Global Potassium Sulfate Market Size, Share, and COVID-19 Impact Analysis, By Form (Solid, Liquid), By End-User Industry (Agriculture, Pharmaceuticals, Cosmetics, Food & Beverage, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Specialty & Fine ChemicalsGlobal Potassium Sulfate Market Insights Forecasts to 2033

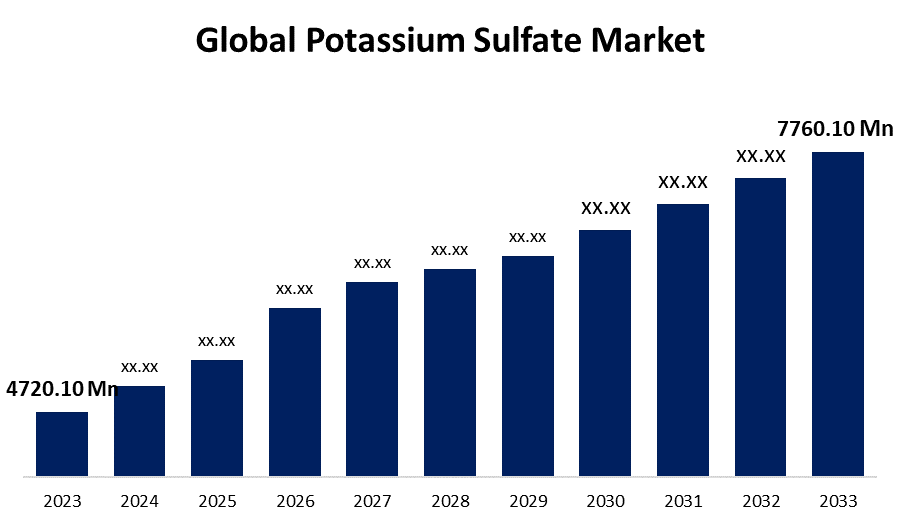

- The Global Potassium Sulfate Market Size was Valued at USD 4,720.10 Million in 2023

- The Market Size is Growing at a CAGR of 5.10% from 2023 to 2033

- The Worldwide Potassium Sulfate Market Size is Expected to Reach USD 7,760.10 Million by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Potassium Sulfate Market Size is Anticipated to Exceed USD 7,760.10 Million by 2033, Growing at a CAGR of 5.10% from 2023 to 2033.

Market Overview

Potassium Sulfate, also known as sulfate of potash and archanite, is a white-colored, non-inflammable, water-soluble inorganic salt. It is mostly used in agrochemicals such as fertilizers to supply potassium and sulfur. Potassium sulfate can also be used in a variety of industrial applications, including the production of glass, dyes, and pharmaceuticals, as well as several chemical processes that require potassium or sulfate ions. It is naturally generated from kainite, arcanite, leonite, and other minerals. The expansion is due to rising demand for high-quality fertilizers, increased awareness of sustainable agriculture techniques, and expanded industrial applications in areas such as pharmaceuticals, food processing, and textiles. According to the United States Geological Survey and Mineral Commodity Summaries 2024, estimated global resources reach around 250 billion tons. A substantial potash resource is located approximately 2,100 meters beneath central Michigan and comprises more than 75 million tons. Most of these are located at depths ranging from 1,800 to 3,100 meters in a 3,110-square-kilometer area of Montana and North Dakota, as an extension of the Williston Basin deposits in Manitoba and Saskatchewan, Canada. The world's annual potash production capacity is expected to rise to around 67.6 million tons of K2O by 2026, up from 64.3 million tons in 2023. Most of the growth would come from new mines and expansion projects in Laos and Russia. New MOP mines in Belarus, Brazil, Canada, Ethiopia, Morocco, Spain, and the United States were scheduled to commence operations in 2026.

Report Coverage

This research report categorizes the market for potassium sulfate market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the potassium sulfate market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the potassium sulfate market.

Global Potassium Sulfate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 4,720.10 Million |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 5.10% |

| 023 – 2033 Value Projection: | USD 7,760.10 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Form, By End-User Industry , By Region |

| Companies covered:: | Tessenderlo Group, K+S Aktiengesellschaft, Van Iperen International, SESODA CORPORATION, K+S Minerals and Agriculture GmbH, Sunway Group, Merck KGaA, HOLLAND COMPANY, Yara International ASA, Sigma- Aldrich Co., Intrepid Poatsh, Inc., Migao Corporation, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The potassium sulfate market is primarily driven by its use in agriculture as a source of potassium and sulfur, two vital elements that improve crop yield and quality. The growing demand for organic and specialty crops such as fruits, vegetables, and herbs. These crops require specialized nutritional formulations, and potassium sulfate is commonly used to address their potassium needs. The growing popularity of organic farming practices and the emphasis on healthy and nutritious food all contribute to the need for potassium sulfate. Beyond agriculture, potassium sulfate is used in a variety of industries, including pharmaceuticals and chemicals, which increases its market demand. Technological advances in manufacturing processes, such as improvements in efficiency, innovations in nutrient delivery systems, and controlled-release fertilizers, can influence the potassium sulfate market growth by changing both production costs and the effectiveness of the product.

Restraining Factors

The market growth of potassium sulfate is limited by competition from replacement products such as potassium chloride, which provide similar agricultural benefits at a cheaper cost. Furthermore, fluctuations in raw material availability and pricing, such as potassium salts and sulfuric acid, can have an impact on production costs and profitability. Regulatory difficulties, such as changing environmental regulations and compliance requirements, further impede industry expansion. According to the U.S. Geological Survey, world production was lower in 2023 owing to producers drawing down potash inventories that had increased in 2022 after supply uncertainty from economic sanctions on Belarus and Russia caused potash prices to rise in the first half of 2022. Prices began to fall in the second half of 2022 as stocks increased, and this trend carried into 2023.

Market Segmentation

The potassium sulfate market share is classified into form and end-user industry.

- The solid segment is estimated to hold the highest market revenue share through the projected period.

Based on the form, the potassium sulfate market is classified into solid, and liquid. Among these, the solid segment is estimated to hold the highest market revenue share through the projected period. The agriculture industry is the largest source of demand for potassium sulfate (solid form). Potassium is a necessary nutrient for plant development and crop production. Solid forms of potassium sulfate, such as powder, granules, and prills, provide a quick and easy approach to getting potassium into the soil. Farmers are looking for effective fertilizers, such as potassium sulfate, to raise crop yields and agricultural productivity as the global population expands and food demand rises. This is expected to help expand the potassium sulfate market in solid form.

- The agriculture segment is anticipated to hold the largest market share through the forecast period.

Based on the end-user industry, the potassium sulfate market is divided into agriculture, pharmaceuticals, cosmetics, food & beverage, and others. Among these, the agriculture segment is anticipated to hold the largest market share through the forecast period. One of the primary market drivers is the increase in demand for high-quality crops. Potassium sulfate, an inorganic chemical, is a great supply of potassium (K) for plants and crops. The potassium component of K2SO2 is equivalent to other potash fertilizers that are commonly used. They also provide a vital supply of sulfate (S), which helps plants produce enzymes and proteins. The global population continues to grow, resulting in increased need for food. Potassium sulfate is an effective fertilizer that promotes crop development and contributes to the growing demand for agricultural products.

Regional Segment Analysis of the Potassium Sulfate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the potassium sulfate market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the potassium sulfate market over the predicted timeframe. This leadership is driven by several factors, including the region's rapid agricultural expansion to meet rising food demand, particularly for high-value crops that benefit from potassium sulfate. Supportive government initiatives promoting sustainable agriculture and balanced fertilization practices and a thriving industrial sector that relies on potassium sulfate for a variety of manufacturing processes. Agricultural technological developments and increased adoption of effective fertilizers help to drive market expansion in the Asia Pacific. The growing population and per capita income are bolstering the region's agriculture business.

Bottom of Form

North America is expected to grow at the fastest CAGR growth of the potassium sulfate market during the forecast period. The region's development of sophisticated agricultural methods and technologies stresses balanced fertilization and sustainable soil management, which drives up demand for potassium sulfate as a potassium and sulfur source. Increasing farmer awareness of its benefits in improving crop yields and quality, particularly in high-value and specialized agriculture sectors, drives market expansion. Potassium sulfate is also favored by regulators for sustainable agriculture and environmental stewardship because it has a smaller environmental impact than alternatives. Technological improvements in fertilizer formulations and application methods contribute to the market's rise in North America, emphasizing the region's driving growth in the potassium sulfate sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the potassium sulfate market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tessenderlo Group

- K+S Aktiengesellschaft

- Van Iperen International

- SESODA CORPORATION

- K+S Minerals and Agriculture GmbH

- Sunway Group

- Merck KGaA

- HOLLAND COMPANY

- Yara International ASA

- Sigma- Aldrich Co.

- Intrepid Poatsh, Inc.

- Migao Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Van Iperen International announced that GreenSwitch Potassium Sulphate (SOP) is a finalist for the prestigious GreenTech Innovation Award 2024, recognizing its unique production methods and long-term impact. This award demonstrates Van Iperen's dedication to developing solutions that increase agricultural output while also encouraging sustainability.

- In February 2024, EverGrow, a major player in the potassium sulfate fertilizer industry in Egypt and the Middle East, planned a large promotional campaign for the first quarter of 2024. The plan is to boost sales in its present markets, which span over 70 countries worldwide, as well as to access new regional and international markets by participating in many significant exhibitions and conferences.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the potassium sulfate market based on the below-mentioned segments:

Global Potassium Sulfate Market, By Form

- Solid

- Liquid

Global Potassium Sulfate Market, By End-User Industry

- Agriculture

- Pharmaceuticals

- Cosmetics

- Food & Beverage

- Others

Global Potassium Sulfate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the potassium sulfate market over the forecast period?The potassium sulfate market is projected to expand at a CAGR of 5.10% during the forecast period.

-

2. What is the market size of the potassium sulfate market?The Global Potassium Sulfate Market Size is Expected to Grow from USD 4,720.10 Million in 2023 to USD 7,760.10 Million by 2033, at a CAGR of 5.10% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the potassium sulfate market?Asia Pacific is anticipated to hold the largest share of the potassium sulfate market over the predicted timeframe.

Need help to buy this report?