Global Prescription Lens Market Size, Share, and COVID-19 Impact Analysis, By Type (Single Vision and Progressive), By Coating Type (Anti-Reflective Coating, Scratch-Resistant Coating, Anti-Fog Coating, and UV Protection), By Application (Myopia, Hypermetropia, Astigmatism, and Presbyopia), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: HealthcareGlobal Prescription Lens Market Insights Forecasts to 2033

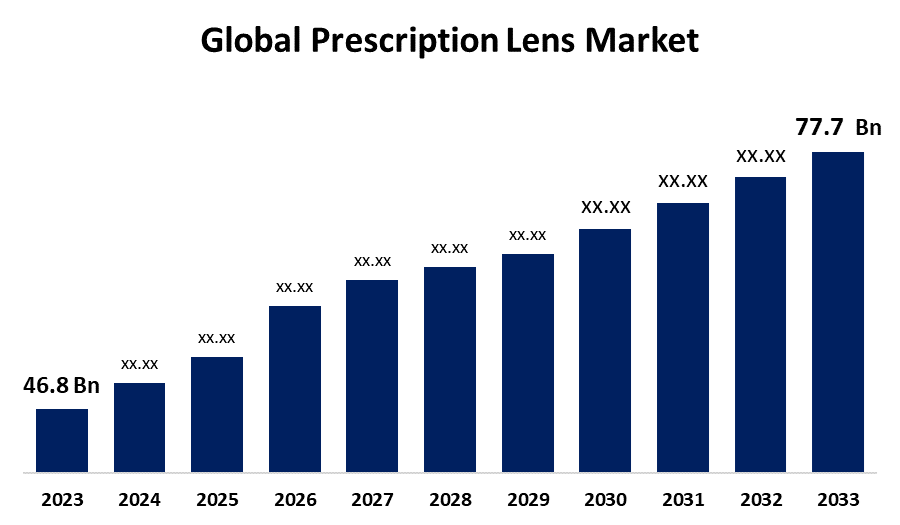

- The Global Prescription Lens Market Size was Valued at USD 46.8 Billion in 2023

- The Market Size is Growing at a CAGR of 5.20% from 2023 to 2033

- The Worldwide Prescription Lens Market Size is Expected to Reach USD 77.7 Billion by 2033

- Aisa Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Prescription Lens Market Size is Anticipated to Exceed USD 77.7 Billion by 2033, Growing at a CAGR of 5.20% from 2023 to 2033.

Market Overview

Prescription lenses are customized eyeglass lenses designed to address visual issues such as myopia, nearsightedness, farsightedness, astigmatism, and presbyopia. These lenses are designed to compensate for refractive flaws in the eye, which improves vision clarity and sharpness. Prescription lenses can be composed of various materials, such as glass, plastic, or polycarbonate, and can be paired with coatings to enhance durability and reduce glare. Prescription lenses are particularly useful in protecting the eyes from dangerous UV radiation, which can cause lasting eye damage. Because of their diverse designs and coatings, these glasses help to resolve the challenge of projecting light onto the retina, resulting in better eyesight. Growing adoption and consumption of eyewear products, especially prescription eyeglasses, is a market growth driver. In August 2023, the World Health Organization estimated that at least 2.2 billion people worldwide have near or distant visual impairments, with 1 billion of these instances being preventable or unaddressed. Globally, only 36% of people with distance vision impairment owing to refractive error and 17% of those with vision impairment due to cataracts are believed to have received adequate therapies. Visual loss can afflict persons of various ages; however, the majority of individuals with visual impairment and blindness are older than 50 years.

Report Coverage

This research report categorizes the market for the prescription lens market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the prescription lens market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the prescription lens market.

Global Prescription Lens Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 46.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.20% |

| 2033 Value Projection: | USD 77.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 166 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Coating Type, By Application and By Region |

| Companies covered:: | Essilor, Nikon Corporation, HOYA Corporation, Carl Zeiss Meditec AG, Rodenstock gmbH, ZEISS Internation, Seiko Optical Products Co. Ltd., Shamir Optical Industry Ltd., GKB Optocs, Johnson and Johnson, Vision Ease, Marcolin, Vision ease, Fielmann Ag, and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The prescription lens market thrives on the widespread prevalence of vision problems like myopia, nearsightedness, and farsightedness, particularly among an aging population. Technological advancements, such as digital surfacing, have enhanced lens quality, while fashion trends drive demand for stylish frames. Increased screen time and health awareness contribute to the growing demand for corrective eyewear. The many types of prescription lenses are accessible based on the person's practical condition, creating an attractive market for significant expansion over time. Furthermore, the long working hours enforced by international firms have shown to be a significant growth element in the market.

Restraining Factors

The prescription lens market confronts a number of constraints that limit its growth and development. These include tight regulatory compliance requirements, high costs for specialist lenses, limited access to eye care services in some areas, and technological hurdles to innovation. Furthermore, consumer knowledge and education about the importance of eye health, as well as changing fashion trends, might affect market demand. Furthermore, online retail competition and global economic conditions provide challenges for traditional brick-and-mortar establishments.

Market Segmentation

The prescription lens market share is classified into type, coating type, and application.

- The single vision segment dominates the market with the largest market share through the forecast period.

Based on the type, the prescription lens market is classified into single vision and progressive. Among these, the single vision segment dominates the market with the largest market share through the forecast period. Single-vision lenses provide crisp vision at a fixed distance, making them ideal for reading, driving, and computer work. They are available in a variety of materials and coatings to suit different tastes and requirements. The single vision category accounts for a considerable share of the industry, catering to individuals with specialized vision needs.

- The anti-reflective coating segment is anticipated to hold the largest revenue share through the projected period.

Based on the coating type, the prescription lens market is categorized into anti-reflective coating, scratch-resistant coating, anti-fog coating, and UV protection. Among these, the anti-reflective coating segment is anticipated to hold the largest revenue share through the projected period. People often prioritize this type of coating because it reduces glare and reflections, providing clearer vision, especially for activities like driving or using digital screens. Plus, it enhances the appearance of the lenses by making them nearly invisible, which is a significant aesthetic benefit.

- The myopia segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the application, the prescription lens market is divided into myopia, hypermetropia, astigmatism, and presbyopia. Among these, the myopia segment is anticipated to grow at the fastest CAGR growth through the forecast period. Due to its high prevalence, particularly among younger populations. Increased screen time, digital gadget usage, and changing lifestyles have all contributed to the growing prevalence of myopia. Furthermore, prejudice is often corrected from a young age, resulting in a steady and long-term necessity for prescription lenses. The availability of single-vision lenses for myopia correction, combined with the requirement for early intervention, has made it the most popular segment in the prescription lens industry.

Regional Segment Analysis of the Prescription Lens Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the prescription lens market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the prescription lens market over the predicted timeframe. The presence of numerous key players, an increasing number of awareness programs, an increasing number of product launches, and the rising prevalence of refractive errors such as myopia, hyperopia, astigmatism, and presbyopia are all contributing factors to growth. North America has a sophisticated healthcare system, which makes it easier to find eyecare doctors who can prescribe corrective eyewear. Furthermore, a significant emphasis on aesthetics and fashion in eyewear options has led customers in North America to invest in prescription lenses with varied coatings and designs.

Asia Pacific is expected to grow at the fastest CAGR growth of the prescription lens market during the forecast period. The increasing prevalence of vision-related disorders, rising awareness about eye health, improving healthcare infrastructure, and growing disposable income are all contributing to the expansion of the market in this region. Additionally, the presence of a large population, particularly in countries like China and India, provides a substantial customer base for prescription eyewear products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the prescription lens market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Essilor

- Nikon Corporation

- HOYA Corporation

- Carl Zeiss Meditec AG

- Rodenstock gmbH

- ZEISS Internation

- Seiko Optical Products Co. Ltd.

- Shamir Optical Industry Ltd.

- GKB Optocs

- Johnson and Johnson

- Vision Ease

- Marcolin

- Vision ease

- Fielmann Ag

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, Essilor, a multinational prescription lens producer, launched the Essilor Stellest lens for the Indian market. This lens was created with the primary goal of addressing myopia progression in youngsters. According to the business, clinical trial results show that wearing the Essilor Stellest lens for 12 hours a day can minimize myopia progression by an average of 67% when compared to single-vision lenses.

- In December 2022, Vision Science and Technology Co. Ltd. (VST), a startup funded by Hong Kong Polytechnic University (PolyU), introduced an innovative eyeglass lens to prevent the progression of myopia. VST has integrated PolyU's two unique technologies to safeguard and improve children's visual health.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the prescription lens market based on the below-mentioned segments:

Global Prescription Lens Market, By Type

- Single Vision

- Progressive

Global Prescription Lens Market, By Coating Type

- Anti-reflective Coating

- Scratch-Resistant Coating

- Anti-Fog Coating

- UV Protection

Global Prescription Lens Market, By Application

- Myopia

- Hypermetropia

- Astigmatism

- Presbyopia

Global Prescription Lens Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?