Global Polyurethane (PU) Microspheres Market Size, Share, and COVID-19 Impact Analysis, By Application (Encapsulation, Paints & Coatings, Adhesive Films, Cosmetics), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Polyurethane (PU) Microspheres Market Insights Forecasts to 2033

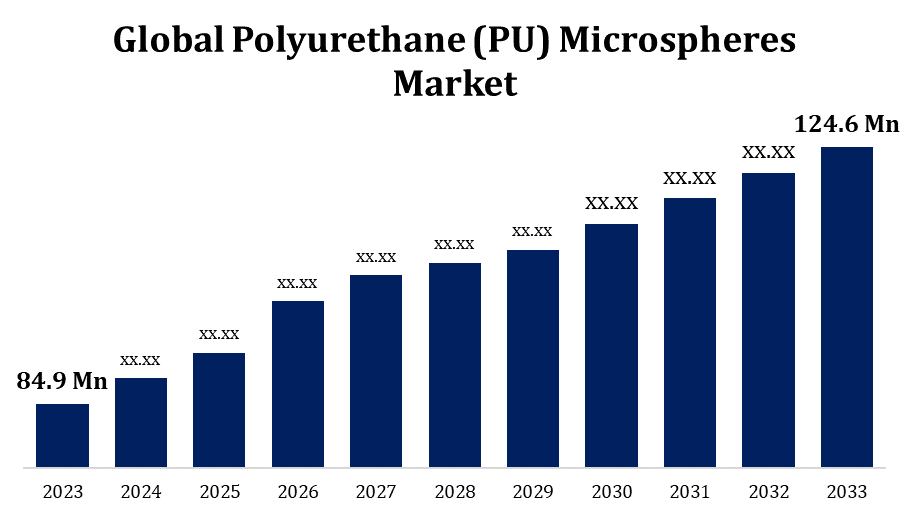

- The Polyurethane (PU) Microspheres Market Size was valued at USD 84.9 Million in 2023.

- The Market Size is growing at a CAGR of 3.91% from 2023 to 2033.

- The Global Polyurethane (PU) Microspheres Market Size is expected to reach USD 124.6 Million by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Polyurethane (PU) Microspheres Market Size is expected to reach USD 124.6 Million by 2033, at a CAGR of 3.91% during the forecast period 2023 to 2033.

The polyurethane (PU) microspheres market is experiencing steady growth, driven by their versatile applications across industries such as automotive, construction, electronics, and healthcare. These microspheres are valued for their lightweight nature, durability, and excellent chemical resistance, making them ideal for coatings, adhesives, and encapsulation applications. Rising demand for high-performance coatings, especially in the automotive and construction sectors, is a significant growth factor. Additionally, advancements in PU microsphere technology, including controlled particle size and tailored functionalities, are expanding their utility in drug delivery and medical applications. However, market growth is tempered by the high production costs and stringent environmental regulations. Asia-Pacific emerges as a key market, fueled by rapid industrialization and infrastructure development, while North America and Europe continue to demand innovative, sustainable solutions.

Polyurethane (PU) Microspheres Market Value Chain Analysis

The value chain of the polyurethane (PU) microspheres market encompasses raw material suppliers, manufacturers, distributors, and end-users. Key raw materials include diisocyanates and polyols, supplied by chemical manufacturers. These are processed by PU microsphere producers who employ advanced polymerization techniques to ensure precise particle size, functionality, and quality. Distributors and wholesalers facilitate the supply chain, bridging manufacturers with diverse industries such as automotive, construction, and healthcare. End-users leverage PU microspheres for applications like coatings, adhesives, and drug delivery systems, benefiting from their durability and customizable properties. Collaboration across the chain, particularly in research and development, drives innovation and sustainability.

Polyurethane (PU) Microspheres Market Opportunity Analysis

The polyurethane (PU) microspheres market presents significant growth opportunities driven by advancements in material science and the increasing demand for specialized coatings and adhesives. The growing automotive and construction industries are key contributors, seeking lightweight, durable materials for enhanced performance. In healthcare, PU microspheres are finding innovative uses in drug delivery systems due to their biocompatibility and controlled release properties. The surge in demand for eco-friendly and sustainable products opens opportunities for the development of bio-based PU microspheres. Emerging markets in Asia-Pacific, with rapid industrialization and infrastructure expansion, offer a fertile ground for market growth. Additionally, technological advancements enabling precise control of microsphere properties can unlock new applications in electronics and textiles. Collaboration between manufacturers and research institutions can further capitalize on these opportunities.

Global Polyurethane (PU) Microspheres Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 84.9 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.91% |

| 2033 Value Projection: | USD 124.6 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 141 |

| Segments covered: | By Application, By Region |

| Companies covered:: | Sanyo chemical industries Ltd. (Japan), Supercolori S.p.A. (Italy), Kolon Industry Inc. (South Korea), Bayer AG (Germany), Heyo Enterprise Co. Ltd. (Taiwan), Chase Corp (U.S.), BASF SE (Germany), SABIC (Saudi Arabia), 3M (U.S.), Asahi Kasei Chemicals Corporation (Japan), Solvay (Belgium), Sumitomo Chemical Co., Ltd (Japan), LyondellBasell Industries Holdings BV (Netherlands), Momentive (U.S.), Mitsubishi Chemical Corporation (Japan), Polyplastics Co. Ltd. (Japan), and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Polyurethane (PU) Microspheres Market Dynamics

Increasing focus on sustainable and environmentally friendly materials

The polyurethane (PU) microspheres market is witnessing a growing emphasis on sustainable and environmentally friendly materials. As industries strive to reduce their environmental footprint, manufacturers are exploring bio-based alternatives to traditional petroleum-derived raw materials. These eco-friendly PU microspheres offer comparable performance while addressing regulatory pressures and consumer demand for green solutions. In sectors like construction, automotive, and healthcare, sustainable microspheres are being integrated into coatings, adhesives, and drug delivery systems, supporting the shift toward circular economy practices. Additionally, advancements in production technologies are enabling more energy-efficient manufacturing processes, further enhancing the market's sustainability profile. Emerging regions, particularly in Asia-Pacific, are expected to drive demand as governments and industries implement stricter environmental regulations. This trend represents a critical opportunity for innovation and competitive differentiation in the market.

Restraints & Challenges

The polyurethane (PU) microspheres market faces several challenges that could hinder its growth. High production costs, driven by the complexity of manufacturing processes and the reliance on petroleum-based raw materials, remain a significant barrier. Price volatility of these raw materials adds further uncertainty, impacting profit margins for manufacturers. Additionally, stringent environmental regulations concerning the use of chemicals and synthetic materials pose compliance challenges, necessitating investment in sustainable alternatives. Limited awareness and adoption of PU microspheres in certain emerging regions also restrict market penetration. Technical challenges, such as achieving precise particle size and consistent quality, complicate production and application processes. Moreover, competition from alternative microspheres, like polystyrene and glass, intensifies market pressures, requiring innovation and cost-effective solutions to maintain competitiveness.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Polyurethane (PU) Microspheres Market from 2023 to 2033. Key sectors such as automotive, construction, electronics, and healthcare are major contributors to the demand for PU microspheres, leveraging their lightweight, durable, and versatile properties. The increasing focus on high-performance coatings and adhesives, especially in automotive manufacturing and infrastructure projects, is a significant growth driver. Additionally, the region’s emphasis on sustainability is spurring interest in eco-friendly and bio-based PU microspheres. However, the market faces challenges, including high production costs and stringent environmental regulations. The presence of leading manufacturers and ongoing research and development initiatives strengthen North America’s position as a key player in the global PU microspheres market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The polyurethane (PU) microspheres market in Asia-Pacific is witnessing robust growth, driven by rapid industrialization, urbanization, and infrastructure development. Key industries, including automotive, construction, electronics, and healthcare, are fueling demand due to the superior performance and versatility of PU microspheres. China leads the region, benefiting from expanding manufacturing capabilities and government initiatives to support industrial growth. The rising emphasis on energy-efficient and sustainable materials further boosts the market, with bio-based PU microspheres gaining traction. However, challenges such as fluctuating raw material prices and limited awareness in some emerging markets persist. Strategic collaborations, investments in advanced manufacturing technologies, and increasing adoption of high-performance coatings and adhesives position Asia-Pacific as a critical growth hub in the global PU microspheres market.

Segmentation Analysis

Insights by Application

The encapsulation segment accounted for the largest market share over the forecast period 2023 to 2033. In the pharmaceutical sector, PU microspheres are increasingly used for controlled drug delivery systems, offering precise release rates and improved therapeutic efficiency. The agriculture industry leverages these microspheres for encapsulating fertilizers and pesticides, ensuring targeted application and reducing environmental impact. Similarly, in personal care products, PU microspheres enhance the delivery of active ingredients in cosmetics. Advancements in encapsulation technologies have enabled the customization of particle sizes and release profiles, expanding their applicability. The shift toward eco-friendly and biodegradable materials is further fueling growth, with research and innovation paving the way for sustainable solutions in encapsulation applications.

Recent Market Developments

- In April 2024, at UTECH Europe 2024, held from April 23 to 25 in Maastricht, Netherlands, Covestro highlighted its dedication to sustainability and the circular economy. The company showcased cutting-edge polyurethane innovations designed to lower carbon emissions and improve recycling efficiency.

Competitive Landscape

Major players in the market

- Sanyo chemical industries Ltd. (Japan)

- Supercolori S.p.A. (Italy)

- Kolon Industry Inc. (South Korea)

- Bayer AG (Germany)

- Heyo Enterprise Co. Ltd. (Taiwan)

- Chase Corp (U.S.)

- BASF SE (Germany)

- SABIC (Saudi Arabia)

- 3M (U.S.)

- Asahi Kasei Chemicals Corporation (Japan)

- Solvay (Belgium)

- Sumitomo Chemical Co., Ltd (Japan)

- LyondellBasell Industries Holdings BV (Netherlands)

- Momentive (U.S.)

- Mitsubishi Chemical Corporation (Japan)

- Polyplastics Co. Ltd. (Japan)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Polyurethane (PU) Microspheres Market, Application Analysis

- Encapsulation

- Paints & Coatings

- Adhesive Films

- Cosmetics

Polyurethane (PU) Microspheres Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Polyurethane (PU) Microspheres Market?The global Polyurethane (PU) Microspheres Market is expected to grow from USD 84.9 million in 2023 to USD 124.6 million by 2033, at a CAGR of 3.91% during the forecast period 2023-2033.

-

2. Who are the key market players of the Polyurethane (PU) Microspheres Market?Some of the key market players of the market are Sanyo chemical industries Ltd. (Japan), Supercolori S.p.A. (Italy), Kolon Industry Inc. (South Korea), Bayer AG (Germany), Heyo Enterprise Co. Ltd. (Taiwan), Chase Corp (U.S.), BASF SE (Germany), SABIC (Saudi Arabia), 3M (U.S.), Asahi Kasei Chemicals Corporation (Japan), Solvay (Belgium), Sumitomo Chemical Co., Ltd (Japan), LyondellBasell Industries Holdings BV (Netherlands), Momentive (U.S.), Mitsubishi Chemical Corporation (Japan), Polyplastics Co. Ltd. (Japan).

-

3. Which segment holds the largest market share?The encapsulation segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Polyurethane (PU) Microspheres Market?North America dominates the Polyurethane (PU) Microspheres Market and has the highest market share.

Need help to buy this report?