Global Polyamide Market Size By Product (Polyamide 6, Polyamide 66, Bio-based Polyamide, Specialty Polyamides), By Application (Engineering Plastics, Fibers), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2032.

Industry: Chemicals & MaterialsGlobal Polyamide Market Insights Forecasts to 2032

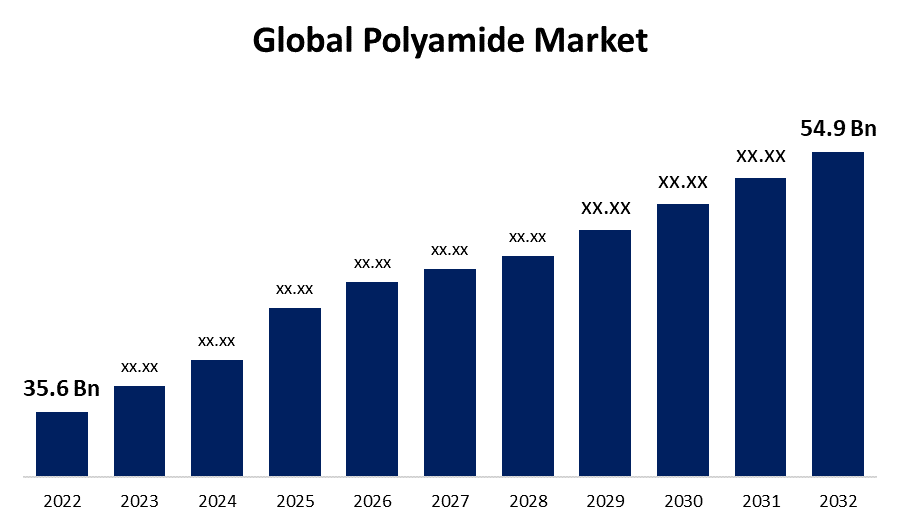

- The Polyamide Market was valued at USD 35.6 Billion in 2022.

- The Market is growing at a CAGR of 7.5% from 2022 to 2032.

- The Global Polyamide Market is expected to reach USD 54.9 Billion by 2032.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Polyamide Market is expected to reach USD 54.9 Billion by 2032, at a CAGR of 7.5% during the forecast period 2022 to 2032.

The rising demand for nylon across a variety of industries has been a major driver of the polyamide market's consistent growth throughout time. The polyamide market is significantly influenced by the automotive, textile, and packaging industries. Polyamide has gained extensive usage due to its adaptability and desirable qualities like strength, durability, and chemical resistance. Engine parts, fuel systems, and interior pieces are just a few of the components in the automotive industry that are made from polyamide. Due to its strength and elasticity, nylon is a preferred material in the textile industry for the creation of clothing, hosiery, and carpets. For films and coatings, the packaging sector also makes use of polyamide. Additionally, the development of bio-based and recycled polyamides has opened up a new market segment and contributed to the movement towards environmentally benign and sustainable materials.

Polyamide Market Value Chain Analysis

The creation of raw materials is where the value chain starts. The basic raw ingredients for polyamides come from petrochemical sources such adipic acid and hexamethylene diamine. To create polyamide resins, the basic ingredients are polymerized. Adipic acid and hexamethylene diamine react chemically to create nylon in this procedure. Manufacturers of polymers are essential in this phase. Polyamide is used in the production of finished goods in downstream industries such as automotive, textiles, packaging, and electronics. For instance, polyamide is moulded into parts like engine parts and interior trims in the vehicle sector. Polyamide is used in the production of goods by end users like automakers, textile manufacturers, and packaging companies. The specific qualities of polyamide that fit the application are frequently what influence the decision to use it.

Polyamide Market Price Analysis

Adipic acid and hexamethylene diamine pricing, for example, have a direct impact on the price of polyamide. The total cost of manufacture of polyamide can be significantly impacted by changes in the price of petrochemicals or other raw materials utilised in the process. Dynamics of supply and demand are very important. Prices may increase if demand for polyamide exceeds supply, and vice versa. Trends in end-user industries including automobiles, textiles, and packaging are among the factors influencing demand. Since petrochemicals are used to make polyamide, variations in energy and oil prices may have an effect on manufacturing costs and, as a result, on polyamide prices. Global economic conditions can affect prices by altering the overall demand for products made with polyamide. Prices may be under pressure as a result of lower demand during economic downturns.

Global Polyamide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 35.6 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 7.5% |

| 022 – 2032 Value Projection: | USD 54.9 Bn |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Product, By Application, By Region, By Geographic Scope. |

| Companies covered:: | Royal DSM., Evonik Industries AG, BASF SE, Koch Industries, Lanxess, Gujarat State Fertilizers & Chemicals Limited (GSFC), Radici Group, Mitsubishi Chemical Holdings, Arkema SA, Ascend Performance Materials LLC, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Polyamide Market Dynamics

Rising demand for electronic devices from the growing population

Numerous electronic components, including connectors, housings, and insulating materials, are made with polyamides. rising demand for polyamides in various applications directly correlates with rising demand for electronic devices such as smartphones, laptops, and wearable technology. Electronic gadgets are becoming smaller, lighter, and more portable, which has increased the demand for materials with excellent strength-to-weight ratios. This need is well suited for polyamides since they offer strength and structural integrity without adding a lot of extra weight. The need for polyamides in casings, connectors, and other components has increased with the spread of consumer electronics, including smart home gadgets and entertainment devices. Polyamides are appropriate for various applications due to their aesthetic and practical qualities. Electronic component demand has surged as a result of the development of the Internet of Things (IoT), where devices are connected to one another to enable data sharing. The requisite material qualities for these components are part of what polyamides contribute to.

Restraints & Challenges

Petrochemical-based raw materials, which are necessary for the synthesis of polyamide, might fluctuate in price depending on the price of oil. This may have an effect on the total cost of production and, consequently, the cost of polyamide products. Alternative materials including polyester, polyethylene, and other high-performance polymers compete with polyamide in the market. The selection of a material is frequently influenced by the demands of a given application and financial constraints. The demand for polyamide on a worldwide scale may be impacted by economic uncertainty, trade disputes, and geopolitical reasons. Market expansion may be hampered by economic downturns or disruptions in international trade.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Polyamide market from 2023 to 2032. The demand for polyamides in the manufacture of electronic components and housings is influenced by the North American region, which consumes a substantial amount of electronic equipment. In the packaging sector, polyamides are used to make coatings and films. In North America, material developments in the packaging industry have improved barrier qualities and sustainability. In the North American polyamide market, there is a growing focus on environmental issues and sustainability. This prompted the creation and widespread use of recycled materials and bio-based polyamides. Both domestic and foreign companies compete in the North American market. Important businesses in the polyamide industry may be engaged in raw material production, polymerization, compounding, and end-product manufacturing.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. China in particular is a significant centre for polyamide product manufacture in the Asia-Pacific region. Numerous production facilities for polymerizing and processing polyamides are located in the area. Asia-Pacific's automotive industry is a significant consumer of polyamide materials. The use of polyamides in various components has been influenced by the automotive industry's need for lightweight, high-performance materials. The need for industrial materials, such as polyamides, for use in machinery, equipment, and manufacturing processes has surged as a result of the quick industrialization of nations like China and India.

Segmentation Analysis

Insights by Product

The Polyamide 6 segment accounted for the largest market share over the forecast period 2023 to 2032. In the automotive sector, polyamide 6 is frequently used to make a variety of parts, including those for engines, fuel systems, and interiors. The adoption of PA6 has been fueled by the automobile industry's need for lightweight materials with excellent strength and endurance. Appliances, athletic goods, and consumer electronics are just a few of the products made with PA6 in the consumer goods industry. Its adaptability and capacity to tolerate a variety of circumstances play a part in its success in this market. Appliances, athletic goods, and consumer electronics are just a few of the products made with PA6 in the consumer goods industry. Its adaptability and capacity to tolerate a variety of circumstances play a part in its success in this market.

Insights by Application

Engineering plastics segment is witnessing the fastest market growth over the forecast period 2023 to 2032. In the production of several components for the automotive industry, engineering polymers, particularly polyamides, are widely used. These could comprise structural components, interior pieces, electrical connectors, and engine parts. The development of engineering plastics based on polyamide has been fueled by the need for lightweight materials with excellent strength and durability in automotive applications. Engineering plastics are being used more frequently in a variety of industries, such as consumer products, automotive, and aerospace, as a result of the overall industry trend towards lightweighting to boost fuel efficiency and decrease emissions. Global market characteristics, such as trade patterns, economic conditions, and regulatory changes, have an impact on the segment growth of engineering plastics.

Recent Market Developments

- In August 2020, in order to acquire BASF Performance Polyamides India, BASF India, a BASF SE affiliate, approved the merger.

Competitive Landscape

Major players in the market

- Royal DSM.

- Evonik Industries AG

- BASF SE

- Koch Industries

- Lanxess

- Gujarat State Fertilizers & Chemicals Limited (GSFC)

- Radici Group

- Mitsubishi Chemical Holdings

- Arkema SA

- Ascend Performance Materials LLC

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Polyamide Market, Product Analysis

- Polyamide 6

- Polyamide 66

- Bio-based Polyamide

- Specialty Polyamides

Polyamide Market, Application Analysis

- Engineering Plastics

- Fibers

Polyamide Market, Regional Analysis

North America

- US

- Canada

- Mexico

Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

South America

- Brazil

- Argentina

- Colombia

Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Polyamide Market?The global Polyamide Market is expected to grow from USD 35.6 Billion in 2023 to USD 54.9 Billion by 2032, at a CAGR of 7.5% during the forecast period 2023-2032.

-

Who are the key market players of the Polyamide Market?Some of the key market players of market are Royal DSM., Evonik Industries AG, BASF SE, Koch Industries, Lanxess, Gujarat State Fertilizers & Chemicals Limited (GSFC), Radici Group, Mitsubishi Chemical Holdings, Arkema SA, Ascend Performance Materials LLC

-

Which segment holds the largest market share?Polyamide 6 segment holds the largest market share and is going to continue its dominance.

-

Which region is dominating the Polyamide Market?North America is dominating the Polyamide Market with the highest market share.

Need help to buy this report?