Global Process Analyzer Market Size, Share, and COVID-19 Impact Analysis, By Liquid Analyzer (MLSS, Total Organic Carbon, pH, Liquid Density, Conductivity, Dissolved Oxygen), By Gas Analyzer (Oxygen, Carbon Dioxide, Moisture, Toxic Gas, Hydrogen Sulfide), By Industry (Oil & Gas, Petrochemcial, Pharmaceuticals, Water & Wastewater, Power, Food & Beverages, Paper & Pulp, Metals & Mining, Cement and Glass, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Semiconductors & ElectronicsGlobal Process Analyzer Market Insights Forecasts to 2032

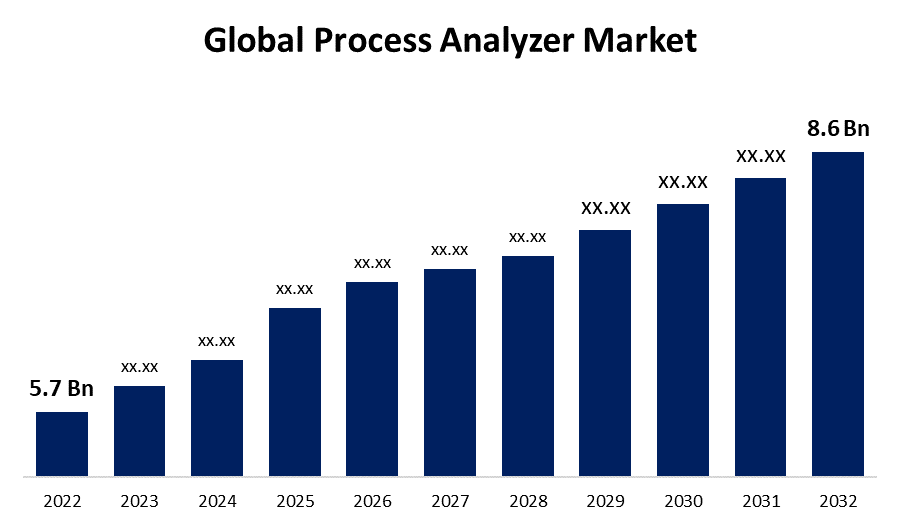

- The Global Process Analyzer Market Size was valued at USD 5.7 Billion in 2022.

- The Market Size is Growing at a CAGR of 4.2% from 2022 to 2032

- The Worldwide Process Analyzer Market Size is expected to reach USD 8.6 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Process Analyzer Market size is anticipated to exceed USD 8.6 Billion by 2032, growing at a CAGR of 4.2% from 2022 to 2032. The demand for extremely precise process analyzers is growing in the rapidly expanding fields of drug development, bioprocessing, and personalized medicine. These analytical instruments are essential in pharmaceutical development and manufacturing, ensuring the highest levels of quality.

Market Overview

Process analyzers are electronic tools that are used to examine various industrial processes. They primarily determine the chemical composition and physical properties of substances in order to optimize processes and protect assets. They also examine the liquid and gaseous content of a product during the manufacturing process. Liquid analyzers are used to monitor process chemistry, including fluid quality, whereas gas analyzers are used to monitor industrial, natural, and process gas streams. They can also withstand harsh environments and extreme weather. Process analyzers are widely used in the oil and gas, chemical, petrochemical, and pharmaceutical industries because of these advantages. One of the key factors driving market growth is the expanding oil and gas industry. Furthermore, there is a growing demand for wastewater treatment plants because industrial wastewater contains high levels of salts, particles, and toxic chemicals that are harmful to the environment. The increasing scarcity of water is fueling the demand for wastewater treatment and disposal, which is also driving market growth. Furthermore, manufacturers are increasingly using analyzers to continuously monitor production processes in order to optimize resource usage and reduce waste. Manual inspection techniques are rapidly being replaced to reduce losses caused by human errors, which is propelling market growth.

Report Coverage

This research report categorizes the market for the global process analyzer market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the process analyzer market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the process analyzer market.

Global Process Analyzer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 5.7 Billion |

| Forecast Period: | 2022 - 2032 |

| Forecast Period CAGR 2022 - 2032 : | 4.2% |

| 2032 Value Projection: | USD 8.6 Billion |

| Historical Data for: | 2018 - 2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Liquid Analyzer, By Gas Analyzer, By Industry, By Region |

| Companies covered:: | ABB, Emerson Electric Co., Siemens, Endress+Hauser Group Services AG, Yokogawa Electric Corporation, Mettler Toledo, Suez, Thermo Fisher Scientific, Inc., Ametek. Inc, Anton Paar GmbH, Others, and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The world's freshwater availability is decreasing due to a variety of factors, including climatic changes, disrupted weather patterns, and increased pollution. Water conservation is becoming more popular, and initiatives such as increasing the efficiency of water supply systems, rainwater harvesting, and wastewater treatment are being implemented. Wastewater is water that has been used in industrial plants or by households. It must be treated before being discharged into another body of water, such as a river or lake, to avoid further polluting water sources. Globally, there is an urgent need for safe drinking water, which increases the demand for water and wastewater treatment plants. To monitor the chemicals in the water, these plants use various types of process analyzers. Several companies have begun to invest in water and wastewater treatment plants in order to provide safe drinking water to people all over the world. Demand for liquid and gas analyzers with advanced control capabilities has risen in tandem with the demand for water in the pharmaceutical and food industries.

Restraining Factors

A lack of skilled professionals makes operating the process analyzer difficult, which can lead to errors in substance monitoring. Furthermore, due to the high cost of process analyzers and their software, manufacturers prefer simple and low-cost monitoring solutions over installing high-cost process analyzers. This constrains the market.

Market Segmentation

The Global Process Analyzer Market share is classified into liquid analyzer and gas analyzer.

- The MLSS segment is expected to grow at the fastest pace in the global process analyzer market during the forecast period.

The global process analyzer market is categorized by liquid analyzer into MLSS, total organic carbon, pH, liquid density, conductivity, dissolved oxygen. Among these, the MLSS segment is expected to grow at the fastest pace in the global process analyzer market during the forecast period. The importance of MLSS analyzers in wastewater treatment processes is driving their increased use. These analyzers are critical for monitoring and optimizing microorganism concentrations in activated sludge, which is a critical component in wastewater treatment. The increased emphasis on environmental sustainability and strict regulatory guidelines has increased demand for effective wastewater treatment. MLSS analyzers help to maintain the proper microorganism concentration, which aids in efficient waste breakdown. Furthermore, advances in sensor technology and automation have boosted the adoption of MLSS analyzers, ensuring accurate, real-time monitoring for efficient wastewater management and regulatory compliance.

- The oxygen segment is expected to grow at the rapid pace in the global process analyzer market during the forecast period.

Based on the gas analyzer, the global process analyzer market is divided into oxygen, carbon dioxide, moisture, toxic gas, hydrogen sulfide. Among these, the oxygen segment is expected to grow at the rapid pace in the global process analyzer market during the forecast period. An oxygen analyzer is a type of gas analyzer that is widely used in a variety of industries. The concentration of oxygen in combustion processes determines whether the combustion is rich or lean. These analyzers are useful for controlling boiler combustion, measuring oxygen levels in flammable gas mixtures, and monitoring environmental conditions in reflow furnaces and globe boxes. The oxygen analyzer segment is expected to be driven by the anticipated widespread use of oxygen analyzers across industries, allowing it to achieve the highest Compound Annual Growth Rate (CAGR) during the forecast period.

Regional Segment Analysis of the Global Process Analyzer Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold a significant share of the global process analyzer market over the predicted timeframe.

Get more details on this report -

North America is projected to hold a significant share of the global process analyzer market over the predicted years. The Mexico and Canada are the significant contributor in the North America process analyzer market in 2022. This is owing to the prevalence of advanced technology and the introduction of new products in the process analyzer market. Pharmaceutical companies in the United States have already begun to use process analyzers for water quality control, as has the Environmental Protection Agency (EPA). Furthermore, the process analyzer market in Canada had the largest market share, while the process analyzer market in the United States was the fastest-growing market in the North America region.

Asia Pacific is expected to grow at the fastest pace in the global process analyzer market during the forecast period. The widespread use of process analyzer solutions in Asia can be attributed to the region's large manufacturing base. Because of the low labor costs and ready access to a skilled workforce, many prominent global corporations from various sectors have relocated their manufacturing facilities to this region. The Asia Pacific region is home to major industries such as automotive, consumer electronics, pharmaceuticals, refining, and mining, cementing its position as a key hub for these sectors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global process analyzer along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABB

- Emerson Electric Co.

- Siemens

- Endress+Hauser Group Services AG

- Yokogawa Electric Corporation

- Mettler Toledo

- Suez

- Thermo Fisher Scientific, Inc.

- Ametek. Inc

- Anton Paar GmbH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, Thermo Fisher Scientific Inc. unveiled two new wet chemistry analyzers that provide fully automated testing in accordance with U.S. Environmental Protection Agency (EPA) standards. These systems provide precise and streamlined analytical capabilities to environmental, agricultural, and industrial testing laboratories.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Process Analyzer Market based on the below-mentioned segments:

Global Process Analyzer Market, By Liquid Analyzer

- MLSS

- Total Organic Carbon

- pH

- Liquid Density

- Conductivity

- Dissolved Oxygen

Global Process Analyzer Market, By Gas Analyzer

- Oxygen

- Carbon Dioxide

- Moisture

- Toxic Gas

- Hydrogen Sulfide

Global Process Analyzer Market, By Industry

- Oil & Gas

- Petrochemcial

- Pharmaceuticals

- Water & Wastewater

- Power

- Food & Beverages

- Paper & Pulp

- Metals & Mining

- Cement and Glass

- Others

Global Process Analyzer Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?