Global Point-of-Care Molecular Diagnostics Market Size, Share, and COVID-19 Impact Analysis, By Technology (PCR-based, Genetic Sequencing-based, Hybridization-based, and Microarray-based), By Application (Infectious Diseases, Oncology, Hematology, Prenatal Testing, Endocrinology, and Others), By Test Location (OTC and POC), By End-Use (Decentralized Labs, Hospitals, Home-care, Assisted Living Healthcare Facilities, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: HealthcareGlobal Point-of-Care Molecular Diagnostics Market Insights Forecasts to 2032

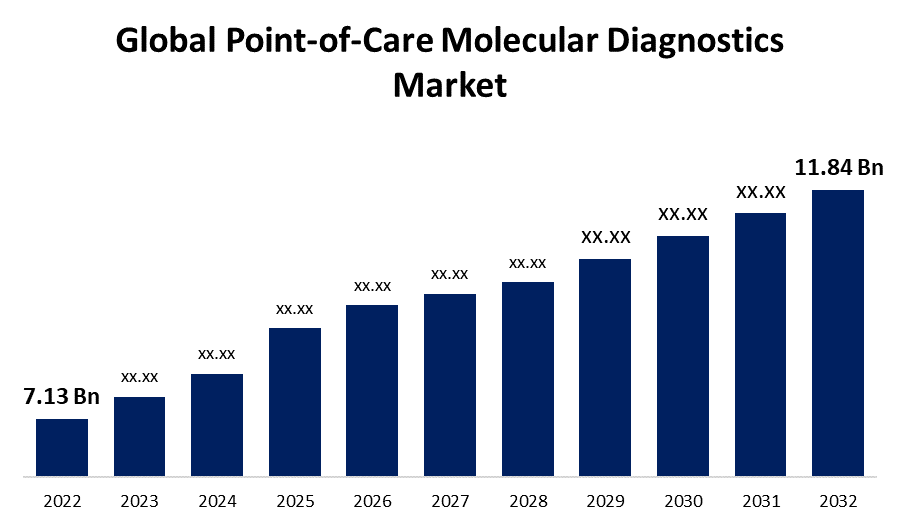

- The Global Point-of-Care Molecular Diagnostics Market Size was valued at USD 7.13 Billion in 2022.

- The Market is growing at a CAGR of 5.2% from 2022 to 2032.

- The Worldwide Point-of-Care Molecular Diagnostics Market Size is expected to reach USD 11.84 Billion by 2032.

- Asia-Pacific is expected to grow fastest during the forecast period.

Get more details on this report -

The Global Point-of-Care Molecular Diagnostics Market Size is expected to reach USD 11.84 Billion by 2032, at a CAGR of 5.3% during the forecast period 2022 to 2032.

Market Overview

Point-of-care molecular diagnostics (POC MDx) is a rapidly advancing field in medical technology that enables rapid and accurate detection of infectious diseases, genetic disorders, and other medical conditions at the patient's bedside or in a clinical setting, without the need for complex laboratory infrastructure. This innovative approach leverages nucleic acid amplification techniques, such as polymerase chain reaction (PCR) and isothermal amplification, to detect specific genetic sequences or pathogens in patient samples, like blood, saliva, or swabs, within minutes to a few hours. POC MDx offers numerous benefits, including timely diagnosis, early intervention, and improved patient outcomes, particularly in resource-limited or remote areas where access to centralized laboratories is limited. With its potential to revolutionize healthcare delivery, POC MDx holds promise in transforming disease management and preventive measures on a global scale.

Report Coverage

This research report categorizes the market for point-of-care molecular diagnostics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the point-of-care molecular diagnostics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the point-of-care molecular diagnostics market.

Global Point-of-Care Molecular Diagnostics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 7.13 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 5.2% |

| 022 – 2032 Value Projection: | USD 11.84 Bn |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Technology, By Application, By Test Location, By Region. |

| Companies covered:: | Abbott, Bayer AG, F. Hoffmann-La Roche AG, Nova Biomedical, QIAGEN, Nipro Diagnostics, Danaher, Bio-Rad Laboratories, Inc., bioMerieux, Agilent Technologies, Inc., Abaxis, OraSure Technologies and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The point of care molecular diagnostics (POC MDx) market is driven by several key factors, the increasing prevalence of infectious diseases and genetic disorders demands rapid and accurate diagnostic solutions at the patient's bedside. The need for immediate results to facilitate prompt clinical decision-making, especially in critical situations, fuels the demand for POC MDx technologies. Additionally, the rise in decentralized healthcare settings, such as clinics and ambulatory care centers, seeks portable and user-friendly diagnostic tools. Furthermore, advancements in nucleic acid amplification techniques and the miniaturization of lab-on-a-chip devices enhance the accessibility and affordability of POC MDx platforms. The market is also influenced by the growing demand for personalized medicine and the potential to curb the spread of antimicrobial resistance through targeted therapies. Overall, these drivers create a strong momentum for the expansion of the POC MDx market globally.

Restraining Factors

The point of care molecular diagnostics (POC MDx) market faces several notable restraints. The high development and manufacturing costs associated with sophisticated POC MDx devices can limit their accessibility, particularly in resource-constrained regions. Regulatory challenges and the need for stringent quality control can also hinder market growth. Additionally, the complexity of molecular testing procedures may require specialized training for healthcare professionals, leading to slower adoption rates. Furthermore, the competition from traditional laboratory-based diagnostic methods and the established dominance of existing diagnostic technologies pose barriers to the widespread acceptance of POC MDx. Overcoming these restraints necessitates continuous technological advancements, cost-effectiveness, and streamlined regulatory pathways to unlock the full potential of POC MDx in transforming point-of-care diagnostics.

Market Segmentation

- In 2022, the PCR-based segment accounted for around 57.4% market share

On the basis of the technology, the global point-of-care molecular diagnostics market is segmented into PCR-based, genetic sequencing-based, hybridization-based, and microarray-based. The dominance of the PCR-based segment in the molecular diagnostics market can be attributed to several key factors. Polymerase chain reaction (PCR) is a powerful and widely used nucleic acid amplification technique that enables the detection and quantification of specific DNA or RNA sequences with exceptional sensitivity and specificity. Its versatility allows it to be applied in various diagnostic applications, ranging from infectious diseases to genetic disorders and oncology. PCR-based assays offer rapid and accurate results, making them invaluable in time-sensitive clinical settings. The ability to detect minute amounts of target DNA or RNA ensures early diagnosis and appropriate treatment, improving patient outcomes. PCR has witnessed significant technological advancements, such as real-time PCR and digital PCR, enhancing its sensitivity, quantification capabilities, and multiplexing capacity. These improvements have widened the scope of PCR applications and increased its adoption in clinical laboratories worldwide. PCR-based tests have been pivotal during disease outbreaks and pandemics, allowing for swift identification and tracking of infectious agents. The ongoing COVID-19 pandemic is a notable example, where PCR has played a crucial role in diagnosing and monitoring the virus's spread. Moreover, the establishment of a robust infrastructure for PCR-based testing in healthcare facilities, along with the availability of a wide range of commercial PCR assay kits, has further fueled the segment's growth. Furthermore, PCR's compatibility with automation and high-throughput systems has accelerated sample processing, making it suitable for handling large-scale screening and testing efforts.

- In 2022, the infectious diseases segment dominated with more than 28.3% market share

Based on the application, the global point-of-care molecular diagnostics market is segmented into infectious diseases, oncology, hematology, prenatal testing, endocrinology, and others. The dominance of the infectious disease segment in the molecular diagnostics market can be attributed to several key factors, such as infectious diseases pose a significant global health burden, leading to a high demand for efficient and timely diagnostic solutions. Molecular diagnostics offers highly sensitive and specific tests for detecting pathogens, enabling early identification and appropriate treatment. This aspect becomes particularly crucial during disease outbreaks or pandemics, where rapid and accurate diagnosis is critical for containment and management. The increasing prevalence of infectious diseases, such as respiratory infections, sexually transmitted infections, and hospital-acquired infections, has driven the need for robust diagnostic tools. Molecular diagnostics' ability to detect a wide range of pathogens with high accuracy makes it an indispensable tool in the clinical setting. The ongoing development of new assays and platforms that enhance the efficiency and automation of molecular diagnostic tests further boosts the market for infectious disease diagnostics. Advances in nucleic acid amplification techniques, such as real-time PCR, digital PCR, and isothermal amplification, have revolutionized the sensitivity, speed, and throughput of infectious disease testing. Moreover, the rising awareness about the importance of early diagnosis for infectious diseases, coupled with increasing government initiatives and funding for infectious disease control and surveillance programs, have also contributed to the segment's dominance. Additionally, the growing demand for point-of-care testing to facilitate rapid diagnosis and patient management has further bolstered the market for infectious disease molecular diagnostics.

Regional Segment Analysis of the Point-of-Care Molecular Diagnostics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 40.5% revenue share in 2022.

Get more details on this report -

Based on region, North America's dominance in the point-of-care molecular diagnostics market can be attributed to several key factors because the region boasts a well-established and advanced healthcare infrastructure, which facilitates the adoption of innovative diagnostic technologies. North America has a high prevalence of infectious diseases and chronic conditions, creating a significant demand for rapid and accurate diagnostic solutions at the point of care. Additionally, the presence of prominent players in the molecular diagnostics industry, coupled with extensive research and development activities, drives market growth. Moreover, favorable government initiatives and policies aimed at promoting point-of-care testing further contribute to the region's leadership in this sector. Overall, North America's favorable market conditions, coupled with its commitment to advancing healthcare, have enabled it to secure the largest revenue share in the point-of-care molecular diagnostics market.

Recent Developments

- In February 2022, Sense Biodetection and Una Health (Una) have formed a strategic agreement for the distribution of the Veros COVID-19 test in the United Kingdom. Through this partnership, Una will be responsible for distributing the Veros test, which is developed by Sense Biodetection, in the UK market. The agreement aims to expand accessibility to the Veros COVID-19 test and enhance the nation's testing capabilities during the ongoing pandemic.

- In March 2022, Capsulomics, a healthcare company, revealed plans to launch two PCR-based epigenetic tests specifically designed for detecting esophageal cancer. These tests are expected to offer advanced diagnostic capabilities, utilizing molecular markers to provide accurate and early detection of the disease. This move represents a significant step forward in improving esophageal cancer screening and diagnosis, potentially leading to better patient outcomes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global point-of-care molecular diagnostics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Abbott

- Bayer AG

- F. Hoffmann-La Roche AG

- Nova Biomedical

- QIAGEN

- Nipro Diagnostics

- Danaher

- Bio-Rad Laboratories, Inc.

- bioMerieux

- Agilent Technologies, Inc.

- Abaxis

- OraSure Technologies

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global point-of-care molecular diagnostics market based on the below-mentioned segments:

Point-of-Care Molecular Diagnostics Market, By Technology

- PCR-based

- Genetic Sequencing-based

- Hybridization-based

- Microarray-based

Point-of-Care Molecular Diagnostics Market, By Application

- Infectious Diseases

- Oncology

- Hematology

- Prenatal Testing

- Endocrinology

- Others

Point-of-Care Molecular Diagnostics Market, By Test Location

- OTC

- POC

Point-of-Care Molecular Diagnostics Market, By End-Use

- Decentralized Labs

- Hospitals

- Home-care

- Assisted Living Healthcare Facilities

- Others

Point-of-Care Molecular Diagnostics Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?