Global Pultrusion Market Size, Share, and COVID-19 Impact Analysis, By Fiber (Glass, Carbon, Aramid), By Resin (Polyester, Epoxy, Polyurethane, Vinyl Ester), By End-Use (Industrial, Housing, Power & Energy, Consumer, Civil Engineering, Automotive, Aerospace), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Pultrusion Market Insights Forecasts to 2033

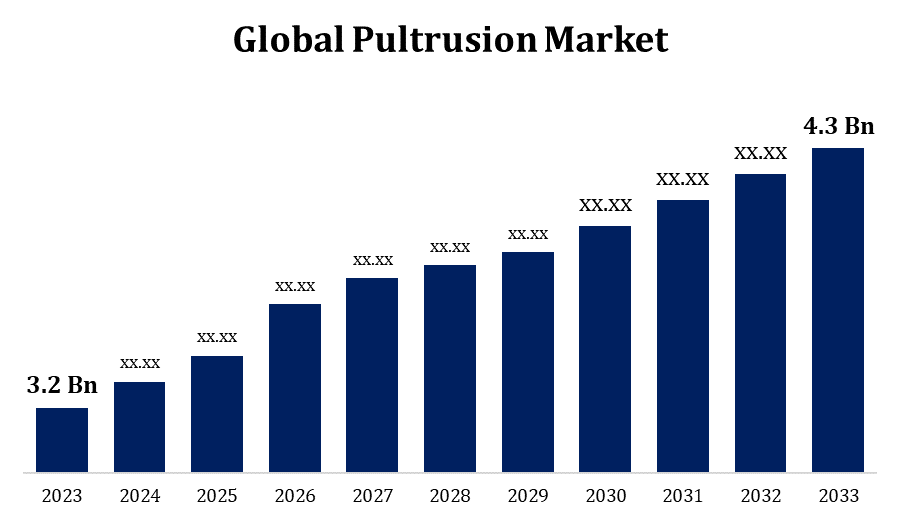

- The Pultrusion Market Size was valued at USD 3.2 Billion in 2023.

- The Market Size is growing at a CAGR of 3.00% from 2023 to 2033.

- The Global Pultrusion Market Size is expected to reach USD 4.3 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Pultrusion Market Size is expected to reach USD 4.3 billion by 2033, at a CAGR of 3.00% during the forecast period 2023 to 2033.

The pultrusion market is experiencing steady growth, driven by increasing demand for lightweight, durable, and corrosion-resistant materials across various industries. Pultrusion is a cost-effective manufacturing process for producing composite materials with consistent quality and high strength-to-weight ratios. Key applications include construction, automotive, electrical, and aerospace sectors, where the need for advanced materials is growing. The construction industry, in particular, is leveraging pultruded profiles for infrastructure development due to their low maintenance and longevity. Innovations in resin technology and reinforcement fibers are further enhancing the versatility and performance of pultruded products. Additionally, the rising focus on sustainability is propelling the adoption of composites as eco-friendly alternatives to traditional materials. However, high initial costs and limited awareness in some regions pose challenges to market expansion.

Pultrusion Market Value Chain Analysis

The pultrusion market value chain encompasses raw material suppliers, pultrusion process manufacturers, distributors, and end-users. It begins with raw material suppliers providing resins, fibers, and reinforcements like glass, carbon, or aramid fibers. These materials are then processed by pultrusion manufacturers, where the continuous pulling technique creates high-strength composite profiles. Equipment providers play a critical role by supplying advanced machinery and automation technologies to enhance efficiency and precision. Distributors and wholesalers form the next link, ensuring the timely delivery of pultruded products to diverse industries such as construction, automotive, and aerospace. Finally, end-users integrate these profiles into applications like structural components, panels, and insulation. Collaboration between stakeholders, including innovation in raw materials and manufacturing techniques, drives value addition across the chain.

Pultrusion Market Opportunity Analysis

The pultrusion market presents significant growth opportunities driven by rising demand for lightweight, durable, and corrosion-resistant materials across industries. The construction sector offers vast potential as infrastructure projects increasingly adopt pultruded composites for their strength, low maintenance, and longevity. Automotive and aerospace industries are also key growth areas, focusing on weight reduction to enhance fuel efficiency and meet stringent emission standards. The renewable energy sector, particularly wind energy, creates opportunities for pultruded components in turbine blades and support structures. Innovations in resin systems, such as bio-based or recyclable options, align with the growing emphasis on sustainability, unlocking further market potential. Additionally, expanding awareness in emerging markets and advancements in automation for cost-effective production open avenues for increased adoption of pultrusion technology globally.

Global Pultrusion Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.00% |

| 2033 Value Projection: | 4.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 239 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Fiber, By Resin, By Region |

| Companies covered:: | Excel Composites, Bedford Reinforced Plastics, Jiangsu Amer New Material Co Ltd, Strong well corporation, Creative Composites Group, Fibrolux GmbH Inc, JAMCO Corporation, Fibergrate Composite Structure, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Pultrusion Market Dynamics

Expanding application potential in civil engineering, residential construction, and the automotive sector

The pultrusion market is witnessing expanding application potential across civil engineering, residential construction, and the automotive sector, driven by the need for high-performance, lightweight, and durable materials. In civil engineering, pultruded composites are increasingly utilized in bridges, walkways, and structural reinforcements due to their exceptional strength, corrosion resistance, and low maintenance requirements. The housing sector benefits from pultruded products in doors, window frames, and roofing systems, offering enhanced thermal insulation and longevity. Meanwhile, the automotive industry leverages pultruded components to reduce vehicle weight, improving fuel efficiency and meeting stricter emission standards. The versatility of pultrusion technology allows for the customization of profiles to meet specific industry demands, further broadening its applications. These trends underscore the growing relevance of pultrusion in these vital sectors.

Restraints & Challenges

High initial costs associated with machinery and tooling often deter small-scale manufacturers from entering the market. Additionally, the complex production process requires skilled labor, which may not be readily available in all regions. Limited awareness about pultrusion and its benefits, particularly in developing economies, hinders market penetration. The market also encounters competition from traditional materials like steel and aluminum, which are well-established and widely understood by industries. Regulatory constraints related to the use of certain resins and environmental concerns regarding non-recyclable composites further pose challenges. Moreover, achieving uniformity in quality during large-scale production can be technically demanding. Addressing these issues through innovation, cost-effective technologies, and awareness campaigns is crucial for overcoming these obstacles.

Regional Forecasts

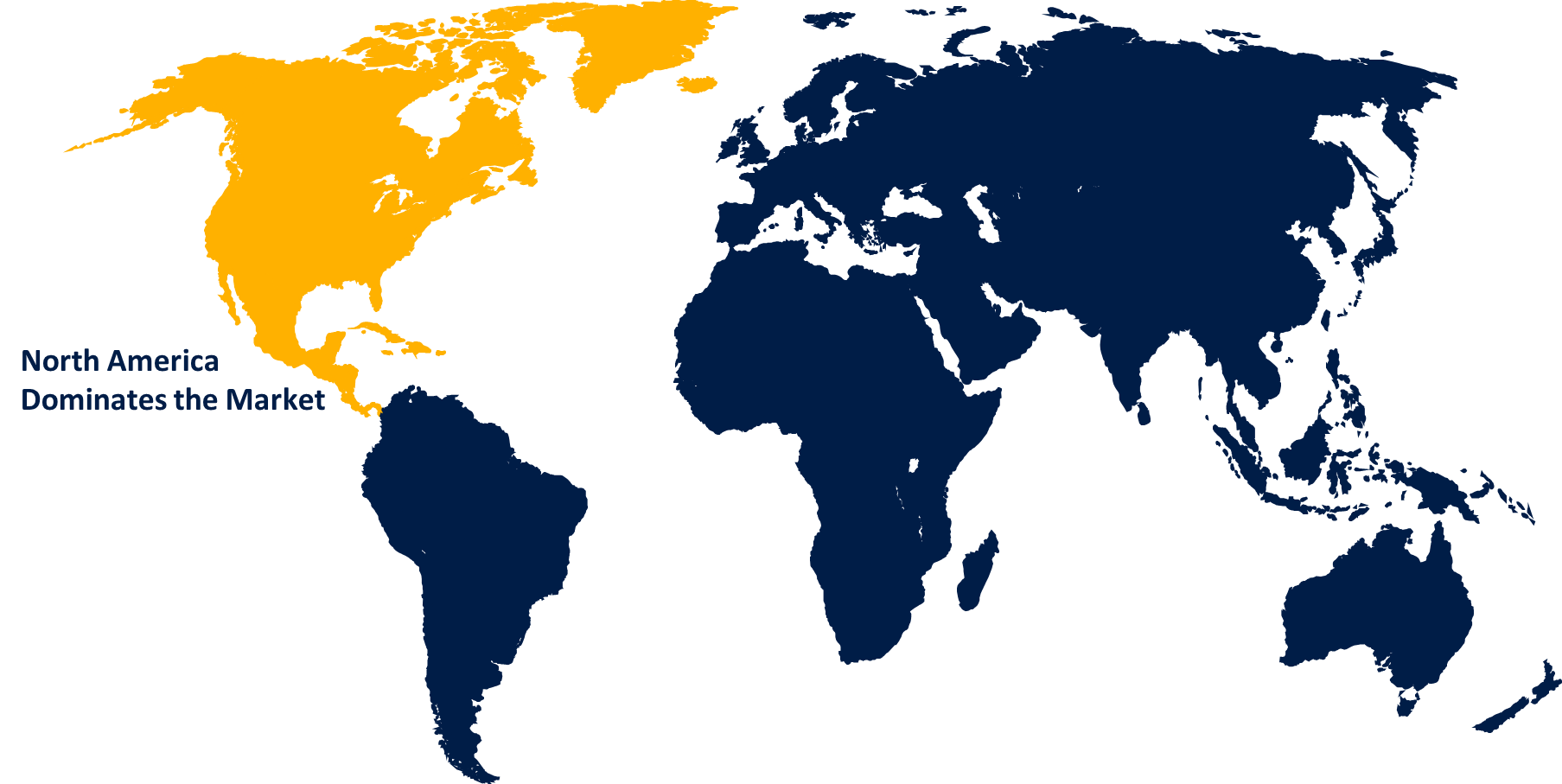

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Pultrusion Market from 2023 to 2033. The region's well-established infrastructure development projects increasingly utilize pultruded composites for their strength, durability, and corrosion resistance, particularly in bridges, walkways, and utility poles. In the automotive sector, manufacturers are adopting pultruded components to enhance fuel efficiency and meet stringent emission regulations. Aerospace applications also show strong demand for lightweight, high-performance materials. The presence of key industry players and access to advanced manufacturing technologies further bolster the market. Additionally, North America's focus on sustainability is fostering the use of eco-friendly resin systems and recyclable composites. However, challenges such as high initial costs and competition from traditional materials persist, requiring continuous innovation and market education to sustain growth.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The automotive industry in the region is also embracing pultruded composites for weight reduction and improved fuel efficiency. Growing investments in renewable energy, particularly in wind power, are further boosting the demand for pultruded components like turbine blades and support structures. Additionally, advancements in manufacturing technologies and cost-effective production make pultrusion an attractive solution for various industries. However, challenges such as limited awareness of composite benefits and competition from traditional materials require focused efforts in education and market penetration strategies to unlock the region's full potential.

Segmentation Analysis

Insights by Fiber

The glass fiber segment accounted for the largest market share over the forecast period 2023 to 2033. Glass fibers offer high strength-to-weight ratios, corrosion resistance, and thermal stability, making them ideal for diverse applications across industries. In construction, glass fiber-reinforced composites are widely used in bridges, railings, and structural reinforcements for their durability and low maintenance. The automotive sector benefits from glass fiber composites to achieve lightweight components that enhance fuel efficiency and reduce emissions. Additionally, the renewable energy sector, especially wind power, is adopting glass fiber-reinforced pultruded profiles for turbine blades and structural elements. Innovations in glass fiber formulations and compatibility with advanced resin systems further expand their application scope, solidifying their role as a dominant material in the pultrusion market.

Insights by Resin

The polyester segment accounted for the largest market share over the forecast period 2023 to 2033. Polyester resins, particularly unsaturated polyesters, are widely used in pultrusion for their strength, corrosion resistance, and compatibility with reinforcement materials like glass fibers. Their affordability makes them a preferred choice across industries such as construction, automotive, and electrical. In construction, polyester-based composites are used for structural profiles, gratings, and utility poles due to their durability and resistance to harsh environmental conditions. The automotive sector leverages polyester pultruded components for lightweighting applications, improving vehicle efficiency. Innovations in resin formulations, including improved thermal stability and fire retardancy, are further enhancing the performance and scope of polyester resins, driving their growth in the pultrusion market.

Insights by End Use

The industrial segment accounted for the largest market share over the forecast period 2023 to 2033. Pultruded composites are gaining traction in industries such as manufacturing, electrical, and utilities, where components like structural beams, frames, and electrical enclosures benefit from the superior mechanical properties and weather resistance of composites. The industrial sector’s need for high-performance materials that reduce maintenance costs and extend product lifecycles is driving the adoption of pultruded profiles. Additionally, the growing focus on sustainability is promoting the use of eco-friendly composite materials. As automation and production technologies improve, the industrial segment continues to expand, with pultrusion offering cost-effective solutions for diverse applications, including machinery, piping, and industrial equipment components.

Recent Market Developments

- In Nov 2021, Strongwell Corporation has unveiled a new product called Strongirt, designed specifically for the commercial construction industry.

Competitive Landscape

Major players in the market

- Excel Composites

- Bedford Reinforced Plastics

- Jiangsu Amer New Material Co Ltd

- Strong well corporation

- Creative Composites Group

- Fibrolux GmbH Inc

- JAMCO Corporation

- Fibergrate Composite Structure

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Pultrusion Market, Fiber Analysis

- Glass

- Carbon

- Aramid

Pultrusion Market, Resin Analysis

- Polyester

- Epoxy

- Polyurethane

- Vinyl Ester

Pultrusion Market, End Use Analysis

- Industrial

- Housing

- Power & Energy

- Consumer

- Civil Engineering

- Automotive

- Aerospace

Pultrusion Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Pultrusion Market?The global Pultrusion Market is expected to grow from USD 3.2 billion in 2023 to USD 4.3 billion by 2033, at a CAGR of 3.00% during the forecast period 2023-2033.

-

2. Who are the key market players of the Pultrusion Market?Some of the key market players of the market are Excel Composites, Bedford Reinforced Plastics, Jiangsu Amer New Material Co Ltd, Strong well corporation, Creative Composites Group, Fibrolux GmbH Inc, JAMCO Corporation, Fibergrate Composite Structure.

-

3. Which segment holds the largest market share?The industrial segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Pultrusion Market?North America dominates the Pultrusion Market and has the highest market share.

Need help to buy this report?