Global Pod Vapes Market Size, Share, and COVID-19 Impact Analysis, By Pod Type (Pre-filled Pods and Refillable Pods), By Nicotine Strength (Low Nicotine [0-3 mg], Medium Nicotine [3-6 mg], and High Nicotine [6 mg+]), By Flavor Profile (Fruit Flavors, Dessert Flavors, Tobacco Flavors, Menthol Flavors, and Others), By Distribution Channel (Online and Offline), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Consumer GoodsGlobal Pod Vapes Market Insights Forecasts to 2033

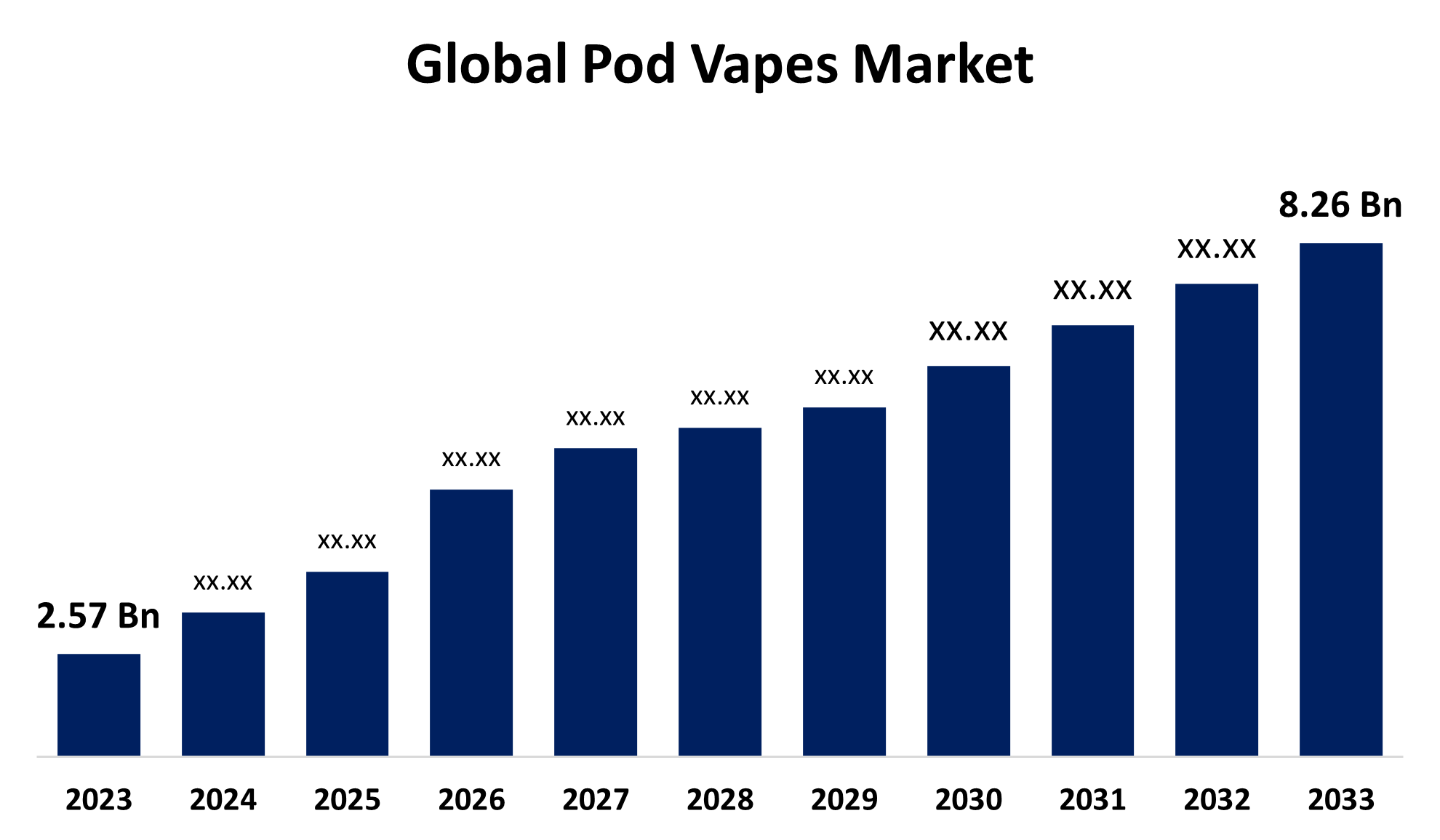

- The Global Pod Vapes Market Size was estimated at USD 2.57 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 12.38% from 2023 to 2033

- The Worldwide Pod Vapes Market Size is Expected to Reach USD 8.26 Billion by 2033

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Pod Vapes Market size is expected to cross USD 8.26 billion by 2033, growing at a CAGR of 12.38% from 2023 to 2033. The pod vapes market is driven by the demand for flavor-varying disposable pod vapes has increased.

Market Overview

The market for pod vapes, also referred to as a pod system or pod mods, is an industry that belongs to pod vapes, a type of electronic cigarette (e-cigarette) that uses small, open, or disposable pods in place of conventional e-liquid tanks. Pods typically have an e-liquid (often with nicotine), a heating element, and sometimes a battery. Pod vapes are popular for being discreet, portable, and easy to use. They are growing in popularity used as a substitute for conventional cigarettes and other vaping devices, thus, their demand is high in the market. The market has expanded due to the growing adoption of user-friendly pod vapes owing to the popularity of nicotine salts.

Additionally, the market for pod vapes is growing as a result of consumer’s changing lifestyles and growing awareness of the harmful effects of smoking. Also, governments in several developed nations are encouraging smokers to adopt pod vapes to lessen the harmful effects that traditional cigarettes have on both the environment and smokers.

Report Coverage

This research report categorizes the pod vapes market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the excavator bucket market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the pod vapes market.

Global Pod Vapes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.57 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.38% |

| 2033 Value Projection: | USD 8.26 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 214 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Pod Type, By Nicotine Strength, By Flavor Profile, By Distribution Channel, By Region |

| Companies covered:: | British American Tobacco, JUUL Labs, Inc., Imperial Brands PLC, VapePod, NJOY, Philip Morris Products S.A., Shenzhen Eleaf Electronics Co., Ltd., Nutrovape, KININ, Japan Tobacco Inc., Altria Group, Hangsen International Group, Eleaf Electronics, Ballantyne Brands, Shenzhen Kanger Technology, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The market for pod vapes is expanding as a result of growing awareness that vaping is a safer option than smoking, which is supported by research findings and health organizations that endorse vaping as a smoking cessation tool. Additionally, advancements in pod vape technology enhance efficiency, use, and versatility attracting both novice and seasoned vapers due to advancements in pop vape technology such as improved battery life, coil design, and smart features like Bluetooth-enabled vapes. In addition, the expansion of the pod vape market is mostly due to the increase of retail channels, especially e-commerce platforms, which offer a vast selection of vaping products to consumers. Furthermore, pod vapes’ popularity is being driven by aggressive social media marketing and the introduction of several flavors, such as mint, orange, coffee, Bavarian cream, and cotton candy.

Restraining Factors

The market is facing several challenges. Pod vapes' limited battery life is one of its major restraints. Additionally, the nicotine in pod vapes limits their global adoption, which eventually hinders the market's expansion. In addition, the regulatory environment, varying across regions, is a challenge to the growth of the vaping market because strict regulations affect consumer access and product availability, particularly in developing nations. Furthermore, concerns about pod vapes, long-term health effects, and potential teen switch to regular cigarettes are major public health issues, with negative media representations impacting consumers' perceptions and the expansion of the industry.

Market Segmentation

The pod vapes market share is classified into pod type, nicotine strength, flavor profile, and distribution channel.

- The pre-filled pods segment held a significant market share in 2023 and is estimated to grow at a CAGR of 11.37% throughout the projection period.

Based on the pod type, the global pod vapes market is categorized into pre-filled pods and refillable pods. Among these, the pre-filled pods segment held a significant market share in 2023 and is estimated to grow at a CAGR of 11.37% throughout the projection period. This segment is attributed to growing in popularity due to their convenience and ease of use. Additionally, because of their user-friendly design, these systems are ideal for beginners who are new to vaping. The pre-filled pod system potentially spills and leaks by doing away with the necessity for manual filling, which is especially appealing to consumers who want a hassle-free experience. Furthermore, a range of pre-filled flavor options is often included with pre-filled pod vapes, enabling users to switch flavors with ease and without requiring maintenance.

- The low nicotine [0-3mg] segment accounted for the largest market share in 2023 and is expected to grow at a CAGR of 12.15% throughout the forecast period.

Based on the nicotine strength, the global pod vapes market is classified into low nicotine [0-3 mg], medium nicotine [3-6 mg], and high nicotine [6 mg+]. Among these, the low nicotine [0-3mg] segment accounted for the largest market share in 2023 and is expected to grow at a CAGR of 12.15% throughout the forecast period. This segment is growing because consumers who are health-conscious and prefer products with lower nicotine content or who want to progressively reduce their nicotine usage are mostly responsible for this development. In addition, low-nicotine pods are particularly well-liked by novice vapers and casual consumers who can be more sensitive to the negative effects of nicotine.

- The tobacco flavors segment dominated the global pod vapes market share in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the flavor profile, the global pod vapes market is divided into fruit flavors, dessert flavors, tobacco flavors, menthol flavors, and others. Among these, the tobacco flavors segment dominated the global pod vapes market share in 2023 and is anticipated to grow at the fastest CAGR during the forecast period. This segment expansion is because tobacco flavors are still widely available and popular among consumers transitioning from traditional cigarettes. Additionally, the tobacco flavor is an option, particularly among older populations, since it offers an assured continuum for people looking for a smoking cessation strategy.

- The online segment held a significant market share in 2023 and is anticipated to grow at the fastest CAGR during the projected timeframe.

Based on the distribution channel, the global pod vapes market is divided into online and offline. Among these, the online segment held a significant market share in 2023 and is anticipated to grow at the fastest CAGR during the projected timeframe. The convenience of online sales is unparalleled. There is no need for customers to go to physical stores since they can get pod vapes from the convenience of their homes. This accessibility is particularly alluring for consumers who might not live close to local vape shops. Additionally, online retailers offer a larger selection of pod vape brands, flavors, and models than physical stores, customers can choose products that fit their interest. In addition, they offer competitive pricing due to reduced overhead costs in brick-and-mortar stores, appealing to price-conscious consumers seeking affordable options.

Regional Segment Analysis of the Pod Vapes Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

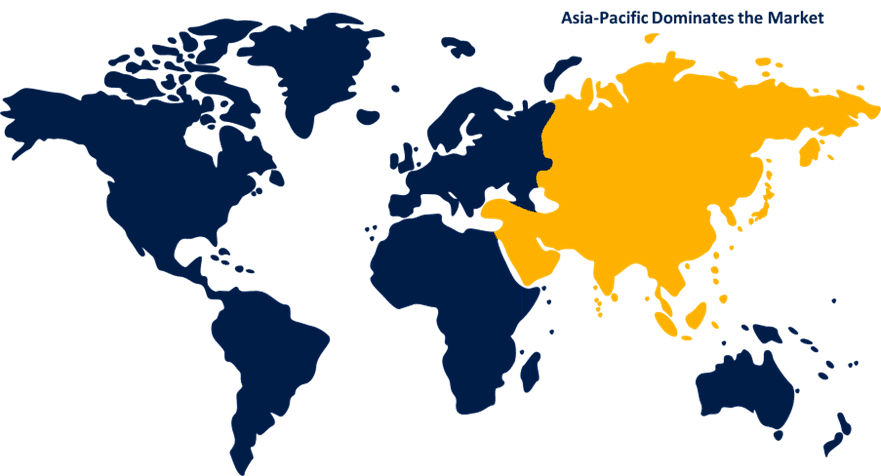

Asia Pacific is anticipated to hold the largest share of the pod vapes market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the pod vapes market over the predicted timeframe. The region’s market is growing because there are a lot of smokers in the region. The Asia Pacific market for pod vapes, particularly in India, China, and Japan, has been driven by shifting lifestyles and increasing disposable income. In addition, growing awareness of pod vaping as a safer alternative to traditional smoking is being driven by public health efforts and online information among smokers in the region. Additionally, China, a major force in the Asia Pacific area, is a major center for vaping technology, consistently creating cutting-edge products with improved characteristics. Furthermore, e-commerce platforms in the region have made pod vapes much more accessible to customers, making them simple to buy in both urban and rural locations.

North America is expected to grow at the fastest CAGR growth of the pod vapes market during the forecast period. The market in the region is anticipated to expand steadily due to the strong presence of major companies and the growing popularity of vaping as a smoking cessation method. Additionally, the established culture, high level of consumer awareness, and presence of major pod vape manufacturers and brands in the United States have made it the dominant market for vaping. Since strict, the North American regulatory environment has given rise to a structure that facilitates the expansion of the vaping sector, with safeguards in place to guarantee consumer protection and product safety.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the pod vapes market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- British American Tobacco

- JUUL Labs, Inc.

- Imperial Brands PLC

- VapePod

- NJOY

- Philip Morris Products S.A.

- Shenzhen Eleaf Electronics Co., Ltd.

- Nutrovape

- KININ

- Japan Tobacco Inc.

- Altria Group

- Hangsen International Group

- Eleaf Electronics

- Ballantyne Brands

- Shenzhen Kanger Technology

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2023, Altria Group, Inc. declared that it had acquired the vaping business NJOY Holdings, Inc. The business will sell NJOY e-vapor goods under the Altria subsidiary NJOY, LLC (NJOY). Furthermore, Altria Group Distribution Company will handle the distribution of NJOY's products.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the pod vapes market based on the below-mentioned segments:

Global Pod Vapes Market, By Pod Type

- Pre-filled Pods

- Refillable Pods

Global Pod Vapes Market, By Nicotine Strength

- Low Nicotine [0-3 mg]

- Medium Nicotine [3-6 mg]

- High Nicotine [6 mg+]

Global Pod Vapes Market, By Flavor Profile

- Fruit Flavors

- Dessert Flavors

- Tobacco Flavors

- Menthol Flavors

- Others

Global Pod Vapes Market, By Distribution Channel

- Online

- Offline

Global Pod Vapes Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the pod vapes market over the forecast period?The pod vapes market is projected to expand at a CAGR of 12.38% during the forecast period.

-

What is the market size of the pod vapes market?The Global Pod Vapes Market size is expected to grow from USD 2.57 billion in 2023 to USD 8.26 billion by 2033, at a CAGR of 12.38% during the forecast period 2023-2033.

-

Which region holds the largest share of the pod vapes market?Asia Pacific is anticipated to hold the largest share of the pod vapes market over the predicted timeframe.

Need help to buy this report?