Global Premium Spirits Market Size, Share, and COVID-19 Impact Analysis, By Product (Vodka, Whiskey, Gin, Tequila, Rum, Brandy, and Others), By Distribution Channel (On-Trade and Off-Trade), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Consumer GoodsGlobal Premium Spirits Market Insights Forecasts to 2033

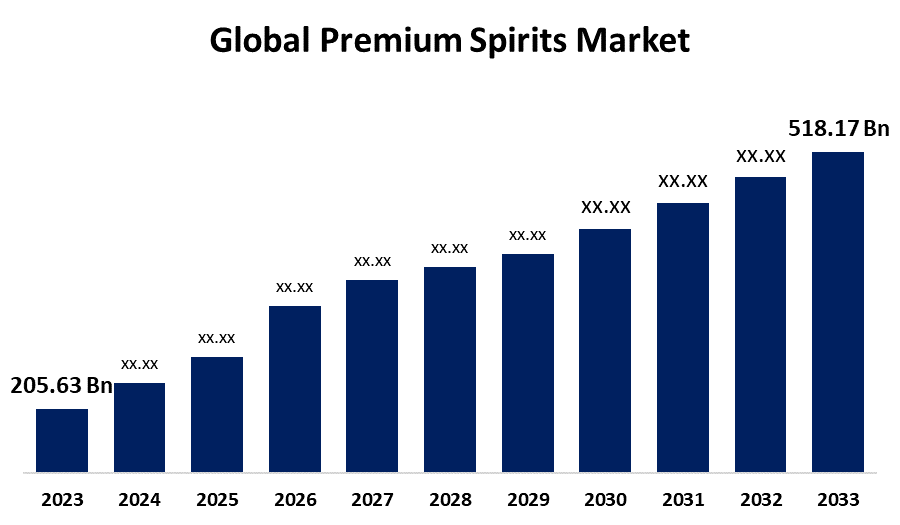

- The Global Premium Spirits Market Size was Valued at USD 205.63 Billion in 2023

- The Market Size is Growing at a CAGR of 9.68% from 2023 to 2033

- The Worldwide Premium Spirits Market Size is Expected to Reach USD 518.17 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Premium Spirits Market Size is Anticipated to Exceed USD 518.17 Billion by 2033, Growing at a CAGR of 9.68% from 2023 to 2033.

Market Overview

Premium spirits commonly referred to as ultra-premium or super-premium spirits are distilled alcoholic drinks made with the most superior components and techniques. They are characterized by their exceptional quality, distinct flavours, and often, limited availability. These distilled spirits are made by fermenting fruits, grains, or other sugar sources and then distilling them by heating and chilling the mixture to obtain concentrated alcohol. Alcoholic spirit is also known as "liquor" or "hard liquor." During the distillation process, the fermented spirit is heated, and the generated steam is simultaneously caught and cooled to create a distillate with increased alcohol content. Several factors cause the growing demand for high-end spirits. Essentially, there is more interest in premium spirits than mass-produced alternatives due to a shift in customer preferences towards higher-quality and more distinctive products. Innovations in taste characteristics, limited-edition releases, and packaging design define the premium spirit sector. With distinctive ingredients, aging methods, and barrel finishes, craft distilleries are becoming increasingly inventive. Sustainable ingredient sourcing, carbon-neutral production methods, and environmentally friendly packaging are examples of the way brands are innovating. The millennial generation's increasing appetite for high-end beverages is propelling industry expansion. Millennials have emerged as a significant segment of the alcohol-consuming population in recent times, and it is anticipated that the habit will continue throughout the projected period. Growing disposable income is the main factor propelling the premium spirit market's expansion. High net-worth consumers can purchase the highest caliber alcoholic beverages.

Report Coverage

This research report categorizes the market for the premium spirits market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the premium spirits market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the premium spirits market.

Global Premium Spirits Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 205.63 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.68% |

| 2033 Value Projection: | USD 518.17 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Distribution Channel, By Region |

| Companies covered:: | Asahi Group Holdings, Ltd., Diageo plc, Tanduay Distillers, Inc., Bacardi Limited, Allied Blenders and Distillers Pvt. Ltd., Suntory Holdings Limited, Davide Campari-Milano N.V., SAZERAC CO, INC, Pernod Ricard, Constellation Brands, Inc., Rémy Cointreau, Highwood Distillers, Heaven Hill Distilleries, Inc., LVMH, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Compared to the lives of adults, children lead distinct lifestyles. The alcoholic beverage industry has been an important driver in the expansion of the premium spirits industry since people prefer partying and clubbing over more traditional pastimes including drinking, smoking, and other addictions. Premium spirits are becoming more and more in demand in this region because of the expanding cocktail culture in many industrialized and rising nations. The primary component of a cocktail's preparation is premium alcohol. It implies that a growing trend in cocktail culture may boost demand for high-end spirits.

Restraining Factors

Increased health consciousness among consumers, stricter government laws on alcohol, and shifting consumer preferences towards non-alcoholic or low-alcohol beverages over conventional alcoholic ones are the key factors limiting the market's growth.

Market Segmentation

The premium spirits market share is classified into product and distribution channel.

- The vodka segment is predicted to hold the largest market revenue share through the forecast period.

Based on the product, the premium spirits market is categorized into vodka, whiskey, gin, tequila, rum, brandy, and others. Among these, the vodka segment is predicted to hold the largest market revenue share through the forecast period. Worldwide product sales have increased due to the availability of various vodkas, including flavored and gluten-free versions. Luxury vodka brands like Ketel One Vodka (Diageo), Tito's Vodka, Chase Vodka, Grey Goose, Van Gogh Vodka, Belvedere, Absolut Vodka, Stolichnaya, and Three Olives are starting to gain global recognition due to their superior quality.

- The on-trade segment is anticipated to grow at the highest CAGR during the forecast period.

Based on the distribution channel channel, the premium spirits market is categorized into on-trade and off-trade. Among these, the on-trade segment is anticipated to grow at the highest CAGR during the forecast period. The distribution channel known as "on-trade," which encompasses establishments including bars, restaurants, clubs, and hotels, is crucial in determining where premium spirits are consumed. These businesses are progressively curating their drink menus to feature a wide variety of premium options, providing patrons with customized experiences that enhance customary drinking times.

Regional Segment Analysis of the Premium Spirits Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the premium spirits market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the premium spirits market over the forecast period. The premiumization trend is anticipated to fuel market expansion. Important companies including Bacardi Limited and Campari Group are expected to support market expansion. Spirits like cognac, vodka, and whisky are in more demand in the area due to the success of brands like Absolut, Jack Daniels, and Kendall-Jackson. Demand for premium brands is higher because consumers view alcohol as a status symbol, they associate "premium" labels with superior quality and taste, and their per capita income is rising.

Asia Pacific is expected to grow at the fastest CAGR growth of the premium spirits market during the forecast period. Due to the smart marketing efforts of well-known companies like Pernod Ricard and Diageo, the demand for premium spirits in the Asia Pacific region is rising significantly. According to the Scotch Whisky Association, record value shipments to China, a market up 165% from 2019, were bolstered by value increases in Singapore (19%) and Taiwan (8%). Scotch whisky’s premiumization is still a major factor in these important markets: single malt whisky is becoming increasingly popular among a growing customer base, with double-digit growth expected in China and Singapore by 2022.

One of the main factors propelling the growth of the spirits industry in the Europe region is the quick increase in demand for premium quality spirits among the young and wealthy people in the area due to shifting cultural perspectives. Growing numbers of European consumers are searching for fresh and intriguing spirits options compared to their usual selections, which is propelling revenue growth in the spirits industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the premium spirits market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Asahi Group Holdings, Ltd.

- Diageo plc

- Tanduay Distillers, Inc.

- Bacardi Limited

- Allied Blenders and Distillers Pvt. Ltd.

- Suntory Holdings Limited

- Davide Campari-Milano N.V.

- SAZERAC CO, INC

- Pernod Ricard

- Constellation Brands, Inc.

- Rémy Cointreau

- Highwood Distillers

- Heaven Hill Distilleries, Inc.

- LVMH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, Allied Blenders and Distillers partnered with the Bollywood actor Ranveer Singh to launch a new company that offers a portfolio of high-end products.

- In July 2024, NeuWorld Spirits, a conglomerate with a wide portfolio comprising tobacco, FMCG, and real estate, disclosed the debut of Living Legend Premium Vodka, an expensive white spirits product.

- In July 2024, Suntory Holdings announced the establishment of Suntory India Private Limited, which aims to cover corporate functions required to build a firm business foundation accelerate growth in its existing spirits business, and establish opportunities for soft drinks as well as health and wellness businesses in the Indian market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the premium spirits market based on the below-mentioned segments:

Global Premium Spirits Market, By Product

- Vodka

- Whiskey

- Gin

- Tequila

- Rum

- Brandy

- Others

Global Premium Spirits Market, By Distribution Channel

- On-Trade

- Off-Trade

Global Premium Spirits Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the premium spirits market over the forecast period?The premium spirits market is to expand at 9.68% during the forecast period.

-

2. Which region is expected to hold the highest share in the premium spirits market?The North America region is expected to hold the largest share of the premium spirits market.

-

3. Who are the top key players in the premium spirits market?The key players in the premium spirits market are Asahi Group Holdings, Ltd., Diageo plc, Tanduay Distillers, Inc., Bacardi Limited, Allied Blenders and Distillers Pvt. Ltd., Suntory Holdings Limited, Davide Campari-Milano N.V., SAZERAC CO, INC, Pernod Ricard, Constellation Brands, Inc., Rémy Cointreau, Highwood Distillers, Heaven Hill Distilleries, Inc., LVMH, and others.

Need help to buy this report?