Global Quenching Fluids & Salts Market Size, Share, and COVID-19 Impact Analysis By Product (Oil, Polymer and Salts), By Application (Hot quenching and Cold quenching), By End-user (Automotive, Aerospace & defense, Mining, Defense and Others), and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Analysis and Forecast 2021 – 2030

Industry: Chemicals & MaterialsGlobal Quenching Fluids & Salts Market Insights Forecasts to 2030

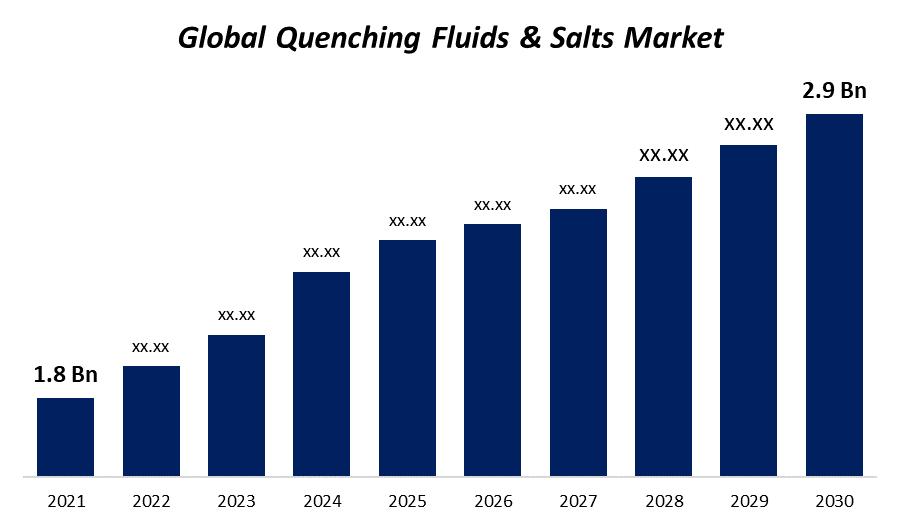

- The global Quenching Fluids & Salts Market was valued at USD 1.8 Billion in 2021.

- The Market is growing at a CAGR of 4.0% from 2021 to 2030

- The global Quenching Fluids & Salts Market is expected to reach USD 2.9 Billion by 2030

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The global Quenching Fluids & Salts Market is expected to reach USD 2.9 Billion by 2030, at a CAGR of 4.0% during the forecast period 2021 to 2030. Global Quenching Fluids & Salts Market demand is expected to increase due to rising product demand in modern heat-treatment techniques. Additionally, the global automobile industry's growth, the adoption of polymer quenchant products, and growing safety concerns will all contribute to the industry's advancement in the field of quenching fluids and salts.

Market Overview

Quenching fluids and salts are the kinds of chemical products that are used while processing different kinds of metals to give them the necessary metallurgical qualities. The heat treatment process is typically carried out internally by commercial heat treatment companies as well as by numerous end-user industries & metal working industries that utilise the heat treatment process inside their units. The quenching fluids & salts market will be driven by rising industrial growth in a number of emerging economies, such as India, Brazil, Vietnam, and Mexico over the forecast period. Additionally, to attain the appropriate metal qualities, the automotive sector needs a heat treatment method. The housing sector profits from the increasing population and increased population, which also drives the total building industry. The desire for different electrical and technological equipment has also been driven by the increase in disposable income. Additionally, the need for quenching fluids and salts will continue to rise as a result of the quickly developing technological innovations and the necessity to modify the properties of metals. Due to the building and construction materials there is rapid development in the Quenching fluids and salts market, there has been an increase in the demand for building materials including metals and polymer quenching fluids in recent years. In the coming years, expansion in the construction sector is projected to have a beneficial effect on the market for quenching fluids and salts. The market of quenching fluids and salts has been significantly damaged by the COVID-19 epidemic. To decrease the risk of COVID-19 infections, governments have implemented stringent restrictions and regulations. These rules resulted in the closure or restriction of operation of a number of industrial units. Low production yield was the result. The adoption of strict government regulations that had a negative influence on corporate strategy slowed the growth of many end-use sectors. However, in the market in quenching fluids and salts a global lockdown can be lifted in order to encourage growth.

Report Coverage

This research report categorizes the Market for global Quenching Fluids & Salts based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Global Quenching Fluids & Salts Market. Recent Market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the Market. The report strategically identifies and profiles the key Market players and analyses their core competencies in each global Quenching Fluids & Salts Market sub-segments.

Global Quenching Fluids & Salts Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 1.8 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 4.0% |

| 2030 Value Projection: | USD 2.9 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 204 |

| Tables, Charts & Figures: | 133 |

| Segments covered: | By Product, By Application, By End-user By Region, COVID-19 Impact Analysis |

| Companies covered:: | Petrofer, CONDAT, Exxon Mobil Corporation, Castrol Ltd., Croda International Plc., Chevron Corporation, Chemtool Incorporated, FUCHS, Quaker Chemical Corporation, DuBois Chemicals, and Quaker Houghton |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Segmentation Analysis

- In 2021, the Oil segment dominated the Market with the largest Market share of 41.1% and Market revenue of 1.60 Billion.

Based on the Product, the global Quenching Fluids & Salts Market is categorized into Oil, Polymer and Salts. In 2021, the Oil segment dominated the Market with the largest Market share of 41.1% and Market revenue of 1.60 Billion. Global Quenching Fluids & Salts Market demand is expected to increase due to rising product demand in modern heat-treatment techniques. Low-speed oils, medium-speed oils, specific types of quenching oils, fast-speed oils, and other oil products are used in the quenching fluids & salts market. Medium-speed oils are used with metals that need consistent metallurgical properties and medium to high hardening abilities. Furthermore, unique requirements and various heat treatment methods typically call for using specialised types of quenching oils. The demand for quenching products in the market is anticipated to rise significantly throughout the forecasted period.

- In 2021, the Cold quenching segment accounted for the largest share of the Market, with 53.3% and a Market revenue of 2.07 Billion.

Based on the Application, the Quenching Fluids & Salts Market is categorized into Hot quenching and Cold quenching. In 2021, the Cold quenching segment accounted for the largest share of the Market, with 53.3% and a Market revenue of 2.07 Billion. Many different automobile parts, including springs, fastening tools, and many kinds of forged components, use the cold quenching technique. Cold quenching oils provide the operational flexibility of many commercial heat treatment facilities. This causes its use in heat treatment facilities to increase throughout the forecasted period. Due to the increasing high economic status and rising air travel, the market for quenching fluids and salts is anticipated to gain from the increased demand for aircraft components in various emerging nations.

- In 2021, the Aerospace segment accounted for the largest share of the Market, with 25.7% and a Market revenue of 1.00 Billion.

Based on the End-user, the Quenching Fluids & Salts Market is categorized into Automotive, Aerospace & Defence, Mining, Domestic and Other. In 2021, the Aerospace segment accounted for the largest share of the Market, with 25.7% and a Market revenue of 1.00 Billion. The widespread demand in the Aerospace segment is primarily responsible for the market growth. Aerostructures, landing gears, jet engine parts, and other crucial aerospace sector components are all produced using the heat treatment technique. The aerospace industry will be encouraged by the increase of domestic and international travel in several emerging nations, including China, India, Brazil, and Vietnam. Additionally, the aviation industry will also be driven by rising middle-class populations that like flying and expanding international tourism due to lower flight fares and is anticipated to rise significantly throughout the forecasted period.

Regional Segment Analysis of the Quenching Fluids & Salts Market

Get more details on this report -

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

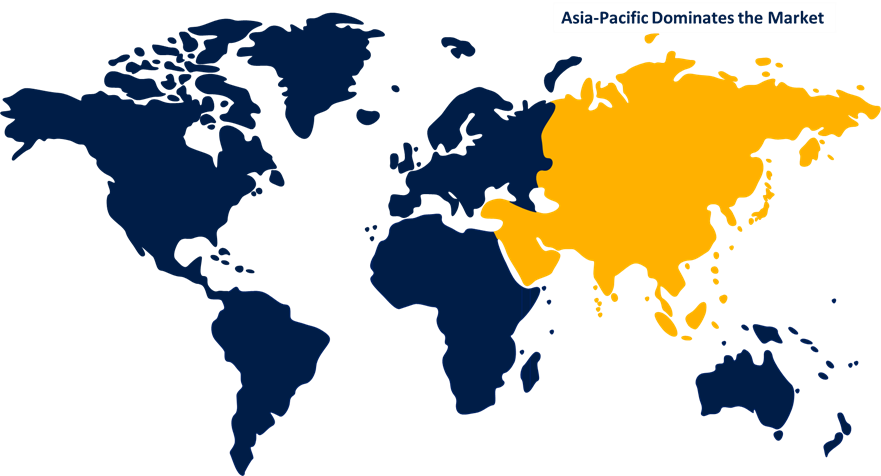

Asia Pacific emerged as the largest Market for the global Quenching Fluids & Salts Market, with a Market share of around 33.3% and 1.29 Billion of the Market revenue in 2021.

- Asia Pacific emerged as the largest Market for the global Quenching Fluids & Salts Market, with a Market share of around 33.3% and 1.29 Billion of the Market revenue in 2021. The demand for Quenching Fluids & Salts s is being driven by the rising acceptance by the market. driven by the region's expanding aerospace and automotive industry. China and India are the main drivers of the region's auto sales. Additionally, over the anticipated period, the market for quenching fluids & salts in the region will be supported by the expansion of heat treatment facilities in the area. Sales of electric vehicles are increasing throughout the Asia Pacific due to the increasing penetration of electric-driven vehicles there and the fast developing infrastructure needed for them. Governments in the area are putting policies in place that make it simple and economical to drive electric cars. Growing use of electric vehicles in the region will benefit the global market, the Asia Pacific region is anticipated to lead the market throughout the anticipated period.

- North America Market is expected to grow at the fastest CAGR between 2021 and 2030, owing to the increasing encouragement and benefits for foreign businesses to enter the region. Due to the region's growing commercial heat treatment facilities, North America is predicted to grow at a large rate as demand for quenching products, supportive government initiatives and advantageous economic policies for commercial projects are expected to increase the market share for Quenching Fluids & Salts.

Competitive Landscape

The report offers the appropriate analysis of the key organizations/companies involved within the global Quenching Fluids & Salts Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment Market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and Cold quenching. This allows for the evaluation of the overall competition within the Market.

List of Key Market Players:

- Petrofer

- CONDAT

- Exxon Mobil Corporation

- Castrol Ltd.

- Croda International Plc.

- Chevron Corporation

- Chemtool Incorporated

- FUCHS

- Quaker Chemical Corporation

- DuBois Chemicals

- Quaker Houghton

Key Target Audience

- Market Players

- Investors

- Applications

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Some of the Key Developments:

- In May 2017, The new THERMA series of quenching oils from CONDAT complies with the new oil consumption regulations. High-refined base oils are used in producing these goods, which improves the effectiveness of the heat-treating procedure.

- In November 2019, The Indian government outlined a plan to invest around USD approximately two billion in buses to improve the nation's public transportation system.

Market Segment

This study forecasts global, regional, and country revenue from 2019 to 2030. Spherical Insights has segmented the global Quenching Fluids & Salts Market based on the below-mentioned segments:

Global Quenching Fluids & Salts Market, By Product

- Oil

- Polymer

- Salts

Global Quenching Fluids & Salts Market, By Application

- Hot quenching

- Cold quenching

Global Quenching Fluids & Salts Market, By End-user

- Automotive

- Aerospace & defense

- Mining

- Domestic

- Other

Global Quenching Fluids & Salts Market, Regional Analysis

- North America

- US

- Canada

- Mexico

-

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

South America

- Brazil

- Argentina

- Rest of South America

Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?