Global Precision Engineering Machines Market Size, Share, and COVID-19 Impact Analysis, By Type (CNC Machine Tools, EDM Machine Tools, and Others), By End-Use (Automotive and Non-Automotive), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2032

Industry: Semiconductors & ElectronicsGlobal Precision Engineering Machines Market Insights Forecasts to 2032

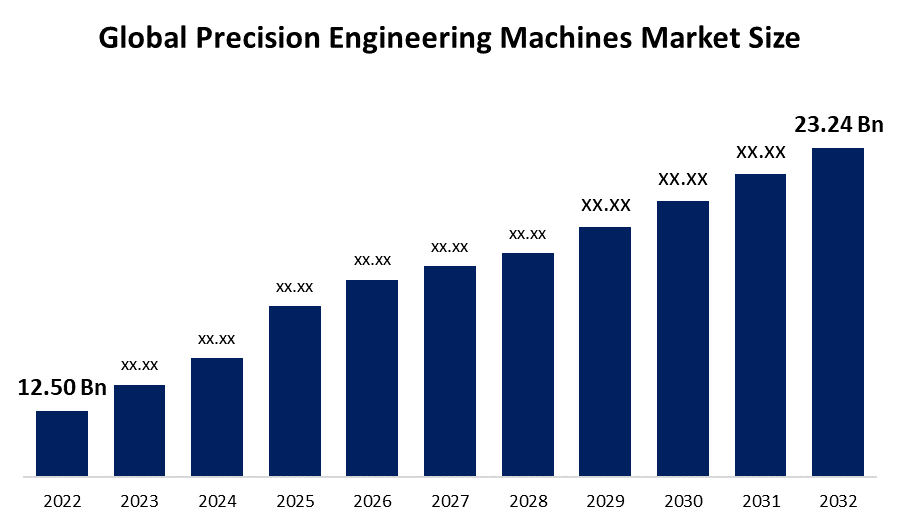

- The Global Precision Engineering Machines Market Size was valued at USD 12.50 billion in 2022.

- The market is growing at a CAGR of 6.4% from 2023 to 2032

- The global precision engineering machines market is expected to reach USD 23.24 billion by 2032

- Europe is expected to grow significant during the forecast period

Get more details on this report -

The Global Precision Engineering Machines Market Size is expected to reach USD 23.24 billion by 2032, at a CAGR of 6.4% during the forecast period 2023 to 2032.

Market Overview

Precision engineering machines are highly advanced mechanical devices designed to carry out precise and intricate manufacturing processes with exceptional accuracy and repeatability. These machines play a critical role in various industries, including aerospace, automotive, electronics, and medical equipment. They are equipped with cutting-edge technologies such as computer numerical control (CNC) systems, advanced sensors, and high-precision actuators. Precision engineering machines are capable of performing tasks like milling, turning, grinding, and drilling with micron-level precision, ensuring the production of complex components and products with tight tolerances. They are engineered to minimize vibrations, thermal effects, and other factors that could affect the precision of the machining process. These machines are instrumental in pushing the boundaries of manufacturing capabilities, enabling the production of intricate parts that are crucial for advancing technology and innovation.

Report Coverage

This research report categorizes the market for precision engineering machines market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the precision engineering machines market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the precision engineering machines market.

Precision Engineering Machines Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 12.50 Billion |

| Forecast Period: | 2022 - 2032 |

| Forecast Period CAGR 2022 - 2032 : | 6.4% |

| 2032 Value Projection: | USD 23.24 Billion |

| Historical Data for: | 2018 - 2021 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Type, By End-Use, By Region |

| Companies covered:: | Amada Machine Tools Co., Ltd., Amera-Seiki, DATRON AG, Dalian Machine Tool Group (DMTG) Corporation, DMG Mori Co., Ltd., FANUC Corporation, Haas Automation, Inc., Hurco Companies, Inc., Okuma Corporation, Shenyang Machine Tool Co., Ltd., Yamazaki Mazak Corporation |

Get more details on this report -

Driving Factors

The precision engineering machines market is driven by several factors, the increasing demand for high-precision components across industries like aerospace, automotive, electronics, and medical equipment is a significant driver. As technology advances and products become more complex, the need for precision manufacturing rises. Additionally, the growing emphasis on automation and efficiency in manufacturing processes is driving the adoption of precision engineering machines. These machines offer advanced features like CNC systems, which enhance productivity and reduce human error. Furthermore, the rising focus on miniaturization and lightweight designs in industries such as electronics and aerospace drives the demand for precision engineering machines capable of producing intricate and precise components. Moreover, the continuous advancements in sensor technologies, robotics, and artificial intelligence are fueling the growth of precision engineering machines by enabling higher levels of automation, accuracy, and productivity.

Restraining Factors

The precision engineering machines market faces certain restraints that can impact its growth, the high cost associated with these machines, including their acquisition, maintenance, and operation, can act as a significant restraint, especially for small and medium-sized enterprises with limited budgets. Additionally, the complexity of operating and programming precision engineering machines requires skilled personnel, which may create a shortage of qualified operators. Moreover, the rapid pace of technological advancements in this field means that machines can quickly become outdated, necessitating frequent upgrades or replacements. Furthermore, stringent regulatory requirements and quality standards in industries such as aerospace and medical equipment can pose challenges for precision engineering machine manufacturers in terms of compliance and certification.

Market Segmentation

- In 2022, the CNC machine tools segment accounted for around 37.2% market share

On the basis of the type, the global precision engineering machines market is segmented into CNC machine tools, EDM machine tools, and others. The CNC machine tools segment has emerged as the dominant force in the precision engineering machines market, capturing the largest market share. The CNC machine tools offer a wide range of applications and capabilities, including milling, turning, grinding, and drilling, making them versatile and suitable for various industries. The ability to automate processes, achieve high precision, and handle complex geometries has made CNC machines indispensable in modern manufacturing. Additionally, industries such as automotive, aerospace, electronics, and medical equipment heavily rely on CNC machine tools for producing intricate components with tight tolerances. The automotive sector, in particular, demands precision machining for engine components, transmission systems, and chassis parts. The aerospace industry requires CNC machines for manufacturing critical aircraft parts like turbine blades and structural components. Moreover, continuous technological advancements in CNC systems, tooling, and software have further enhanced their performance, accuracy, and efficiency. The integration of advanced features like multi-axis control, real-time monitoring, and adaptive machining capabilities has expanded the scope and capabilities of CNC machines. Furthermore, the increasing demand for automation, productivity, and quality in manufacturing processes drives the adoption of CNC machine tools. Their ability to reduce human error, improve repeatability, and optimize production workflows make them highly sought after in industries striving for efficiency. Overall, the CNC machine tools segment's dominance can be attributed to its versatility, precision, broad industry applications, and continuous technological advancements, positioning it as the leading choice for precision engineering machines in the market.

- In 2022, the non-automotive segment dominated with more than 73.5% market share

Based on end-use, the global precision engineering machines market is segmented into automotive and non-automotive. The non-automotive segment has emerged as the dominant sector in the precision engineering machines market, capturing the largest market share. The non-automotive sector encompasses a wide range of industries, including aerospace, electronics, medical equipment, energy, and general manufacturing. These industries have a substantial demand for precision engineering machines to manufacture intricate components, parts, and products with high accuracy and precision. The aerospace industry, in particular, requires precision engineering machines for manufacturing critical aircraft components, such as turbine blades, landing gear, and structural components. The electronics industry relies on precision machines for producing circuit boards, semiconductor components, and microelectromechanical systems (MEMS). The medical equipment sector utilizes precision engineering machines for manufacturing implants, surgical instruments, and medical devices. Moreover, the non-automotive segment is witnessing rapid advancements in technology, driving the need for precision engineering machines. Industries such as aerospace and electronics are constantly pushing the boundaries of miniaturization, complexity, and performance, requiring advanced machines capable of delivering micron-level precision. Additionally, the non-automotive sector often requires customization, smaller batch sizes, and flexibility in manufacturing processes, making precision engineering machines highly suitable due to their ability to adapt and deliver precision at varying scales. Overall, the diverse industries within the non-automotive segment, coupled with their specific precision manufacturing needs, contribute to its substantial market share in the precision engineering machines market.

Regional Segment Analysis of the Precision Engineering Machines Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific dominated the market with more than 32.5% revenue share in 2022.

Get more details on this report -

Based on region, Asia Pacific has emerged as the dominant region in the precision engineering machines market, capturing a significant market share. Several factors contribute to this dominance because this region is the world's largest manufacturing hub, including China, Japan, and South Korea, which have a robust demand for precision engineering machines across industries. These countries are known for their expertise in manufacturing electronic components, automotive parts, and machinery, driving the need for high-precision machines. Asia Pacific benefits from lower labor costs compared to other regions, making it an attractive location for manufacturing operations. Additionally, the region has witnessed significant investments in infrastructure development and industrial automation, further fueling the demand for precision engineering machines. Moreover, supportive government policies and initiatives aimed at promoting advanced manufacturing technologies have also contributed to the growth of the precision engineering machines market in Asia Pacific.

Recent Developments

- In January 2022, The Precision Machining section of the Mercedes Benz Truck Factory was bought by Balu Forge Industries Ltd (BFIL) of Mannheim, Germany. The acquisition will be incorporated into BFIL's brand-new machining facilities in Belgaum, Karnataka, and will cement the company's position as a global leader in precision manufacturing. Because of the extension, BFIL will be able to produce crankshafts and other precision machined parts for original equipment manufacturers of class 7 and class 8 trucks and heavy-duty vehicles.

- In November 2022, Momentum Manufacturing Group, a prominent North American metal manufacturing services supplier, has announced the purchase of precision machining service providers Evans Industries Inc. and Little Enterprises LLC by middle-market private equity company One Equity Partners. The acquisitions broaden Momentum's capabilities, enhance its exposure to mission-critical end markets, and add over 160 talented team members.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global precision engineering machines market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Amada Machine Tools Co., Ltd.

- Amera-Seiki

- DATRON AG

- Dalian Machine Tool Group (DMTG) Corporation

- DMG Mori Co., Ltd.

- FANUC Corporation

- Haas Automation, Inc.

- Hurco Companies, Inc.

- Okuma Corporation

- Shenyang Machine Tool Co., Ltd.

- Yamazaki Mazak Corporation

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global precision engineering machines market based on the below-mentioned segments:

Precision Engineering Machines Market, By Type

- CNC Machine Tools

- EDM Machine Tools

- Others

Precision Engineering Machines Market, By End-Use

- Automotive

- Non-Automotive

Precision Engineering Machines Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?