Global Pro Self-Hosted Digital Payment Gateway Market Size, Share, and COVID-19 Impact Analysis, By Integration Type (API Integration, Hosted Checkout, and Plugins), By End Users (Small and Medium Enterprises, Large Enterprises, E-Commerce Platforms, and Retailers), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Information & TechnologyGlobal Pro Self-Hosted Digital Payment Gateway Market Insights Forecasts to 2033

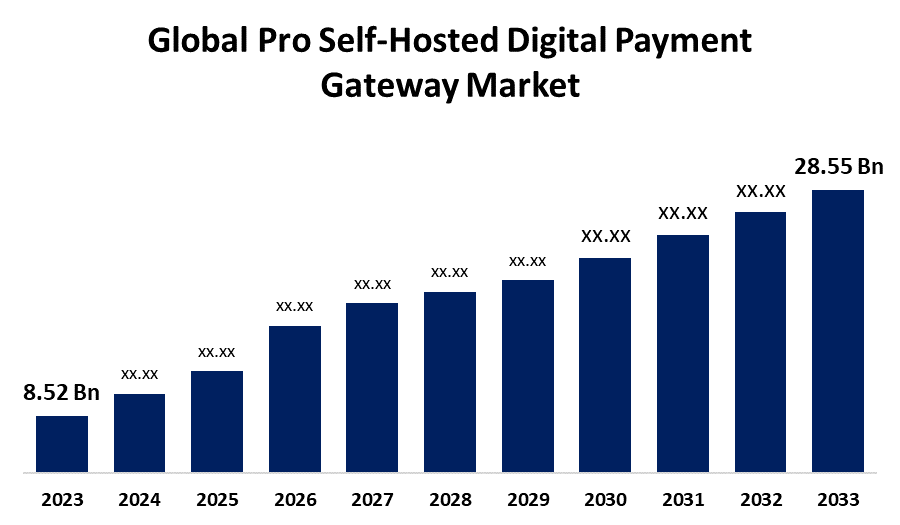

- The Global Pro Self-Hosted Digital Payment Gateway Market Size was Valued at USD 8.52 Billion in 2023

- The Market Size is Growing at a CAGR of 12.85% from 2023 to 2033

- The Worldwide Pro Self-Hosted Digital Payment Gateway Market Size is Expected to Reach USD 28.55 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Pro Self-Hosted Digital Payment Gateway Market Size is anticipated to exceed USD 28.55 Billion by 2033, growing at a CAGR of 12.85% from 2023 to 2033.

Market Overview

The term "Pro Self-Hosted Digital Payment Gateway" describes a payment processing system in which a company has complete control over the checkout page on their own website. This means that they gather customer payment information directly on their website instead of redirecting it to a page run by a different payment provider. This allows them more customization and control over the customer experience, but it also necessitates more technical know-how to handle security for sensitive payment data. Additionally, the industry is growing as a consequence of the quick adoption of online payment methods brought about by growing consumer awareness of the advantages of transactions over the internet, including their dynamic payment preferences. The increase in use of mobile wallets and advancements in mobile payment technology are responsible for the growth. One of the key elements propelling the market expansion is the growing spread of smartphones and the internet.

Report Coverage

This research report categorizes the global pro self-hosted digital payment gateway market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global pro self-hosted digital payment gateway market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global pro self-hosted digital payment gateway market.

Global Pro Self-Hosted Digital Payment Gateway Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.52 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.85% |

| 2033 Value Projection: | USD 28.55 Billion |

| Historical Data for: | 2021-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Integration Type, By End Users, By Regional |

| Companies covered:: | BlueSnap, Alipay, Stripe, Adyen, Braintree, Authorize.Net, 2Checkout, Worldpay, Klarna, Payoneer, Skrill, Razorpay, Others, and |

| Pitfalls & Challenges: | COVID-19 Impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The self-hosted digital payment industry has seen substantial partnerships and investments, demonstrating its increasing significance in the financial technology environment. For instance, in September 2024, Jack HenryTM (Nasdaq: JKHY) announced a partnership with Moov, a cutting-edge digital payments processor, to allow local and regional financial institutions to provide small and medium-sized company (SMB) clients with improved digital payment services. SMBs will be able to get same-day funds for payments received, automate reconciliations to accounting software programs, and accept payments with a simple phone tap due to the cloud-native service. Financial institutions will provide the service, allowing them to better meet the deposit and payment demands of their corporate clients. Furthermore, in 2023, the total number of payments made in the UK was 48.1 billion, up from 45.7 billion in 2022. Consumers accounted for 85% of these, with businesses making up the remaining 15%1. This significant increase in contactless payments in the UK and globally is further propelling the market for pro self-hosted digital payment gateways.

Restraints & Challenges

The growing number of cyberattacks and information breaches is anticipated to hamper market expansion beyond the projected period. It is anticipated that the growing number of data breaches and cyberattacks will impede market expansion over the forecast period.

Market Segmentation

The global pro self-hosted digital payment gateway market share is classified into integration type and end users.

- The API integration segment is expected to hold the largest share of the global pro self-hosted digital payment gateway market during the forecast period.

Based on the integration type, the global pro self-hosted digital payment gateway market is categorized as API integration, hosted checkout, and plugins. Among these, the API integration segment is expected to hold the largest share of the global pro self-hosted digital payment gateway market during the forecast period.API integration is especially crucial since it makes it easier for methods of payment and a merchant's platform to interact, which improves customer experience and the speed of transactions.

- The small and medium enterprises segment is expected to grow at the fastest CAGR during the forecast period.

Based on the end users, the global pro self-hosted digital payment gateway market is categorized as small and medium enterprises, large enterprises, e-commerce platforms, and retailers. Among these, the small and medium enterprises segment is expected to grow at the fastest CAGR during the forecast period. As self-hosted digital payment gateways are used more frequently by small and medium-sized businesses to boost customer satisfaction and transaction security, they play a crucial role.

Regional Segment Analysis of the Global Pro Self-Hosted Digital Payment Gateway Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global pro self-hosted digital payment gateway market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global pro self-hosted digital payment gateway market over the forecast period. Technological developments and the use of payment gateways in thriving end-use sectors like retail and e-commerce are responsible for the expansion. The region's market is expanding due in part to the existence of well-known companies like Square, PayPal Holdings Inc., Mastercard, BluePay, and Amazon Payments Inc. The US is a major market for online payment gateways because of the region's growing automation and industry 4.0 adoption.

Europe is expected to grow at the fastest CAGR growth of the global pro self-hosted digital payment gateway market during the forecast period. Regulations like PSD2 are driving a major movement in Europe toward open banking and integrated payment systems. This trend promotes competition among payment providers while guaranteeing security and adherence to stringent regulatory frameworks across member states, enabling smooth transactions and improved customer experiences through improved data sharing. Additionally, the broad adoption of digital transactions by both consumers and businesses is one of the main factors contributing to the rise of contactless payments. Mobile contactless payment solutions are easily accessible to consumers in the UK, where over 90% of consumers own a mobile phone.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global pro self-hosted digital payment gateway market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BlueSnap

- Alipay

- Stripe

- Adyen

- Braintree

- Authorize.Net

- 2Checkout

- Worldpay

- Klarna

- Payoneer

- Skrill

- Razorpay

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In August 2024, the partnership between multichannel payments provider PayPoint Plc (PayPoint) and leading financial services company Cardstream has been formally announced. Through the strong cooperation, PayPoint will be able to continue developing a dependable and expandable solution for customers by incorporating Cardstream's Gateway Connectivity into their MultiPay digital payments platform.

Market Segment

- This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global pro self-hosted digital payment gateway market based on the below-mentioned segments:

Global Pro Self-Hosted Digital Payment Gateway Market, By Integration Type

- API Integration

- Hosted Checkout

- Plugins

Global Pro Self-Hosted Digital Payment Gateway Market, By End Users

- Small and Medium Enterprises

- Large Enterprises

- E-Commerce Platforms

- Retailers

Global Pro Self-Hosted Digital Payment Gateway Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global pro self-hosted digital payment gateway market over the forecast period?The global pro self-hosted digital payment gateway market size is expected to grow from USD 8.52 Billion in 2023 to USD 28.55 Billion by 2033, at a CAGR of 12.85% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share of the global pro self-hosted digital payment gateway market?North America is projected to hold the largest share of the global pro self-hosted digital payment gateway market over the forecast period.

-

3. Who are the top key players in the global pro self-hosted digital payment gateway market?BlueSnap, Alipay, Stripe, Adyen, Braintree, Authorize.Net, 2Checkout, Worldpay, Klarna, Payoneer, Skrill, Razorpay, and others

Need help to buy this report?