Global Puddings Market Size, Share, and COVID-19 Impact Analysis, By Type (Sweet Pudding, Savory Pudding, Frozen Pudding, Instant Pudding, and Others), By Flavor (Chocolate, Vanilla, Fruit, Caramel, and Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Independent Retailers, Online Sales, Specialty Stores, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Food & BeveragesGlobal Puddings Market Insights Forecasts to 2033

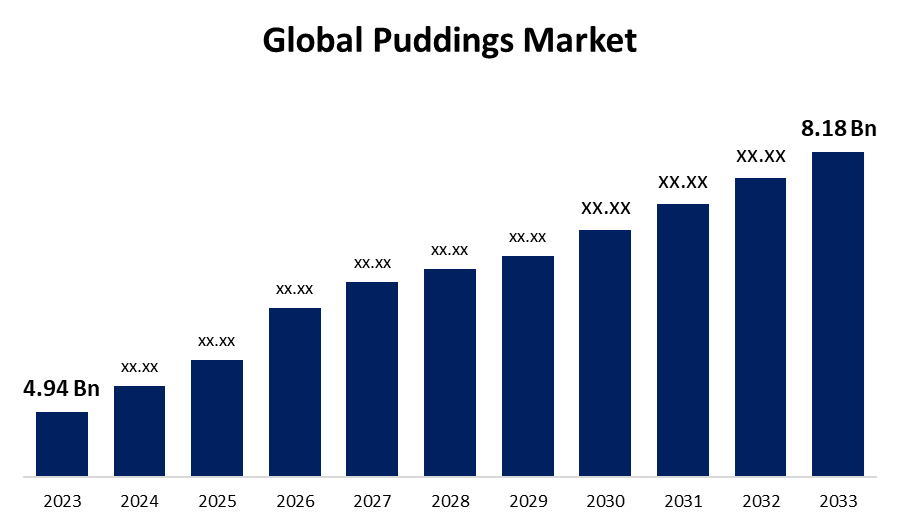

- The Global Puddings Market Size was Estimated at USD 4.94 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 5.17% from 2023 to 2033

- The Worldwide Puddings Market Size is Expected to Reach USD 8.18 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global puddings Market Size was worth around USD 4.94 Billion in 2023 and is predicted to Grow to around USD 8.18 Billion by 2033 with a compound annual Growth rate (CAGR) of 5.17% between 2023 and 2033. The Growth of the Puddings Market is driven by rising consumer demand for indulgent and convenient desserts, Growing disposable incomes, increasing popularity of premium and health-oriented variants, flavour and packaging innovations, and the increasing availability of ready-to-eat and instant pudding products across retail channels.

Market Overview

The "pudding market" is the portion of the food business that is involved in the manufacture, distribution, and sale of pudding foods. The desserts are usually sweet, creamy, and prepared from ingredients such as milk, sugar, eggs, and flavourings. The market encompasses a broad variety of products, ranging from classic puddings to instant, ready-to-eat, and health-oriented varieties such as sugar-free or plant-based puddings. The shift towards snacking over regular meals has raised the demand for easy and indulgent desserts such as puddings. Puddings are not only gaining popularity as desserts but also as snacks to be consumed on the move, particularly among professionals and students seeking quick indulgence during breaks between meals. Additionally, the market for puddings is transforming with emerging taste profiles and innovative ingredients. Producers are trying new exotic flavors like salted caramel, matcha, and tropical fruits, as well as adding functional ingredients like probiotics or plant-based proteins. These innovations keep the market new and interesting, appealing to various tastes and preferences.

Report Coverage

This research report categorizes the puddings market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the puddings market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the puddings market.

Global Puddings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.94 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.17% |

| 2033 Value Projection: | USD 8.18 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Flavour, By Distribution Channel and By Region |

| Companies covered:: | Alchem, Alkaloids Corporation, C2 Pharma, Vital Labs, Amgen Inc., Bayer AG, Teva Pharmaceutical Industries Ltd., Sanofi S.A., GlaxoSmithKline plc, Zydus Cadila, Mylan N.V., Pfizer Inc., AstraZeneca plc, and and Sun Pharmaceutical Laboratories Ltd and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Customers are increasingly demanding convenient foods. Puddings, particularly instant and ready-to-eat types, are ideal for busy lifestyles. They have low preparation time, making them a desirable product for individuals requiring quick and simple desserts, leading to the demand for the pudding market. Additionally, to meet evolving consumer preferences, companies are continuously launching new tastes and innovative types of puddings. Exotic ingredients, seasonal flavours, and novel textures entice a larger customer base, generating buzz and feuling market demand.

Restraining Factors

Classic puddings, particularly those with high fat and sugar content, are criticized as they contribute to health complications such as obesity, diabetes, and heart disease. Such products may be avoided by health-oriented consumers, thus reducing their market demand. Additionally, puddings, especially fresh or homemade pudding, tend to have a shorter shelf life when baked or processed, unlike other dessert products. This may restrict distribution channels as well as hike prices for producers, particularly for pudding that has to be refrigerated to keep it fresh.

Market Segmentation

The puddings market share is classified into type, flavor, and distribution channel.

- The sweet pudding segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the puddings market is divided into sweet pudding, savory pudding, frozen pudding, instant pudding, and others. Among these,the sweet pudding segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed to sweet puddings, like chocolate, vanilla, and caramel puddings, which are the most widely sought-after worldwide. They meet the universal need for rich, dessert-like foods, so they are the first choice for the majority of consumers. Sweet puddings are easily tailored with various flavors, toppings, and ingredients, so they suit a broad variety of taste preferences.

- The chocolate segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the flavour, the puddings market is divided into chocolate, vanilla, fruit, caramel, and others. Among these, the chocolate segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is due to chocolate being among the world's favourite flavours. Chocolate has a rich, decadent flavor that has mass appeal and hence is the first choice for numerous consumers who crave a comfort dessert that will leave them satisfied. Chocolate is more than just a flavour; it is a cultural icon in desserts. Due to this fact, chocolate pudding is well ingrained in many cuisines, also contributing to its popularity.

- The supermarkets/hypermarkets segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the puddings market is divided into supermarkets/hypermarkets, convenience stores, independent retailers, online sales, specialty stores, and others. Among these, the supermarkets/hypermarkets segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The growth is driven by hypermarkets and supermarkets provide a wide range of pudding products, ranging from various brands, sizes, and flavors. This extensive variety caters to the varying tastes of customers, making such shopping centers very attractive to consumers.

Regional Segment Analysis of the Puddings Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the puddings market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the puddings market over the predicted timeframe. North America, and more specifically the United States, has the largest portion of the world's pudding market because it has a well-established consumer base for pudding products. Puddings, particularly in well-known flavours such as chocolate and vanilla, have been a household staple in America for decades. The area is home to some of the largest and most well-known pudding brands, such as Jell-O, which have a strong history and brand recognition. These brands are predominantly found on store shelves, rendering them highly available to customers.

Asia Pacific is expected to grow at a rapid CAGR in the puddings market during the forecast period. Western-type desserts such as puddings are becoming common in cities across Asia. Multinational brands are entering the markets there and local companies are changing their strategies to match evolving tastes by presenting a blend of traditional and Western-type puddings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the puddings market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PC Pudding

- Dr. Oetker

- Kozy Shack

- Jell-O

- Ensure

- Snack Pack

- Hannaford

- Sara Lee

- Great Value

- Royal

- Cafe Classics

- Trader Joe’s

- Safeway

- Simply Delish

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2024, Ella's Kitchen launched a new and enhanced "Perfect Puddings" range, including Apple and Cinnamon Crumble and Strawberry and Blackcurrant Summer Pudding. The new packaging features 'easy to open' pots to support toddlers' independence.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the puddings market based on the below-mentioned segments:

Global Puddings Market, By Type

- Sweet Pudding

- Savory Pudding

- Frozen Pudding

- Instant Pudding

- Others

Global Puddings Market, By Flavor

- Chocolate

- Vanilla

- Fruit

- Caramel

- Others

Global Puddings Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Independent Retailers

- Online Sales

- Specialty Stores

- Others

Global Puddings Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the puddings market over the forecast period?The global puddings market is projected to expand at a CAGR of 5.17% during the forecast period.

-

2. What is the market size of the puddings market?The global puddings market size is expected to grow from USD 4.94 Billion in 2023 to USD 8.18 Billion by 2033, at a CAGR of 5.17% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the puddings market?North America is anticipated to hold the largest share of the puddings market over the predicted timeframe.

Need help to buy this report?