Global Protective Packaging Market Size, Share, and COVID-19 Impact Analysis, By Type (Flexible Protective Packaging, Foam Protective Packaging, and Rigid Protective Packaging), By Material (Paper & Paperboard, Plastic Foams, Plastic, and Others), By Function (Void Fill, Wrapping, Insulation, Blocking & Bracing, and Cushioning), By End-Use (Food & Beverage, Industrial Goods, Consumer Electronics, Household Appliances, Healthcare, Automotive, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Chemicals & MaterialsGlobal Protective Packaging Market Insights Forecasts to 2032

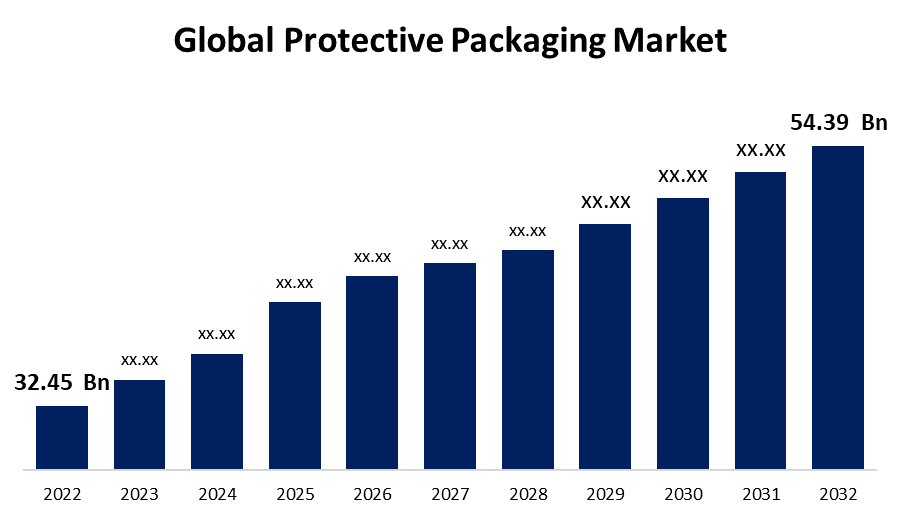

- The Global Protective Packaging Market Size was valued at USD 32.45 Billion in 2022.

- The Market is Growing at a CAGR of 5.3% from 2022 to 2032

- The Worldwide Protective Packaging market is expected to reach USD 54.39 Billion by 2032

- North America is expected to Grow significant during the Forecast period

Get more details on this report -

The Global Protective Packaging Market Size is expected to reach USD 54.39 Billion by 2032, at a CAGR of 5.3% during the Forecast period 2022 to 2032.

Market Overview

Protective packaging refers to a range of materials and techniques used to safeguard products during transportation, storage, and handling. Its primary goal is to ensure the integrity and safety of goods, minimizing the risk of damage or breakage. Protective packaging employs a variety of materials, including foam, bubble wrap, corrugated cardboard, air cushions, and molded pulp, among others, to create a barrier around the product, absorbing shocks and preventing movement. This type of packaging is designed to provide cushioning, shock absorption, and impact resistance, shielding items from moisture, dust, temperature fluctuations, and other external factors that may pose a threat to their quality or functionality. Protective packaging is widely used across industries, such as electronics, pharmaceuticals, automotive, and e-commerce, to safeguard fragile or delicate items, ensuring they reach customers in pristine condition while minimizing the risk of returns or replacements, enhancing customer satisfaction, and reducing waste.

Report Coverage

This research report categorizes the market for protective packaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the protective packaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the protective packaging market.

protective-packaging-market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 32.45 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.3% |

| 2032 Value Projection: | USD 54.39 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Materials, By Function, By End-Use, By Region |

| Companies covered:: | Sealed Air Corporation, Sonoco Products Company, Smurfit Kappa Group PLC., WestRock Company, Huhtamaki OYJ, DS Smith PLC, Pregis LLC, Pro-Pac Packaging Limited, Dow Chemical Company, Intertape Polymer Group, Storopack Hans Reichenecker Gmbh, International Paper Company, EcoEnclose, Point Five Packaging, Universal Protective Packaging, Inc. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The protective packaging market is influenced by several key drivers, because the growth of the e-commerce industry is a significant factor driving the demand for protective packaging. With the increasing trend of online shopping, there is a greater need for secure packaging that can protect products during shipping. The rise in global trade and logistics activities has increased the importance of protective packaging in ensuring the safe transportation of goods across long distances. Additionally, the growing awareness regarding sustainable packaging solutions has led to the adoption of eco-friendly materials and designs in protective packaging, driven by environmental regulations and consumer preferences. Moreover, the increasing focus on product safety and the prevention of damage during transit has heightened the demand for advanced protective packaging solutions. Overall, the expansion of industries like electronics, automotive, and pharmaceuticals has contributed to the growth of the protective packaging market, as these sectors require specialized packaging to safeguard delicate and high-value products.

Restraining Factors

The protective packaging market faces certain restraints that impact its growth, the increasing emphasis on sustainability and the reduction of packaging waste pose challenges for the industry, as finding eco-friendly materials and designs that maintain the same level of protection can be costly and technically demanding. The fluctuating raw material prices can impact the profitability of protective packaging manufacturers, affecting their ability to offer competitive pricing. Additionally, stringent regulations and compliance requirements related to packaging materials and recycling can add complexity and costs to the production and disposal processes. Overall, the growing popularity of lightweight and compact packaging solutions poses a restraint, as it may compromise the level of protection provided, particularly for fragile or sensitive products.

Market Segmentation

- In 2022, the flexible segment accounted for around 63.5% market share

On the basis of the type, the global protective packaging market is segmented into flexible protective packaging, foam protective packaging, and rigid protective packaging. The flexible type of packaging has emerged as the dominant segment in the protective packaging market, capturing the largest market share. This can be attributed to several factors driving its popularity and widespread adoption. The flexible packaging offers versatility and adaptability, making it suitable for a wide range of products across various industries. Its ability to conform to the shape and size of the item being packaged makes it an ideal choice for protecting products of different dimensions. Additionally, the flexibility of the packaging material allows for easy customization and printing, enabling brand differentiation and attractive designs. The flexible packaging is lightweight and space-efficient, offering cost savings in terms of transportation and storage. Its reduced weight compared to rigid packaging materials reduces shipping costs and environmental impact. Furthermore, flexible packaging takes up less space, optimizing warehouse storage and shelf display, which is particularly beneficial for the retail industry. Moreover, the barrier properties of flexible packaging, such as resistance to moisture, oxygen, and UV light, provide excellent protection for products, ensuring their freshness, integrity, and extended shelf life. This is particularly valuable for perishable goods and sensitive items that require high levels of protection. Overall, the growing demand for sustainable packaging solutions has boosted the popularity of flexible packaging. Many flexible packaging materials are recyclable and require less energy and resources during production, aligning with the increasing environmental concerns and regulations.

- In 2022, the food & beverage segment dominated with more than 38.5% market share

Based on the end-use, the global protective packaging market is segmented into food & beverage, industrial goods, consumer electronics, household appliances, healthcare, automotive, and others. The food & beverage end-use segment has emerged as the leading contributor to the largest market share in the protective packaging industry. The food & beverage industry requires robust protective packaging solutions to ensure the preservation and safety of perishable products. Protective packaging provides a barrier against moisture, contaminants, and physical damage, extending the shelf life and maintaining the quality of food and beverage items. The rise of convenience and on-the-go consumption trends has increased the demand for single-serve and portion-controlled packaging formats. Protective packaging plays a crucial role in safeguarding these individual portions, preventing leaks, spills, and contamination during transportation and handling. Moreover, the growth of e-commerce and online food delivery services has further fueled the demand for protective packaging in the food & beverage sector. These packaging solutions are designed to withstand the challenges of shipping and transportation, ensuring that food and beverages reach customers in optimal condition. Additionally, increasing consumer awareness regarding food safety and hygiene has driven the need for secure and tamper-evident packaging solutions. Protective packaging helps build trust among consumers, assuring them of the product's integrity and preventing tampering or contamination.

Regional Segment Analysis of the Protective Packaging Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

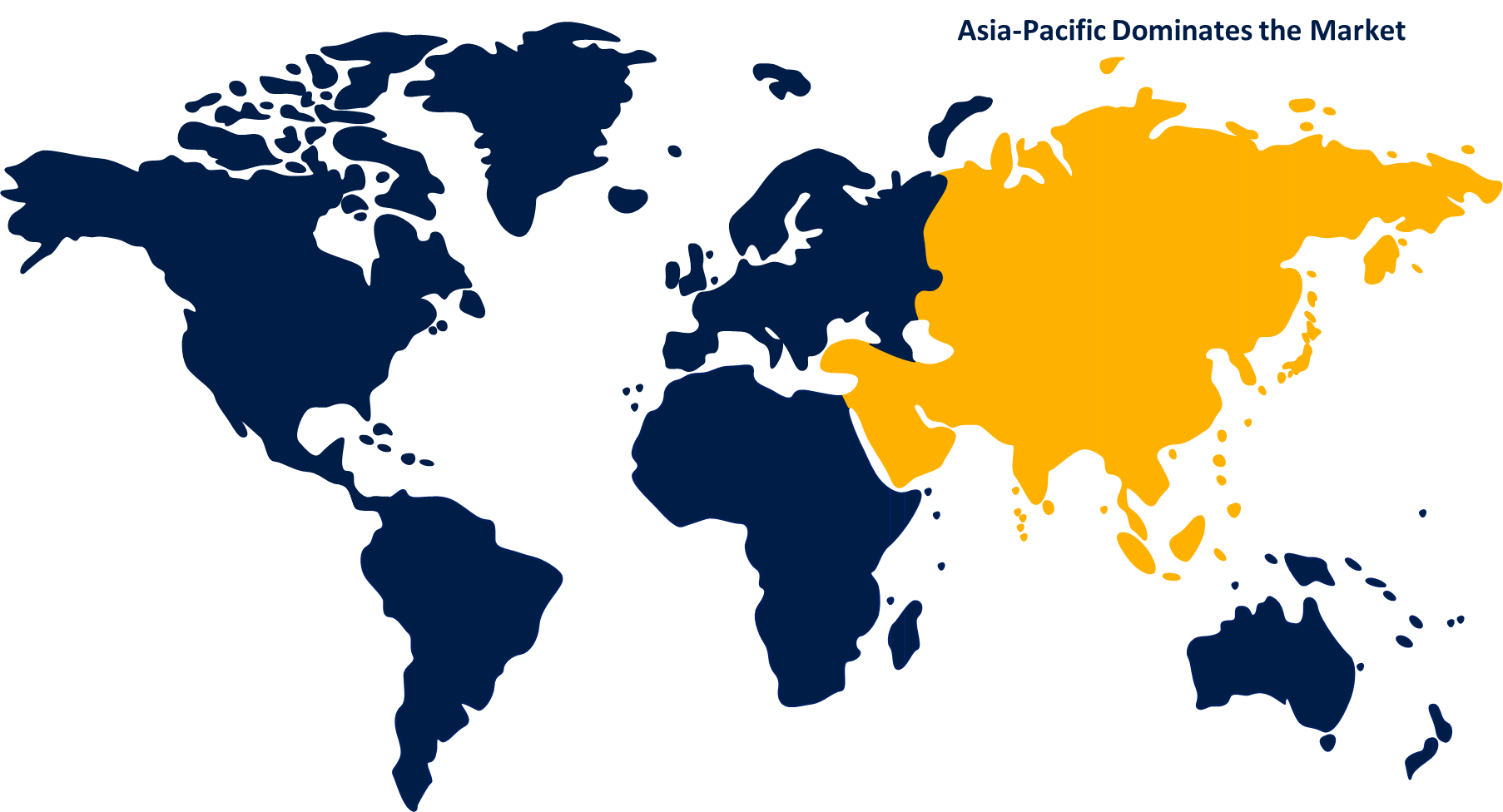

Asia-Pacific dominated the market with more than 40.6% revenue share in 2022.

Get more details on this report -

Based on region, Asia Pacific has emerged as a dominant player in the protective packaging market, accounting for a significant share of the global market. Several factors contribute to this regional dominance, because the rapid economic growth in countries like China and India has led to an expansion in manufacturing activities and increased demand for protective packaging solutions. These nations are major hubs for industries such as electronics, automotive, and consumer goods, which require robust packaging for safe transportation. The rise of e-commerce in the region has fueled the demand for protective packaging as online retail continues to grow. Additionally, the increasing population and urbanization have resulted in a higher consumption of packaged products, further boosting the need for reliable protective packaging. Moreover, favorable government initiatives, infrastructure development, and a rising middle class with higher disposable incomes have all contributed to the growth of the protective packaging market in the Asia Pacific region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global protective packaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Sealed Air Corporation

- Sonoco Products Company

- Smurfit Kappa Group PLC.

- WestRock Company

- Huhtamaki OYJ

- DS Smith PLC

- Pregis LLC

- Pro-Pac Packaging Limited

- Dow Chemical Company

- Intertape Polymer Group

- Storopack Hans Reichenecker Gmbh

- International Paper Company

- EcoEnclose

- Point Five Packaging

- Universal Protective Packaging, Inc.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, Smurfit Kappa has unveiled Vitop Uni taps, a new addition to its bag-in-box product line up. These taps offer an extra layer of security, safeguarding the packaging against tampering throughout its journey to final distribution. The launch of Vitop Uni taps demonstrates Smurfit Kappa's commitment to enhancing the protection and integrity of their bag-in-box packaging solutions. This innovation ensures that products remain secure and tamper-free until they reach the end consumer

- In November 2022, Sonoco Products Company has announced intentions to increase the manufacture of Sonopost Cornerposts across Europe. This expansion will be accomplished by the establishment of a protective packaging manufacturing factory in Bursa, Turkey. This strategic move intends to increase Sonoco's footprint in the European market while also meeting the region's rising need for protective packaging solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global protective packaging market based on the below-mentioned segments:

Protective Packaging Market, By Type

- Flexible Protective Packaging

- Foam Protective Packaging

- Rigid Protective Packaging

Protective Packaging Market, By Material

- Paper & Paperboard

- Plastic Foams

- Plastic

- Others

Protective Packaging Market, By Function

- Void Fill

- Wrapping

- Insulation

- Blocking & Bracing

- Cushioning

Protective Packaging Market, By End-Use

- Food & Beverage

- Industrial Goods

- Consumer Electronics

- Household Appliances

- Healthcare

- Automotive

- Others

Protective Packaging Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?