Global Purified Terephthalic Acid (PTA) Market Size, Share, and COVID-19 Impact Analysis, By Application (Polyester, Polybutylene Terephthalate, Plasticizers), By End User (Textile, Bottling & Packaging, Home Furnishing), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal Purified Terephthalic Acid (PTA) Market Insights Forecasts to 2033

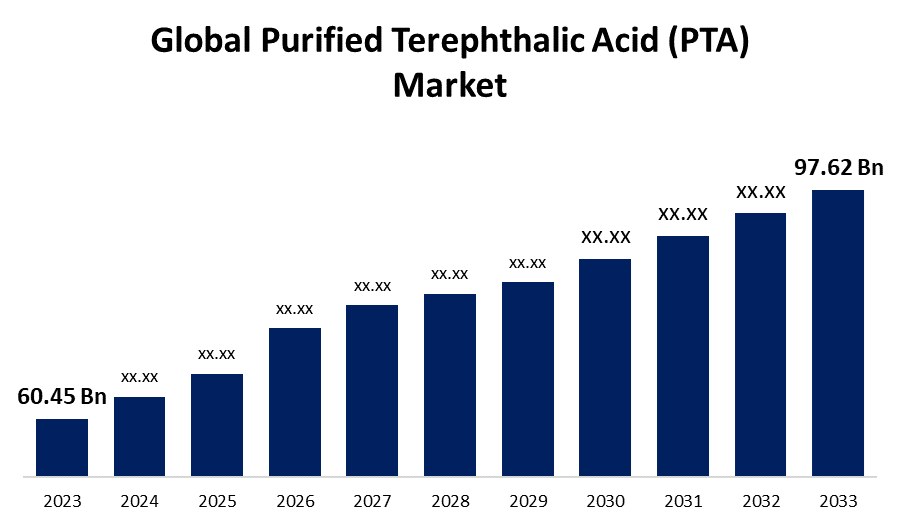

- The Global Purified Terephthalic Acid (PTA) Market Size was Valued at USD 60.45 Billion in 2023

- The Market Size is Growing at a CAGR of 4.91% from 2023 to 2033

- The Worldwide Purified Terephthalic Acid (PTA) Market Size is Expected to Reach USD 97.62 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Purified Terephthalic Acid (PTA) Market Size is Anticipated to Exceed USD 97.62 Billion by 2033, Growing at a CAGR of 4.91% from 2023 to 2033.

Market Overview

The production of polyester-coated resins for automotive components, coil coatings, industrial maintenance, and general metal processing requires the use of purified terephthalic acid (PTA). This material is utilized in the automotive industry for coating automobile parts. Purified terephthalic acid's (PTA) main advantages include its ability to remove greasy stains, clay, and dirt from surfaces. An organic substance known as purified terephthalic acid (PTA) is created commercially by oxidizing paraxylene with atmospheric oxygen. The majority of PTA is used in the production of polyester resins, which are used to make PET material bottles, polyester films, polyester fiber, and yarn. In the production of plasticizers, copolyester ether elastomers, cyclohexane dimethanol, terephthaloyl chloride, polybutylene terephthalate, and other materials, PTA is also working as an intermediary. PTA-produced polyesters find application in a range of industries, including packaging and textiles. The market for purified terephthalic acid (PTA) is anticipated to expand quickly due to the growing demand for PTA in a variety of applications. The market for purified terephthalic acid is made up of a diverse ecosystem of downstream stakeholders, vendors, and government agencies, as well as upstream participants such as suppliers of raw materials.

Report Coverage

This research report categorizes the market for the global purified terephthalic acid (PTA) market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global purified terephthalic acid (PTA) market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global purified terephthalic acid (PTA) market.

Global Purified Terephthalic Acid (PTA) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 60.45 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.91% |

| 2033 Value Projection: | USD 97.62 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By End User, By Region |

| Companies covered:: | Indorama Ventures, Samyang Corporation, Indian Oil Corporation, BP (British Petroleum), Samsung Petrochemical Co. Ltd, Formosa Plastics Group, Reliance Industries Limited, Sinopec Yizheng Chemical Fibre Company, Mitsui Chemicals, Eastman Chemical Company, DuPont, Alfa Group, Mitsubishi Chemical Corporation, SABIC, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The purified terephthalic acid (PTA) market is being driven by an increase in demand for PTA because of its toughness and flexibility in the production of carbonated plastic bottles. Because of its dimensional stability and toughness, polyester films are made using purified terephthalic acid (PTA) as a raw material. Purified terephthalic acid (PTA) demand is anticipated to rise due to an increase in the use of these films in data storage tapes and sheets and photographic films. The purified terephthalic acid (PTA) market is anticipated to be driven by an increase in demand from the food and beverage and pharmaceutical packaging industries.

Restraining Factors

The fluctuating prices of raw materials, especially about para-xylene. Environmental issues related to the manufacture and disposal of items made of polyester.

Market Segmentation

The global purified terephthalic acid (PTA) market share is classified into application and end-user.

- The polyester segment dominates the market with the largest market share through the forecast period.

Based on the application, the global purified terephthalic acid (PTA) market is categorized into polyester, polybutylene terephthalate, and plasticizers. Among these, the polyester segment dominates the market with the largest market share through the forecast period. Three types are present for polyester film grade, fiber and yarn grade, and Polyethylene Terephthalate (PET) grade. PET polymers, polyester fibers, and packaging films are made with it. Food and beverage items like chips, pickles, jams, fruit juices, and soft beverages are packaged using PET resins. PET is taking the place of more conventional packaging materials like glass, paper, metal, and aluminum because of its many advantages, which include increased strength, low weight, enhanced clarity, extended durability, and more design flexibility.

- The bottling & packaging segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the end user, the global purified terephthalic acid (PTA) market is categorized as textile, bottling & packaging, and home furnishing. Among these, the bottling & packaging segment is anticipated to grow at the fastest CAGR growth through the forecast period. Packaging increases the product's shelf life, adds aesthetic value, and offers protection. It is anticipated that the packaging market will find new opportunities due to the growing demand for products for personal care brought on by the launch of sophisticated products and the development of formulations for target consumer groups. Throughout the projected period, there will likely be an increase in demand for PET bottling and packaging due to its many sizes and shapes, flexibility, and affordability for consumption while traveling.

Regional Segment Analysis of the Global Purified Terephthalic Acid (PTA) Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global purified terephthalic acid (PTA) market over the predicted timeframe.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global purified terephthalic acid (PTA) market over the predicted timeframe. The packaging and paints and coatings industries will see significant growth due to growing foreign investments and an aging population. The increasing processed foods industry in India is expected to produce a huge market because of the growing demand for Indian brands like MTR ready-to-eat foodstuff, Bikanervala Foods, and "ITC's Kitchens of India" in retail outlets. In India, the Ministry of Food Processing declared that 42 food processing parks would be created immediately. Therefore, it is anticipated that shortly, market demand will be fueled by regulatory support meant to promote India's food processing production.

North America is expected to grow at the fastest CAGR growth of the global purified terephthalic acid (PTA) market during the forecast period. The area's continued industrialization and urbanization trends, together with the growing demand for PTA in the packaging and textile industries, are the main factors propelling the market's revenue growth. Furthermore, the United States purified terephthalic acid market was increasing at the fastest rate in the North American area, while Mexico's pure terephthalic acid market held the biggest market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global purified terephthalic acid (PTA) market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Indorama Ventures

- Samyang Corporation

- Indian Oil Corporation

- BP (British Petroleum)

- Samsung Petrochemical Co. Ltd

- Formosa Plastics Group

- Reliance Industries Limited

- Sinopec Yizheng Chemical Fibre Company

- Mitsui Chemicals

- Eastman Chemical Company

- DuPont

- Alfa Group

- Mitsubishi Chemical Corporation

- SABIC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, China’s Sinopec Yizheng Chemical Fiber Company commissioned the world’s largest purified terephthalic acid plant. It has a 3-million-ton annual production capacity.

- In October 2023, GAIL (India) acquired a 1.25 MMTPA purified terephthalic acid plant of JBF Petrochemical Ltd. It was renamed as GAIL Mangalore Petrochemicals Ltd., a wholly-owned subsidiary of GAIL.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global purified terephthalic acid (PTA) market based on the below-mentioned segments:

Global Purified Terephthalic Acid (PTA) Market, By Application

- Polyester

- Polybutylene

- Terephthalate

- Plasticizers

Global Purified Terephthalic Acid (PTA) Market, By End User

- Textile

- Bottling & Packaging

- Home Furnishing

Global Purified Terephthalic Acid (PTA) Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which are the key companies that are currently operating within the market?Indorama Ventures, Samyang Corporation, Indian Oil Corporation, BP (British Petroleum), Samsung Petrochemical Co. Ltd, Formosa Plastics Group, Reliance Industries Limited, Sinopec Yizheng Chemical Fibre Company, Mitsui Chemicals, Eastman Chemical Company, DuPont, Alfa Group, Mitsubishi Chemical Corporation, SABIC, and Others

-

2.What is the size of the global purified terephthalic acid (PTA) market?The Global Purified Terephthalic Acid (PTA) Market Size is Expected to Grow from USD 60.45 Billion in 2023 to USD 97.62 Billion by 2033, at a CAGR of 4.91% during the forecast period 2023-2033.

-

3.Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global purified terephthalic acid (PTA) market over the predicted timeframe.

Need help to buy this report?