Global Quantum Technologies in Military Market Size, Share, and COVID-19 Impact Analysis, By Technology (Quantum Computing, Quantum Sensing, Quantum Communication), By Application (Quantum Cybersecurity, Quantum Communication Network, Quantum Positioning, Navigation, and Timing (PNT) System, Quantum Underwater Warfare, Quantum Space Warfare, Others), By End-User(AirForce, Army, and Navy), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Aerospace & DefenseGlobal Quantum Technologies in Military Market Insights Forecasts to 2033

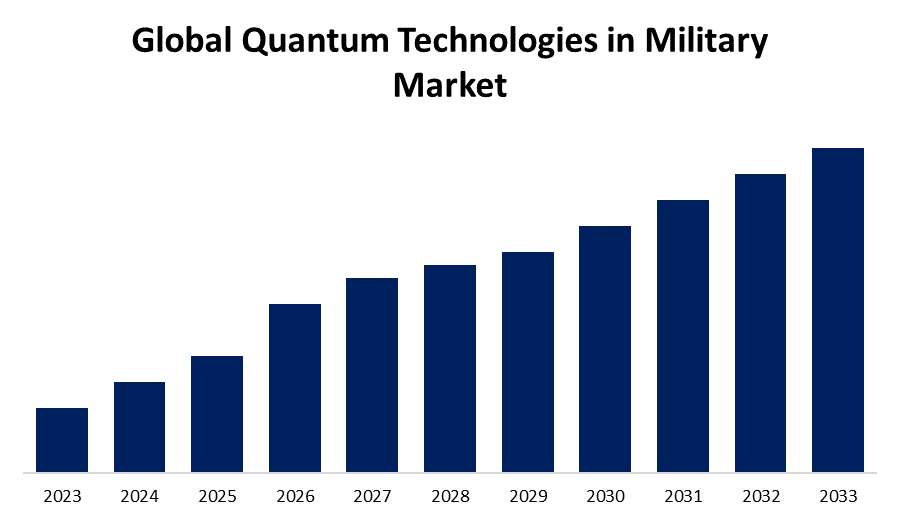

- The Market Size is Growing at a CAGR of 19.2% from 2023 to 2033

- The Worldwide Quantum Technologies in Military Market Size is Anticipated to Hold a Significant Share by 2033

- Aisa Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Quantum Technologies in Military Market Size is Anticipated to Hold a Significant Share by 2033, at 19.2% CAGR from 2023 to 2033.

Market Overview

Quantum technologies in military applications encompass a range of emerging technologies that leverage principles from quantum mechanics to enhance various aspects of defense and security operations. These technologies aim to exploit quantum properties such as superposition, entanglement, and quantum coherence to achieve capabilities that surpass classical technologies in several areas including quantum communication, quantum computing, quantum metrology, quantum radar and lidar, quantum simulation, and many others.

The military quantum technologies market is driven by the need for enhanced security, advanced computational power, and precise sensing capabilities. Significant investments and geopolitical competition are accelerating development, while integration with existing systems further boosts growth in this sector. For instance, IQM Quantum Computers, OpenOcean, and Lakestar released the OpenOcean-IQM-Lakestar State of Quantum 2024 Report, Over 30 governments have pledged over $40 billion in public funding for quantum technologies, with over 20 actively involved. National labs and dedicated computing centers have accelerated practical applications, representing an estimated 2x the quantum VC investment peak in 2022.

According to the Centre for Land Warfare Studies, India has made great progress toward establishing itself as a major participant in quantum computing. The Indian government has shown its commitment to creating indigenous quantum capabilities by establishing the National Mission on Quantum Technologies and Applications (NM-QTA) in the 2020-21 budget, with an outlay of Rs 8,000 crores (roughly $1.1 billion) over five years.

Report Coverage

This research report categorizes the market for quantum technologies in military based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the quantum technologies in military market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the quantum technologies in military market.

Global Quantum Technologies in Military Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 19.2% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Technology, By Application, By End-User, By Region |

| Companies covered:: | IBM, Lockheed Martin Corporation, Northrop Grumman Corporation, International Defense Security & Technology Inc., Boeing, Raytheon Technologies, D-Wave Systems, Honeywell Quantum Solutions, Quantum Coating Inc., Rigetti Computing, The Whisper Company, Sweetwater Defense, QUANTUM DEFEN5E (QD5), and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The adoption of quantum technologies in the military market is propelled by several compelling factors including the need for enhanced security and encryption methods that quantum systems offer, ensuring robust protection of sensitive military communications and data. Quantum computing's unparalleled computational power promises to revolutionize logistics optimization, cryptography, and simulations critical to military operations. Advancements in quantum sensors and imaging technologies provide superior capabilities for detecting stealthy targets and enhancing situational awareness. Moreover, the dual-use potential of these technologies fosters collaboration across military, academic, and commercial sectors, accelerating innovation. Amid global competition and strategic imperatives, nations are investing heavily to maintain technological superiority and leverage quantum advancements for defense applications, marking a pivotal shift in military technology development towards quantum technologies in the military market worldwide.

Restraining Factors

The adoption of quantum technologies in the military market faces several significant restraining factors including the technological immaturity of many quantum systems, which limits their practical deployment due to issues like scalability and reliability. High costs associated with research, development, and infrastructure also pose financial challenges for military budgets, hindering widespread implementation. For instance, according to Quantum Insider report 2024, Venture capital investment in quantum companies fell by half, from $2.2 billion in 2022 to about $1.2 billion in 2023 globally, Europe, Middle East, and Africa increased by 3%, the United States fell by 80%, and the APAC region decreased by 17%.

Market Segmentation

The quantum technologies in military market share are classified into technology, application, and end-user.

- The quantum computing segment is estimated to hold the highest market revenue share through the projected period.

Based on the technology, the quantum technologies in military market are classified into quantum computing, quantum sensing, and quantum communication. Among these, the quantum computing segment is estimated to hold the highest market revenue share through the projected period. Quantum computing is attributed to its potential to revolutionize military operations by offering unprecedented computational power, capable of solving complex problems exponentially faster than classical computers. This capability is particularly valuable in areas such as cryptography, simulations for weapons development, optimizing logistics, and conducting advanced research in materials science and chemistry.

- The quantum communication network segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the quantum technologies in military market are divided into quantum cybersecurity, quantum communication network, quantum positioning, navigation, and timing (PNT) systems, quantum underwater warfare, quantum space warfare, and others. Among these, the quantum communication network segment is anticipated to hold the largest market share through the forecast period. Quantum communication network networks are pivotal for military operations due to their ability to provide highly secure communication channels using quantum key distribution (QKD) and advanced cryptographic protocols. As cybersecurity threats continue to evolve, defense agencies prioritize investments in quantum communication to safeguard sensitive military data against interception and cyber-attacks. Ongoing advancements in quantum communication networks further enhance the efficiency and reliability of these networks, driving their adoption across global defense sectors.

- The airforce segment dominates the market with the largest market share through the forecast period.

Based on the end-user, the quantum technologies in military market are categorized into airforce, army, and navy. Among these, the airforce segment dominates the market with the largest market share through the forecast period. This dominance is driven by the air force's strategic focus on technological superiority and its specific operational needs. Quantum technologies offer significant advantages in communication, computing, and sensing, crucial for air force missions such as surveillance, reconnaissance, and early warning systems. Governments and defense agencies worldwide are increasingly investing in quantum technologies to enhance air force capabilities, reflecting the sector's pivotal role in advancing military applications of quantum technologies.

Regional Segment Analysis of the Quantum Technologies in Military Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the quantum technologies in military market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the quantum technologies in military market over the predicted timeframe. North America region dominance is due to the region's robust technological prowess and extensive investments in quantum research and development, particularly spearheaded by the U.S. Department of Defense and other defense agencies. With a strong foundation of defense contractors, research institutions, and government initiatives focused on advancing quantum technologies, North America benefits from strategic collaborations that accelerate innovation. The region's substantial defense market size and high demand for cutting-edge military capabilities further bolster its role as a global leader in driving growth and application of quantum technologies for military purposes. Top of Form

Bottom of Form

Asia Pacific is expected to grow at the fastest CAGR growth of the quantum technologies in military market during the forecast period. This growth is driven by increasing defense expenditures across countries like China, India, Japan, and South Korea, aimed at modernizing military capabilities. The region's rapid technological advancements, coupled with strategic geopolitical dynamics and initiatives promoting indigenous research and development, further bolster its position. With a burgeoning market potential and heightened demand for advanced military technologies, Asia Pacific emerges as a pivotal area for the adoption and integration of quantum computing, communication, and sensing technologies within military operations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the quantum technologies in the military market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IBM

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- International Defense Security & Technology Inc.

- Boeing

- Raytheon Technologies

- D-Wave Systems

- Honeywell Quantum Solutions

- Quantum Coating Inc.

- Rigetti Computing

- The Whisper Company

- Sweetwater Defense

- QUANTUM DEFEN5E (QD5)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Taiwan’s National Science and Technology Council (NSTC) group visits Finland and France to boost quantum technology collaboration.

- In May 2024, DIU developed a new emerging tech portfolio and seeks industry for quantum sensing capabilities.

- In March 2024, The Indian Army established an elite tech unit, STEAG, to investigate future communication technologies. This elite team is charged with exploring and evaluating future communication technologies such as 6G, artificial intelligence (AI), machine learning, and quantum computing for military purposes.

- In April 2024, Rigetti and Oxford Instruments nanoscience announced the successful Completion of the Innovate UK Project to Launch One of the First UK-based Quantum Computers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the quantum technologies in military market based on the below-mentioned segments:

Global Quantum Technologies in Military Market, By Technology

- Quantum Computing

- Quantum Sensing

- Quantum Communication

Global Quantum Technologies in Military Market, By Application

- Quantum Cybersecurity

- Quantum communication network

- Quantum positioning, navigation, and timing (PNT) system

- Quantum Underwater warfare

- Quantum Space warfare

- Others

Global Quantum Technologies in Military Market, By End-User

- AirForce

- Army

- Navy

Global Quantum Technologies in Military Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the quantum technologies in military market over the forecast period?The quantum technologies in the military market are projected to expand at a CAGR of 19.2% during the forecast period.

-

2. What is the market size of quantum technologies in the military market?The Global Quantum Technologies in Military Market Size is Expected to Hold a Significant Share by 2033, at 19.2% CAGR from 2023 to 2033.

-

3. Which region holds the largest share of the quantum technologies in the military market?North America is anticipated to hold the largest share of the quantum technologies in military market over the predicted timeframe.

Need help to buy this report?