Global Point-of-Use Water Treatment Systems Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Tabletop Pitchers, Faucet-Mounted Filters, Counter-Top Units, Under-The-Sink Filters, Others), By Technology Type (Reverse Osmosis Systems, Ultrafiltration Systems, Distillation Systems, Disinfection Methods, Filtration Methods, Ion Exchange, Others), By Application (Residential, Non-Residential), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Machinery & EquipmentGlobal Point-of-Use Water Treatment Systems Market Insights Forecasts to 2032

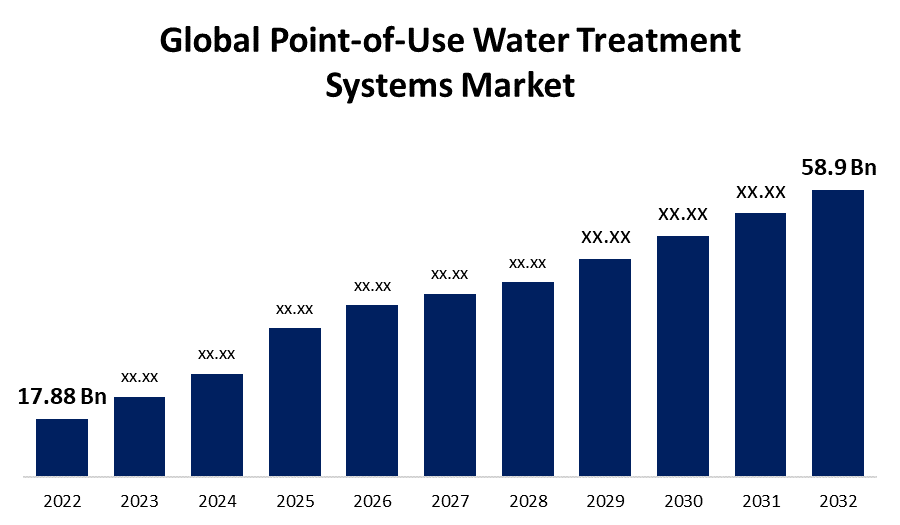

- The Global Point-of-Use Water Treatment Systems Market Size was valued at USD 17.88 Billion in 2022.

- The Market Size is Growing at a CAGR of 12.7% from 2022 to 2032

- The Worldwide Point-of-Use Water Treatment Systems Market Size is expected to reach USD 58.9 Billion by 2032

- Europe is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Point-of-Use Water Treatment Systems Market Size is expected to reach USD 58.9 Billion by 2032, at a CAGR of 12.7% during the forecast period 2022 to 2032.

Point-of-Use (POU) water treatment systems are typically installed right before the water is utilized for drinking, cooking, or in a laboratory that requires highly cleansed water. Water purification systems at the point of use (PoU) are simple to use, easy to put into operation, and require minimal space. Point-of-use (POU) systems are critical water-treatment options in underdeveloped areas because they are user-friendly, low-cost, low-maintenance, and grid-independent. POU filters are typically effective at dissolving hard water and reducing limescale in kitchen utensils, shower heads, and shower enclosures as long as the treatment cartridges are switched out on a regular basis. The overall market for point-of-use water treatment systems is anticipated to expand significantly in the coming years owing to rising demand for clean and healthy drinking water, rising water contaminating substances, a growing human population, increased awareness of the environmental advantages of water treatment, and recent developments in the water and wastewater treatment industry.

The major key players in the Global Point-of-Use Water Treatment System Market include LG Electronics, Coway Co. Ltd., Best Water Technology AG, Toray Industries Pentair PLC, Honeywell International, Panasonic Corporation, Unilever PLC, A.O. Smith, Culligan, and Amway Corp. Market manufacturers are closely monitoring advancements in the water purifier industry and developing innovative company tactics to strengthen their competitive edge. Furthermore, corporations are investing heavily in R&D and offering innovative designs as well as expanded capacities to increase their adoption.

For instance, on January 2023, Coway Co., Ltd., "The Best Life Solution Company," announced that the Neo Plus Water Purifier CHP-264L has received NSF-JWPA P508 certification for its water filtering capacity in low-water pressure locations. Coway is now the world's first water purifier manufacturer to be NSF-JWPA P508 certified. The NSF-JWPA P508 procedure assesses the performance of point-of-use (POU) systems in places with low water pressure.

Global Point-of-Use Water Treatment Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022 : | USD 17.88 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 12.7% |

| 2032 Value Projection: | USD 58.9 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Technology Type, By Application, By Region |

| Companies covered:: | LG Electronics, Coway Co. Ltd., Best Water Technology AG, Toray Industries Pentair PLC, Honeywell International, Panasonic Corporation, Unilever PLC, A.O. Smith, Culligan, Amway Corp, 3M, Pentair, Koninklijke Philips N.V., EcoWater Systems LLC, Katadyn Group, Kent RO Systems Ltd. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Consumers have grown increasingly concerned regarding their overall wellness as they become more aware of water-borne diseases and contaminants in water, and they demand clean drinking water avert such serious ailments. Furthermore, water programs run by various environmental organizations are raising awareness in both mature and emerging economies over the nutritional benefits of drinking and utilizing clean water. As a result, growing public awareness of water-borne diseases is driving up the market for point-of-use water treatment systems all over the globe.

Furthermore, with the recent development of the Internet of Things, smart water filtration systems have emerged as an upcoming technical paradigm in the water purification business. These cognitive purifiers are intended to succeed in traditional filters such as reverse osmosis and ultraviolet water filtration devices. They are small and easy to use with smartphones and tablets. likewise, point-of-use water purification devices are reasonably priced for consumers. The increase in the number of real estate projects is likely to drive the growth of the global point of use water treatment systems market. Growing awareness of health concerns in established regions such as North America and Europe, as well as developing countries in the Asia Pacific, is likely to boost the popularity of the point of use water treatment systems market during the forecast period.

Restraining Factors

However, the costly initial equipment and operating costs of these types of systems have limited their popularity among domestic consumers. The price of the equipment of these systems is large, and subsequent maintenance raises the cost of operation. Additionally, the operating and maintenance expenses of some point-of-use water treatment systems are substantial. Because of a lack of methodologies, infrastructure, and revenue, nations with limited resources are having difficulty developing these water treatment plants. Nonetheless, these countries are working on combining many different technologies in order to obtain a proper solution that is within expenditure while being simple to put into operation.

Market Segmentation

By Product Type Insights

The counter-top unit segment is dominating the market with the largest revenue share over the forecast period.

On the basis of product type, the global point-of-use water treatment systems market is segmented into the tabletop pitchers, faucet-mounted filters, counter-top units, under-the-sink filters, and others. Among these, the counter-top unit segment is dominating the market with the largest revenue share of 38.6% over the forecast period. Counter-top filters are also referred to as on-counter filters. The filters themselves are mounted on the counter-top and have a direct connection to the tap. Countertop units use reverse osmosis and carbon activation techniques. These filters remove impurities that consist of bacteria, dirt, chlorine, particles, rust, and metals such as mercury, lead, silt, copper, benzene, cadmium, and cysts. The primary benefit of counter-top devices is that they lack the need for regular filter changes. However, they necessitate some plumbing. Unlike pitcher water filters, counter-top units do not cool water.

By Technology Type Insights

The reverse osmosis systems segment is witnessing significant CAGR growth over the forecast period.

On the basis of technology type, the global point of use water treatment systems market is segmented into reverse osmosis systems, ultrafiltration systems, distillation systems, disinfection methods, filtration methods, ion exchange, and others. Among these, the reverse osmosis systems segment is witnessing significant CAGR growth over the forecast period. The rise in demand can be ascribed to the widespread use of this technology as well as its ease of installation and use. RO systems use cutting-edge membrane filtering technology to remove 99% of water impurities while providing the same high-quality water as packaged water. As a result, these systems are widely used for water purification. RO water purifiers come in a variety of sizes and shapes, including wall-mounted, tabletop, under-the-sink, and under-the-counter models.

By Application Insights

The residential segment accounted for the largest revenue share of more than 57.2% over the forecast period.

On the basis of application, the global point-of-use water (POU) treatment systems market is segmented into residential and non-residential. Among these, the residential segment is dominating the market with the largest revenue share of 57.2% over the forecast period. The residential usage is primarily concerned with the implementation of point-of-use water treatment systems to generate drinkable water for residential use. Because of the growing need for treated drinking water, elimination of bad taste, odor, and coloring, suspended particles, biodegradable organics, and harmful bacteria, the residential water treatment industry is predicted to increase rapidly. Furthermore, non-residential is growing at the highest pace in this application. Small-scale commercial, industrial, and healthcare facilities, educational institutions, sports facilities, and transportation facilities are all included in the non-residential section. An upsurge in population and increased knowledge of the benefits of water treatment can be contributed to the segment's growth.

Regional Insights

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 38.7% market share over the forecast period. In Asia Pacific, the market for point-of-use water treatment systems is primarily driven by China, India, and ASEAN countries, which are dealing with concerns about treated water, fast urbanization, and economic expansion. These nations currently expanding populations provide a large consumer market. China has a huge presence of domestic equipment makers and suppliers, which helps it lead the global position, owing to large-scale investments in technological development.

Europe, on the contrary, is expected to grow the fastest during the forecast period. Germany dominated the point of use water treatment system market followed by the U.K. The increasing water consumption for household usage would result in the rising demand for point of use water treatment systems in this region.

The North America market is expected to register a substantial CAGR growth rate during the forecast period. North America is a highly developed market with a high level of consumer knowledge about the necessity of a well-being-oriented lifestyle and safe drinking water. Furthermore, the existence of gigantic commercial producers and their widely recognized distribution channels fuels the expansion of the region's point-of-use water treatment systems market. Government measures to limit single-use plastic water bottles have a significant impact on the Latin American market. Additionally, a greater understanding by customers of the importance of drinking clean water is projected to propel the water industry in Brazil and Mexico.

List of Key Market Players

- LG Electronics

- Coway Co. Ltd.

- Best Water Technology AG

- Toray Industries Pentair PLC

- Honeywell International

- Panasonic Corporation

- Unilever PLC

- A.O. Smith

- Culligan

- Amway Corp

- 3M

- Pentair

- Koninklijke Philips N.V.

- EcoWater Systems LLC

- Katadyn Group

- Kent RO Systems Ltd.

Key Market Developments

- On May 2022, Brita®, a 30-year leader in at-home water filtering solutions, has announced an extended cooperation initiative with municipalities across the United States. Cities with lead in their drinking water are struggling to provide short-term water filtration solutions for their residents, particularly solutions that do not involve simply giving away environmentally destructive, single-use plastic water bottles, as a result of the updated, more stringent EPA lead and copper rule, which requires more testing and inventorying of lead services lines. According to a recent EPA Memorandum on the implementation of the Clean Water and Drinking Water state revolving fund provisions, infrastructure bill funding will cover the purchase of temporary pitcher filters or point-of-use (POU) devices certified by an American National Standards Institute, but funding for bottled water is not eligible under this appropriation.

- On October 2022, Asahi Kasei, a diversified Japanese multinational corporation, and its subsidiary Crystal IS concluded in a bacterial performance test that an experimental KlaranTM WR water treatment reactor demonstrated over 75% higher performance than a traditional low pressure mercury lamp system using an equivalent power consumption level. KlaranTM WR is an inline Point of Use (PoU) water treatment reactor that blends Crystal IS' UVC LEDs on aluminum nitride (AlN) substrates with Asahi Kasei's R&D competence in optics and fluid dynamics.

- In November 2021, DuPont Water Solutions (DWS) introduced a new point-of-use reverse osmosis membrane filter for use in commercial buildings. The TapTec LC HF-4040 combines high flow rates with dependability and ease of operation. The new compact filter solves the challenges of being cost-effective, dependable, and simple to operate while delivering high flow rates.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Point-of-Use Water Treatment Systems Market based on the below-mentioned segments:

Point-of-Use Water Treatment Systems Market, Product Type Analysis

- Tabletop Pitchers

- Faucet-Mounted Filters

- Counter-Top Units

- Under-The-Sink Filters

- Others

Point-of-Use Water Treatment Systems Market, Technology Type Analysis

- Reverse Osmosis Systems

- Ultrafiltration Systems

- Distillation Systems

- Disinfection Methods

- Filtration Methods

- Ion Exchange

- Others

Point-of-Use Water Treatment Systems Market, Application Analysis

- Residential

- Non-Residential

Point-of-Use Water Treatment Systems Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?