Global Private Equity Market Size, Share, and COVID-19 Impact Analysis, By Fund Type (Buyout, Venture Capital (VCs), Real Estate, Infrastructure, and Others), By Sector (Technology, Financial Services, Real Estate and Services, Healthcare, Energy and Power, Industrial, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Private Equity Market Insights Forecasts to 2033

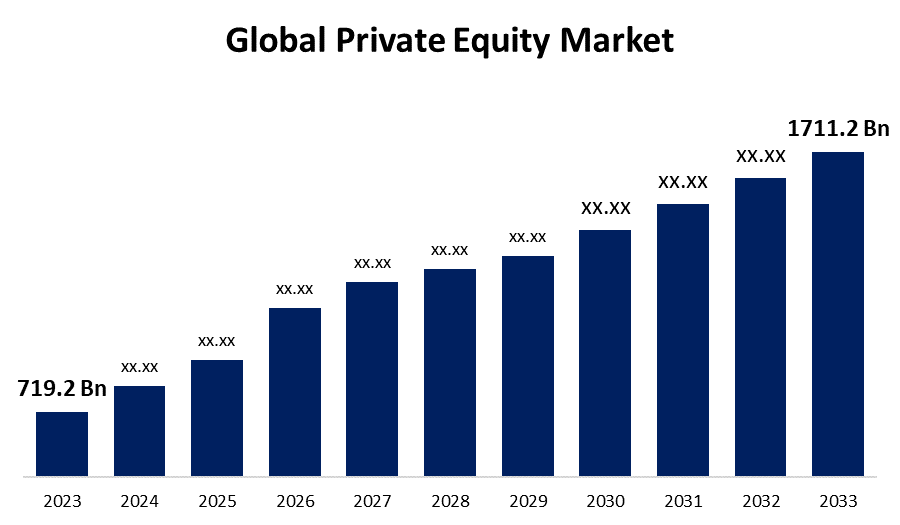

- The Global Private Equity Market Size was Valued at USD 719.2 Billion in 2023

- The Market Size is Growing at a CAGR of 9.05% from 2023 to 2033

- The Worldwide Private Equity Market Size is Expected to Reach USD 1711.2 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Private Equity Market Size is Anticipated to Exceed USD 1711.2 Billion by 2033, Growing at a CAGR of 9.05% from 2023 to 2033.

Market Overview

Private equity is a form of investment in which funds from various sources such as institutional investors, high-net-worth individuals, or pension funds are pooled to acquire ownership rights in private companies. Unlike publicly traded companies, these investments are not listed on a stock exchange. Private equity firms deploy these funds to purchase a significant portion or all of a company, aiming to increase its value over time through active management strategies. They work closely with the acquired company's management, implementing operational improvements, strategic changes, and growth initiatives to enhance its performance and ultimately deliver returns to investors. Private equity spans various stages of business, from startups to established companies, and often involves turnaround efforts to unlock a company's full potential before exiting the investment through avenues such as restructuring expansion or an IPO or sale. Private equity's potential for high returns stems from active participation in company management, proactively implementing changes that increase operational efficiency and increase the overall value of invested companies. Access to specific proficiency and wide networks enables private equity firms to guide and support portfolio companies, driving growth, innovation, and streamlined operations. This flexibility in the private equity market allows companies to deploy different investment strategies across industry and company stages, optimizing risk while taking advantage of different opportunities.

Report Coverage

This research report categorizes the market for the global private equity market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and restraining factors influencing the global private equity market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global private equity market.

Global Private Equity Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 719.2 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 9.05% |

| 023 – 2033 Value Projection: | USD 1711.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Fund Type, By Sector, By Region |

| Companies covered:: | Bank of America Corp., Blackstone Inc., CVC Capital Partners, HSBC Holdings Plc, BDO Australia, Tarrant Capital IP, AHAM Asset Management Berhad, Bain and Co. Inc., Ernst and Young Global Ltd., Morgan Stanley, Allens, Apollo Global Management, Inc., The Carlyle Group, Warburg Pincus LLC, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The private equity market is expected to grow significantly due to high return potential, access to particular expertise and networks, and flexibility in investment strategies. Furthermore, the opportunity for ESG integration is expected to provide lucrative opportunities for market growth over the forecast period. The availability of large amounts of capital in the market and the increasing need to diversify capital are the major factors contributing to the growth of the private equity market. Additionally, private equity has a low correlation compared to other investment classes, making it a preferable option for ultra-high-net-worth individuals (UHNIs) and high-net-worth individuals (HNIs). The number of private equity deals is predicted to increase due to the emerging trend of start-up culture. This contributes to the growth of private equity deals as investors have more control and freedom over their funds without government interference.

Restraining Factors

Regulatory complexity poses a significant restraining factor, demanding strict compliance across multiple jurisdictions, which increases operational overheads. Limited liquidity due to long investment horizons further hampers rapid monetization of investments. Increasing competition for attractive deals, regulatory complexities, and broader economic uncertainty are the major restraining factors facing the global private equity market. Transaction risk is a major restraining factor for the global growth of the capital investment market. Transaction risks arise when a company conducts financial transactions or maintains accounts in a currency other than its internal currency. The risks that a company faces while doing financial transactions between countries are called transaction risks.

Market Segmentation

The global private equity market share is classified into fund type and sector.

- The buyout segment is expected to hold the largest share of the global private equity market during the forecast period.

Based on the fund type, the global private equity market is divided into buyouts, venture capital (VCs), real estate, infrastructure, and others. Among these, the buyout segment is expected to hold the largest share of the global private equity market during the forecast period. The growing preference for the buyout fund type, since it involves acquiring a well-established company with strong expansion potential, is propelling the growth of this segment. Buyout funds allow investors to take the majority of the share, gain control of businesses, streamline operations, and drive value creation through active management. Buyouts like these allow the investor to generate substantial returns by leveraging the target company's assets and cash flows.

- The technology segment is expected to hold the largest share of the global private equity market during the forecast period.

Based on the sector, the global private equity market is divided into technology, financial services, real estate and services, healthcare, energy and power, industrial, and others. Among these, the technology segment is expected to hold the largest share of the global private equity market during the forecast period. This is attributed to its inherent dynamism and potential for disruptive innovation. Private equity's magnetism to technology lies in the rapid evolution of the sector, which offers opportunities for high-growth investments in areas such as software, AI, and digital platforms. The technology sector is constantly introducing innovative solutions, reshaping industries, and meeting the growing needs of consumers, making it a priority for private equity investment.

Regional Segment Analysis of the Global Private Equity Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global private equity market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global private equity market over the predicted timeframe. The region has a well-established ecosystem for equity private equity, boasts of mature financial infrastructure, access to large amounts of capital from institutional investors, and a regulatory environment conducive to investment activities. Moreover, North America is home to a technology and innovation landscape, that attracts substantial private equity funds into tech-driven companies and startups. The presence of a diverse range of industries coupled with a culture that encourages entrepreneurial ventures further boosts private equity activity in the region. Additionally, historically strong economic performance and a relatively stable political environment provide to investor confidence, making North America a striking center for private equity investment.

Asia Pacific is expected to grow at the fastest pace in the global private equity market during the forecast period. The region's economic expansion and growing middle class led to increased consumer spending and business opportunities. As economies in the Asia-Pacific develop and mature, entrepreneurial activity and innovation in various sectors have increased, attracting investor interest. Additionally, favorable demographic trends, technological advancements, and government initiatives supporting economic development and infrastructure investment create a conducive environment for private equity growth. Relatively untapped potential in many industries, coupled with increased globalization and interconnection, has positioned the Asia-Pacific region as a hotspot for private equity investors seeking high returns and diversified portfolios.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global private equity market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bank of America Corp.

- Blackstone Inc.

- CVC Capital Partners

- HSBC Holdings Plc

- BDO Australia

- Tarrant Capital IP

- AHAM Asset Management Berhad

- Bain and Co. Inc.

- Ernst and Young Global Ltd.

- Morgan Stanley

- Allens

- Apollo Global Management, Inc.

- The Carlyle Group

- Warburg Pincus LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, private equity firm True North entered the private credit market with the launch of 'True North Private Credit'. The company said it recognized the need to expand its product offering beyond private equity (PE) to leverage its capabilities and fully deliver value to all stakeholders. The private credit sector in India is rapidly developing into a strong segment due to a favorable risk-reward equation and the presence of a good regulatory framework. Hence, True North has decided to enter Private Credit (PC) to offer agile capital solutions to well-governed and profitable enterprises and deliver high, risk-adjusted returns to its investors.

- In July 2023, Verity, a leading provider of investment research and management software, announced the launch of VerityRMS for private equity, a deal intelligence platform that simplifies the due diligence and dealmaking process for private equity firms. For more than a decade, Verity has enabled the world's leading fund managers to centralize their research, foster collaboration, and accelerate decision-making.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global private equity market based on the below-mentioned segments:

Global Private Equity Market, By Fund Type

- Buyout

- Venture capital (VCs)

- Real estate

- Infrastructure

- Others

Global Private Equity Market, By Sector

- Technology

- Financial Services

- Real Estate and Services

- Healthcare

- Energy and Power

- Industrial

- Others

Global Private Equity Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Bank of America Corp., Blackstone Inc., CVC Capital Partners, HSBC Holdings Plc, BDO Australia, Tarrant Capital IP, AHAM Asset Management Berhad, Bain and Co. Inc., Ernst and Young Global Ltd., Morgan Stanley, Allens, Apollo Global Management, Inc., The Carlyle Group, Warburg Pincus LLC, and others.

-

2. What is the size of the global private equity market?The Global Private Equity Market is expected to grow from USD 719.2 Billion in 2023 to USD 1711.2 Billion by 2033, at a CAGR of 9.05% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global private equity market over the predicted timeframe.

Need help to buy this report?