Global Protective Coatings Market Size, Share, and COVID-19 Impact, By Resin (Acrylic, Epoxy, Polyurethane, Alkyd, Polyester), By Formulation (Water Borne, Solvents Borne, Powder Based), By End Use (Acrylic, Epoxy, Polyurethane, Alkyd, Polyester), by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Chemicals & MaterialsGlobal Protective Coatings Market Insights Forecasts to 2032

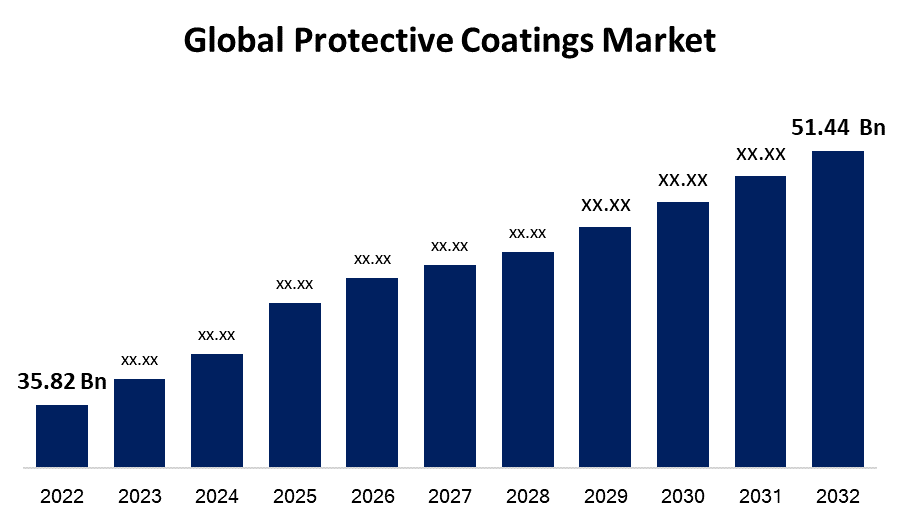

- The Protective Coatings Market was valued at USD 35.82 Billion in 2022.

- The Market is Growing at a CAGR of 8.1% from 2022 to 2032

- The Global Protective Coatings Market Size is expected to reach USD 51.44 Billion by 2032

- North America is expected To Grow the fastest during the forecast period

Get more details on this report -

The Global Protective Coatings Market Size is expected to reach USD 51.44 Billion by 2032, at a CAGR of 8.1% during the forecast period 2022 to 2032.

Protective coatings are substances that are applied to surfaces to add an additional layer of defence against various environmental causes, corrosion, wear and tear, and other types of damage. These coatings are intended to improve the underlying substrate's performance and durability. Protective coatings come in a variety of varieties, each having unique qualities and areas of use. Protective coatings offer a strong layer of defence against wear, abrasion, impact, and other types of physical damage, which can considerably increase the longevity of substrates. This may result in lower maintenance costs, better functionality, and longer coating lifespan. Although installing protective coatings may initially cost more than keeping surfaces uncovered, the long-term cost reductions can add up. Coatings can increase the lifespan of substrates, lessen the need for frequent repairs or replacements, and eventually cut maintenance costs by preventing damage, corrosion, and early deterioration.

Impact of COVID 19 On Global Protective Coatings Market

Lockdowns, travel bans, and decreased production operations brought about by the pandemic have affected global supply networks. The supply of raw materials has been impacted, and manufacture and distribution of protective coatings have been hampered. During the pandemic, the construction industry, a significant user of protective coatings, experienced a slowdown. Because of lockdown procedures and monetary instability, numerous construction projects were postponed or abandoned. The need for protective coatings was directly impacted by this drop in construction activity. The requirement for workplace upgrades or upkeep was reduced as many businesses migrated to remote work arrangements. The demand for protective coatings for commercial structures temporarily decreased as a result. During the pandemic, the significance of hygiene and health-related measures increased. The demand for antimicrobial coatings and surface treatments expanded as a result of the increased emphasis on cleaning and disinfection, particularly in healthcare institutions, public areas, and transportation.

Key Market Drivers

Over the past ten years, the market for protective coatings has grown consistently, and it is anticipated that this trend will continue in the years to come. The development of infrastructure, rising industrialisation, and growing public awareness of the value of shielding surfaces from corrosion, wear and tear, and other environmental variables are all contributing factors in this growth. Construction and the automotive sectors are two major businesses that are driving the protective coatings market. These sectors utilise protective coatings to extend the lifespan and durability of buildings, bridges, highways, cars, and other structures. As protective coatings are crucial for preventing corrosion in pipelines, tanks, and offshore structures, the oil and gas industry is another important driver of market expansion. Additionally, the market for protective coatings has seen the development of new technologies and formulations as a result of the growing demand for sustainable and ecologically friendly coatings.

Key Market Challenges

The protective coatings business has a substantial challenge as a result of increasingly strict environmental regulations, notably those pertaining to volatile organic compounds (VOCs) and hazardous air pollutants (HAPs). To create ecologically friendly coating formulations that abide by these rules while keeping performance standards, manufacturers must spend in research and development. The market may be affected by the cost and availability of the raw ingredients used in protective coatings, such as resins, pigments, and additives. Fluctuations in the cost of raw materials or their scarcity might raise manufacturing costs, which can have an impact on the profitability and pricing strategies of coating producers. To ensure correct surface preparation, coating application, and curing, the application of protective coatings can be difficult and labor-intensive. Protective coating adoption may be constrained by a lack of competent applicators and training programmes, particularly in developing markets or sectors where the application procedure necessitates specialised knowledge.

Market Segmentation

Formulation Insights

Solvent borne segment is dominating the market with the largest market share

On the basis of formulation, the global protective coatings market is segmented into Water Borne, Solvents Borne, Powder Based. Among these, solvent borne segment is dominating the market with the largest market share over the forecast period. Multiple variables have had an impact on the development of protective coatings that are solvent-borne. In spite of the fact that solvent-borne coatings have historically been widely used in a variety of sectors, including the automotive, aerospace, marine, and industrial ones, their development has slowed recently as a result of growing environmental concerns and stricter laws regarding the emissions of volatile organic compounds (VOCs).

End Use Insights

Construction segment accounted the largest market share over the forecast period

Based on the end use, the global protective coatings market is segmented into Infrastructure, Construction, Commercial Real Estate, Industrial Plants and Facilities, Oil & Gas, Power, Mining. Among these, construction segment accounted the largest market share over the forecast period. Global infrastructure projects, including those for the construction of buildings, bridges, roads, trains, and other structures, are surging. To increase longevity, guard against corrosion and weathering, and adhere to safety rules, these projects need protective coatings. The adoption of protective coatings in the construction industry is being driven by the rising demand for infrastructure development. Coatings are employed in the building industry for aesthetic reasons in addition to protection. Architectural coatings are applied to surfaces to improve the aesthetic appeal of buildings. These coatings might be textured, decorative, or have particular colours or effects. The desire for coatings that offer both security and aesthetic appeal helps the industry expand.

Resin Insights

Epoxy resin segment is dominating the market over the forecast period

On the basis of resin, the global protective coatings market is segmented into Acrylic, Epoxy, Polyurethane, Alkyd, Polyester. Among these, epoxy resin segment is dominating the market over the forecast period. In the market for protective coatings, epoxy resin has grown significantly in recent years. Epoxy resin is a versatile substance renowned for its superior mechanical, chemical, and adhesive qualities. Due to these qualities, it is ideally suited for many protective coating applications, such as corrosion prevention, commercial floors, marine coatings, and automotive finishes. In rising economies, infrastructure growth and rapid urbanisation have raised demand for protective coatings. Epoxy coatings are frequently applied to infrastructure projects like bridges, roads, tunnels, and buildings because they provide durable defence against the elements, chemicals, and wear.

Regional Insights

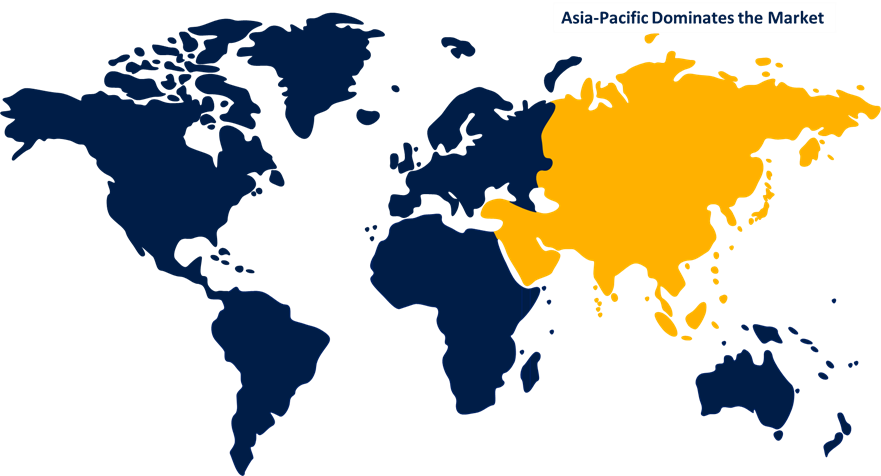

Asia Pacific is dominating the market with the largest market share

Get more details on this report -

Among all other regions, Asia Pacific is dominating the market with the largest market share. Infrastructure projects like roads, bridges, railways, airports, and smart cities are receiving significant investment from nations like China, India, and Southeast Asian countries. In order to extend the lifespan of these structures, protective coatings are crucial for shielding them from corrosion, weathering, and other environmental influences. Protective coatings are needed in the region's developing industrial sector, which includes the manufacturing, automotive, aerospace, and marine sectors, to protect machinery, equipment, and structures from abrasion, chemicals, corrosion, and other harm.

Europe, on the other hand is witnessing the fastest market growth over the forecast period. The automotive, aerospace, marine, building, oil and gas, and industrial manufacturing sectors are some of the major consumers of protective coatings in Europe. Market trends have also been influenced by the region's emphasis on ecologically friendly and sustainable coatings.

Recent Market Developments

- In September 2022, For leading-edge protection (LEP) on wind turbine rotor blades, Hempel introduced Hempablade Edge 171.

- In August 2022, The acquisition of Westdeutsche Farben GmbH, a German coatings producer with technological know-how in water-based coatings, by Kansai Paint strengthened its global business operations.

List of Key Companies

- PPG Industries, Inc.

- RPM International, Inc

- Solvay S.A.

- Diamond Vogel Paints

- Clariant International Ltd.

- Ashland Inc.

- Royal DSM N.V.

- Axalta Coating System Ltd.

- Sono-Tek Corporation

- Jotun A/S

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global Protective Coatings Market based on the below-mentioned segments:

Protective Coatings Market, Formulation Analysis

- Water Borne

- Solvents Borne

- Powder Based

Protective Coatings Market, Resin Analysis

- Acrylic

- Epoxy

- Polyurethane

- Alkyd

- Polyester

Protective Coatings Market, End User Analysis

- Infrastructure

- Construction

- Commercial Real Estate

- Industrial Plants and Facilities

- Oil & Gas

- Power

- Mining

Protective Coatings Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of Protective Coatings Market?The global Protective Coatings Market is expected to grow from USD 35.82 Billion in 2022 to USD 51.44 Billion by 2032, at a CAGR of 8.1% during the forecast period 2022-2032.

-

2. Who are the key market players of Protective Coatings Market?Some of the key market players of PPG Industries, Inc., RPM International, Inc, Solvay S.A., Diamond Vogel Paints, Clariant International Ltd., Ashland Inc., Royal DSM N.V., Axalta Coating System Ltd., Sono-Tek Corporation, Jotun A/S

-

3. Which segment hold the largest market share?Epoxy segment holds the largest market share is going to continue its dominance.

-

4. Which region is dominating the Protective Coatings Market?Asia Pacific is dominating the Protective Coatings Market with the highest market share.

Need help to buy this report?