Global Plasma Feed Market Size, Share, and COVID-19 Impact Analysis, By Source (Bovine, Porcine, and Others), By Application (Pet Food, Aquafeed, Swine Food, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: AgricultureGlobal Plasma Feed Market Insights Forecasts to 2033

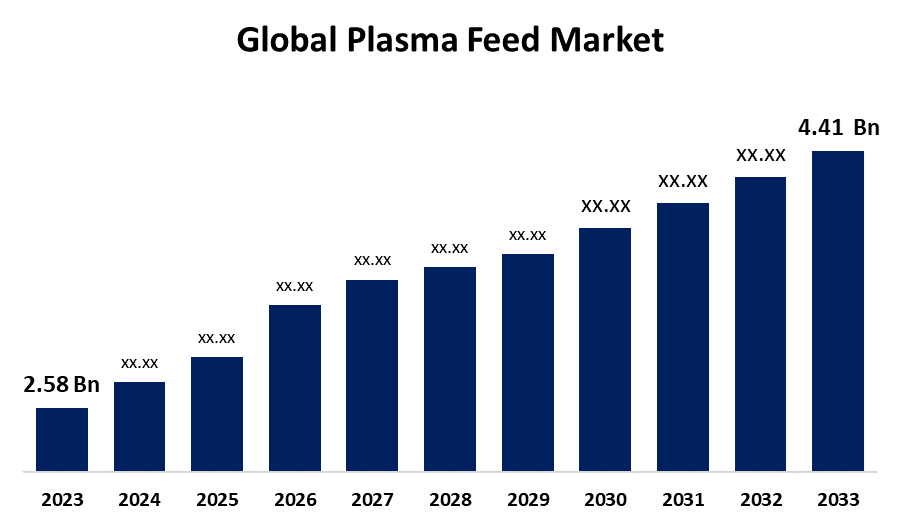

- The Global Plasma Feed Market Size was Valued at USD 2.58 Billion in 2023

- The Market Size is Growing at a CAGR of 5.51% from 2023 to 2033

- The Worldwide Plasma Feed Market Size is Expected to Reach USD 4.41 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Plasma Feed Market Size is Anticipated to Exceed USD 4.41 Billion by 2033, Growing at a CAGR of 5.51% from 2023 to 2033.

Market Overview

Plasma feed is a type of animal feed that includes plasma proteins collected from the animals. Plasma feed contains substantial amounts of phosphate, vitamin B12, calcium, sodium, potassium, chloride, and magnesium. It also contains essential amino acids and has been demonstrated to outperform other protein sources such as skim milk. Plasma feed is made up of feed products with animal-derived plasma proteins as the main element. It is created by separating blood cells from blood plasma, which is a yellowish liquid rich in protein, antibodies, and other beneficial components. This plasma is then dried or converted to a powder or liquid state for convenient storage and transportation. The global market for plasma feed is rising as the feed industry's demand for alternative protein sources grows. There are two basic ways plasma feed ends up in animal meals. It is an easily digested supply of protein and essential amino acids, both of which are essential building blocks for animal development, repair, and health. Plasma carries antibodies that help the immune system flourish and fight infections. The use of plasma feed in pet food is mostly pushed by the premium pet nutrition movement. Pet owners are increasingly seeking high-quality, natural products for their cherished dogs. Adding plasma powder to pet food enhances its nutritional value, palatability, and texture, making it more appealing to pets. In the case of livestock feed, plasma feed can improve animal performance while potentially reducing antibiotic use.

Report Coverage

This research report categorizes the market for the global plasma feed market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global plasma feed market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global plasma feed market.

Global Plasma Feed Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.58 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.51% |

| 2033 Value Projection: | USD 4.41 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Source, By Application and By Region |

| Companies covered:: | Darling Ingredients Inc., Kraeber & Co. GmbH, Lauridsen Group Inc., Lican Food, Lihme Protein Solutions, Puretein Agri LLC, Rocky Mountain Biologicals, Veos Group, Eccofeed LLC, Feedworks Pty Ltd., SARIA Group, Sera Scandia A/S, Daka Denmark AS, Nutreco NV, and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The plasma feed market is significantly influenced by increased demand for high-quality animal protein, which serves as the primary driver of industry dynamics. The consumption of meat and other animal-derived products is increasing as the world's population grows and prosperity rises. This increase in demand raises livestock production needs, placing pressure on the animal feed industry to innovate and adapt. As traditional protein sources confront environmental and efficiency issues, there is an urgent need to study alternative possibilities to meet expanding demand. This shift toward sustainable protein sources not only illustrates the industry's commitment to environmental responsibility but also creates a profitable opportunity for innovative protein technologies such as plasma feed. In this context, players are increasingly concentrating on optimizing production methods, improving nutritional profiles, and ensuring ethical protein input sources to meet evolving customer demands and regulatory requirements. As the need for high-quality animal protein increases, the market for innovative protein solutions is likely to rise dramatically, opening the way for a more sustainable and resilient future for the animal feed industry.

Restraining Factors

Uncertainty in recognizing blood-based products for livestock feed, as well as a demanding worldwide regulatory framework for animal-based protein in ruminant feed, are expected to hinder growth in the global plasma feed market. The primary cause of the restricted raw material availability in the plasma feed industry is plasma sourcing. Plasma feed is mostly made up of animal blood plasma, an essential component derived from dead animals. However, the process of collecting and extracting plasma is intrinsically limited by several criteria, including the amount of blood drawn per animal and the frequency of slaughtering operations.

Market Segmentation

The global plasma feed market share is classified into source and application.

- The porcine segment is expected to hold the largest share of the global plasma feed market during the forecast period.

Based on the source, the global plasma feed market is divided into bovine, porcine, and others. Among these, the porcine segment is expected to hold the largest share of the global plasma feed market during the forecast period. Porcine plasma is a feed ingredient that comprises easily digestible proteins and amino acids, as well as significant amounts of functional bioactive substances such as immunoglobulins, transferrin, growth factors, peptides, and other physiologically active components. Porcine blood meal has numerous health benefits for animals and is extensively used in poultry and porcine feed.

- The pet food segment is expected to hold a significant share of the global plasma feed market during the forecast period.

Based on the application, the global plasma feed market is divided into pet food, aquafeed, swine food, and others. Among these, the pet food segment is expected to hold a significant share of the global plasma feed market during the forecast period. Plasma feed successfully fulfills pets' protein necessities. Plasma feed is an organic, environmentally friendly, and effective food source for pets. Plasma feed establishes its position as an essential component in quality pet food formulas by emphasizing its nutritional excellence, palatability, and digestibility.

Regional Segment Analysis of the Global Plasma Feed Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to grow at the fastest CAGR in the plasma feed market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to grow at the fastest CAGR in the plasma feed market over the predicted timeframe. This dominant position could be attributed to a combination of factors fueling regional growth. The most noticeable of these is an increase in meat consumption, which is being driven by a rapidly expanding population and increased disposable income. As more Asian consumers adopt meat-centric eating habits, the need for animal feed, including plasma feed as a crucial protein source, increases. The region's improving economy contributes significantly to the increased need for plasma feed. A strong meat processing industry in Asia-Pacific guarantees a steady supply of raw plasma for feed production. This significant economic growth generates an environment conducive to the expansion of livestock production and associated feed firms, hence increasing regional acceptance of plasma feed. The dominance of the Asia-Pacific plasma feed market is reinforced by government rules and regulations. Some governments in the region encourage plasma feed production or impose restrictions on antibiotic use in animal feed, creating a more favorable regulatory climate for plasma feed adoption. According to industry researchers, the Asia-Pacific market will continue to grow significantly due to favorable legislative frameworks, rising economic conditions, and a growing demand for meat.

North America is expected to grow at the fastest pace in the global plasma feed market during the forecast period. North America is a prospective market for plasma feed, with excellent growth opportunities due to the convergence of demand drivers and solutions to current challenges. The region reflected global trends, with an increasing population and increasing financial resources pushing up meat consumption and necessitating increased volumes of animal feed, including protein sources such as plasma. Furthermore, North American farmers are increasingly concerned with animal health and performance, seeking treatments that boost immunity and growth. Plasma feed grows as an interesting approach, with potential benefits that address these problems. Consumer demand for antibiotic-free meat may drive the use of plasma feed as a natural replacement. North America's prominence as an agricultural innovation powerhouse encourages study into the beneficial effects of plasma feed for various livestock species and its potential to improve meat quality. Future regulatory improvements, such as loosened limitations on specific blood meal derivatives, may further encourage the use of plasma feed formulations, hence boosting market growth and stimulating innovation in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on global plasma feed market the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Darling Ingredients Inc.

- Kraeber & Co. GmbH

- Lauridsen Group Inc.

- Lican Food

- Lihme Protein Solutions

- Puretein Agri LLC

- Rocky Mountain Biologicals

- Veos Group

- Eccofeed LLC

- Feedworks Pty Ltd.

- SARIA Group

- Sera Scandia A/S

- Daka Denmark AS

- Nutreco NV

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2022, Valley Proteins was acquired by Darling Ingredients Inc., a US-based distributor of sustainable natural ingredients, for an unknown amount. Darling Ingredients Inc. hopes that this acquisition will help to strengthen its operations and provide additional feedstock with a reduced carbon intensity. Valley Proteins is a US-based firm that provides animal feed and pet food materials, particularly plasma feed.

- In January 2021, APC Inc. has announced a new line of blood protein supplements for farmed diets. The new products significantly expand APC's plasma feed offerings and are designed to boost fish growth, health, and disease resistance.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global plasma feed market based on the below-mentioned segments:

Global Plasma Feed Market, By Source

- Bovine

- Porcine

- Others

Global Plasma Feed Market, By Application

- Pet Food

- Aquafeed

- Swine Food

- Others

Global Plasma Feed Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?