Global Powered Mobility Devices Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Powered Wheelchairs, Power Add-on/Propulsion-Assist Units, and Power Operated Vehicles), By Patient (Pediatric and Adult), By Distribution Channel (Brick & Mortar, and Online Channel), By End-use (Hospitals, Home Care, Rehabilitation Centers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Powered Mobility Devices Market Insights Forecasts to 2033

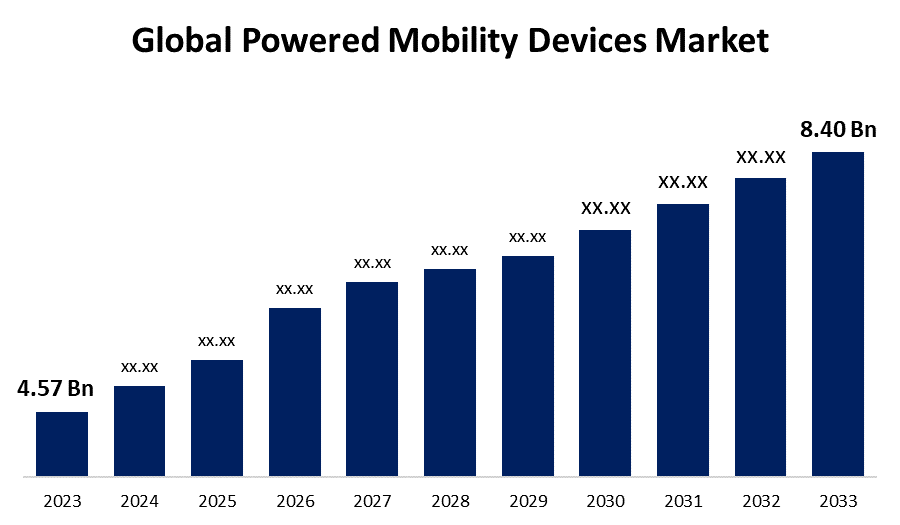

- The Global Powered Mobility Devices Market Size was Valued at USD 4.57 Billion in 2023

- The Market Size is Growing at a CAGR of 6.28% from 2023 to 2033

- The Worldwide Powered Mobility Devices Market Size is Expected to Reach USD 8.40 Billion by 2033

- Asia-Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Size is Anticipated to Exceed USD 8.40 Billion by 2033, Growing at a CAGR of 6.28% from 2023 to 2033.

Market Overview

Powered mobility device means any non-motorized device designed for use by inmates with mobility disabilities or limitations to provide mobility assistance. Examples include wheelchairs, crutches, walkers, canes, braces, or other similar devices. Powered mobility devices increase mobility-related participation in daily life among certain subgroups of adults with mobility restrictions. These devices offer a host of benefits that significantly improve the lives of individuals with mobility challenges. Considering a power mobility device could be a transformative step toward a more independent and enriched lifestyle for individuals facing mobility disabilities. The development of passive standing positions is the most recent advance in the design of powered wheelchairs. Reduction of seated pressure, decreased bone demineralization, increased bladder pressure, improved orthostatic circulatory control, lowered muscular tone, less stress on the muscles of the upper extremities, and improved overall functional status are some of these advantages. Technological advancement propels innovation in the healthcare domain, resulting in the creation of more sophisticated and efficient mobility gadgets tailored to individual requirements and preferences.

Report Coverage

This research report categorizes the market for the global powered mobility devices market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global powered mobility devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global powered mobility devices market.

Global Powered Mobility Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.57 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.28% |

| 2033 Value Projection: | USD 8.40 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Patient, By Distribution, By End-use |

| Companies covered:: | GF Health Products, Inc., Invacare Corporation, Drive DeVilbiss Healthcare, Golden Technologies, Hoveround Corporation, Karman Jealthcare, Inc., Recare Ltd., MEYRA GmbH, Carex Health Brands, Inc., LEVO AG, Pride Mobility Products Corporation, Merits Health Products, Inc., Permobil AB, Sunrise Medical, National Seating & Mobility, Inc., Numotion, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Technological advancement in products, such as improved battery technology, lightweight materials, and enhanced control systems aids in the development of more efficient and user-friendly powered mobility devices. The rise in the incidence of disabilities including age-related disorders, injuries, or diseases is also contributing to driving the global powered mobility devices market. According to WHO statistics, approximately 1.3 billion individuals that is 16% of the world’s population are suffering from some form of disability. Thus, the increased prevalence of cancer and the surging demand for customized personalized devices are propelling the market demand. Customized power mobility devices ensure comfort and make daily life easier for a prolonged period of time. Thus, this flexible tool satisfies long-term demands for mobility-disabled individuals which leads to driving the global powered mobility devices market.

Restraining Factors

The lack of awareness about the application of powered mobility devices such as wheelchairs, crutches, walkers, canes, braces, or other similar devices is restraining the market. Further, the stringent regulatory frameworks hinder the innovation and competition of key market players' product devices which ultimately leads to hampering the market growth.

Market Segmentation

The global powered mobility devices market share is classified into product type, patient, distribution channel, and end-use.

- The powered wheelchairs segment held the largest share of the global powered mobility devices market in 2023.

Based on the product type, the global powered mobility devices market is categorized into powered wheelchairs, power add-on/propulsion-assist units, and power operated vehicles. Among these, the powered wheelchairs segment held the largest share of the global powered mobility devices market in 2023. Electric (motorized) wheelchairs are equipped with comfortable seats, adjustable footrests, and additional features such as padded armrests and headrests. There is increasing demand for powered wheelchairs among the geriatric population owing to age-related diseases that reduce physical mobility.

- The adult segment accounted for the largest revenue share of the global powered mobility devices market in 2023.

Based on the patient, the global powered mobility devices market is categorized into pediatric and adult. Among these, the adult segment accounted for the largest revenue share of the global powered mobility devices market in 2023. Mobility devices, including canes, walkers, and wheelchairs are used by older adults to compensate for decrements in balance, coordination, sensation, strength, and increased risk for falls. The increasing prevalence of chronic disease conditions such as multiple sclerosis, spinal cord injuries, or muscular dystrophy surges the market demand for powered mobility chairs for their daily activities.

- The brick & mortar segment dominated the market with the largest revenue share in 2023.

Based on the distribution channel, the global powered mobility devices market is categorized into brick & mortar, and online channel. Among these, the brick & mortar segment dominated the market with the largest revenue share in 2023. Brick & motor segment possesses the advantage of an in-person shopping experience, readily available customer service, and more convenience as compared to online delivery. It also offers valuable assistance by in-store staff while purchasing devices.

- The home care segment is expected to hold the largest revenue share of the global powered mobility devices market during the forecast period.

Based on the end-use, the global powered mobility devices market is categorized into hospitals, home care, rehabilitation centers, and others. Among these, the home care segment is expected to hold the largest revenue share of the global powered mobility devices market during the forecast period. Individuals can use powered mobility devices in the comfort of their own homes and manage daily tasks. Powered mobility devices intended for domestic usage are frequently small and nimble, making it simple for users to move through doors and other home areas. The increased prevalence of chronic conditions and mobility-related issues enhances the market demand.

Regional Segment Analysis of the Global Powered Mobility Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global powered mobility devices market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the global powered mobility devices market over the forecast period. The creation of sophisticated and user-friendly powered mobility devices is positively impacted by technological innovation and development in battery technology. The integration of powered mobility devices is further facilitated by the availability of rehabilitation services, assistive technology centers, and a network of medical experts. The Rehabilitation Engineering Research Center programs received doubled the funding from the U.S. government to accelerate research in the field of personal mobility.

Asia-Pacific is expected to grow at the fastest CAGR growth of the global powered mobility devices market during the forecast period. Seeking cutting-edge technologies in healthcare solutions and the growing geriatric population in countries like China, India, and Japan are contributing to market demand. The extensive R&D activities undertaken by numerous organizations, including the China Rehabilitation Research Center (CRRC) are anticipated to drive the market. In addition, the rising awareness, high healthcare costs, and emphasis on enhancing access to healthcare are fueling the market expansion in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global powered mobility devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GF Health Products, Inc.

- Invacare Corporation

- Drive DeVilbiss Healthcare

- Golden Technologies

- Hoveround Corporation

- Karman Jealthcare, Inc.

- Recare Ltd.

- MEYRA GmbH

- Carex Health Brands, Inc.

- LEVO AG

- Pride Mobility Products Corporation

- Merits Health Products, Inc.

- Permobil AB

- Sunrise Medical

- National Seating & Mobility, Inc.

- Numotion

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, Sunrise Medical completed the strategic acquisition of Ride Designs. This acquisition marks a significant expansion of Sunrise Medical's custom seating offerings, clinical expertise, and service capabilities, perfectly complementing the extensive range of manual and powered mobility products Sunrise Medical already offered.

- In February 2023, Los Angeles-based mobility firm Reyhee announced via a press release the introduction of “long-lasting mobility solutions” for senior citizens and people with disabilities. The two products, the Cruiser and the Roamer are FDA-cleared, medical-grade electric vehicles designed to make mobility accessible for those who find walking—even a short distance—difficult, if not impossible.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global powered mobility devices market based on the below-mentioned segments:

Global Powered Mobility Devices Market, By Product Type

- Powered Wheelchairs

- Power Add-on/Propulsion-Assist Units

- Power Operated Vehicles

Global Powered Mobility Devices Market, By Patient

- Pediatric

- Adult

Global Powered Mobility Devices Market, By Distribution Channel

- Brick & Mortar

- Online Channel

Global Powered Mobility Devices Market, By End-use

- Hospitals

- Home care

- Rehabilitation centers

- Others

Global Powered Mobility Devices Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?