Global Predictive Vehicle Technology Market Size, Share, and COVID-19 Impact Analysis, By Hardware (ADAS, Telematics, and OBD), By Application (Pro-Active Alerts, and Safety & Security), By Vehicle Type (Passenger Vehicle, and Commercial Vehicle), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Predictive Vehicle Technology Market Insights Forecasts to 2033

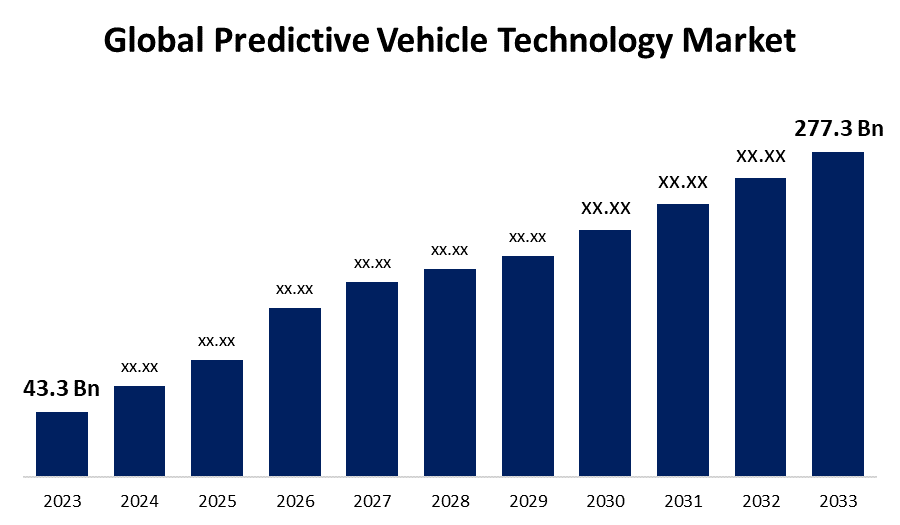

- The Global Predictive Vehicle Technology Market Size was Valued at USD 43.3 Billion in 2023

- The Market Size is Growing at a CAGR of 20.4% from 2023 to 2033

- The Worldwide Predictive Vehicle Technology Market Size is Expected to Reach USD 277.3 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Predictive Vehicle Technology Market Size is Anticipated to Exceed USD 277.3 Billion by 2033, Growing at a CAGR of 20.4% from 2023 to 2033.

Market Overview

Predictive vehicle technology refers to a group of automotive innovations that use prophetic analytics to forecast vehicle behavior by utilizing both historical and real-time data. Advanced driver assistance systems use predictive algorithms to anticipate driver behaviour, and traffic patterns, allowing for proactive assistance such as adaptive cruise control, and predictive braking. Predictive vehicle technology combines artificial intelligence (AI) and machine learning (ML) to understand the vehicle owner's trends and operating patterns, thereby improving vehicle safety. Data mining, neural networks, system modelling, and simulation are some of the tools used. Predictive vehicle technology personalizes the driving experience by automating the process of changing vehicle settings, such as the infotainment system and application preferences. AI and ML will be an integral part of future vehicles and the auto industry, as predictive technologies gain popularity across all vehicle types for providing driver comfort and convenience. OEMs are focusing on the adoption of IoT and connected gadgets in vehicles that can operate using voice commands.

Report Coverage

This research report categorizes the market for the global predictive vehicle technology market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global predictive vehicle technology market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global predictive vehicle technology market.

Global Predictive Vehicle Technology Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 43.3 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 20.4% |

| 023 – 2033 Value Projection: | USD 277.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Hardware, By Application, By Vehicle Type, By Region |

| Companies covered:: | Bosch, Continental, Garrett Motion, Aptiv, Aisin Seiki, ZF, NXP, Valeo, IBM Corporation, Harman International, Magna International Inc., Siemen AG, Honeywell International Inc., Traffilog LTD, Visteon Corporation, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

Innovations in Sensor Technology

The continuous development of sensors, including radar, cameras, and other IoT devices, ensures that vehicles continue to gather and process vast amounts of data continuously. These sensors are also used to develop key inputs for predictive algorithms that monitor and optimize vehicle safety, efficiency, and performance. Predictive maintenance solutions have already started to gain traction and return quite considerable cost savings to automotive manufacturers. The rapid pace of technological innovation, particularly in artificial intelligence (AI), machine learning, and big data analytics, is propelling the development of more advanced predictive vehicle technology solutions. These advancements allow vehicles to analyze complex data sets and make real-time decisions, paving the way for highly intelligent and self-driving vehicles.

Restraining Factors

Perception of high initial investment costs.

For automakers, fleet operators, and suppliers, the initial costs of incorporating predictive technology into vehicles and systems can be a barrier to adoption.

Market Segmentation

The global predictive vehicle technology market share is classified into hardware, application, and vehicle type.

- The ADAS segment is expected to hold the largest share of the global predictive vehicle technology market during the forecast period.

Based on the hardware, the global predictive vehicle technology market is categorized into ADAS, telematics, and OBD. Among these, the ADAS segment is expected to hold the largest share of the global predictive vehicle technology market during the forecast period. Radar, LiDAR, ultrasonic sensors, and cameras are all examples of ADAS components. These sensors sense data and transmit it for further processing. These sensors can be used individually or in combination in a variety of ADAS applications. Leading automakers around the world are incorporating advanced features into passenger and commercial vehicles to improve their safety performance.

- The safety & security segment is expected to grow at the fastest CAGR during the forecast period.

Based on the application, the global predictive vehicle technology market is categorized into pro-active alerts, and safety & security. Among these, the safety & security segment is expected to grow at the fastest CAGR during the forecast period. Automakers around the world are likely to integrate safety and security as an ADAS function. These functions are primarily intended to assist drivers by providing predictive signals. Vehicle occupants in developed countries demand such features from their vehicles. On the other hand, OEMs are including these features in their vehicles in developing countries. Government mandates help to drive the growth of the safety and security segment, as traffic congestion is a major issue in every region.

- The commercial vehicle segment is expected to grow at the fastest CAGR during the forecast period.

Based on the vehicle type, the global predictive vehicle technology market is categorized into passenger vehicles and commercial vehicles. Among these, the commercial vehicle segment is expected to grow at the fastest CAGR during the forecast period. Telematics is ever more being used in commercial vehicles as a means of improving fleet safety. It primarily offers satellite navigation, GPS location tracking, and infotainment features. The ability to track the location of a vehicle in real-time is useful for informing drivers about incoming traffic, vehicle accidents, weather conditions, and congested routes. Government regulations in developed countries support and frequently require the inclusion of commercial telematics in new vehicles, which benefits the global commercial telematics market. These factors have fueled the fastest growth in the commercial vehicle market.

Regional Segment Analysis of the Global Predictive Vehicle Technology Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is projected to hold the largest share of the global predictive vehicle technology market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global predictive vehicle technology market over the forecast period. The Asia Pacific region comprises some of the world's fastest-growing economies, including China and India. Also, the Asia Pacific region is the major automotive market, as increasing consumer purchasing power has fueled demand for automobiles in the region. Additionally, rising sales of commercial vehicles and passenger cars in the region are driving the market forward. The countries in the region are encouraging the integration of commercial telematics into new vehicles, which will be beneficial for predictive vehicle technology market growth.

Europe is expected to grow at the fastest CAGR growth of the global predictive vehicle technology market during the forecast period. Europe is home to major automotive manufacturers and has been at the forefront of early electrification in vehicles. Thus, predictive technology features in Europe are expected to gain popularity during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global predictive vehicle technology market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bosch

- Continental

- Garrett Motion

- Aptiv

- Aisin Seiki

- ZF

- NXP

- Valeo

- IBM Corporation

- Harman International

- Magna International Inc.

- Siemen AG

- Honeywell International Inc.

- Traffilog LTD

- Visteon Corporation

- Others

Key Market Developments

- In September 2023, The fleet management operating business of the industry-leading essential infrastructure services provider M Group Services, M Group Services Plant & Fleet Solutions (MGSPFS), has been collaborating with UK-based fleet safety solutions provider Motormax and Samsara, the creator of the Connected OperationsTM Cloud, to deliver the next generation of in-vehicle safety systems that safeguard motorists, other road users, and citizens.

- In June 2021, A new software solution centered on Model-Based Predictive Control (MPC) technology was launched in collaboration with Hyundai Motor Company (HMC), according to Garrett Motion Inc., a leading provider of differentiated technology for the automotive industry.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global predictive vehicle technology market based on the below-mentioned segments:

Global Predictive Vehicle Technology Market, By Hardware

- ADAS

- Telematics

- OBD

Global Predictive Vehicle Technology Market, By Application

- Pro-Active Alerts

- Safety & Security

Global Predictive Vehicle Technology Market, By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

Global Predictive Vehicle Technology Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?