Global PVDF Membrane Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Hydrophilic PVDF Membrane, Hydrophobic PVDF Membrane), By Technology (Microfiltration (MF) PVDF Membrane, Ultrafiltration (UF) PVDF Membrane, Nanofiltration (NF) PVDF Membrane), By End-use (Pharmaceutical and Biotechnology, Food and Beverage, Electronics and Semiconductor, Water and Wastewater Treatment, Chemical Processing, Oil & Gas, Automotive), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal PVDF Membrane Market Insights Forecasts to 2033

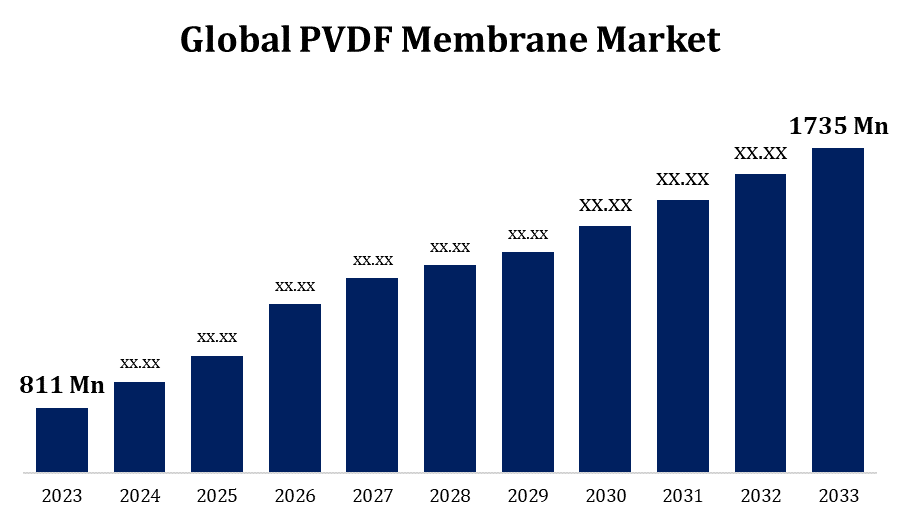

- The PVDF Membrane Market Size was valued at USD 811 Million in 2023.

- The Market Size is growing at a CAGR of 7.90% from 2023 to 2033.

- The Global PVDF Membrane Market Size is expected to reach USD 1735 Million by 2033.

- Asia Pacific is expected to Grow the fastest during the Forecast period.

Get more details on this report -

The Global PVDF Membrane Market Size is expected to reach USD 1735 Million By 2033, at a CAGR of 7.90% during the forecast period 2023 to 2033.

The PVDF (Polyvinylidene Fluoride) membrane market is witnessing significant growth due to its wide applications in industries such as water treatment, pharmaceuticals, and food processing. PVDF membranes are valued for their chemical resistance, mechanical strength, and durability, making them ideal for filtration and separation processes. These membranes are primarily used in ultrafiltration, microfiltration, and reverse osmosis systems, which are essential in ensuring the purity of liquids and gases. The increasing demand for clean water and stringent regulations in wastewater treatment are major factors driving market expansion. Additionally, advancements in membrane technology and the growing adoption of PVDF in biotechnology and healthcare sectors further contribute to the market's upward trajectory. As industries seek more sustainable solutions, the PVDF membrane market is expected to continue expanding in the coming years.

PVDF Membrane Market Value Chain Analysis

The PVDF membrane market value chain involves several key stages, from raw material sourcing to end-user applications. The process begins with the procurement of Polyvinylidene Fluoride resin, which is then processed into membrane products by manufacturers. These membranes undergo various fabrication techniques like casting, stretching, and coating to enhance performance. Once produced, PVDF membranes are distributed through wholesalers and suppliers to various industries, including water treatment, pharmaceuticals, and food processing. End-users, such as municipalities, pharmaceutical companies, and food & beverage manufacturers, employ these membranes for filtration and separation purposes. After the membranes reach their lifecycle's end, they are often recycled or disposed of according to environmental regulations. The entire value chain is influenced by technological advancements, regulatory standards, and market demand for clean and sustainable solutions.

PVDF Membrane Market Opportunity Analysis

The PVDF membrane market presents substantial growth opportunities driven by increasing demand for advanced filtration technologies across various industries. The growing focus on water treatment, both municipal and industrial, offers a major opportunity, as PVDF membranes provide high performance in filtration, desalination, and wastewater treatment. The rising need for clean water, coupled with strict environmental regulations, boosts the demand for efficient filtration solutions. In the healthcare and pharmaceutical sectors, PVDF membranes are essential for applications like drug purification and bioprocessing, creating further growth potential. Additionally, the food and beverage industry seeks high-quality filtration methods for product safety and consistency. With continuous advancements in PVDF membrane technology, such as improved efficiency and cost-effectiveness, the market is poised to expand, offering significant opportunities for manufacturers and suppliers.

PVDF Membrane Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 811 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.90% |

| 2033 Value Projection: | USD 1735 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 138 |

| Segments covered: | By Material Type, By Technology, By End-use, By Region |

| Companies covered:: | 3M, Arkema, Hyundai Micro Co LTD, Cobetter Filtration Equipment Co Ltd, CITIC Envirotech Ltd, Synder Filtration Inc, Daikin Industries Ltd, Solvay S.A, Shanghai Sanai Fu New Material Co., Ltd., Kureha Corporation, Ofluorine Chemical Technology Co., Ltd., Zhejiang Fotech International Co., Ltd., Zhuzhou Hongda Polymer Materials Co., Ltd., GVS SpA, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

PVDF Membrane Market Dynamics

Growth of the Nutraceuticals and Pharmaceuticals Sector

In the pharmaceutical industry, PVDF membranes are essential for drug purification, sterilization, and bioprocessing, ensuring high-quality, contaminant-free products. As regulatory standards become stricter, the demand for efficient filtration systems, particularly for the production of biologics and vaccines, grows. In the nutraceutical sector, PVDF membranes are used for filtering and concentrating active ingredients from natural sources, enhancing product safety and effectiveness. Both sectors' focus on precision, quality, and compliance with health standards drives the adoption of PVDF membranes. The growing emphasis on personalized medicine, biopharmaceuticals, and functional foods further supports market expansion in these high-demand industries, ensuring long-term growth prospects.

Restraints & Challenges

The cost of raw materials, especially high-quality Polyvinylidene Fluoride resin, can be expensive, which may hinder affordability and market accessibility, particularly in emerging economies. Additionally, the manufacturing process involves sophisticated technology, requiring significant investment in research and development, which can limit entry for small players. Another challenge is membrane fouling, where contaminants accumulate on the membrane surface, reducing efficiency and increasing maintenance costs. Environmental concerns also arise, as the disposal or recycling of used membranes is often complex and costly. Lastly, competition from alternative filtration materials, such as ceramic or cellulose-based membranes, may limit market growth. Overcoming these challenges requires continuous innovation, cost reduction, and improved sustainability in membrane technologies.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the PVDF Membrane Market from 2023 to 2033. The region's strict environmental regulations and focus on sustainable solutions fuel the adoption of advanced filtration technologies, such as PVDF membranes, for wastewater treatment and desalination. In the pharmaceutical industry, the need for high-quality filtration in drug production, bioprocessing, and vaccine manufacturing further accelerates market demand. Additionally, the growing focus on clean water access and the advancement of industrial applications in North America promote the use of PVDF membranes in various sectors. The presence of key manufacturers and significant investments in research and development contribute to the region's market expansion. As industries adopt more sophisticated filtration methods, North America remains a dominant player in the PVDF membrane market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China and Japan are key contributors to market growth due to their large-scale water treatment needs, particularly in urban and industrial sectors. The rising pharmaceutical and food processing industries in the region also create strong demand for PVDF membranes in drug purification, bioprocessing, and food safety applications. Additionally, the growing emphasis on sustainable solutions and environmental regulations is prompting greater adoption of PVDF membranes in wastewater treatment and desalination projects. Increased investments in infrastructure development and technological advancements are further boosting the market. As a result, the Asia Pacific region is expected to remain a major driver of global PVDF membrane market growth.

Segmentation Analysis

Insights by Material Type

The hydrophilic PVDF membrane segment accounted for the largest market share over the forecast period 2023 to 2033. Hydrophilic PVDF membranes offer improved water permeability, reduced fouling, and better resistance to organic and biological contamination, making them ideal for water treatment, pharmaceutical, and food & beverage industries. Their high chemical resistance and mechanical strength ensure reliability in demanding processes such as ultrafiltration and microfiltration. As industries focus on improving efficiency and sustainability, hydrophilic PVDF membranes are becoming increasingly popular for use in wastewater treatment, desalination, and bioprocessing applications. The growing demand for clean water, along with stringent regulatory standards, is accelerating the adoption of hydrophilic PVDF membranes. Moreover, advancements in membrane surface modification technologies are further contributing to the segment's rapid growth and market expansion.

Insights by Technology

The Microfiltration (MF) PVDF Membrane segment accounted for the largest market share over the forecast period 2023 to 2033. MF PVDF membranes are widely used in industries such as water treatment, food and beverage, pharmaceuticals, and biotechnology due to their excellent chemical resistance, mechanical strength, and ease of cleaning. The increasing demand for clean water, coupled with stringent water quality regulations, boosts the adoption of MF PVDF membranes in municipal and industrial water treatment. Additionally, MF membranes play a crucial role in biotechnology and pharmaceutical applications, where they are used for sterilization and filtration of proteins and other biomolecules. As the demand for cost-effective, high-performance filtration solutions grows, the MF PVDF membrane segment is expected to see continued expansion.

Insights by End Use

The water and wastewater treatment segment accounted for the largest market share over the forecast period 2023 to 2033. As global water scarcity and pollution concerns intensify, the demand for efficient filtration technologies like PVDF membranes is on the rise. These membranes offer superior resistance to fouling, chemicals, and high temperatures, making them ideal for use in desalination, wastewater treatment, and reclamation projects. The growing emphasis on sustainable solutions and stricter environmental regulations across industries further accelerates the adoption of PVDF membranes in water treatment. Their ability to provide high filtration performance in challenging conditions, such as municipal and industrial wastewater management, positions PVDF membranes as a preferred choice. As urbanization and industrialization continue, the water and wastewater treatment segment is expected to remain a significant growth area for the PVDF membrane market.

Recent Market Developments

- On May 2022, GVS Filter Technology has acquired 100% of Haemotronic, an Italian group renowned for its advanced filtration solutions used in critical applications.

Competitive Landscape

Major players in the market

- 3M

- Arkema

- Hyundai Micro Co LTD

- Cobetter Filtration Equipment Co Ltd

- CITIC Envirotech Ltd

- Synder Filtration Inc

- Daikin Industries Ltd

- Solvay S.A

- Shanghai Sanai Fu New Material Co., Ltd.

- Kureha Corporation

- Ofluorine Chemical Technology Co., Ltd.

- Zhejiang Fotech International Co., Ltd.

- Zhuzhou Hongda Polymer Materials Co., Ltd.

- GVS SpA

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

PVDF Membrane Market, Material Type Analysis

- Hydrophilic PVDF Membrane

- Hydrophobic PVDF Membrane

PVDF Membrane Market, Technology Analysis

- Microfiltration (MF) PVDF Membrane

- Ultrafiltration (UF) PVDF Membrane

- Nanofiltration (NF) PVDF Membrane

PVDF Membrane Market, End User Analysis

- Pharmaceutical and Biotechnology

- Food and Beverage

- Electronics and Semiconductor

- Water and Wastewater Treatment

- Chemical Processing

- Oil & Gas

- Automotive

PVDF Membrane Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the PVDF Membrane Market?The global PVDF Membrane Market is expected to grow from USD 811 million in 2023 to USD 1735 million by 2033, at a CAGR of 7.90% during the forecast period 2023-2033.

-

2. Who are the key market players of the PVDF Membrane Market?Some of the key market players of the market are 3M, Arkema, Hyundai Micro Co LTD, Cobetter Filtration Equipment Co Ltd, CITIC Envirotech Ltd, Synder Filtration Inc, Daikin Industries Ltd, Solvay S.A, Shanghai Sanai Fu New Material Co., Ltd., Kureha Corporation, Ofluorine Chemical Technology Co., Ltd., Zhejiang Fotech International Co., Ltd., Zhuzhou Hongda Polymer Materials Co., Ltd., and GVS SpA.

-

3. Which segment holds the largest market share?The microfiltration (MF) PVDF Membrane segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the PVDF Membrane Market?North America dominates the PVDF Membrane Market and has the highest market share.

Need help to buy this report?