Global Precision Livestock Farming Market Size, Share, and COVID-19 Impact Analysis, By Offering (Software, Hardware, and Services), By Technology (Identification & Tracking, Milking Robots, and Precision Feeding Systems), By Application (Milk Harvesting, Livestock Health, Feeding Management & Behavior Monitoring, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: AgricultureGlobal Precision Livestock Farming Market Insights Forecasts to 2033

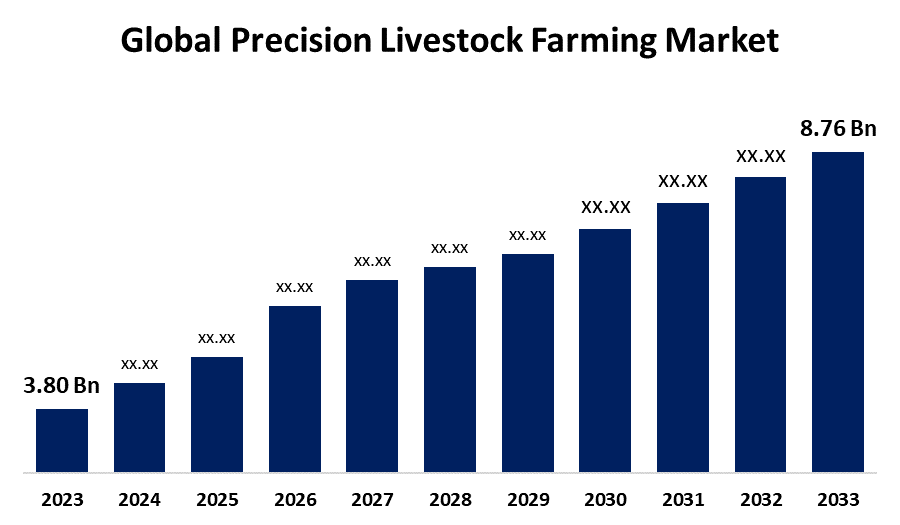

- The Global Precision Livestock Farming Market Size was Valued at USD 3.80 Billion in 2023

- The Market Size is Growing at a CAGR of 8.71% from 2023 to 2033

- The Worldwide Precision Livestock Farming Market Size is Expected to Reach USD 8.76 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Precision Livestock Farming Market Size is Anticipated to Exceed USD 8.76 Billion by 2033, Growing at a CAGR of 8.71% from 2023 to 2033.

Market Overview

The term Precision Livestock Farming (PLF) refers to the integrated application of sensor technologies, associated algorithms, interfaces, and animal husbandry. All animal production methods use PLF technology, which has been most thoroughly discussed in the context of dairy farming. PLF is evolving quickly, going beyond health alerts to become a comprehensive system for making decisions. In addition to external data, it contains sensor and production data from animals. Only a portion of the numerous uses that have been suggested or made commercially available have undergone scientific evaluation; as a result, it is still unclear how they will affect animal health, productivity, and welfare.

For Instance, in February 2022, A $1 million grant was given to a research team at the University of Tennessee Institute of Agriculture to develop and deploy a computer vision system for tracking chicken production. The USDA National Institute of Food and Agriculture's competitive grants program, the Agriculture and Food Research Initiative, provided funding for the award.

The shift from precision to decision livestock farming is one of the main factors driving the market's growth, along with rising labor costs and the need for automation in the livestock sector.

Report Coverage

This research report categorizes the market for the precision livestock farming market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the precision livestock farming market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the precision livestock farming market.

Global Precision Livestock Farming Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.80 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.71% |

| 2033 Value Projection: | USD 8.76 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Offering, By Technology, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Afimilk Agricultural Cooperative Ltd, Aleis Pty Ltd, Allflex USA, BouMatic, Cainthus, Connecterra, Dairymaster, DeLaval Holding AB, Fancom BV, Fullwood Packo SAS, GEA Group, Aktiengesellschaft, HokoFarm-Group, IceRobotics, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The livestock sector is a vital component of the world's food security, contributing significantly to the supply of calories and protein globally through the production of meat, milk, and eggs. Ruminant meat and milk production, especially in grazing systems, is crucial and frequently uses land that is not suited for crop agriculture. Animal agriculture is acknowledged as a primary cause of climate change and a large contributor to greenhouse gas (GHG) emissions. With its 14.5% share of total emissions, the cattle industry is a major source of anthropogenic greenhouse gas emissions. Many techniques requiring modifications to farming operations have been proposed to minimize these emissions. However, a lot of commercial farming methods, particularly in industrial agriculture systems, cause serious issues regarding animal welfare, drawing attention from international trade, investment, and legislative, and business organizations. The cattle industry is seeing an increase in demand for automation as a result of increased productivity, more effective farm management, and lower labor costs. The efficiency of farm outputs has been greatly impacted by the incorporation of AI and IoT in livestock regulation. One of the most important developments in the PLF business is the use of big data.

For instance, in August 2024, A major development in the management of dairy farms, CattleEye announced the debut of its novel Body Condition Scoring (BCS) system for dairy cows. With the use of artificial intelligence, this new technology might provide insightful information with just a security camera placed outside a milking parlor.

Restraining Factors

An innovative approach to managing livestock, precision livestock farming (PLF) offers data-driven decision-making and real-time monitoring to improve output and animal welfare. High upfront investment costs, however, are a major obstacle to its widespread adoption. Purchasing advanced monitoring equipment, updating the current infrastructure to accommodate the new technology, and educating staff members on system operation are just a few of the significant upfront costs associated with investing in PLF technology. Many farmers may find these expenses to be unaffordable, especially in developing nations.

Market Segmentation

The precision livestock farming market share is classified into offering, technology, and application.

- The hardware segment is estimated to hold the highest market revenue share through the projected period.

Based on the offering, the precision livestock farming market is classified into software, hardware, and services. Among these, the hardware segment is estimated to hold the highest market revenue share through the projected period. Technologies for precision livestock farming, or PLF, are proliferating in contemporary agriculture. They are regularly combined with other cutting-edge technologies to enhance production, sustainably operate contemporary farms economically, and enhance human-livestock relationships. Both vast and pasture-based agricultural systems and focused farming operations are continuously in need of new systems.

- The milking robots segment is anticipated to hold the largest market share through the forecast period.

Based on the technology, the precision livestock farming market is divided into identification & tracking, milking robots, and precision feeding systems. Among these, the milking robots segment is anticipated to hold the largest market share through the forecast period. One of the first innovations in precision animal farming, milking robots have transformed dairy production all over the world. The management of the entire farm system has undergone many changes, even as robots take over the milking operation. Milking is now done at the cow's will, allowing it to be spread out throughout 24 hours rather than being done at predetermined times. Despite this capability, milking robot use during 24 hours has received less consideration. The current information gaps regarding the distribution of robot utilization must be identified to develop pertinent research topics and enhance the management of farm milking robots.

For instance, in January 2024, Global pioneer in dairy farming solutions DeLaval announced the introduction of VMS Batch Milking, a robotic milking technology development that lowers labor costs and boosts productivity. With more than 20 years of experience with VMS robotic milking systems, DeLaval is a leader in innovation, providing dairy farmers with tools to enhance their business operations.

- The milk harvesting segment dominates the market with the largest market share through the forecast period.

Based on the application, the precision livestock farming market is categorized into milk harvesting, livestock health, feeding management & behavior monitoring, and others. Among these, the milk harvesting segment dominates the market with the largest market share through the forecast period. This market sector is expected to increase as a result of rising dairy product demand and growing farmer emphasis on raising milk yields. The market for milk harvesting will continue to increase as a result of consumers' growing desire for automated milk harvesting systems and the dairy farms' quick adoption of milking robots. This application can be used to maintain harvesting schedules for individual animals, lower labor costs, and improve milking efficiency.

Regional Segment Analysis of the Precision Livestock Farming Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Europe is anticipated to hold the largest share of the precision livestock farming market over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the precision livestock farming market over the predicted timeframe. Leading the way in the global precision livestock farming market is Europe. The implementation of cutting-edge farming technology, like automated monitoring systems and precision feeding, which facilitate effective and sustainable livestock farming practices, is what propels the region's leadership. Furthermore, the best conditions for livestock are ensured by Europe's strong emphasis on animal health and welfare, which raises production and improves product quality. Moreover, the industry's growth and innovation are fostered by favorable government laws and regulations that encourage the use of precise and sustainable farming practices. Consequently, Europe keeps opening doors for precision livestock production worldwide in the future.

North America is expected to grow at the fastest CAGR growth of the precision livestock farming market during the forecast period. There will probably be a significant need for conditioners due to more land will be used immediately for agricultural and population growth. The market for precision livestock farming in the region has developed owing to the presence of multiple enterprises and forward-thinking farmers. In the livestock industry, North America has a high adoption rate for sophisticated farming and monitoring practices. Precision feeding systems, livestock identification, monitoring, and tracking systems, as well as milking robots, have become commonplace due to rising labor costs and the growing demand for milk and meat. Furthermore, robotic systems and poultry monitoring are becoming more and more popular in the area.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the precision livestock farming market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Afimilk Agricultural Cooperative Ltd

- Aleis Pty Ltd

- Allflex USA

- BouMatic

- Cainthus

- Connecterra

- Dairymaster

- DeLaval Holding AB

- Fancom BV

- Fullwood Packo SAS

- GEA Group

- Aktiengesellschaft

- HokoFarm-Group

- IceRobotics,

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, the Ministry of Fisheries, Animal Husbandry, and Dairying, Government of India, launched a ground-breaking program under the National Digital Livestock Mission in an attempt to transform the livestock farming industry. '1962', the Farmers Mobile Application, is the most recent addition to this project and can be downloaded from the Google Play Store.

- In July 2021, Midori USA, Inc., a biotechnology start-up with a cutting-edge precision platform creating ground-breaking targeted eubiotics that enhance animal health and environmental impact, was bought by DSM.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the precision livestock farming market based on the below-mentioned segments:

Global Precision Livestock Farming Market, By Offering

- Software

- Hardware

- Services

Global Precision Livestock Farming Market, By Technology

- Identification & Tracking

- Milking Robots

- Precision Feeding Systems

Global Precision Livestock Farming Market, By Application

- Milk Harvesting

- Livestock Health

- Feeding Management

- Behavior Monitoring

- Others

Global Precision Livestock Farming Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the precision livestock farming market over the forecast period?The precision livestock farming market is projected to expand at a CAGR of 8.71% during the forecast period.

-

2. What is the market size of the precision livestock farming market?The Global Precision Livestock Farming Market Size is Expected to Grow from USD 3.80 Billion in 2023 to USD 8.76 Billion by 2033, at a CAGR of 8.71% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the precision livestock farming market?Europe is anticipated to hold the largest share of the precision livestock farming market over the predicted timeframe.

Need help to buy this report?