Global Propylene Oxide Market Size, Share, Growth, and Industry Analysis, By Production Process (Chlorohydrin Process, Styrene Monomer Process, Hydrogen Peroxide Process, TBA Co-Product Process, Cumene-Based Process), By Application (Polyether Polyols, Propylene Glycols, Propylene Glycol Ethers and Others), and Regional Propylene Oxide and Forecast to 2033

Industry: Chemicals & MaterialsGlobal Propylene Oxide Market Propylene Oxide Forecasts to 2033

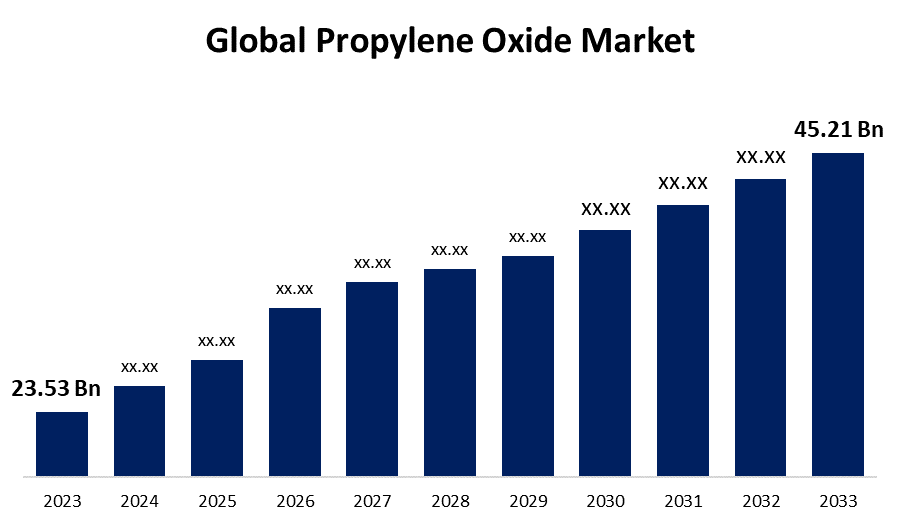

- The Global Propylene Oxide Market Size was Valued at USD 23.53 Billion in 2023

- The Market Size is Growing at a CAGR of 6.75% from 2023 to 2033

- The Worldwide Propylene Oxide Market Size is Expected to Reach USD 45.21 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Propylene Oxide Market Size is Anticipated to Exceed USD 45.21 Billion by 2033, Growing at a CAGR of 6.75% from 2023 to 2033.

PROPYLENE OXIDE MARKET REPORT OVERVIEW

Propylene oxide is a colorless, flammable, volatile liquid that dissolves in ethanol and water and smells like benzene. This extremely reactive chemical provides a feedstock for the synthesis of numerous industrial products. Propylene oxide is produced more than 6 million tons a year worldwide, making it a major industrial commodity. About 70% of the remaining amount is used as polypropylene glycol in the raw materials for urethane, and the remaining fraction is used as propylene glycol in the source ingredients for unsaturated polyesters, foodstuffs, and cosmetics. The demand for urethane is rising dramatically, especially in Asia, and producers of propylene oxide are declaring plans to open new operations. Propylene oxide is a basic, necessary chemical intermediate. Propylene oxide is primarily used to make polyether polyols, propylene glycols, and propylene glycol ethers. It has been accredited for use as a package fumigant for dried fruits and as a bulk fumigant for products such as cocoa, spices, processed nutmeats, starch, and gums. The rising acceptance of propylene oxide plants can enhance market expansion. For instance, in Texas LyondellBasell has declared that it has effectively inaugurated the biggest propylene oxide and tertiary butyl alcohol facility worldwide. The 470 thousand metric tons of propylene oxide and one million metric tons of TBA and its derivatives can be produced annually.

Report Coverage

This research report categorizes the market for the global propylene oxide market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global propylene oxide market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global propylene oxide market.

Global Propylene Oxide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 23.53 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.75% |

| 2033 Value Projection: | USD 45.21 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Production Process, By Application, |

| Companies covered:: | Dow Inc., LyondellBasell Industries Holdings B.V, Royal Dutch Shell PLC, BASF SE, SKC Company AGC Inc, Repsol, Sumitomo Chemical Co., Ltd, Tokuyama Corporation, Indorama Ventures Public Company, INEOS Oxide, Jishen Chemical Industry Co. Ltd, Manali Petrochemicals, Tianjin Dagu Chemical Co., Ltd., PJSC Nizhnekamskneftekhim, Wudi XINYUE Chemical Co., Ltd., and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

DRIVING FACTORS:

The building and food sectors' growing need for propylene oxide is fueling the market's expansion.

As a building chemical, propylene oxide is used in grouts, paints, waterproofing compounds, varnishes, and adhesives. The material also serves as the basis for the production of propylene glycol, which is used in a wide range of food products, such as bread, dairy products, dressings, cake mixes, drink mixes, popcorn, soft drinks, and fast food. The rapidly expanding construction industry combined with the increased demand for packaged food will drive up demand for the product. It provides efficacy without compromising the sensory attributes of food items by enabling a reduction in bacterial load. The need for adhesive products, coatings, sealing compounds, and malleable foams is particularly high in the automobile sector.

RESTRAINING FACTORS

The growth of the propylene oxide market is being restrained by volatility in prices and changing feedstock rates.

It is difficult for market players to develop consistent pricing strategies due to price volatility and shifting feedstock prices. Prompt pricing changes resulting from variations in feedstock expenses are detrimental to both the competitiveness of the propylene oxide market and customer relations. The instability of prices has also made it difficult for customers to manage their own spending, which could affect the propylene oxide industry. Different feedstock costs have affected the competitive dynamics of the propylene oxide industry.

Market Segmentation

The propylene oxide market share is classified into production process and application.

The styrene monomer process segment has the highest share of the market over the forecast period.

Based on the production process, the propylene oxide market is classified into chlorohydrin process, styrene monomer process, hydrogen peroxide process, TBA co-product process, and cumene-based process. The technological developments in catalysts that increase process efficiency are driving the styrene monomer process industry. This pattern is influenced by the rising demand for polystyrene products across a range of industries, including packaging and insulation. Another important driver in the styrene monomer process is a greater emphasis on economical manufacturing methods. Greener alternatives and technologies are being pushed by rules that support environmentally friendly activities within this business. The substantial investments in research and development made by large organizations enable new advancements that support the growth of the market.

Polyether polyols have to greatest market share throughout the forecast period.

Based on application, the propylene oxide market is classified into polyether polyols, propylene glycols, propylene glycol ethers, and others. The market for polyether polyols is being driven by an increasing need for flexible foams in bedding and furniture applications. The segment's expansion is also being aided by increased use in insulation applications and vehicle interiors. The need for polyether polyols to create sustainable solutions has increased due to the desire for eco-friendly products. This significant market is growing as a result of increased research and development attention on high-performance polyols and technological developments. All things considered, the combination of these elements generates a strong market for polyether polyols, which in turn reflects overall shifts in buyer habits and industrial uses.

Regional Segment Analysis of the Global Propylene Oxide Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

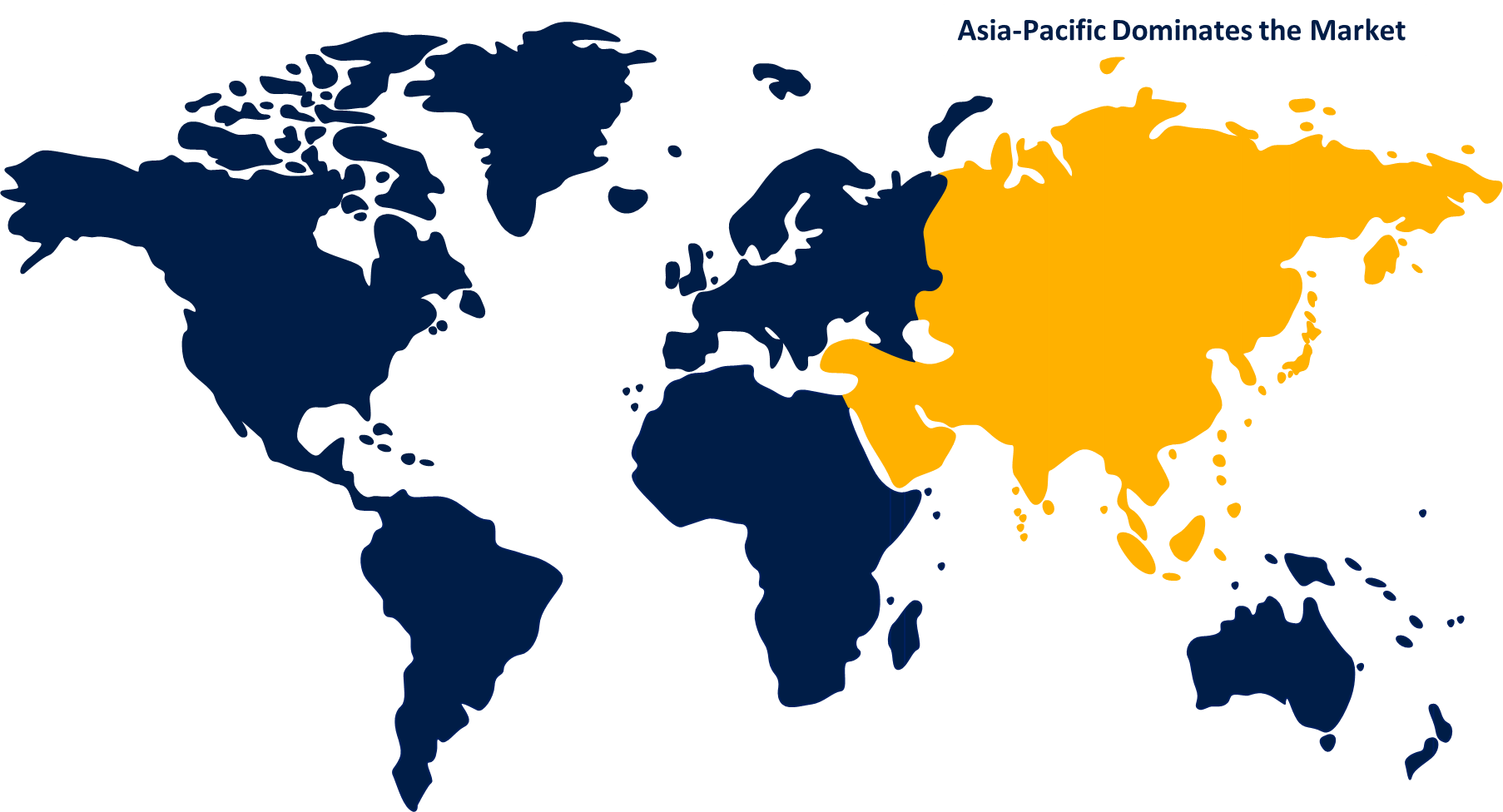

Asia-Pacific will have the biggest share of the propylene oxide market throughout the forecast period.

Get more details on this report -

Asia Pacific is anticipated to become a significant player in the propylene oxide market, seeing rapid growth due to the great expansion of various end-use sectors such as furniture, automotive, and construction, as well as increased plant capacity for polyurethanes. The demand is also expected to rise over the forecast period as a result of the region's growing food and beverage, personal care, and automotive industries. The growth will be aided by the high supply of raw resources, particularly propylene, in China and India. The government plans to expand funding for enormous construction projects can boost the market expansion over the forecast period.

North America is the fastest-growing region during the projected timeframe.

The region's rising demand will be supported by technical advancements produced by numerous US, Mexican, and Canadian enterprises, as well as by the growing building industry, high discretionary income, and rising living standards. Additionally, the region's demand for adhesive and sealant products is expected to increase the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global propylene oxide market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dow Inc.

- LyondellBasell Industries Holdings B.V

- Royal Dutch Shell PLC

- BASF SE

- SKC Company AGC Inc

- Repsol

- Sumitomo Chemical Co., Ltd

- Tokuyama Corporation

- Indorama Ventures Public Company

- INEOS Oxide

- Jishen Chemical Industry Co. Ltd

- Manali Petrochemicals

- Tianjin Dagu Chemical Co., Ltd.

- PJSC Nizhnekamskneftekhim

- Wudi XINYUE Chemical Co., Ltd.

- Others

Key Market Developments

- In November 2022, the intention to increase the production capacity of propylene at LyondellBasell's Channelview Complex near Houston, Texas, was revealed. Using the company's existing technology, a new propylene factory would be constructed to convert ethylene into propylene for the production of propylene oxide and polypropylene.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global propylene oxide market based on the below-mentioned segments:

Global Propylene Oxide Market, By Production Process

- Chlorohydrin Process

- Styrene Monomer Process

- Hydrogen Peroxide Process

- TBA Co-Product Process

- Cumene-Based Process

Global Propylene Oxide Market, By Application

- Polyether Polyols

- Propylene Glycols

- Propylene Glycol Ethers

- Others

Global Propylene Oxide Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global propylene oxide market over the forecast period?The global propylene oxide market size is expected to grow from USD 23.53 Billion in 2023 to USD 45.21 Billion by 2033, at a CAGR of 6.75% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global propylene oxide market?Asia-Pacific is projected to hold the largest share of the global propylene oxide market over the forecast period.

-

3. Who are the top key players in the propylene oxide market?Dow Inc, LyondellBasell Industries Holdings B.V, Royal Dutch Shell PLC, BASF SE, SKC Company AGC Inc, Repsol, Sumitomo Chemical Co., Ltd, Tokuyama Corporation, Indorama Ventures Public Company, INEOS Oxide, Jishen Chemical Industry Co. Ltd, Manali Petrochemicals, Tianjin Dagu Chemical Co., Ltd, PJSC Nizhnekamskneftekhim, Wudi XINYUE Chemical Co., Ltd, and Others.

Need help to buy this report?