Global Polymer Nanocomposites Market Size, Share, and COVID-19 Impact Analysis, By Type (Carbon Nanotubes, Metal Oxide, Nanofiber, Nanoclay, Graphene, and Others (Expanded graphite, Recycled paper, Wood, Recycled fibers)), By Application (Packaging, Automotive, Electronics & Semiconductor, Aerospace & Defense, Coatings, Energy, and Others (Sports, Healthcare)), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Polymer Nanocomposites Market Insights Forecasts to 2033

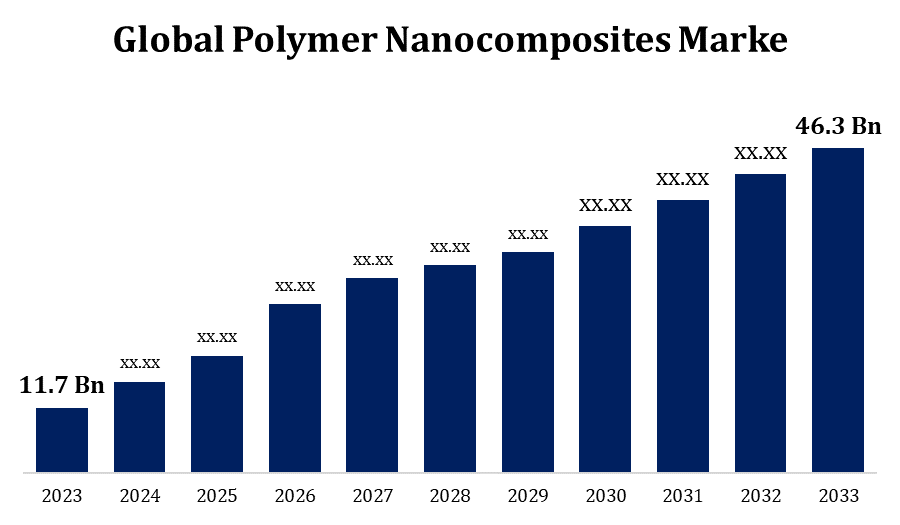

- The Polymer Nanocomposites Market Size was valued at USD 11.7 Billion in 2023.

- The Market Size is growing at a CAGR of 14.75% from 2023 to 2033.

- The Global Polymer Nanocomposites Market Size is expected to reach USD 46.3 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the Forecast period.

Get more details on this report -

The Global Polymer Nanocomposites Market Size is expected to reach USD 46.3 Billion by 2033, at a CAGR of 14.75% during the Forecast period 2023 to 2033.

The polymer nanocomposites market is experiencing significant growth due to its versatile applications across industries like automotive, packaging, electronics, and construction. These materials combine polymers with nanomaterials, offering enhanced properties such as improved mechanical strength, thermal stability, and barrier performance. The increasing demand for lightweight and durable materials in automotive and aerospace sectors is a key driver. In packaging, polymer nanocomposites provide superior barrier properties, extending product shelf life. Additionally, advancements in nanotechnology and eco-friendly innovations are expanding their applications in sustainable solutions. However, challenges like high production costs and regulatory concerns may hinder growth. Asia-Pacific leads the market, driven by robust industrialization and rising consumer demand. Overall, the polymer nanocomposites market is poised for steady growth, driven by innovation and expanding end-user industries.

Polymer Nanocomposites Market Value Chain Analysis

The polymer nanocomposites market value chain encompasses multiple stages, starting from raw material suppliers to end-users. Raw material suppliers provide polymers, nanomaterials such as nanoclays, carbon nanotubes, and graphene, and other additives. These inputs are processed by manufacturers to create polymer nanocomposites with tailored properties like enhanced strength, thermal resistance, and barrier performance. The processing stage includes techniques such as melt mixing, in situ polymerization, and solution blending. Distributors and suppliers bridge the gap between manufacturers and end-use industries, ensuring timely delivery and customization. Key end-user industries include automotive, packaging, electronics, and construction, leveraging these materials for applications like lightweight parts, protective coatings, and high-performance films. Innovations in materials and manufacturing technologies further streamline the value chain, fostering market growth and efficiency.

Polymer Nanocomposites Market Opportunity Analysis

The polymer nanocomposites market presents significant growth opportunities driven by advancements in nanotechnology and increasing demand for high-performance materials. In the automotive and aerospace sectors, the push for lightweight, fuel-efficient vehicles creates a need for durable yet lightweight components, where polymer nanocomposites excel. The packaging industry offers another lucrative opportunity, as these materials enhance barrier properties, extend shelf life, and support sustainability goals with biodegradable options. The growing emphasis on renewable energy opens doors for polymer nanocomposites in wind turbines and solar panels, leveraging their enhanced strength and thermal properties. Emerging economies in Asia-Pacific and Latin America offer untapped potential due to rapid industrialization and infrastructure development. Additionally, innovation in eco-friendly nanocomposites aligns with global sustainability trends, further expanding market prospects.

Global Polymer Nanocomposites Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 11.7 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 14.75% |

| 2033 Value Projection: | USD 46.3 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Nanophase Technologies Corporation, The Arkema Group, DuPont, RTP Company, Showa Denko Carbon, Inc., Inframat Corporation, Powdermet, Inc., Nanocor, Inc., Nanocyl S.A., Evonik Industries AG, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Polymer Nanocomposites Market Dynamics

The market growth is being driven by the expanding applications across diverse end-user industries

The polymer nanocomposites market is experiencing robust growth due to their expanding applications across diverse end-user industries. In the automotive sector, these materials are utilized for lightweight, durable components that improve fuel efficiency and performance. The packaging industry benefits from polymer nanocomposites’ superior barrier properties, which enhance product preservation and shelf life. Electronics manufacturers leverage these materials for advanced features like thermal stability and electrical conductivity, vital for modern devices. Construction industries utilize polymer nanocomposites in coatings, adhesives, and high-strength materials to improve durability and weather resistance. The healthcare sector also presents growing opportunities, with applications in drug delivery systems and medical devices. This widespread adoption across sectors, coupled with innovations in nanotechnology, continues to propel the polymer nanocomposites market forward.

Restraints & Challenges

High production costs and complex manufacturing processes limit the scalability and affordability of these materials, especially for cost-sensitive industries. The lack of standardized regulations and guidelines for nanomaterials raises concerns about safety, environmental impact, and long-term effects, affecting market acceptance. Limited awareness and expertise in handling nanocomposites among manufacturers and end-users further constrain adoption. Recycling and disposal of polymer nanocomposites pose sustainability challenges, as their advanced properties can complicate traditional recycling methods. Additionally, competition from conventional materials and emerging substitutes with similar performance characteristics adds pressure. Overcoming these challenges will require advancements in cost-effective production techniques, clearer regulatory frameworks, and enhanced education and training to unlock the full potential of polymer nanocomposites.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Polymer Nanocomposites Market from 2023 to 2033. Key industries such as automotive, aerospace, packaging, and electronics leverage these materials for their superior mechanical, thermal, and barrier properties. In the automotive and aerospace sectors, the focus on lightweight materials to enhance fuel efficiency and performance boosts adoption. The region's thriving packaging industry benefits from nanocomposites’ ability to extend product shelf life and improve packaging durability. Innovation hubs in the U.S. and Canada are fostering research and development, leading to new applications and cost-effective manufacturing processes. However, challenges like high production costs and regulatory compliance persist. With increasing investments in nanotechnology and sustainability, North America remains a significant contributor to the global polymer nanocomposites market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Automotive and aerospace industries in countries like China, India, and Japan are adopting polymer nanocomposites for lightweight and durable components to improve fuel efficiency and reduce emissions. The region’s thriving packaging industry benefits from these materials' enhanced barrier properties, addressing food safety and shelf-life requirements. Electronics manufacturing in South Korea, Japan, and Taiwan leverages nanocomposites for thermal management and miniaturization in advanced devices. Favorable government initiatives, abundant raw materials, and cost-effective labor contribute to market expansion.

Segmentation Analysis

Insights by Type

The nanoclay segment accounted for the largest market share over the forecast period 2023 to 2033. Nanoclay enhances mechanical strength, thermal stability, and barrier performance, making it highly sought after in industries like packaging, automotive, and construction. In the packaging sector, nanoclay-based nanocomposites improve the barrier properties of films and containers, extending shelf life and ensuring product safety. Automotive and aerospace industries utilize nanoclay for lightweight, high-performance components that boost fuel efficiency and durability. Additionally, construction applications benefit from nanoclay’s ability to reinforce polymers in coatings, adhesives, and structural materials. The ease of availability and compatibility with various polymers further drives its adoption. As sustainability gains prominence, innovations in bio-based nanoclay composites are expected to propel this segment’s growth further.

Insights by Application

The automotive segment accounted for the largest market share over the forecast period 2023 to 2033. Polymer nanocomposites, such as those reinforced with nanoclays, carbon nanotubes, or graphene, are increasingly used in manufacturing vehicle components like bumpers, body panels, interior parts, and under-the-hood applications. These materials offer superior mechanical strength, thermal stability, and durability while reducing overall vehicle weight. The demand for electric vehicles (EVs) further accelerates adoption, as lightweight materials are critical for extending battery range and improving performance. Additionally, nanocomposites enhance safety and sustainability by improving impact resistance and enabling recyclability. As automotive manufacturers invest in advanced materials, the polymer nanocomposites market within this segment is poised for sustained growth.

Recent Market Developments

- In May 2023, As per the India Brand Equity Foundation (IBEF), India’s food processing industry is expected to reach a value of US$ 535 billion by 2025–2026.

Competitive Landscape

Major players in the market

- Nanophase Technologies Corporation

- The Arkema Group

- DuPont

- RTP Company

- Showa Denko Carbon, Inc.

- Inframat Corporation

- Powdermet, Inc.

- Nanocor, Inc.

- Nanocyl S.A.

- Evonik Industries AG

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Polymer Nanocomposites Market, Type Analysis

- Carbon Nanotubes

- Metal Oxide

- Nanofiber

- Nanoclay

- Graphene

- Others

- Expanded graphite

- Recycled paper

- Wood

- Recycled fibers

Polymer Nanocomposites Market, Application Analysis

- Packaging

- Automotive

- Electronics & Semiconductor

- Aerospace & Defense

- Coatings

- Energy

- Others

- Sports

- Healthcare

Polymer Nanocomposites Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Polymer Nanocomposites Market?The global Polymer Nanocomposites Market is expected to grow from USD 11.7 billion in 2023 to USD 46.3 billion by 2033, at a CAGR of 14.75% during the forecast period 2023-2033.

-

2. Who are the key market players of the Polymer Nanocomposites Market?Some of the key market players of the market are Nanophase Technologies Corporation, The Arkema Group, DuPont, RTP Company, Showa Denko Carbon, Inc., Inframat Corporation, Powdermet, Inc., Nanocor, Inc., Nanocyl S.A., and Evonik Industries AG.

-

3. Which segment holds the largest market share?The automotive segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Polymer Nanocomposites Market?North America dominates the Polymer Nanocomposites Market and has the highest market share.

Need help to buy this report?