Global Polyethylene Furanoate Market Size, Share, and COVID-19 Impact Analysis, By Source (Plant Based, Bio-Based, and Others), By Application (Bottles, Fibers, Films, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal Polyethylene Furanoate Market Insights Forecasts to 2033

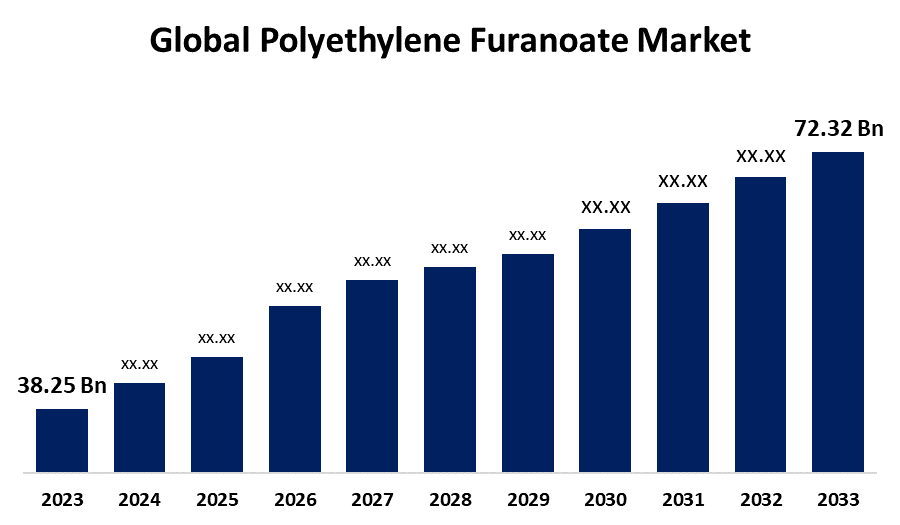

- The Global Polyethylene Furanoate Market Size was estimated at USD 38.25 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 6.58% from 2023 to 2033

- The Worldwide Polyethylene Furanoate Market Size is Expected to Reach USD 72.32 Billion by 2033

- Asia-Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Polyethylene Furanoate Market Size is expected to cross USD 72.32 Billion by 2033, growing at a CAGR of 6.58% from 2023 to 2033.

Market Overview

The global polyethylene furanoate market is the manufacturing, distribution, and use of PEF, a bio-based and fully recyclable polyester that is made from 2,5-furandicarboxylic acid (FDCA) and ethylene glycol. PEF is also a sustainable replacement for polyethylene terephthalate (PET) because it has better barrier properties, mechanical strength, and biodegradability. Market drivers include growing sustainability efforts, legislative policies supporting environment-friendly materials, expanding bioplastics technology, and growing consumer demand for green package solutions. Furthermore, PEF has excellent mechanical, thermal, and barrier properties that qualify it for various textile uses, such as fibers, fabrics, and packaging materials. The fact that PEF can survive extreme temperatures and harsh chemical conditions means that it makes textile products more durable and long-lasting, and both producers and consumers will find this appealing. In addition, the increased application of polyethylene furanoate in manufacturing flexible and rigid packaging solutions for various industries such as pharmaceuticals, food & beverages, consumer goods, etc., is fueling its demand. For instance, the National Bureau of Statistics of China reported that 59.12 million metric tons of non-alcoholic drinks were manufactured in China in the first four months of 2023. Production of non-alcoholic drinks in April was 14.55 million metric tons, about 3% higher than the previous year's production for the first four months. It would ultimately increase the need for bottles manufactured from PEF in the forecast period.

Report Coverage

This research report categorizes the polyethylene furanoate market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the polyethylene furanoate market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the polyethylene furanoate market.

Global Polyethylene Furanoate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 38.25 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.58% |

| 2033 Value Projection: | USD 72.32 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Source, By Application, and By Region |

| Companies covered:: | Mitsui Chemicals, Inc., BASF, Danone, ALPLA, DuPont., Origin Materials, Avantium N.V., Corbion, TOYOBO CO., LTD., ADM, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand for high-performance materials in the automotive sector is driving a spike in demand for polyethylene furanoate (PEF) globally. With manufacturers of automobiles seeking to optimize the efficiency, longevity, and eco-friendliness of their products, the need for more advanced materials that can offer high-performance capabilities at lower environmental costs is on the rise. PEF, a bio-based plastic alternative to conventional petroleum-based plastics, presents a strong solution with its superior mechanical properties, including high strength, stiffness, and heat resistance. These attributes render PEF particularly suitable for various automotive applications, such as lightweight components, interior trim, and under-the-hood components. The move towards sustainability compels industries to shift to bio-based substitutes for conventional plastics. PEF is synthesized from renewable feedstocks, including plant-derived sugars, which decrease the reliance on petrochemical-based plastics. The movement is increasing in strength as consumers and industries become increasingly looking for more sustainable products. Additionally, governments across the globe are implementing policies that encourage renewable materials, offering subsidies, taxation advantages, and funds to aid in the construction of bio-based technologies. These incentives are prompting industries to take up alternatives like PEF. Consequently, the industry of polyethylene furanoate is growing considerably.

Restraining Factors

The high production cost, low worldwide production capacity, market competition from bio-based PET and other compounds, technical complexities in processing, and regulatory constraints are predicted to slow down polyethylene furanoate demand over the forecasted period.

Market Segmentation

The polyethylene furanoate market share is classified into source and application.

- The bio-based segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the source, the polyethylene furanoate market is divided into plant-based, bio-based, and others. Among these, the bio-based segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This dominance is attributed to the growing demand for sustainable and green materials, mounting government policies encouraging bio-based alternatives, and heightened consumer consciousness about environmental effects. The bio-based segment enjoys growth in bioplastics technology, enhanced manufacturing processes, and significant investments in research and development.

- The bottles segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe.

Based on the application, the polyethylene furanoate market is divided into bottles, fibers, films, and others. Among these, the bottles segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe. This growth can be attributed to the growing need for sustainable packaging materials, especially in food and beverage, where PEF's higher barrier properties against oxygen, carbon dioxide, and water vapor improve product shelf life. Moreover, growing consumer demand for green and biodegradable packaging, coupled with strict government regulations on single-use plastics, is further accelerating PEF bottle adoption.

Regional Segment Analysis of the Polyethylene Furanoate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the polyethylene furanoate market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the polyethylene furanoate market over the predicted timeframe. The development is fueled by increasing demand for sustainable materials. Growing consumer consciousness about sustainability has led larger regional players to look for bio-based packaging solutions. With the presence of well-established players focused on utilizing sustainable materials and a strong infrastructure for production and distribution, market dynamics are strengthened. Besides, there are plenty of raw material resources like corn stover, which make local production of PEF easier, and thus it is a potential opportunity for manufacturers to target environmentally friendly customers in North America.

Asia-Pacific is expected to grow at the fastest CAGR growth of the polyethylene furanoate market during the forecast period. The dominance can be attributed to the fast-increasing need for green packaging materials, especially in nations such as China and India, where consumer awareness of environmental matters is increasing. In China, the government's initiative towards an environmentally friendly economy and a tightening grip on plastic waste management stimulated demand for PEF due to its sustainable nature compared to conventional packaging materials. Likewise, in India, growing consumer demand for green products combined with government policies aimed at controlling plastic pollution have presented a massive market opportunity for PEF manufacturers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the polyethylene furanoate market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsui Chemicals, Inc.

- BASF

- Danone

- ALPLA

- DuPont.

- Origin Materials

- Avantium N.V.

- Corbion

- TOYOBO CO., LTD.

- ADM

- Others

Recent Developments

- In October 2024, Avantium N.V. introduced the Releaf brand to market plant-based and recyclable PEF, providing sustainable solutions for bottles, packaging, and textiles. The brand is designed to diminish the use of fossil plastics and illustrates its versatility through an installation at Dutch Design Week, developed with design studio Hoogvliet Jongerius. The installation highlights the aesthetic and functional capabilities of sustainable materials. This move represents a major step in incorporating sustainability into the packaging and textile sectors.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the polyethylene furanoate market based on the below-mentioned segments:

Global Polyethylene Furanoate Market, By Source

- Plant-Based

- Bio-Based

- Others

Global Polyethylene Furanoate Market, By Application

- Bottles

- Fibers

- Films

- Others

Global Polyethylene Furanoate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the polyethylene furanoate market over the forecast period?The polyethylene furanoate market is projected to expand at a CAGR of 6.58% during the forecast period.

-

2. What is the market size of the polyethylene furanoate market?The Global Polyethylene Furanoate Market Size is Expected to Grow from USD 38.25 Billion in 2023 to USD 72.32 Billion by 2033, at a CAGR of 6.58% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the polyethylene furanoate market?North America is anticipated to hold the largest share of the polyethylene furanoate market over the predicted timeframe.

Need help to buy this report?