Global Poultry Farming Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product (Grading Systems, Monitoring, Egg Handling Equipment, Vaccination Equipment, Lighting Systems, Hatchers, And Setters, Incubators, And Brooders, Washers And Waste Removal Systems, Feeding And Watering Systems, and Others), By Application (Broiler Breeding Equipment and Layer Breeding Equipment), By Type (Turkey, Duck, Chicken, And Others), By Operation (Manual, Semi-Automatic, and Automatic), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023-2033.

Industry: AgricultureGlobal Poultry Farming Equipment Market Insights Forecasts to 2033

- The Global Poultry Farming Equipment Market Size was Valued at USD 3,890.13 Million in 2023

- The Market Size is Growing at a CAGR of 9.01% from 2023 to 2033

- The Worldwide Global Poultry Farming Equipment Market is Expected to Reach USD 9,220.13 Million by 2033

- Asia-Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Poultry Farming Equipment Market Size is anticipated to exceed USD 9,220.13 million by 2033, growing at a CAGR of 9.01% from 2023 to 2033.

Market Overview

The poultry farm equipment including tools and machinery, is employed to raise and care for poultry such as chickens and turkeys. The equipment includes feeding equipment, watering equipment, ventilation equipment, brooding equipment, lighting equipment, and others. Poultry farming equipment is used for easy management and animal handling. The poultry equipment takes care of poultry in the absence of humans or caretakers. It works automatically and makes things easier. It increases the productivity rate of poultry. Poultry farm equipment is the major constituent of poultry farming. Commercial poultry farming uses chicken farming technology to make handling and managing the animals easier. Numerous people breed poultry for a variety of reasons and applications. This apparatus mechanically feeds and cares for the animals in accordance with each person's needs and preferences. The growing demand for food from the growing population has led to a greater focus on increasing the productivity and quality of poultry in recent years, which has driven the global market. The term "poultry" describes domesticated birds that are raised by people mainly for their meat, eggs, and feathers. Raising chickens is referred to as poultry farming.

Report Coverage

This research report categorizes the market for the global poultry farming equipment based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global poultry farming equipment market. recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global poultry farming equipment market.

Global Poultry Farming Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

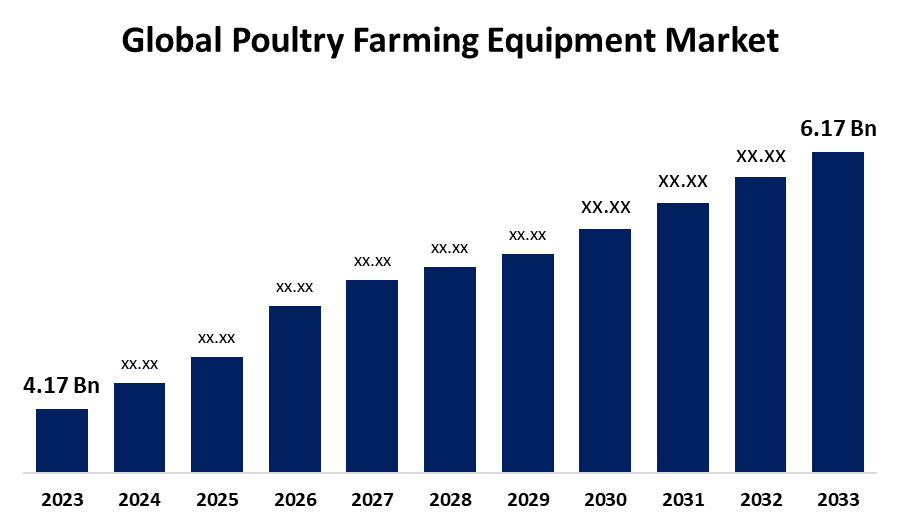

| Market Size in 2023: | USD 4.17 Billion |

| Forecast Period: | 2023 – 2033. |

| Forecast Period CAGR 2023 – 2033. : | 4.00% |

| 023 – 2033. Value Projection: | USD 6.17 Billion |

| Historical Data for: | 2021-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Valco Industries, Inc., Tecno Poultry Equipment Spa, OFFICINE FACCO & C. Spa, ME International Installation GmbH, Jansen Poultry Equipment, Jamesway Incubator Company, Big Dutchman AG, Real Tuff Livestock Equipment, Royal Livestock Farms, FarmTek, Afimilk Ltd, Murray Farm Care Ltd., Bob-White Systems, Pearson International LLC, and Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Some of the primary factors driving the growth of the worldwide poultry farming equipment market revenue are the rising consumption of poultry meat, such as chicken, ducks, and turkeys, as well as the rapid adoption of innovative poultry farming techniques. The expanding usage of technologically improved poultry farming equipment and the increased emphasis on food safety, quality, and hygiene in poultry farms have helped to boost the global market's income. The sales of poultry farming equipment have also been driven by increased government investments in animal production and instruments, such as electric brooders and automatic feeding systems, which decrease manual labor and boost productivity.

Restraining Factors

Small and medium-sized farmers may be unable to afford the initial high cost of chicken farming equipment. In certain places, the use of poultry farming equipment may be restricted by a lack of technical know-how and a trained labor force. Regular maintenance and repairs are necessary for poultry farming equipment, which might raise operating expenses. This is for healthy poultry farming; it is important to maintain hygienic conditions in poultry feed and housing.

Market Segmentation

The global poultry farming equipment market share is classified into product, application, type, and operation.

- The feeding and watering system segment is projected to hold the highest share of the global poultry farming equipment market during the forecast period.

Based on the product, the global poultry farming equipment market is categorized into grading systems, monitoring, egg handling equipment, vaccination equipment, lighting systems, hatchers and setters, incubators and brooders, washers and waste removal systems, feeding and watering systems, and others. Among these, the feeding and watering system segment is projected to hold the highest share of the global poultry farming equipment market during the forecast period. Around the world, more and more people are using automatic watering and feeding systems. This is by decreasing the need for manual work, avoiding feed waste, and enhancing the productivity and well-being of the birds, these technologies can increase the efficiency of poultry farming operations.

- The broiler breeding equipment segment is projected to hold the largest share of the global poultry farming equipment market during the forecast period.

Based on the application, the global poultry farming equipment market is divided into broiler breeding equipment and layer breeding equipment. Among these, the broiler breeding equipment segment is projected to hold the largest share of the global poultry farming equipment market during the forecast period. This is because packaged and processed chicken products are becoming more and more popular, and there is a growing need for poultry products like chicken and eggs. The most popular meat in the world, poultry is regarded as an affordable and wholesome source of protein. Sustainable and environmentally friendly equipment is becoming more and more popular in the poultry farming industry.

- The chicken segment is projected to hold the largest share of the global poultry farming equipment market during the forecast period.

Based on the type, the global poultry farming equipment market is divided into turkey, duck, chicken, and others. Among these, the chicken segment is projected to hold the largest share of the global poultry farming equipment market during the forecast period. One of the main factors propelling the market for poultry farming equipment is the rising consumption of meals high in protein. Another significant factor propelling the market for poultry farming equipment is the growing interest in fitness and wellness. Sales of poultry farming equipment are increasing as packaged and processed chicken products gain popularity.

- The automatic segment is expected to be the largest share of the global poultry farming equipment market during the forecast period.

Based on the operation, the global poultry farming equipment market is categorized into manual, semi-automatic, and automatic. Among these, the automatic segment is expected to be the largest share of the global poultry farming equipment market during the forecast period. This is because international corporations are becoming more prevalent in the poultry industry. The need for automated poultry farming technology is being driven by the growing labor shortage. There is a scarcity of skilled people in the global labor market, and labor expenses are increasing. This is because international corporations are becoming more prevalent in the poultry industry.

Regional Segment Analysis of the Global Poultry Farming Equipment.

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

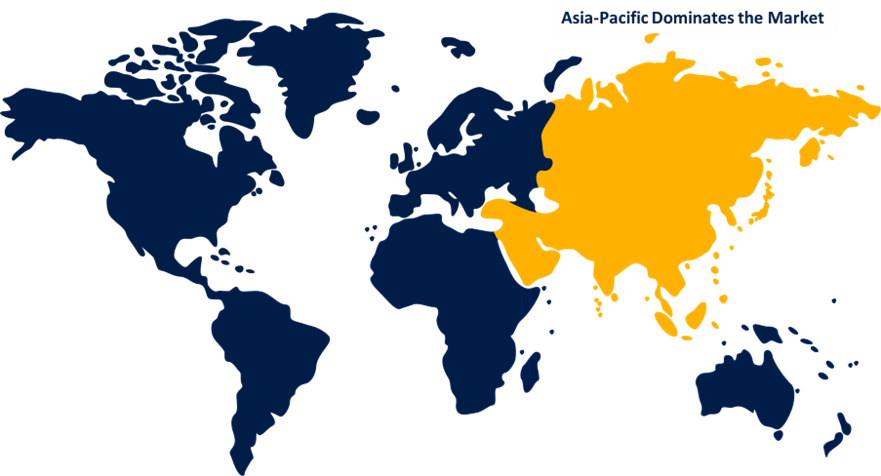

Asia-Pacific is expected to dominate the share of global poultry farming equipment market during the forecast period.

Get more details on this report -

Asia-Pacific is anticipated to dominate the share of global poultry farming equipment market during the forecast period. This is because about 60% of the world's population lives in Asia-Pacific, which raises food consumption. The market is expanding due to rising disposable incomes and per capita incomes in the area. The poultry sector is supported by the government, especially in China. China is accelerating its adoption of cutting-edge processing technologies.

North America is expected to hold the largest share of the global poultry farming equipment market during the forecast period. This is due to the market for poultry farming equipment in North America being mostly driven by the region's numerous large-scale, sophisticated chicken farms. Poultry goods are becoming more and more popular, particularly packaged and processed chicken products. The business of equipment used in poultry farming is growing because of quick technical developments. The market for equipment used in poultry farming is expanding as a result of increased animal protein demand.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the global poultry farming equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Valco Industries, Inc.

- Tecno Poultry Equipment Spa

- OFFICINE FACCO & C. Spa

- ME International Installation GmbH

- Jansen Poultry Equipment

- Jamesway Incubator Company

- Big Dutchman AG

- Real Tuff Livestock Equipment

- Royal Livestock Farms

- FarmTek

- Afimilk Ltd

- Murray Farm Care Ltd.

- Bob-White Systems

- Pearson International LLC

- Others

Key Market Developments

- In November 2023, at IPPE 2024, the leading worldwide event devoted to poultry, feed, and meat technologies, Watson-Marlow Fluid Technologies Solutions (WMFTS) will showcase its high-efficiency pump technology for effluent treatment and poultry processing.

- In April 2023, the maker of equipment for poultry farming, Innovative Poultry Products LLC, announced plans to expand its operations in Bamberg County. According to a press statement, the company plans to invest USD 2.86 million in a facility expansion, which is expected to create 30 new jobs over the next five years.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global poultry farming equipment market based on the below-mentioned segments:

Global Poultry Farming Equipment Market, By Product

- Grading system

- Monitoring

- Egg handling equipment

- Vaccination equipment

- Lighting system

- Hatchers and setters

- Incubators and brooders

- Washers and waste removal system

- Feeding and watering system

- Others

Global Poultry Farming Equipment Market, By Application

- Broiler breeding equipment

- Layer breeding equipment

Global Poultry Farming Equipment Market, By Crop Type

- Turkey

- Duck

- Chicken

- Others

Global Poultry Farming Equipment Market, By Operation

- Manual

- Semi-Automatic

- Automatic

Global Poultry Farming Equipment Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size and growth rate?The global poultry farming equipment market size is expected to grow from USD 4.17 Billion in 2023 to USD 6.17 Billion by 2033, at a CAGR of 4.00% during the forecast period 2023-2033.

-

2. Which is the largest regional market for Global Poultry Farming Equipment?Asia-Pacific is anticipated to dominate the share of global poultry farming equipment market during the forecast period

-

3. What are the key players in leveraging the poultry farming equipment market?Some of the significant players in the poultry farming equipment market are Valco Industries, Inc., Tecno Poultry Equipment Spa, OFFICINE FACCO & C. Spa, ME International Installation GmbH, Jansen Poultry Equipment, Jamesway Incubator Company, Big Dutchman AG, Real Tuff Livestock Equipment, Royal Livestock Farms, FarmTek, Afimilk Ltd, Murray Farm Care Ltd., Bob-White Systems, Pearson International LLC.

Need help to buy this report?