Global Powertrain Sensor Market Size, Share, and COVID-19 Impact Analysis, By Powertrain Subsystem (Engine, Drivetrain, Exhaust), By Propulsion (ICE, EV), By Vehicle Type (Light-duty vehicle, Heavy-duty vehicle), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Powertrain Sensor Market Insights Forecasts to 2033

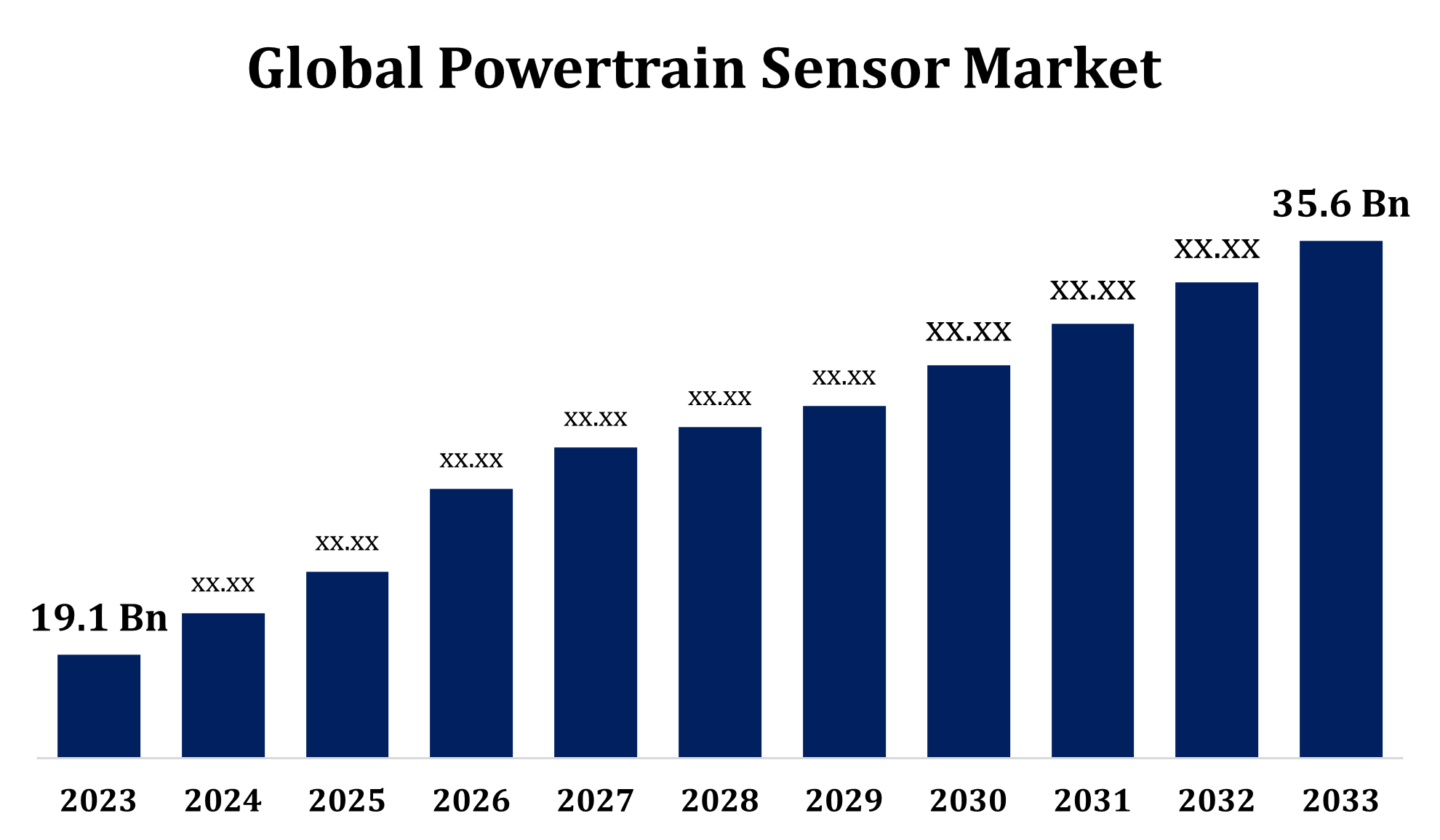

- The Global Powertrain Sensor Market was valued at USD 19.1 Billion in 2023.

- The Market is Growing at a CAGR of 6.42% from 2023 to 2033.

- The Global Powertrain Sensor Market is expected to reach USD 35.6 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Powertrain Sensor Market Size is Expected to Reach USD 35.6 Billion by 2033, at a CAGR of 6.42% during the forecast period 2023 to 2033.

The powertrain sensor market is experiencing significant growth due to the rising demand for advanced automotive technologies, particularly electric vehicles (EVs) and hybrid vehicles. These sensors play a crucial role in monitoring the performance and efficiency of powertrain systems, which include the engine, transmission, and driveline components. Powertrain sensors enable better fuel efficiency, lower emissions, and enhanced vehicle safety by providing real-time data on engine parameters, temperature, pressure, and vibration. The market is driven by increasing automotive production, advancements in sensor technologies, and a growing focus on sustainability. As the automotive industry shifts toward electrification, the demand for powertrain sensors, including those used in battery management systems and motor control, is expected to rise significantly in the coming years.

Powertrain Sensor Market Value Chain Analysis

The powertrain sensor market value chain involves several stages, starting with raw material suppliers who provide components like semiconductors and materials for sensor manufacturing. These materials are then processed by sensor manufacturers, who design and produce powertrain sensors for various automotive applications. Sensor manufacturers often collaborate with OEMs (Original Equipment Manufacturers) and Tier 1 suppliers to integrate sensors into vehicle powertrains, including electric, hybrid, and internal combustion engine systems. Once the sensors are integrated, they are distributed to automotive manufacturers, who use them in vehicle production. Aftermarket suppliers also play a key role by offering replacement and upgraded sensors. The final stage involves vehicle end-users who benefit from improved powertrain performance, efficiency, and safety, which drives demand for advanced sensors and solutions in the automotive sector.

Powertrain Sensor Market Opportunity Analysis

The powertrain sensor market presents significant opportunities driven by several key factors. The shift toward electric vehicles (EVs) and hybrid vehicles is a major opportunity, as these vehicles require advanced sensors for battery management, motor control, and energy efficiency. Additionally, the growing demand for fuel-efficient and low-emission vehicles is pushing automakers to adopt sophisticated powertrain technologies, boosting the need for precision sensors. Emerging markets with increasing automotive production provide untapped potential for sensor adoption. Moreover, advancements in sensor technologies such as wireless sensors, MEMS (Micro-Electro-Mechanical Systems), and IoT integration open new avenues for growth. The rise in autonomous vehicle development also creates opportunities for sensors to improve vehicle performance, safety, and real-time data analysis, further expanding market potential.

Global Powertrain Sensor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 19.1 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 6.42% |

| 023 – 2033 Value Projection: | USD 35.6 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 251 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Powertrain Subsystem Analysis, By Propulsion Analysis, By Vehicle Type Analysis, By Regional Analysis |

| Companies covered:: | Continental AG, Robert Bosch GmbH, DENSO CORPORATION, HELLA GmbH & Co. KGaA, VALEO SERVICE, Mitsubishi Electric Automotive America Inc., Infineon Technologies AG, Texas Instruments Incorporated, NXP Semiconductors, TE Connectivity., Littelfuse, Inc., Allegro MicroSystems, Inc., TDK-Micronas GmbH, Melexis, HYUNDAI KEFICO Corporation, PCB Piezotronics, Inc., Kyocera, Murata Manufacturing Co., Ltd, and Other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Powertrain Sensor Market Dynamics

Increasing motor vehicle manufacturing to propel the market growth

The rising motor vehicle manufacturing is expected to significantly drive the growth of the powertrain sensor market. As global vehicle production continues to expand, particularly with the increasing demand for electric vehicles (EVs) and hybrids, the need for advanced powertrain sensors becomes more critical. These sensors are essential for optimizing vehicle performance, enhancing fuel efficiency, reducing emissions, and ensuring safety. The growing focus on sustainability and regulatory requirements for lower emissions further accelerates the adoption of advanced powertrain technologies, where sensors play a vital role. Additionally, the expanding automotive industry in emerging markets presents new opportunities for powertrain sensor manufacturers. As vehicle production scales up to meet evolving consumer demands, the powertrain sensor market is poised for substantial growth in the coming years.

Restraints & Challenges

One of the primary challenges is the high cost of advanced sensors, particularly those used in electric and hybrid vehicles, which can increase the overall vehicle cost. Additionally, the complexity of integrating multiple sensors into modern powertrain systems, especially with the rise of electric and autonomous vehicles, presents technical challenges. Variability in sensor quality and reliability, especially under harsh operating conditions, can also impact performance and durability. Another challenge is the need for continuous innovation to keep up with evolving automotive technologies, which demands significant investment in research and development. Moreover, the market faces supply chain disruptions and fluctuating raw material costs, which can affect sensor production and availability. These factors create barriers to broader market adoption.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Powertrain Sensor Market from 2023 to 2033. The powertrain sensor market in North America is witnessing significant growth, driven by the region's robust automotive industry, technological advancements, and increasing adoption of electric vehicles (EVs). The demand for advanced powertrain sensors is fueled by the need for improved fuel efficiency, reduced emissions, and enhanced vehicle performance. North America's focus on sustainability and stricter emission regulations further supports the integration of advanced sensor technologies in both traditional and electric powertrains. The presence of major automotive manufacturers and Tier 1 suppliers in the region also accelerates the market expansion. Additionally, the growing interest in autonomous vehicles and connected car technologies presents new opportunities for powertrain sensors in North America. As vehicle production increases, the market is expected to see sustained growth, making North America a key region for sensor manufacturers.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The powertrain sensor market in the Asia Pacific region is experiencing rapid growth, driven by the increasing production of vehicles, particularly in emerging countries. The rise in demand for electric vehicles (EVs) and hybrid vehicles is a major factor contributing to the growth, as these vehicles require advanced powertrain sensors for optimal performance and energy efficiency. Additionally, Asia Pacific is home to several leading automotive manufacturers and a growing base of Tier 1 suppliers, further boosting market demand. The region's focus on reducing emissions and improving fuel efficiency aligns with the adoption of innovative sensor technologies. Moreover, the expanding automotive market in emerging economies offers new opportunities for sensor manufacturers. With rising vehicle production and technological advancements, the Asia Pacific market is poised for significant growth.

Segmentation Analysis

Insights by Powertrain Subsystem

The engine segment accounted for the largest market share over the forecast period 2023 to 2033. The engine sub-system segment in the powertrain sensor market is experiencing notable growth due to the increasing focus on improving engine performance, fuel efficiency, and reducing emissions. Sensors in this sub-system play a critical role in monitoring key parameters such as temperature, pressure, airflow, and exhaust gases, helping optimize engine operations and ensuring compliance with stringent emission regulations. With the rise of electric and hybrid vehicles, the demand for advanced sensors that monitor engine performance, battery management systems, and motor control is also expanding. Additionally, the shift toward more fuel-efficient internal combustion engines in conventional vehicles further drives growth in this segment. As manufacturers strive to meet environmental standards and enhance vehicle efficiency, the engine sub-system segment is expected to continue its upward trajectory in the powertrain sensor market.

Insights by Propulsion

The ICE propulsion segment accounted for the largest market share over the forecast period 2023 to 2033. Despite the rise of electric vehicles, ICE-powered vehicles remain dominant in many regions, spurring ongoing demand for advanced sensors. These sensors are essential for optimizing engine performance, fuel efficiency, emissions control, and overall vehicle safety. They monitor crucial parameters such as air-fuel ratio, exhaust gas temperature, pressure, and engine vibrations, ensuring that the engine operates within optimal conditions. Furthermore, as stricter environmental regulations are implemented globally, the need for more precise sensors to control emissions and improve fuel economy has intensified. This segment's growth is further supported by the continuous development of more efficient and reliable ICE technologies, making it a vital part of the overall powertrain sensor market.

Insights by Vehicle Type

The heavy duty vehicles segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by the increasing demand for advanced sensor technologies to improve the performance, efficiency, and safety of commercial vehicles. Sensors in HDVs are critical for monitoring engine parameters, transmission performance, fuel efficiency, and emissions, ensuring compliance with stringent environmental regulations. As heavy-duty vehicles play a vital role in logistics, transportation, and industrial sectors, the need for more reliable and durable powertrain sensors is rising. Additionally, the growing emphasis on reducing carbon emissions and improving fuel economy in HDVs further fuels sensor adoption. The shift toward hybrid and electric technologies in large trucks and buses also drives the demand for specialized sensors. As the global HDV fleet continues to grow, the powertrain sensor market in this segment is expected to expand rapidly.

Recent Market Developments

- In October 2019, Melexis has expanded its precision pressure sensor portfolio with new analog output sensor ICs, the MLX90817 and MLX90818. These sensors mark a significant advancement in accuracy, size, and versatility, playing a crucial role in making future engines cleaner and more efficient than current models.

Competitive Landscape

Major players in the market

- Continental AG

- Robert Bosch GmbH

- DENSO CORPORATION

- HELLA GmbH & Co. KGaA

- VALEO SERVICE

- Mitsubishi Electric Automotive America Inc.

- Infineon Technologies AG

- Texas Instruments Incorporated

- NXP Semiconductors

- TE Connectivity.

- Littelfuse, Inc.

- Allegro MicroSystems, Inc.

- TDK-Micronas GmbH

- Melexis

- HYUNDAI KEFICO Corporation

- PCB Piezotronics, Inc.

- Kyocera

- Murata Manufacturing Co., Ltd

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Powertrain Sensor Market, Powertrain Subsystem Analysis

- Engine

- Drivetrain

- Exhaust

Powertrain Sensor Market, Propulsion Analysis

- ICE

- EV

Powertrain Sensor Market, Vehicle Type Analysis

- Light-duty vehicle

- Heavy-duty vehicle

Powertrain Sensor Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Powertrain Sensor Market?The global Powertrain Sensor Market is expected to grow from USD 19.1 billion in 2023 to USD 35.6 billion by 2033, at a CAGR of 6.42% during the forecast period 2023-2033.

-

2.Who are the key market players of the Powertrain Sensor Market?Some of the key market players of the market are Continental AG, Robert Bosch GmbH, DENSO CORPORATION, HELLA GmbH & Co. KGaA, VALEO SERVICE, Mitsubishi Electric Automotive America Inc., Infineon Technologies AG, Texas Instruments Incorporated, NXP Semiconductors, TE Connectivity., Littelfuse, Inc., Allegro MicroSystems, Inc., TDK-Micronas GmbH, Melexis, HYUNDAI KEFICO Corporation, PCB Piezotronics, Inc., kyocera, and Murata Manufacturing Co., Ltd.

-

3.Which segment holds the largest market share?The ICE segment holds the largest market share and is going to continue its dominance.

-

4.Which region dominates the Powertrain Sensor Market?North America dominates the Powertrain Sensor Market and has the highest market share.

Need help to buy this report?