Global Pre-Workout Supplements Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Powder, Capsule, Liquid, and Others), By Distribution Channel (Online, and Offline), By End-Users (Athletes, Bodybuilders, Fitness Enthusiasts, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Consumer GoodsGlobal Pre-Workout Supplement Market Insights Forecasts to 2033

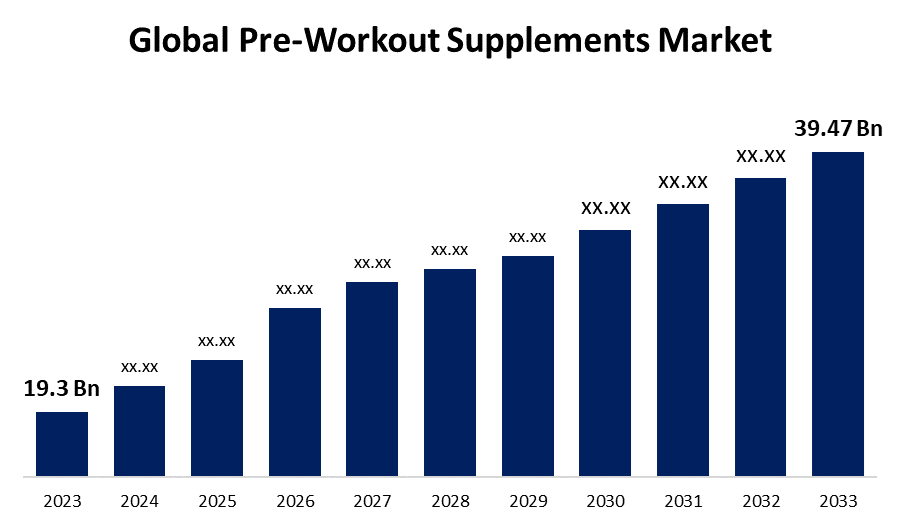

- The Global Pre-Workout Supplements Market Size was Valued at USD 19.3 Billion in 2023

- The Market Size is Growing at a CAGR of 7.42% from 2023 to 2033

- The Worldwide Pre-Workout Supplements Market Size is Expected to Reach USD 39.47 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Pre-Workout Supplements Market Size is Anticipated to Exceed USD 39.47 Billion by 2033, Growing at a CAGR of 7.42% from 2023 to 2033.

Market Overview

A pre-workout supplement is a combination of performance-enhancing chemicals that provide the muscles with the proper amount of nutrition to improve energy levels, avoid early tiredness, and keep them focused during exercises. Pre-workout supplements contain ingredients such as caffeine to boost energy, beta-alanine to control muscle fatigue, branch chain amino to reduce protein breakdown, creatine to improve performance, and nitric oxide to maintain normal blood vessel function, in addition to proprietary blends. The market is predicted to rise significantly over the forecast period due to the increasing significance of an active lifestyle, increased knowledge of the benefits of proteins, and growth in the amount of health and fitness facilities. In addition, consumers who engage in vigorous exercise choose pre-workout supplements because they boost blood vessel dilatation, which allows more oxygen to be transported to muscles and so improves performance. These factors are projected to drive demand for energy-boosting products like pre-workout supplements. Consumers are becoming more aware of their health and engaging in various routines such as gym, exercise, and yoga. The growing popularity of health and fitness routines is expected to raise demand for pre-workout supplements.

Report Coverage

This research report categorizes the market for the global pre-workout supplements market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global pre-workout supplements market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global pre-workout supplements market.

Global Pre-Workout Supplements Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 19.3 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.42% |

| 2033 Value Projection: | USD 39.47 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 270 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Distribution Channel, By End-Users, By Region |

| Companies covered:: | ALLMAX Nutrition, Inc., Beast Sports Nutrition, BPI Sports, LLC, eFlow Nutrition LLC, EFX Sports, Finaflex, GAT Sport, Magnum Nutraceuticals, MusclePharm Corporation, Nutrabolt Corporation, Nutrex Research, Inc., SAN, SynTech Nutrition (Medix Laboratories NV), Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing acceptance of bodybuilding and fitness activities is one of the primary drivers for revenue growth in the worldwide pre-workout supplement market. The rise of social media influencers and celebrities that promote healthy lifestyles has generated consumer interest in accomplishing their fitness goals. Pre-workout supplements are intended to provide consumers with the energy, focus, and endurance they need to perform at their peak physically. The expansion of e-commerce platforms and online retail channels is fueling an increase in market revenue. The rising popularity of health and fitness routines is predicted to increase demand for pre-workout supplements.

Restraining Factors

Consumers' high awareness of supplement side effects can limit the growth of the market. They are pricey, addictive, and can lead to dependency, limiting the total expansion of the pre-workout supplement market.

Market Segmentation

The global pre-workout supplement market share is classified into product type, distribution channel, and end-users.

- The powder segment is anticipated the largest share of the market during the forecast period.

Based on product type, the global pre-workout supplements are categorized into powder, capsule, liquid, and others. Among these, the powder segment is anticipated the largest share of the market during the forecast period. Consumers also choose powder since it allows them to customize the amount of dose needed. Some of consumers have difficulty swallowing capsules and tablets, thus resulting in a trend toward powder form. Furthermore, users can boost the nutritious quality of powder by mixing it with milk. The powder version has a faster absorption rate than capsules and can provide instant results. Furthermore, the convenience of carrying many items together is one of the factors boosting demand for powder pre-workout supplements.

- The offline segment accounted for the largest market share during the forecast period.

Based on distribution channel, the global pre-workout supplements are categorized into online, and offline. Among these, the offline segment accounted for the largest market share during the forecast period. Consumers benefit significantly from offline stores that provide a wider assortment, minimized pricing, and improved awareness of international brands making them a perfect platform for purchasing pre-workout supplements. Furthermore, the increasing number of retail stores such as GNC, vitamin shops, and Walmart is driving market expansion throughout the projected timeframe.

- The athletic segment is anticipated to hold the largest market share over the forecast period.

Based on end-users, the global pre-workout supplements are categorized into athletes, bodybuilders, fitness enthusiasts, and others. Among these, the athletic segment is anticipated to hold the largest market share over the forecast period. The athletic market segment possesses an important market share, and it is expected to maintain its dominance during the forecast period. The primary driver of the worldwide pre-workout supplements market is athletes, who desire to improve their abilities and endurance during hard activities or contests. Pre-workout vitamins help athletes raise their power, focus, and energy levels, resulting in better overall performance.

Regional Segment Analysis of the Global Pre-Workout Supplement Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to dominate the global pre-workout supplements market during the projected timeframe.

Get more details on this report -

North America is anticipated to dominate the global pre-workout supplements market during the projected timeframe. This significance reflects the region's strong presence and influence in the sector. A variety of factors, including a well-established exercise culture, increased consumer health consciousness, and a thriving fitness industry, are driving market expansion. Furthermore, a diverse product range and the presence of important market participants boosted the region's position as a global leader in pre-workout supplements. Key manufacturers are developing innovative products to assurance that consumers have a diverse selection of products to pick from. The development of healthy beverages and protein shakes derived from organic components is predicted to increase demand for pre-workout supplements in the United States.

Asia Pacific pre-workout supplements market is estimated to have the quickest CAGR during the forecast period. An increasing number of fitness and health facilities, evolving consumer preferences for nutritional items, and rising health consciousness are some of the primary drivers of market growth in the region. The demand for pre-workout supplements in the region is expected to rise as more multinational firms establish themselves.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global pre-workout supplements market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ALLMAX Nutrition, Inc.

- Beast Sports Nutrition

- BPI Sports, LLC

- eFlow Nutrition LLC

- EFX Sports

- Finaflex

- GAT Sport

- Magnum Nutraceuticals

- MusclePharm Corporation

- Nutrabolt Corporation

- Nutrex Research, Inc.

- SAN

- SynTech Nutrition (Medix Laboratories NV)

- Others

Key Market Developments

- In March 2022, Qimia Makmal Arad Company and QNT SA formed a cooperation. Qimia is now the authorized distributor in Iran for QNT's functional meals, supplements, and sports nutrition products.

- In October 2022, The company Nutrabolt, which founded the well-known global pre-workout brand C4, revealed new, updated packaging for all of its formulas catering to different customer segments and relaunched the brand's category-defining pre-workout powders.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global pre-workout supplements market based on the below-mentioned segments:

Global Pre-Workout Supplements Market, By Product Type

- Powder

- Capsule

- Liquid

- Others

Global Pre-Workout Supplements Market, By Distribution Channel

- Online

- Offline

Global Pre-Workout Supplements Market, By End-Users

- Athlete

- Bodybuilders

- Fitness Enthusiasts

- Others

Global Pre-Workout Supplements Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?