Global Process Analytical Technology Market Size, Share, and COVID-19 Impact Analysis By Technology (Spectroscopy, Chromatography, Particle Size Analysis, Capillary Electrophoresis, and Others), By Measurement (On-line, In-line, At-line, and Off-line), By End User (Pharmaceutical Manufacturers, Biopharmaceutical Manufacturers, Contract Research & Manufacturing Organizations, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: HealthcareGlobal Process Analytical Technology Market Insights Forecasts to 2033

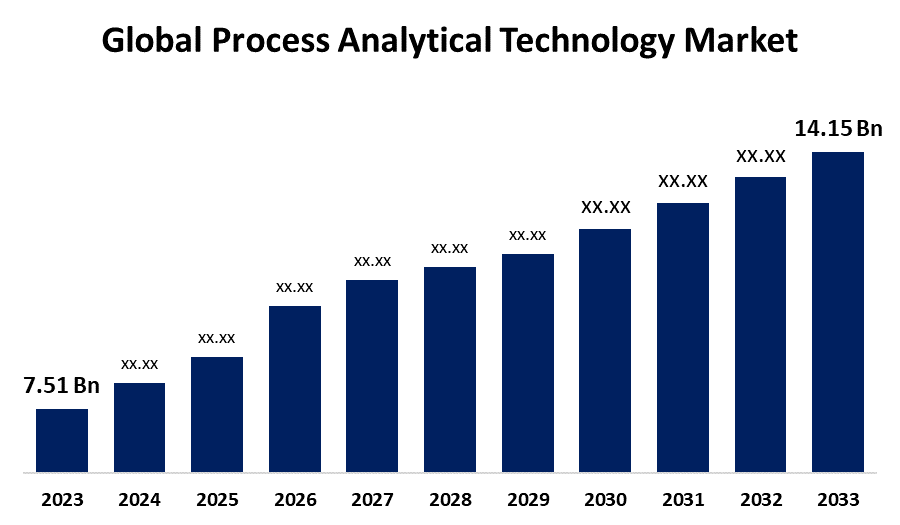

- The Global Process Analytical Technology Market Size Was Valued at USD 7.51 Billion in 2023

- The Market Size is Growing at a CAGR of 6.54% from 2023 to 2033

- The Worldwide Process Analytical Technology Market Size is Expected to Reach USD 14.15 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Process Analytical Technology Market Size is Anticipated to Exceed USD 14.15 Billion by 2033, Growing at a CAGR of 6.54% from 2023 to 2033.

Market Overview

The use of cutting-edge instruments and technologies for the real-time monitoring and control of industrial processes is known as "process analysis technology" (PAT). Spectrophotometry and chromatography are two of the many methods and procedures used in PAT. They serve as a source of accurate, timely, and helpful data that can be utilized to guarantee product quality and optimize production. By offering real-time monitoring and control of production processes, PAT technologies can help to improve drug quality by assuring that drugs are produced consistently and based on the appropriate standards. This market is expanding due to factors such as growing global biosimilar sales, increasing direct and indirect financial investments in analytical instruments, drug discovery partnerships, conferences, and symposia centered around analytical technologies and growth in the global biosimilar industry. The ability of process analytical chemistry to record and understand vast amounts of data, along with other developments in the field, is driving the pharmaceutical industry's use of these technologies.

For instance, in June 2024, In addition to many upgrades to current products, Thermo Fisher Scientific announced at the American Society for Mass Spectrometry (ASMS) conference in Anaheim, California, the launch of a new mass spectrometry platform.

Report Coverage

This research report categorizes the global process analytical technology market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global process analytical technology market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global process analytical technology market.

Global Process Analytical Technology Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.51 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.54% |

| 2033 Value Projection: | USD 14.15 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Technology, By Measurement, By End User, By Region |

| Companies covered:: | Thermo Fisher Scientific, CGT Catapult, Rentschler Biopharma, Danaher Corporation, Agilent Technologies, Inc., Pharmacopeia (USP), Shimadzu Corporation, Waters Corporation, Bruker Corporation, Emerson Electric Co., ABB Ltd.,, PerkinElmer, Inc, Mettler-Toledo International Inc., Carl Zeiss AG, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Process analytical technology (PAT) technology is a robust tool used in pharmaceutical and biopharmaceutical production processes to measure Critical Process Parameters (CPPs) and assess and control Critical Quality Attributes (CQAs). By using these tools, the production process can run more smoothly, producing higher-quality products with better overall performance. Biologics, such as vaccinations and monoclonal antibodies, can be made better by using PAT technologies. Complex molecules like biologics need exact control over the manufacturing process to guarantee their safety and effectiveness. By providing real-time data on product quality and minimizing the need for final batch discarding or reprocessing, PAT provides continuous monitoring of pharmaceutical production.

Restraining Factors

The shortage of skilled workers with experience in the creation and application of process analytical technology is predicted to restrict the global market for this technology. The frameworks used to carry out PAT are complex and continuously varying depending on the location. Due to it is still a relatively new idea, there are not many qualified experts in the field.

Market Segmentation

The global process analytical technology market share is classified into technology, measurement, and end user.

- The spectroscopy segment is expected to hold the largest share of the global process analytical technology market during the forecast period.

Based on the technology, the global process analytical technology market is divided into spectroscopy, chromatography, particle size analysis, capillary electrophoresis, and others. Among these, the spectroscopy segment is expected to hold the largest share of the global process analytical technology market during the forecast period. The spectroscopy is widely used in both qualitative and quantitative analyses of pharmaceutical and biopharmaceutical products, the spectroscopy market is expected to grow rapidly in the forecast period. In developing drugs, mass spectroscopy (MS) and chromatography are utilized to get quantitative data for pharmacokinetic and pharmacodynamic research.

- The on-line segment is expected to hold the largest share of the global process analytical technology market during the forecast period.

Based on the measurement, the global process analytical technology market is divided into on-line, in-line, at-line, and off-line. Among these, the on-line segment is expected to hold the largest share of the global process analytical technology market during the forecast period. The decreased product variation, automatic feedback with quality control features, and the removal of delays associated with conventional monitoring systems are some advantages of on-line procedures. The advantages of on-line approaches are anticipated to drive industry growth and support the expansion of the process analytical technology market.

- The pharmaceutical manufacturers segment is expected to hold the largest share of the global process analytical technology market during the forecast period.

Based on the end user, the global process analytical technology market is divided into pharmaceutical manufacturers, biopharmaceutical manufacturers, contract research & manufacturing organizations, and others. Among these, the pharmaceutical manufacturers segment is expected to hold the largest share of the global process analytical technology market during the forecast period. The majority of PAT tool and technology users are pharmaceutical manufacturers, who use tools for making sure their products conform to strict regulatory criteria and quality standards. Process analytical technologies, or PATs, are important for the development and scaling up of asymmetric chiral molecule syntheses, which include the production of active medicinal ingredients in pharmaceutical manufacturers.

Regional Segment Analysis of the Global Process Analytical Technology Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global process analytical technology market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global process analytical technology market over the predicted timeframe. North America is known for its strict FDA regulations on drug approval and safety, the large number of pharmaceutical manufacturers based there, and the rapid adoption of new technology. The expanding market for biologics and greater funding for biotechnology and pharmaceutical research are other factors supporting this market growth in North America.

For instance in December 2022, a suite of R&D analytical solutions was launched by the U.S. Pharmacopeia (USP), which also announced the inauguration of the USP Advanced Manufacturing Technology Lab in Richmond, Virginia.

Asia Pacific is expected to grow at the fastest pace in the global process analytical technology market during the forecast period. Asia-Pacific is defined by a high concentration of contract manufacturing organizations (CMOs), a growing focus on regulatory compliance, and a growing number of pharmaceutical and biotech companies using PAT. China, Japan, and India represent the regions that have made the biggest contributions to the growth of the PAT market in the Asia-Pacific region.

Europe is anticipated to hold a significant share of the global process analytical technology market over the predicted timeframe. Process analytical technology (PAT) in Europe is growing, mostly due to the contributions of Germany, the UK, and France. The growing demand for high-quality products and a growing focus on process improvement are factors driving this market growth. PAT is being used more frequently to meet the regulatory requirements in Europe, where the biotech and pharmaceutical industries are heavily regulated.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global process analytical technology market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Thermo Fisher Scientific

- CGT Catapult

- Rentschler Biopharma

- Danaher Corporation

- Agilent Technologies, Inc.

- Pharmacopeia (USP)

- Shimadzu Corporation

- Waters Corporation

- Bruker Corporation

- Emerson Electric Co.

- ABB Ltd.,

- PerkinElmer, Inc

- Mettler-Toledo International Inc.

- Carl Zeiss AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2023, A partnership between Rentschler Biopharma, Refeyn, and Cell and Gene Therapy Catapult (CGT Catapult) was announced. Through this partnership, the production of adeno-associated viruses (AAVs) for gene therapy will be produced more efficiently by utilizing state-of-the-art process analytical technologies (PAT). The partners want to develop an automated and digitalized platform for producing AAV gene therapy.

- In March 2023, to improve product quality and safety while boosting production levels, the Cell and Gene Therapy Catapult (CGT Catapult) announced the opening of a new laboratory in Stevenage. This facility has been specially designed and equipped to enable cell and gene therapy developers to monitor and control their advanced therapy manufacturing processes in real-time.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global process analytical technology market based on the below-mentioned segments:

Global Process Analytical Technology Market, By Technology

- Spectroscopy

- Chromatography

- Particle Size Analysis

- Capillary Electrophoresis

- Others

Global Process Analytical Technology Market, By Measurement

- On-line

- In-line

- At-line

- Off-line

Global Process Analytical Technology Market, By End User

- Pharmaceutical Manufacturers

- Biopharmaceutical Manufacturers

- Contract Research & Manufacturing Organizations

- Others

Global Process Analytical Technology Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which are the key companies that are currently operating within the market?Thermo Fisher Scientific, CGT Catapult, Rentschler Biopharma, Danaher Corporation, Agilent Technologies, Inc., Pharmacopeia (USP), Shimadzu Corporation, Waters Corporation, Bruker Corporation, Emerson Electric Co., ABB Ltd., PerkinElmer, Inc, Mettler-Toledo International Inc., Carl Zeiss AG, and Others.

-

2.What is the size of the global process analytical technology market?The global process analytical technology market is expected to grow from USD 7.51 Billion in 2023 to USD 14.15 Billion by 2033, at a CAGR of 6.54% during the forecast period 2023-2033.

-

3.Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global process analytical technology market over the predicted timeframe.

Need help to buy this report?