Covestro AG

- Chase Corporation

- H.B. Fuller Company

- DEHN SE + Co KG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the pipeline anti corrosion tapes market based on the below-mentioned segments:

Global Pipeline Anti Corrosion Tapes Market, By Product Type

- Polyethylene Tapes

- Polypropylene Tapes

- PVC Tapes

- Others

Global Pipeline Anti Corrosion Tapes Market, By Application

- Oil & Gas

- Water Treatment

- Chemical Processing

- Others

Global Pipeline Anti Corrosion Tapes Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the pipeline anti corrosion tapes market over the forecast period?The pipeline anti corrosion tapes market is projected to expand at a CAGR of 8.65% during the forecast period.

-

What is the market size of the pipeline anti corrosion tapes market?The Global Pipeline Anti Corrosion Tapes Market Size is Expected to Grow from USD 1.23 Billion in 2023 to USD 2.82 Billion by 2033, at a CAGR of 8.65% during the forecast period 2023-2033.

-

Which region holds the largest share of the pipeline anti corrosion tapes market?North America is anticipated to hold the largest share of the pipeline anti corrosion tapes market over the predicted timeframe

Need help to buy this report?