Global Poultry Meat Market Size, Share, and COVID-19 Impact Analysis, By Meat Type (Chicken, Turkey, Duck, Goose), By processing type (Whole Birds, Cut-up Parts, Marinated, Breaded), By Distribution Channel (Supermarkets and Hypermarkets, Independent Retailers, Butchers, Online Retailers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Food & BeveragesGlobal Poultry Meat Market Insights Forecasts to 2033

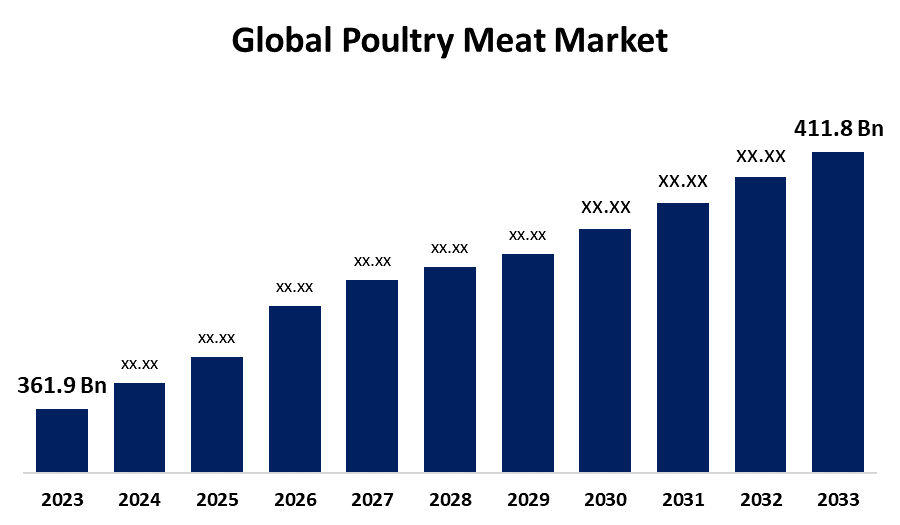

- The Global Poultry Meat Market Size was estimated at USD 361.9 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 1.30% from 2023 to 2033

- The Worldwide Poultry Meat Market Size is Expected to Reach USD 411.8 Billion by 2033

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Poultry Meat Market size was worth around USD 361.9 Billion in 2023 and is predicted to grow to around USD 411.8 Billion by 2033 with a compound annual growth rate (CAGR) of 1.30% between 2023 and 2033. The market for poultry meat is influenced by trends like growing consumer demand for healthy, low-cost protein, rising awareness of the nutritional value of poultry, expanding populations, urbanization, and shifting dietary patterns. Moreover, improvements in poultry farming, processing technology, and distribution systems also fuel market growth and availability.

Market Overview

The poultry meat industry is the business that produces, processes, and distributes meat from domesticated birds like chickens, turkeys, ducks, and other birds. Poultry meat is an affordable source of protein in comparison to other meats like beef and pork, which makes it a favorite among consumers looking for cheap and healthy foods. Furthermore, increasing demand for protein-rich foods and the cost-effectiveness of poultry meat relative to other animal proteins are key drivers of the poultry meat market. Red meat consumption health concerns and increasing disposable incomes have also boosted the market growth. In addition, technological improvements in poultry farming and processing have enhanced production efficiency and lowered costs, making poultry meat more affordable to consumers. In addition to this, the growth of the food service industry is also adding to the growth of the poultry meat market industry. Poultry meat is a popular menu item in cafes, drive-through restaurants, and other food service places. The growing number of food service places all over the world is providing increased opportunities for chicken meat suppliers.

Report Coverage

This research report categorizes the poultry meat market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the poultry meat market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the poultry meat market.

Global Poultry Meat Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 361.9 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 1.30% |

| 2033 Value Projection: | USD 411.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Meat Type, By Processing Type, By Distribution Channel |

| Companies covered:: | BRF, Pilgrim’s Pride, Perdue Farms, Sanderson Farms, Keystone Foods, JBS, OSI Group, Tyson Foods, Foster Farms, Hormel Foods, Cargill, and Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

Chicken and other poultry meat are generally cheaper than other meats such as beef and pork. This is why it has become a popular choice for consumers looking for an economical source of protein, especially in populous areas where middle-class consumers are pushing demand for the poultry meat market. There has been heightened awareness regarding health and nutrition, which has resulted in consumers opting for poultry as a leaner, healthier source of protein compared to higher-fat meats. Chicken and other poultry items are low in fat content, so they are a good choice for individuals seeking to have a balanced diet or wishing to reduce weight. Furthermore, advancements in poultry production, including automation, better nutrition through improved feed, and enhanced disease control, resulted in impressive efficiency enhancements. These technologies lower production costs and enhance meat quality, bringing poultry within reach and appealing more to consumers further boosting its demand.

Restraining Factors

Food safety concerns like contamination by bacteria such as Salmonella or E. coli can affect consumer trust in poultry products. Health concerns regarding the administration of antibiotics and hormones in poultry production also bring about low demand in poultry meat markets. Additionally, the growth in plant-based meat substitutes and lab-grown meat creates competition for the poultry industry. As people increasingly become health-oriented or eco-conscious, demand for alternative protein sources can curb the expansion of conventional meat markets, including poultry.

Market Segmentation

The poultry meat market share is classified into meat type, processing type, and distribution channel.

- The chicken segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the meat type, the poultry meat market is divided into chicken, turkey, duck, and goose. Among these, the chicken segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The growth attributed to chicken is extremely versatile and may be prepared in numerous ways, grilled, fried, baked, or boiled appealing to different culinary preferences globally. It is applied in various forms of cuisine, ranging from Western to Asian cuisine. Chicken is mostly lower in cost than other meats such as beef and pork and therefore is a viable source of protein for a wide variety of customers, including consumers in developing and emerging markets.

- The whole birds segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the processing type, the poultry meat market is divided into whole birds, cut-up parts, marinated, and breaded. Among these, the whole birds segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is due to whole birds tend to be cheaper per kilogram than pre-cut or processed poultry pieces. Customers seeking a cost-effective alternative tend to prefer purchasing whole birds since they offer greater value for money. Whole birds can be cooked in several ways, roasted, grilled, or slow-cooked, and utilized in a variety of dishes. This makes whole birds attractive to both households and food service outlets.

- The supermarkets and hypermarkets segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the poultry meat market is divided into supermarkets and hypermarkets, independent retailers, butchers, and online retailers. Among these, the supermarkets and hypermarkets segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The growth is driven by supermarkets and hypermarkets are one-stop shopping centers, providing various products, including fresh, frozen, and processed poultry. Supermarkets and hypermarkets often promote offers, discounts, and loyalty schemes, which entice customers to buy poultry products in bulk or for a lower amount. This aids in increasing their market share in the poultry meat segment.

Regional Segment Analysis of the Poultry Meat Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

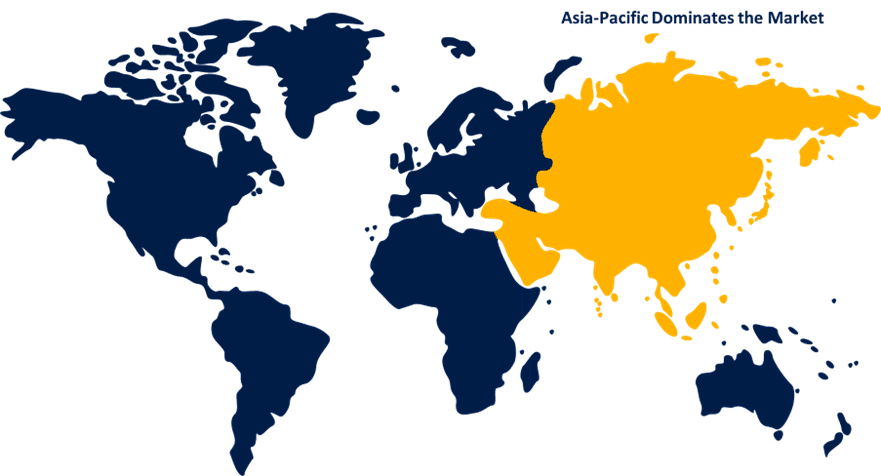

Asia Pacific is anticipated to hold the largest share of the poultry meat market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the poultry meat market over the predicted timeframe. Asia-Pacific contains some of the biggest poultry-producing countries in the world, such as China and Thailand. These nations possess sophisticated poultry farming technologies in the form of automated farming systems and enhanced breeding methods, whose adoption has remarkably enhanced production efficiency. This has facilitated the enhanced availability and accessibility of poultry meat, contributing to its dominant market share.

North America is expected to grow at a rapid CAGR in the poultry meat market during the forecast period. North America, and especially the United States, boasts some of the most developed poultry production technologies. Automation, maximized feed, disease control systems, and improved breeding have maximized efficiency in production. Such technology enables poultry farmers to keep pace with increasing demand without incurring increased costs, reducing the price of poultry and boosting its market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the poultry meat market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BRF

- Pilgrim's Pride

- Perdue Farms

- Sanderson Farms

- Keystone Foods

- JBS

- OSI Group

- Tyson Foods

- Foster Farms

- Hormel Foods

- Cargill

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2024, Allana Group introduced the Indian Poultry Alliance (IPA), a major effort to unite multiple stakeholders in the poultry industry. The alliance hopes to improve the efficiency, sustainability, and growth of the Indian poultry industry through collaboration and innovation. The launch represents a strategic step to improve conditions in the industry and enhance overall market conditions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the poultry meat market based on the below-mentioned segments:

Global Poultry Meat Market, By Meat Type

- Chicken

- Turkey

- Duck

- Goose

Global Poultry Meat Market, By Processing Type

- Whole Birds

- Cut-up Parts

- Marinated

- Breaded

Global Poultry Meat Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Independent Retailers

- Butchers

- Online Retailers

Global Poultry Meat Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the poultry meat market over the forecast period?The global poultry meat market is projected to expand at a CAGR of 1.30% during the forecast period.

-

2. What is the market size of the poultry meat market?The global poultry meat market size is expected to grow from USD 361.9 Billion in 2023 to USD 411.8 Billion by 2033, at a CAGR of 1.30% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the poultry meat market?Asia Pacific is anticipated to hold the largest share of the poultry meat market over the predicted timeframe.

Need help to buy this report?