Global Polyolefin Pipes Market Size By Type (Polypropylene Pipes (PP), Polyethylene Pipes (PE)), By Application (Power And Communication, Waste Water Drainage), By End-User (Agriculture, Industrial), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Chemicals & MaterialsGlobal Polyolefin Pipes Market Insights Forecasts to 2033

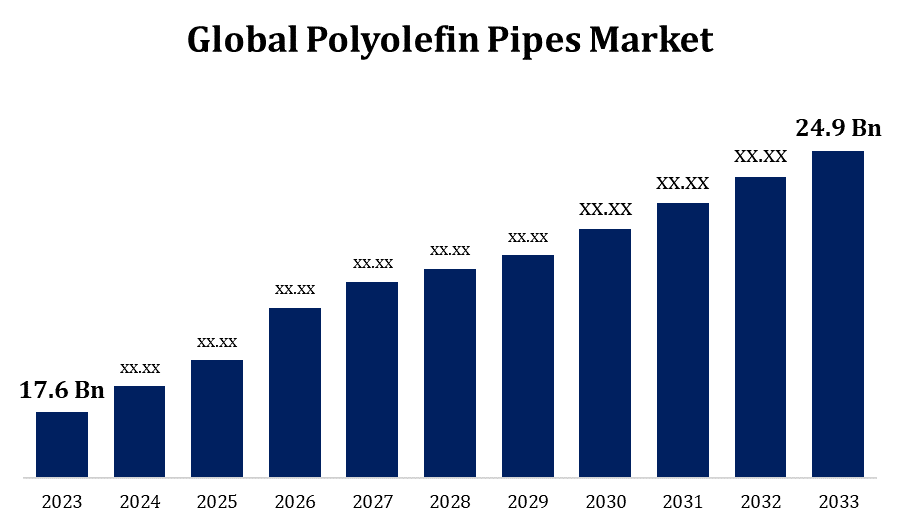

- The Global Polyolefin Pipes Market Size was valued at USD 17.6 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.53% from 2023 to 2033.

- The Global Polyolefin Pipes Market Size is expected to reach USD 24.9 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Polyolefin Pipes Market is expected to reach USD 24.9 Billion by 2033, at a CAGR of 3.53% during the forecast period 2023 to 2033.

Polyolefin pipes have gained popularity in a variety of applications due to their versatility. These pipes are predominantly made from polyethylene (PE) and polypropylene (PP), which are types of polyolefin polymers. The polyolefin pipes market has been growing due to factors such as their durability, flexibility, and corrosion resistance. In industries like water supply, polyolefin pipes are renowned for their ability to endure extreme environmental conditions and pollutants. They're the superheroes of the piping world, impervious to corrosion the way caped crusaders are to crime. Their light weight makes them simple to handle and install, which contributes to their widespread use.

Polyolefin Pipes Market Value Chain Analysis

The journey begins with vendors supplying the necessary raw materials, which include polyethylene and polypropylene resins. These vendors are critical in deciding the final product's quality and qualities. The resin is then sent to producers, who work their magic with it. The polyolefin is extruded, moulded, and shaped into pipes of various diameters and requirements. When the pipes are finished, they are delivered to distributors and wholesalers. These middlemen make it possible for the pipes to be distributed efficiently to numerous retailers and end customers. The next destination on our value chain journey is retailers. They make the pipes available to contractors, builders, and other end users. The pipes are subsequently delivered to the contractors and construction companies in charge of installing them. The end-users, which can include industries, municipalities, and other entities, are the ultimate destination. Polyolefin pipes are used for a variety of purposes, including water delivery, gas transfer, and industrial activities.

Polyolefin Pipes Market Opportunity Analysis

With continued worldwide infrastructure development, there is a constant demand for dependable and long-lasting piping systems. Due to its corrosion resistance and long lifespan, polyolefin pipes stand to benefit greatly from infrastructure developments in industries such as water supply, electricity, and construction. The transition to alternative energy sources opens up new opportunities for polyolefin pipes. They are ideal for solar and geothermal energy systems, where resilience to external variables is critical. Polyolefin pipes may play an important role in these initiatives as the globe embraces sustainable practices. The rise of smart cities and the incorporation of IoT (Internet of Things) into infrastructure open up new prospects for innovative pipe systems. Polyolefin pipes can be used in smart city infrastructure because of its versatility and ease of installation.

Global Polyolefin Pipes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 17.6 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.53% |

| 2033 Value Projection: | USD 24.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application, By End-User, By Region And Segment Forecasts, By Geographic Scope And Forecast |

| Companies covered:: | AGRU, Advanced Drainage Systems, Aliaxis, Aquatherm, Chevron Phillips Chemical Company, Future Pipe Industries, GF Piping Systems, JM Eagle, Prinsco, Radius Systems, Thai-Asia P.E. Pipe Co., Ltd., United Poly Systems, WL Plastics, and Other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Market Dynamics

Polyolefin Pipes Market Dynamics

Numerous applications of polyolefins in a wide range of industries

Polyolefin pipes are widely utilised in water distribution systems. Their resilience to corrosion and chemicals guarantees that clean, uncontaminated water is delivered. These pipes are popular for municipal water distribution networks. Polyolefin pipes are used in the gas sector to transport natural gas and other gases. Because of their lightweight nature and corrosion resistance, they are an excellent choice for such applications, preserving the integrity of the gas supply infrastructure. Polyolefin pipes are extremely important in the oil and gas sector, particularly in offshore drilling and subsea applications. They are a solid solution for these tough environments due to their resistance to seawater corrosion and longevity under difficult conditions.

Restraints & Challenges

The price volatility of raw materials, notably polyethylene and polypropylene resins, has a direct impact on polyolefin pipes. Raw material price fluctuations can have an impact on overall production costs, making it difficult for manufacturers to maintain competitive pricing. Economic insecurity, geopolitical conflicts, and global market volatility can all have an impact on infrastructure investments and construction projects. Because of these uncertainties, demand for polyolefin pipes may fluctuate, hurting market growth. End-users may be uninformed about the advantages and applications of polyolefin pipes. Educational campaigns are required to highlight the benefits of these pipes and encourage their use in diverse industries.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Polyolefin Pipes Market from 2023 to 2033. Infrastructure development and upkeep are ongoing needs in North America. Polyolefin pipes are well-suited for use in water supply, gas transport and industrial infrastructure projects due to their durability and corrosion resistance. North America has a significant demand for effective water management solutions. Polyolefin pipes are essential components of water distribution networks, sewage systems, and stormwater management systems. Polyolefin pipes are anticipated to see growing use as municipalities focus on replacing ageing infrastructure. The increased emphasis in North America on renewable energy presents prospects for polyolefin pipes in solar and geothermal projects.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific region is rapidly urbanising, resulting in a rush in infrastructure development. Polyolefin pipes are widely utilised in water supply and sewage systems, making them essential in the development of new cities and the growth of existing ones. Rapid modernization in nations such as China and India is increasing demand for dependable pipe systems in a variety of industrial applications. Polyolefin pipes are valued for their chemical resistance, making them ideal for conveying industrial fluids. The Asia-Pacific region's increased energy consumption encourages investments in energy infrastructure. Polyolefin pipes are used in the oil and gas industry, such as pipelines and exploration projects, where corrosion resistance is critical.

Segmentation Analysis

Insights by Type

The polypropylene piping segment accounted for the largest market share over the forecast period 2023 to 2033. Polypropylene pipes have good chemical resistance, making them ideal for a wide range of applications in industries where corrosion resistance is critical. Chemical processing plants and industrial facilities are included. Polypropylene pipes' flexibility makes installation easier. They bend and manoeuvre effortlessly, reducing the need for intricate fittings and making them a popular choice in plumbing systems for home and commercial construction. Polypropylene pipes are certified for use with potable water. They are a safe and dependable solution for water distribution systems in residential and commercial buildings due to their resistance to chemical leaching and ability to maintain water quality.

Insights by Application

The Waste Water Drainage segment accounted for the largest market share over the forecast period 2023 to 2033. Wastewater frequently comprises a variety of chemicals and pollutants. Because of its chemical resistance, polyolefin pipes are well-suited for handling various forms of wastewater, including industrial effluents, without deterioration or compromise in performance. Water drainage systems necessitate long-lasting piping solutions. Polyolefin pipes, which are noted for their durability and resistance to wear, are a dependable solution for wastewater applications, eliminating the need for regular repairs and maintenance. The resistance to abrasion of polyolefin pipes is a desirable quality in wastewater drainage applications where the conveyed fluid may contain abrasive particles. This resistance guarantees that the pipes' structural integrity is maintained throughout time.

Insights by End User

The agriculture segment accounted for the largest market share over the forecast period 2023 to 2033. Polyolefin pipes are noted for their flexibility, which allows them to be readily manoeuvred and put out in agricultural environments. This adaptability simplifies installation, especially in regions with diverse topography. Polyolefin pipes are appealing for agricultural applications due to their low cost of materials and installation. Farmers and agricultural operators frequently want dependable yet economical irrigation solutions, and polyolefin pipes fit the bill. Efficient irrigation systems using polyolefin pipes help to protect and optimise crop productivity. Consistent and controlled water delivery promotes plant development and productivity in agricultural settings.

Recent Market Developments

- In January 2021, GF Piping Systems acquires FGS Brazil Industries, which serves the local gas and water distribution markets as well as other industrial segments.

Competitive Landscape

Major players in the market

- AGRU

- Advanced Drainage Systems

- Aliaxis

- Aquatherm

- Chevron Phillips Chemical Company

- Future Pipe Industries

- GF Piping Systems

- JM Eagle

- Prinsco

- Radius Systems

- Thai-Asia P.E. Pipe Co., Ltd.

- United Poly Systems

- WL Plastics

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Polyolefin Pipes Market, Type Analysis

- Polypropylene Pipes (PP)

- Polyethylene Pipes (PE)

Polyolefin Pipes Market, Application Analysis

- Power And Communication

- Waste Water Drainage

Polyolefin Pipes Market, End User Analysis

- Agriculture

- Industrial

Polyolefin Pipes Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Polyolefin Pipes Market?The global Polyolefin Pipes Market is expected to grow from USD 17.6 billion in 2023 to USD 24.9 billion by 2033, at a CAGR of 3.53% during the forecast period 2023-2033.

-

2. Who are the key market players of the Polyolefin Pipes Market?Some of the key market players of market are AGRU, Advanced Drainage Systems, Aliaxis, Aquatherm, Chevron Phillips Chemical Company, Future Pipe Industries, GF Piping Systems, JM Eagle, Prinsco, Radius Systems, Thai-Asia P.E. Pipe Co., Ltd., United Poly Systems, and WL Plastics.

-

3. Which segment holds the largest market share?The agriculture segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Polyolefin Pipes Market?North America is dominating the Polyolefin Pipes Market with the highest market share.

Need help to buy this report?