Global Polyisocyanurate Foam (PIR) Sandwich Panel Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Thickness Below 51 mm, Thickness 51 mm-100 mm, Thickness Above 100 mm), By Application (Building Wall, Building Roof, and Cold Storage), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Advanced MaterialsGlobal Polyisocyanurate Foam (PIR) Sandwich Panel Market Insights Forecasts to 2033

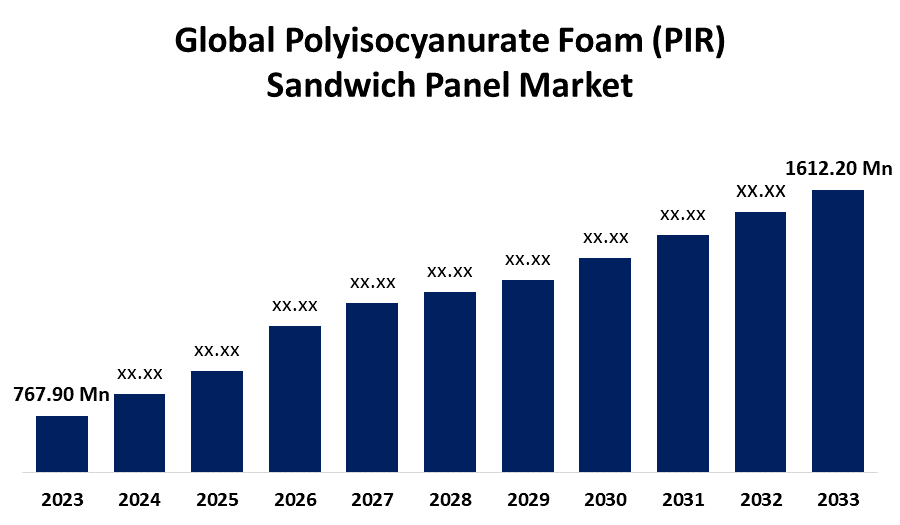

- The Global Polyisocyanurate Foam (PIR) Sandwich Panel Market Size was Valued at USD 767.90 Million in 2023

- The Market Size is Growing at a CAGR of 7.70% from 2023 to 2033

- The Worldwide Polyisocyanurate Foam (PIR) Sandwich Panel Market Size is Expected to Reach USD 1612.20 Million by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Polyisocyanurate Foam (PIR) Sandwich Panel Market Size is Anticipated to Exceed USD 1612.20 Million by 2033, Growing at a CAGR of 7.70% from 2023 to 2033.

Market Overview

A polyisocyanurate foam (PIR) sandwich panel is a type of building material commonly used in construction for its excellent thermal insulation properties. Polyisocyanurate foam (PIR) is used in sandwich panels for high fire resistance and moisture resistance. It enhances structural strength, lightweight, and is easy to install. The demand for energy-efficient buildings is increasing, and people are becoming more aware of the benefits of using polyisocyanurate foam PIR sandwich panels. Sandwich panels help in the short and long-term storage of food and other items. The demand for sandwich panels for cold storage of food and other commodities is expected to expand over the forecast period. The polyisocyanurate foam (PIR) sandwich panel market is growing due to its superior thermal insulation, energy efficiency, and versatility, as well as its expansion in the construction industry and advancements in PIR technology.

Report Coverage

This research report categorizes the market for polyisocyanurate foam (PIR) sandwich panel based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the polyisocyanurate foam (PIR) sandwich panel market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the polyisocyanurate foam (PIR) sandwich panel market.

Global Polyisocyanurate Foam (PIR) Sandwich Panel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 767.90 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.70% |

| 2033 Value Projection: | USD 1,612.20 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 254 |

| Tables, Charts & Figures: | 116 |

| Segments covered: | By Product Type, By Application, and By Region |

| Companies covered:: | Kingspan, Metecno, NCI Building Systems, Assan Panel, Isopan, ArcelorMittal, TATA Steel, Romakowski, Lattonedil, Silex, Marcegaglia, Ruukki, Italpannelli, Tonmat, Nucor Building Systems, Changzhou Jingxue, Alubel, Zhongjie Group, BCOMS, TENAX PANEL, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The polyisocyanurate (PIR) foam sandwich panel market is propelled by several factors including the panels' exceptional thermal insulation enhances energy efficiency, helping to meet rigorous building codes and regulations aimed at improving energy performance. Their durability, fire resistance, and cost-effectiveness make them a preferred choice in construction, aligning with the growing emphasis on sustainability and green building practices. Technological advancements have further boosted their appeal by improving performance and ease of installation. Furthermore, rapid urbanization and infrastructure development, especially in emerging markets, contribute to increased demand for the polyisocyanurate foam (PIR) sandwich panel market.

Restraining Factors

The polyisocyanurate (PIR) foam sandwich panel market faces several restraining factors including high initial costs can be a barrier for some projects, particularly in budget-conscious segments. The market is competitive, with alternative insulation materials like polyurethane and extruded polystyrene offering lower costs or different benefits. Furthermore, limited market awareness and complex regulatory environments can hinder adoption. Fluctuations in raw material prices further affect production costs and pricing.

Market Segmentation

The polyisocyanurate foam (PIR) sandwich panel market share is classified into product type and application.

- The thickness below 51 mm segment is estimated to hold the highest market revenue share through the projected period.

Based on the product type, the polyisocyanurate foam (PIR) sandwich panel market is classified into thickness below 51 mm, thickness 51 mm-100 mm, and thickness above 100 mm. Among these, the thickness below 51 mm segment is estimated to hold the highest market revenue share through the projected period. The segment dominance is due to the cost-effectiveness, versatility, and ease of installation associated with thinner panels, making them a preferred choice for a variety of applications, including walls, ceilings, and roofing systems. The segment offers effective thermal insulation, aligning with energy efficiency standards.

- The building roof segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the polyisocyanurate foam (PIR) sandwich panel market is divided into building wall, building roof, and cold storage. Among these, the building roof segment is anticipated to hold the largest market share through the forecast period. The dominance of the building roof segment is due to PIR panels' exceptional thermal insulation properties, which enhance energy efficiency by minimizing heat transfer. Furthermore, their fire resistance and durability make them highly suitable for roofing applications. The increasing focus on energy-efficient building roofs and the ongoing construction and renovation activities further contribute to the strong demand for PIR panels in roofing.

Regional Segment Analysis of the Polyisocyanurate Foam (PIR) Sandwich Panel Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the polyisocyanurate foam (PIR) sandwich panel market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the polyisocyanurate foam (PIR) sandwich panel market over the predicted timeframe. The Asia Pacific region is dominant due to rapid urbanization, significant infrastructure development, and increasing industrial activities. The region’s strong economic growth and stringent energy efficiency regulations further boost the demand for polyisocyanurate foam (PIR) material. Furthermore, ongoing technological advancements and innovative construction practices in the region contribute to the rising use of PIR sandwich panels, reinforcing its anticipated market leadership.

North America is expected to grow at the fastest CAGR growth of the polyisocyanurate foam (PIR) sandwich panel market during the forecast period. The fastest expansion is due to robust construction and renovation activities, stringent building codes, and a strong emphasis on energy efficiency. Technological innovations and economic stability also contribute to this rapid growth. The region increasingly adopts PIR panels for their superior insulation properties and compliance with energy-saving regulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the polyisocyanurate foam (PIR) sandwich panel market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kingspan

- Metecno

- NCI Building Systems

- Assan Panel

- Isopan

- ArcelorMittal

- TATA Steel

- Romakowski

- Lattonedil

- Silex

- Marcegaglia

- Ruukki

- Italpannelli

- Tonmat

- Nucor Building Systems

- Changzhou Jingxue

- Alubel

- Zhongjie Group

- BCOMS

- TENAX PANEL

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2021, PH Insulation, based in Russia, produced 20 million square meters of sandwich panels. The jubilee 20-millionth square meter sandwich panel was produced on the first PH Insulation Continuous Line. The sandwich panel's core is PIR Premier, with a thickness of 80 mm and a length of 7380 mm. The metal is AISI 304 stainless steel.

- In May 2021, Pearl Polyurethane Systems LLC, a Dubai-based system house, launched a new research and development (R&D) initiative in the Middle East to develop improved continuous sandwich panel concepts, to continuously bring breakthrough new products to the market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the polyisocyanurate foam (PIR) sandwich panel market based on the below-mentioned segments:

Global Polyisocyanurate Foam (PIR) Sandwich Panel Market, By Product Type

- Thickness Below 51 mm

- Thickness 51 mm-100 mm

- Thickness Above 100 mm

Global Polyisocyanurate Foam (PIR) Sandwich Panel Market, By Application

- Building Wall

- Building Roof

- Cold Storage

Global Polyisocyanurate Foam (PIR) Sandwich Panel Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the polyisocyanurate foam (PIR) sandwich panel market over the forecast period?The polyisocyanurate foam (PIR) sandwich panel market is projected to expand at a CAGR of 7.70% during the forecast period.

-

2. What is the market size of the polyisocyanurate foam (PIR) sandwich panel market?The Global Polyisocyanurate Foam (PIR) Sandwich Panel Market Size is Expected to Grow from USD 767.90 Million in 2023 to USD 1612.20 Million by 2033, at a CAGR of 7.70% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the polyisocyanurate foam (PIR) sandwich panel market?Asia Pacific is anticipated to hold the largest share of the polyisocyanurate foam (PIR) sandwich panel market over the predicted timeframe.

Need help to buy this report?