Global Precision Turned Product Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Operation (Manual Operation and CNC Operation), By Machine Types (Automatic Screw Machines, Rotary Transfer Machines, Computer Numerically Controlled (CNC), and Lathes or Turning Centers), By End-User (Industries, Automobile, Electronics, Defense, and Healthcare), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Machinery & EquipmentGlobal Precision Turned Product Manufacturing Market Insights Forecasts to 2033

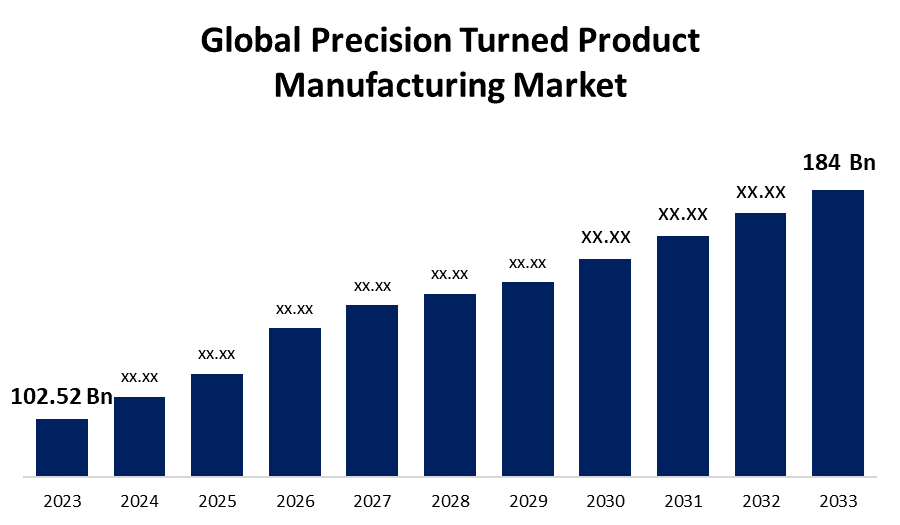

- The Global Precision Turned Product Manufacturing Market Size was Valued at USD 102.52 Billion in 2023

- The Market Size is Growing at a CAGR of 6.02% from 2023 to 2033

- The Worldwide Precision Turned Product Manufacturing Market Size is Expected to Reach USD 184 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Precision Turned Product Manufacturing Market Size is Anticipated to Exceed USD 184 Billion by 2033, Growing at a CAGR of 6.02% from 2023 to 2033.

Market Overview

Precision-turned products are components manufactured through the turning process, which involves rotating a workpiece on a lathe while a cutting tool shapes it to precise specifications. It uses various techniques such as facing, chamfering, threading, tapping, drilling, and knurling to deform a workpiece into the desired shape and dimensions, often using Swiss and CNC machining or turning.

Precision-turned products are used in industries that require high accuracy and consistency, such as aerospace, automotive, medical, and electronics. One of the features of precision-turned parts is the high accuracy, as they are machined to exact dimensions with very little tolerance, ensuring they fit perfectly in assemblies. Examples of precision-turned parts include shafts, pins, connectors, fasteners, and valves.

There are several benefits of precision-turned product manufacturing. It yields parts with little tolerance, high accuracy, and superior functionality. These precision-turned parts boost the performance of equipment and machinery, offer longevity and exceptional efficiency, reduce waste, and save energy. Precision Turned Product Manufacturing can also produce parts with complex geometries, including threads, grooves, and contours, further expanding the range of possible applications.

Additionally, precision-turned product manufacturing follows lean manufacturing principles, reducing unnecessary material removal and costs. The CNC machines also reduce human error and waste, ensuring consistent quality in large production volumes.

Report Coverage

This research report categorizes the market for the global precision turned product manufacturing market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global precision-turned-product manufacturing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global precision turned product manufacturing market.

Global Precision Turned Product Manufacturing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 102.52 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.02% |

| 2033 Value Projection: | USD 184 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 263 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Operation, By Machine Types, By End-User, By Region |

| Companies covered:: | Haas Automation Inc., Moog Inc., Sandvik AB, FANUC Corporation, Hurco Companies Inc., Parker Hannifin Corporation, Hardinge Inc., DMG MORI Co. Ltd., Stanley Black & Decker Inc., Tsugami Corporation, NSK Ltd., Barnes Group Inc., Gleason Corporation, Doosan Corporation, Kennametal Inc., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

Driving Factors

The global precision turned product manufacturing market is fuelled by the increasing demand for high-precision components across industries, including aerospace, automotive, and electronics. Technological advancements in manufacturing processes, including computer numerical control (CNC) systems, have enhanced the efficiency and accuracy of precision turning, further fueling market expansion.

The trend of outsourcing manufacturing to regions with cost-effective labor, like China and India, has also contributed to market growth. Additionally, the rising adoption of automation, Industry 4.0, and lean manufacturing practices has improved productivity and quality in precision turning operations. The continuous innovation in materials science, enabling the use of various alloys and composites, has broadened the application scope of precision turned products. The increasing focus on sustainable manufacturing practices and the need for complex, custom-designed components have created new opportunities, driving the market forward.

Restraining Factors

Despite its growth trajectory, the global precision turned product manufacturing market might face some restraining factors. One major challenge is the high initial investment required for setting up and maintaining precision turning machinery, particularly CNC machines, which could be prohibitive for small manufacturers. Another constraint is the dependence on skilled lathe and CNC machine operators to operate and maintain the machinery. The shortage of skilled labor in certain regions can hinder market expansion. Additionally, fluctuations in raw material prices and availability, regulations regarding environmental compliance, and waste disposal can pose challenges to sustained growth in the precision turned product manufacturing market.

Market Segmentation

The global precision turned product manufacturing market share is classified by operation, machine types, and end-user.

- The CNC operation segment is expected to hold the largest share of the global precision turned product manufacturing market during the forecast period.

Based on the operation, the global precision turned product manufacturing market is divided into manual operation and CNC operation. Among these, the CNC operation segment is expected to hold the largest share of the global precision turned product manufacturing market during the forecast period. CNC operation offers benefits, including high precision, accuracy, and speed. It enables the production of complex parts with tight tolerances, making them ideal for industries like aerospace, automotive, and electronics. The ability to program and reprogram CNC machines for various operations gives greater flexibility and adaptability in production, making them an attractive option for manufacturers.

- The computer numerically controlled (CNC) machines segment is expected to hold the largest share of the global precision turned product manufacturing market during the forecast period.

Based on machine types, the global precision turned product manufacturing market is divided into automatic screw machines, rotary transfer machines, computer numerically controlled (CNC), and lathes or turning centers. Among these, the computer numerically controlled (CNC) machines segment is expected to hold the largest share of the global precision turned product manufacturing market during the forecast period. CNC machines perform automated operations and are ideal for producing complex parts with tight tolerances. They can operate around the clock without human intervention, boosting production capacity and reducing labour costs. These factors, along with the availability and ongoing innovation in CNC technology, have made CNC machines the preferred choice for precision turned product manufacturing across various industries.

- The automobile segment is expected to grow at the fastest CAGR in the global precision turned product manufacturing market during the forecast period.

Based on end-user, the global precision turned product manufacturing market is divided into industries, automobile, electronics, defense, and healthcare. Among these, the automobile segment is expected to grow at the fastest CAGR in the global precision turned product manufacturing market during the forecast period. The segmental growth is fueled by the increasing demand for high-performance, fuel-efficient vehicles, and the trend of electric and autonomous vehicles. The intricate components required for these vehicles, such as engine parts, transmission systems, and suspension components, drive the need for precision turned products. The automotive industry's focus on making vehicles lightweight and reducing emissions enhances the demand for high-precision components, as these factors directly impact vehicle performance and fuel efficiency.

Regional Segment Analysis of the Global Precision Turned Product Manufacturing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global precision turned product manufacturing market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global precision turned product manufacturing market over the predicted timeframe. This dominance is attributed to the established manufacturing industry, particularly in the United States. The presence of major industries such as aerospace, automotive, and electronics, which require high-precision components, drives the demand for precision turned products. Additionally, North America has leading precision turned product manufacturers, including companies like Stanley Black & Decker Inc., Parker Hannifin Corporation, and Doosan Corporation, which contribute to the regional market share.

The strong economic foundation, advanced technological capabilities, and favorable business environment also support the growth of this market segment. Furthermore, the emphasis on innovation, quality control, and adherence to international manufacturing standards ensure that precision turned products meet the high demands of various industries.

Asia Pacific is expected to grow at the fastest pace in the global precision turned product manufacturing market during the predicted timeframe. This rapid growth is attributed to the rising number of factories and the economy, leading to a surge in demand for precision turned components across various industries such as electronics, automotive, and aerospace. Additionally, countries like India and China are investing heavily in high-tech manufacturing machines, including CNC machines and automation, to enhance their production capabilities and efficiency. The presence of a large and skilled workforce, along with favourable business environments, further supports the growth of precision turned product manufacturing in this region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global precision turned product manufacturing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Haas Automation Inc.

- Moog Inc.

- Sandvik AB

- FANUC Corporation

- Hurco Companies Inc.

- Parker Hannifin Corporation

- Hardinge Inc.

- DMG MORI Co. Ltd.

- Stanley Black & Decker Inc.

- Tsugami Corporation

- NSK Ltd.

- Barnes Group Inc.

- Gleason Corporation

- Doosan Corporation

- Kennametal Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, PrecisionX Group (PrecisionX), a portfolio company of CORE Industrial Partners (CORE), announced the acquisition of MSK Precision Products, Inc. (MSK), a key provider of manufacturing and assembly of high-precision components for the medical, aerospace, defense, and telecommunications industries.

- In January 2024, RTC Aerospace, a portfolio company of private equity firm Stellex Capital Management, acquired Vanderhorst Brothers Industries, a Simi Valley, California-based manufacturer of precision aerospace parts.

- In January 2024, H&E Equipment Services Inc. (“H&E”) announced the acquisition of the business of Precision Rentals (“Precision”).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global precision turned product manufacturing market based on the below-mentioned segments:

Global Precision Turned Product Manufacturing Market, By Operation

- Manual Operation

- CNC Operation

Global Precision Turned Product Manufacturing Market, By Machine Types

- Automatic Screw Machines

- Rotary Transfer Machines

- Computer Numerically Controlled (CNC)

- Lathes or Turning Centers

Global Precision Turned Product Manufacturing Market, By End-User

- Industries

- Automobile

- Electronics

- Defense

- Healthcare

Global Precision Turned Product Manufacturing Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which are the key companies that are currently operating within the market?Haas Automation Inc., Moog Inc., Sandvik AB, FANUC Corporation, Hurco Companies Inc., Parker Hannifin Corporation, Hardinge Inc., DMG MORI Co. Ltd., Stanley Black & Decker Inc., Tsugami Corporation, NSK Ltd., Barnes Group Inc., Gleason Corporation, Doosan Corporation, Kennametal Inc., and Others.

-

2.What is the size of the global precision turned product manufacturing market?The Global Precision Turned Product Manufacturing Market is expected to grow from USD 102.52 Billion in 2023 to USD 184 Billion by 2033, at a CAGR of 6.02% during the forecast period 2023-2033.

-

3.Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global precision turned product manufacturing market over the predicted timeframe.

Need help to buy this report?