Global Protein Powder Market By Source (Animal-Based, Plant-Based), By Product (Protein Powder, Ready-To-Drink, Protein Bars & Others), By Application (Sports Nutrition & Functional Food), By Distribution Channel (Supermarket/Hypermarket, Online, Drugstore, Nutrition & Health Food Store & Others); By Region (U.S., Canada, Mexico, Rest Of North America, The UK, France, Germany, Italy, Spain, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest Of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest Of Southeast Asia), Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest Of Middle East & Africa, Brazil, Argentina, Rest Of Latin America) – Global Insights, Growth, Size, Comparative Analysis, Trends And Forecast, 2021-2030

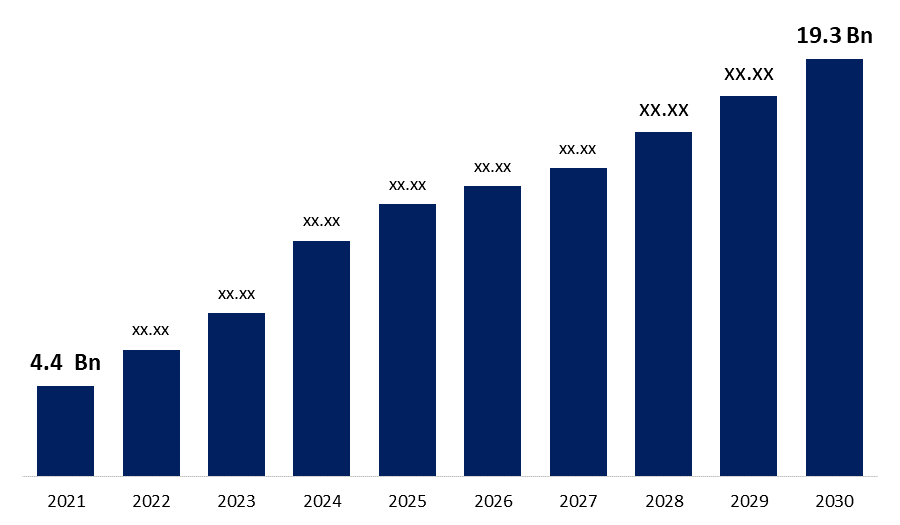

Industry: Consumer GoodsThe Global Protein Powder Market size was valued at USD 4.4 Billion in 2021. The market is projected to grow USD 19.3 Billion in 2030, at a CAGR of 4.52%. Protein powder has a lot of health benefits, including helping to build healthy muscles and tissues, repair tissue, manage weight, synthesize enzymes, boost the immune system, and maintain healthy cholesterol levels. As a result, the product's various benefits should help the protein powder business thrive during the anticipated time. In the food sector, protein powder is regarded as a necessary dietary supplement. The proliferation of COVID-19 has had a significant impact on demand for various nutritional goods in the food business. On the other hand, supply chain disruptions have occurred as a result of the nationwide lockdowns. In the aftermath of the COVID-19 pandemic, rising consumer demand for nutritional supplements to promote immunity due to their high efficiency against viral infections and acute respiratory tract disorders is projected to raise market demand. Furthermore, the rapid spread of COVID-19 has increased consumer concerns about health and wellness as a protection against disease, which may help the protein powder market trends following the corona virus outbreak.

Get more details on this report -

The stringent regulations imposed by various regional governments on the application and usage of various food additives are expected to limit the growth of protein powder in the near future. The European Union, for example, has tight restrictions regarding the quantity and quality of microbial components in food products. Furthermore, the negative consequences of excessive protein improvements, bad product claims and publicity, and the widespread availability of less expensive protein substitutes are likely to stymie product growth in the forecast timeframe. Manufacturers, on the other hand, are employing a variety of methods and marketing activities to educate consumers about the harmful health consequences of consuming a low-cost protein powder.

Proteins derived from animal sources are becoming more expensive, prompting producers to seek out cheaper alternatives. Supplements made from plant-based proteins such as soy, canola, rice, wheat, and pea are becoming increasingly popular. Various companies are exploring new prospects by valorizing ingredients to improve product nutritional content or creating new applications for vicelin, globulins, prolamins, and albumins, among others.

Global Protein Powder Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 4.4 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 4.52% |

| 2030 Value Projection: | USD 19.3 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Source, By Product, By Application, By Distribution Channel, |

| Companies covered:: | ABH Pharma Inc, Amway, Herbalife International of America, Inc, Abbott, Glanbia Group, Makers Nutrition, GlaxoSmithKline, GNC Holdings, Vitaco Health, Living Inc, Omega Protein, Atlantic Multipower UK Limited, Melaleuca Inc, Dalblads. |

| Growth Drivers: | 1) The animal-based segment accounted largest market share 2) The protein powder segment accounted largest market share |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Source Outlook

The animal-based segment accounted largest market share for the global protein powder market in 2020 owing to the growing adoption of meat and dairy proteins, such as whey, casein, egg, chicken, and beef. Animal proteins have long been thought to be complete proteins since they contain all of the essential amino acids. In 2021, the most popular animal-based proteins were whey and casein. Whey proteins, including concentrates, isolates, and hydrolysates, are highly digestible and have a balanced amino acid profile. However, because hydrolyzed whey proteins are more expensive than regular whey proteins, many whey supplement makers use them in modest amounts in their recipes.

The plant-based segment is anticipated to register a significant growth rate over the forecast period for the global protein powder market in 2020 owing to the Veganism is becoming more popular around the world, particularly in industrialised countries such as the United States and Europe. Plant-based protein powders are becoming increasingly popular, as they include more fibre and important minerals while being lower in calories and fat than animal proteins. Furthermore, the emergence of various animal flus, such as bird flu, may lead to a shift in consumer preference for plant-based protein powders, boosting market growth throughout the anticipated timeframe.

Product Outlook

The protein powder segment accounted largest market share for the global protein powder market in 2020 owing to the changing lifestyle and customer preference towards powder-based products. The powders are made from a range of proteins, including whey, casein, soy, pea, and egg. These powders are high in vitamins, greens (such as dried vegetables), minerals, grains, fibres, extra fats, and/or thickeners, among other necessary micronutrients. They aid in the development and toning of muscles, the production of enzymes and hormones, weight loss, and tissue healing in the human body. Furthermore, the protein powder segment is expected to develop due to increased demand from bodybuilders, top athletes, and recreational exercisers.

The ready-to-drink segment is anticipated to register a significant growth rate over the forecast period for the global protein powder market in 2020 owing to the growing emergence among millennials. Protein drinks with a precise formulation for immediate consumption are known as RTD supplements. RTDs have a high protein content and can be ingested before, after, or during a workout. These proteins are easily absorbed by the body and aid in lean muscle building as well as muscle rehabilitation. Protein gels, capsules, cakes, biscuits, and bites are among the products in the others category. Because of the high competition from protein powders such as protein powders, bars, and RTDs, these items are anticipated to develop at a slower rate than the other major protein powders.

Application Outlook

The sports nutrition segment registers the highest market share in 2020 of the global protein powder market. This is due to the protein powders are widely used in the sports and medical industries due to their widespread use as dietary supplements by athletes, bodybuilders, and other athletes. Given the exposure to a wider client base, including lifestyle and recreational users, the availability of sports nutrition products in supermarkets and convenience stores is projected to boost demand.

Furthermore, rising demand for sports nutritional supplements to promote lean muscle growth, improve performance, aid in weight loss, and increase stamina is likely to fuel the sports nutrition segment's rise in the future years. The growing number of people participating in sports and other physical activities to combat obesity is expected to fuel market expansion. However, the popularity of energy drinks and sugar-free carbonated soft drinks is growing.

Distribution Channel Outlook

The supermarket/hypermarket segment register the highest market share in 2020 of the global protein powder market owing to the Walmart and other major stores in the United States are investing in private label protein variations to encourage the sale of protein goods. However, due to significant competition from other distribution channels such as online stores and direct-to-consumer (DTC) channels, the retail sale of protein products is expected to expand at a slower rate over the projected period.

The online segment is anticipated to register a significant growth rate over the forecast period for the global protein powder market in 2020 owing to the increased use of the internet for purchasing, shorter lead times, greater convenience, and more discounts are all pushing protein powder sales through online businesses.

Get more details on this report -

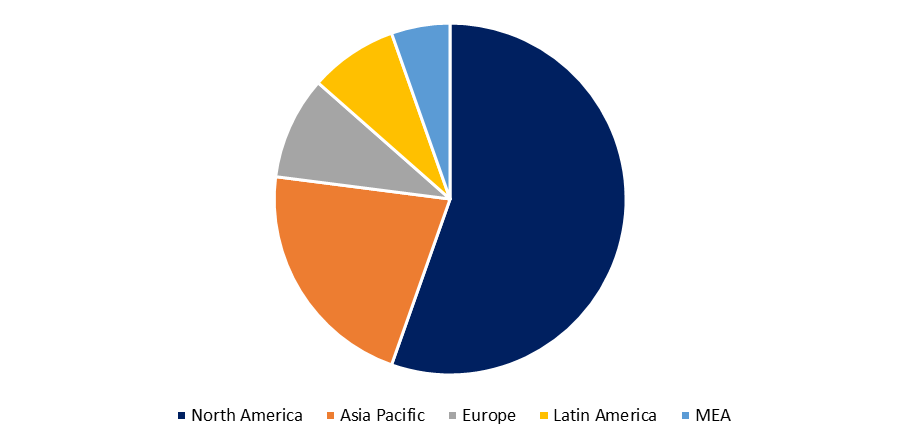

Regional Outlook

North America dominated largest market share for the global protein powder market in 2020 owing to the industry's growth is predicted to be aided by increased customer awareness of health and wellness, as well as knowledge of product benefits. In 2021, Europe was the second-largest regional market, and it is predicted to increase significantly throughout the projection period. Protein supplement demand is likely to rise in the region as people place a greater emphasis on living a healthy lifestyle and have more discretionary income.

Asia Pacific is anticipated to emerge as the fastest-growing region over the forecast period. This is due to the modernization and the rising desire for on-the-go snacking options in growing economies like China and India are driving product demand in the region. Over the projected period, the protein powders industry in Asia Pacific is expected to be driven by changing consumer lifestyles as a result of rising disposable income.

Key Companies & Recent Developments

Partnerships, strategic mergers, and acquisitions are expected to be the most successful strategies for industry participants to get speedy access to growing markets while also improving technological capabilities. For example, In 2018, Glanbia introduced BevEdge technology, which allows manufacturers to eliminate lecithin from their products. Whey, milk, casein, and pea are just a few examples of animal and plant-based products that can benefit from this technology. in July 2019, Nestlé and Corbion signed a cooperative development agreement to assist create algae-based products that are high in vitamins and protein.

In addition, product differentiation and developments, as well as service expansion, are projected to help organizations thrive in the market. For instance, in 2021, Pownut launched 3 varieties of Homegrown Protein Supplements for men, women and children. In April 2022, NutraBox launched plant protein powder with 100% natural constituents in India.

Market Segmentation of Global Protein Supplement Market

By Source

- Animal-based

- Plant-based

By Product

- Protein Powder

- Ready-to-Drink

- Protein Bars

- Others

By Application

- Sports Nutrition

- Functional Food

By Distribution Channel

- Supermarket/Hypermarket

- Online

- Drugstore

- Nutrition & Health Food Store

- Others

Key Players:

- ABH Pharma Inc

- Amway

- Herbalife International of America, Inc

- Abbott

- Glanbia Group

- Makers Nutrition

- GlaxoSmithKline

- GNC Holdings

- Vitaco Health

- Living Inc

- Omega Protein

- Atlantic Multipower UK Limited

- Melaleuca Inc

- Dalblads

Need help to buy this report?