Global Polyphenylene Sulfide Market Size, Share, and COVID-19 Impact Analysis, By Type (Linear PPS, Cured PPS, Branched PPS), By Application (Automotive, Electrical & Electronics, Industrial, Coatings, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Polyphenylene Sulfide Market Insights Forecasts to 2033

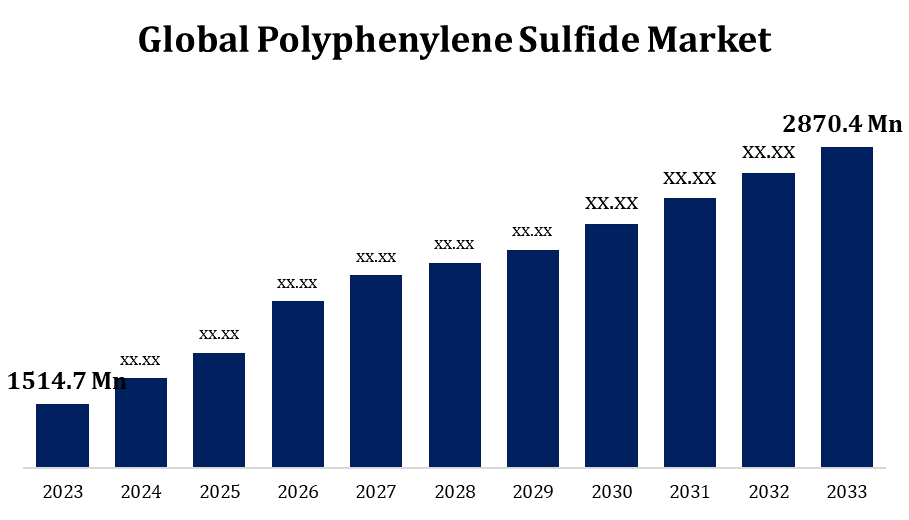

- The Polyphenylene Sulfide Market Size was valued at USD 1514.7 Million in 2023.

- The Market Size is growing at a CAGR of 6.60% from 2023 to 2033.

- The Global Polyphenylene Sulfide Market is expected to reach USD 2870.4 Million by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Polyphenylene Sulfide Market Size is expected to reach USD 2870.4 Million by 2033, at a CAGR of 6.60% during the forecast period 2023 to 2033.

The polyphenylene sulfide (PPS) market is experiencing significant growth due to its exceptional chemical resistance, high thermal stability, and electrical insulating properties, making it ideal for various applications in industries such as automotive, electronics, aerospace, and chemicals. PPS is widely used in manufacturing automotive parts, electrical connectors, and components exposed to extreme conditions, such as high temperatures and harsh chemicals. The automotive industry's shift toward lightweight, durable materials and the increasing demand for electronics are driving the market expansion. Additionally, the growing trend of sustainable manufacturing processes and the development of PPS composites are further enhancing market prospects. However, challenges related to high production costs and limited recycling options may restrain growth. Despite these challenges, PPS remains a key material in advanced engineering applications.

Polyphenylene Sulfide Market Value Chain Analysis

The polyphenylene sulfide (PPS) market value chain begins with the production of raw materials, including sulfur and p-xylene, which are key ingredients in the synthesis of PPS. Manufacturers then process these raw materials through polymerization to create PPS resin, which can be further modified for various applications. The next step involves the conversion of PPS resin into finished products, such as automotive components, electrical parts, and industrial equipment. These products are then distributed to end-users in sectors like automotive, aerospace, electronics, and chemicals. The value chain also includes suppliers of additives, fillers, and composite materials that enhance PPS's properties. Recycling and disposal at the end of the product lifecycle represent the final stage, though recycling options for PPS remain limited, posing challenges to sustainability.

Polyphenylene Sulfide Market Opportunity Analysis

The polyphenylene sulfide (PPS) market presents significant opportunities driven by growing demand across various sectors. The automotive industry is a key driver, as PPS's high thermal stability and chemical resistance make it ideal for lightweight, durable components, supporting the trend towards electric vehicles (EVs) and fuel-efficient cars. In electronics, the demand for high-performance materials for connectors, semiconductors, and electrical insulation further expands PPS opportunities. Aerospace applications also present growth prospects due to PPS’s ability to withstand extreme temperatures. Additionally, the increasing shift towards sustainable manufacturing practices and the development of PPS-based composites opens new avenues in construction, industrial equipment, and consumer goods. Despite challenges in production costs and recycling, technological advancements and growing awareness of PPS’s benefits offer ample market opportunities.

Global Polyphenylene Sulfide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1514.7 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.60% |

| 2033 Value Projection: | USD 2870.4 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Tosoh Corporation (Japan), TORAY INDUSTRIES, INC. (Japan), Celanese Corporation (U.S), SK Chemicals (South Korea), Solvay (Belgium), KUREHA CORPORATION (Japan), Polyplastics Co., Ltd. (Japan), DIC CORPORATION (Japan), Chevron Phillips Chemical Company (U.S), Haohua Honghe Chemical Co., Ltd. (China), Kotec Corporation (Japan), TEIJIN LIMITED (Japan), NHU Materials Co. (China), SABIC (Saudi Arabia), Aetna Plastics Corp. (U.S), and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Polyphenylene Sulfide Market Dynamics

Increase in product usage in coating applications to boost the market growth

The rising use of polyphenylene sulfide (PPS) in coating applications is expected to significantly drive market growth. PPS’s excellent chemical resistance, high thermal stability, and electrical insulating properties make it an ideal choice for coatings in industries like automotive, electronics, and manufacturing. These coatings provide enhanced protection against corrosion, wear, and extreme temperatures, making PPS-coated surfaces more durable and reliable. The increasing demand for high-performance materials in industrial coatings, including for automotive parts and electronic devices, is further accelerating its adoption. As industries prioritize longer-lasting and more efficient solutions, the demand for PPS-based coatings is expected to rise. This trend, combined with growing environmental awareness and sustainability goals, will contribute to the expanding market for PPS in coating applications, fostering continued growth in the coming years.

Restraints & Challenges

One of the primary obstacles is the high production cost of PPS, which is attributed to the expensive raw materials and complex manufacturing processes involved. This makes PPS products more costly compared to alternative materials, limiting their adoption, especially in price-sensitive industries. Additionally, the limited recycling options for PPS pose environmental concerns, as its durability and resistance to degradation make it difficult to recycle efficiently. The market also faces competition from other high-performance polymers, such as PEEK and PTFE, which offer similar benefits at potentially lower costs. Moreover, the reliance on specific raw materials and supply chain vulnerabilities can affect market stability. These challenges require ongoing innovation to maintain competitive advantages in the market.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Polyphenylene Sulfide Market from 2023 to 2033. PPS’s superior thermal stability, chemical resistance, and electrical insulating properties make it a preferred material for manufacturing high-performance components in these sectors. The automotive industry's push towards lightweight and fuel-efficient vehicles, particularly electric vehicles (EVs), is boosting demand for PPS in automotive parts such as fuel systems, connectors, and engine components. Additionally, the growing use of PPS in electronic devices, electrical connectors, and industrial equipment supports market expansion. North America’s emphasis on advanced manufacturing technologies and sustainable materials further enhances the adoption of PPS. However, the market is challenged by the high cost of production and limited recycling options, which could impact growth potential in the long term.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The region’s growing industrial base and increasing demand for high-performance materials in automotive and electrical applications are major factors propelling market growth. Japan and China are significant contributors to the demand for PPS, as they lead in automotive production, consumer electronics, and industrial manufacturing. The region is also focusing on sustainable solutions, which boosts the adoption of PPS in eco-friendly applications. Additionally, the rise of electric vehicles (EVs) and advancements in the electronics sector are expected to further accelerate PPS consumption.

Segmentation Analysis

Insights by Type

The linear PPS segment accounted for the largest market share over the forecast period 2023 to 2033. Linear PPS offers superior thermal stability, chemical resistance, and mechanical strength, making it highly suitable for demanding environments in industries such as automotive, electronics, and aerospace. The automotive sector, in particular, is witnessing an increased adoption of linear PPS for lightweight and durable components, including fuel systems, connectors, and engine parts. The electronics industry also benefits from linear PPS's insulating properties, using it in connectors and circuit boards. As demand for high-performance materials continues to rise in these sectors, the linear PPS segment is expected to grow at a strong pace. Additionally, the material's potential for use in industrial applications further contributes to its market expansion.

Insights by Application

The automotive segment accounted for the largest market share over the forecast period 2023 to 2033. PPS’s exceptional thermal stability, chemical resistance, and electrical insulating properties make it ideal for automotive applications, including fuel systems, engine components, connectors, and electrical parts. With the rise of electric vehicles (EVs), PPS is becoming increasingly popular for battery components, wiring, and connectors due to its ability to withstand extreme conditions. Furthermore, the automotive industry's push for fuel efficiency and reduced emissions has led to greater adoption of lightweight PPS materials for parts that can replace metals, improving overall vehicle performance. This trend is expected to drive continued growth in the automotive segment, making it a significant contributor to the overall PPS market.

Recent Market Developments

- In August 2023, RTP Company has introduced a new series of PPS compounds enhanced with glass fibers and other fillers.

Competitive Landscape

Major players in the market

- Tosoh Corporation (Japan)

- TORAY INDUSTRIES, INC. (Japan)

- Celanese Corporation (U.S)

- SK Chemicals (South Korea)

- Solvay (Belgium)

- KUREHA CORPORATION (Japan)

- Polyplastics Co., Ltd. (Japan)

- DIC CORPORATION (Japan)

- Chevron Phillips Chemical Company (U.S)

- Haohua Honghe Chemical Co., Ltd. (China)

- Kotec Corporation (Japan)

- TEIJIN LIMITED (Japan)

- NHU Materials Co. (China)

- SABIC (Saudi Arabia)

- Aetna Plastics Corp. (U.S)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Polyphenylene Sulfide Market, Type Analysis

- Linear PPS

- Cured PPS

- Branched PPS

Polyphenylene Sulfide Market, Application Analysis

- Automotive

- Electrical & Electronics

- Industrial

- Coatings

- Others

Polyphenylene Sulfide Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Polyphenylene Sulfide Market?The global Polyphenylene Sulfide Market is expected to grow from USD 1514.7 million in 2023 to USD 2870.4 million by 2033, at a CAGR of 6.60% during the forecast period 2023-2033.

-

2. Who are the key market players of the Polyphenylene Sulfide Market?Some of the key market players of the market are Tosoh Corporation (Japan), TORAY INDUSTRIES, INC. (Japan), Celanese Corporation (U.S), SK Chemicals (South Korea), Solvay (Belgium), KUREHA CORPORATION (Japan), Polyplastics Co., Ltd. (Japan), DIC CORPORATION (Japan), Chevron Phillips Chemical Company (U.S), Haohua Honghe Chemical Co., Ltd. (China), Kotec Corporation (Japan), TEIJIN LIMITED (Japan), NHU Materials Co. (China), SABIC (Saudi Arabia), and Aetna Plastics Corp. (U.S).

-

3. Which segment holds the largest market share?The automotive segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Polyphenylene Sulfide Market?North America dominates the Polyphenylene Sulfide Market and has the highest market share.

Need help to buy this report?