Global Radiation Hardened Electronics Market Size, Share, and COVID-19 Impact Analysis, By Component (Mixed Signal ICs, Processors & Controllers, Memory, and Power Management), By Manufacturing Technique (Radiation Hardening By Design (RHBD) and Radiation Hardening By Process (RHBP)), By Product Type (Commercial Off-the-Shelf and Custom Made), By Application (Aerospace & Defense, Medical, Nuclear Power Plants, Space, and Others), Analysis and Forecast 2023 - 2033.

Industry: Semiconductors & ElectronicsGlobal Radiation Hardened Electronics Market Insights Forecasts to 2033

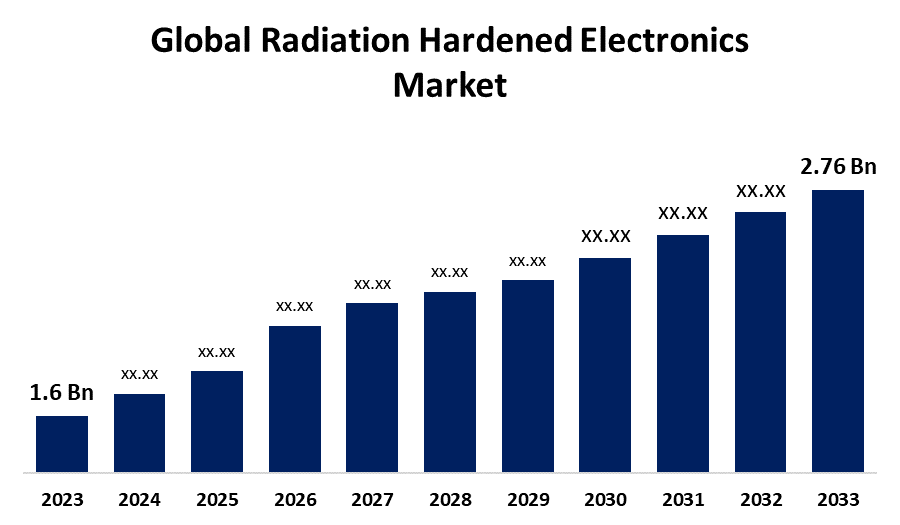

- The Global Radiation Hardened Electronics Market Size was estimated at USD 1.6 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 5.6% from 2023 to 2033

- The Worldwide Radiation Hardened Electronics Market Size is Expected to Reach USD 2.76 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Radiation Hardened Electronics Market Size was worth around USD 1.6 Billion in 2023 and is predicted to Grow to around USD 2.76 Billion by 2033 with a compound annual growth rate (CAGR) of around 5.6% between 2023 and 2033. Continuous research and development efforts in the electronic field contribute to market growth.

Market Overview

The global radiation-hardened electronics market is a niche area that specializes in offering electronic components and systems that can withstand harsh environmental conditions such as intense radiation, extreme temperatures, and pressure. These components are mostly used in aerospace, defense, and space applications where electronic devices must function without failure in space or high-radiation environments. Radiation-hardened electronics are required in satellites, spacecraft, military systems, and high-altitude operations to ensure that critical systems are long-lived and effective, especially when exposed to cosmic and solar radiation. The market is consistently growing owing to the advancements in space exploration and deployment of satellites and increasing demand for high-reliability electronics in defense systems. The growing focus on LEO satellite constellations and deep space exploration programs further accelerates the quest for radiation-hardened electronics. In addition, progress in semiconductor technology and innovation of new materials as well as methods of manufacture further improved the radiation-hardened components' performance and durability. Despite the huge costs involved in production and development, the market for radiation-hardened electronics is critical to space and defense mission reliability, so continuous investments and research have been made in this niche sector.

Report Coverage

This research report categorizes the radiation hardened electronics market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the radiation hardened electronics market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the radiation hardened electronics market.

Global Radiation Hardened Electronics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.6 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.6% |

| 2033 Value Projection: | USD 2.76 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Component, By Manufacturing Technique, By Process (RHBP), By Product Type, By Application |

| Companies covered:: | Honeywell International Inc., Advanced Micro Devices, Inc., BAE Systems., STMicroelectronics, Infineon Technologies AG, Texas Instruments Incorporated, Microchip Technology Inc., Renesas Electronics Corporation., Teledyne Technologies Incorporated., TTM Technologies Inc, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising global demand for electronic equipment, spurred by increasing consumer disposable incomes, is a strong factor driving the radiation-hardened (rad-hard) electronics market. Increasing consumer interest in electronic devices, along with reliable and safe electronics, such as radiation-hardened components, is expected to provide growth opportunities in the market.

Restraining Factors

Complexity in the design of an actual testing environment and high development and designing costs are likely to prove to be the biggest deterrents to the growth of radiation-hardened electronics.

Market Segmentation

The radiation hardened electronics market share is classified into component, manufacturing technique, product type, and application.

- The power management segment accounted for the largest share in 2023 and is projected to grow at a significant CAGR during the forecast period.

Based on the component, the radiation hardened electronics market is divided into mixed signal ICs, processors & controllers, memory, and power management. Among these, the power management segment accounted for the largest share in 2023 and is projected to grow at a significant CAGR during the forecast period. The growth of this segment is driven because it plays an important role in ensuring the reliability and functionality of electronic systems operating within high-radiation environments. In nuclear power plants where, safe operation always relies on electronics, radiation-hardened power management systems are essential to prevent risks or even entire shutdowns.

- The radiation hardening by design (RHBD) segment accounted for a highest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the manufacturing technique, the radiation hardened electronics market is divided into radiation hardening by design (RHBD) and radiation hardening by process (RHBP). Among these, the radiation hardening by design (RHBD) segment accounted for a highest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment growth is driven by designing the components to naturally resist radiation effects rather than leveraging radiation-hardened materials, it lowers the demand for additional protective measures as well as reduces the overall cost of production. RHBD-based memory cells in the transistor chip have better reliability and efficiency, improved stability under stress, and low power consumption.

- The commercial off-the-shelf segment accounted for the largest market share in 2023 and is expected to grow at a substantial CAGR during the forecast period.

Based on product type, the radiation hardened electronics market is divided into commercial off-the-shelf and custom made. Among these, the commercial off-the-shelf segment accounted for the largest market share in 2023 and is expected to grow at a substantial CAGR during the forecast period. The growth in the segment is primarily driven by the need for highly reliable microelectronics at a much lower cost, fueled by the space sector by projects like NASA's deep space missions and deployment of large constellations of small satellites.

- The space segment accounted for the largest share and is anticipated to grow at the remarkable CAGR during the forecast period.

Based on application, the global radiation hardened electronics market is divided into aerospace & defense, medical, nuclear power plants, space, and others. Among these, the space segment accounted for the significant share and is anticipated to grow at the remarkable CAGR during the forceast period. The growth of this segment is due to the rising demand for advanced electronic components that can endure the harsh conditions of radiation and temperature in space environments.

Regional Segment Analysis of the Radiation Hardened Electronics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the radiation hardened electronics market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the radiation hardened electronics market over the predicted timeframe. The United States remains a significant user of satellite-based telemetry and communication systems, increasing the demand for radiation-resistant electronics in North America. Existing strong R&D and manufacturing infrastructure is also one such factor that contributed to the growth of the region in the target market, through the presence of several leading companies in the electronic manufacturing sector within the region.

Asia Pacific is expected to grow at a fastest CAGR in the radiation hardened electronics market during the forecast period. Rising space exploration programs and satellite deployments by countries such as China and India are behind the regional growth. Growing defense & aerospace industries as well as increased spending on vital infrastructure boost the demand for radiation-resistant electronic components. Asia Pacific could be a potential hub for this business, considering government initiatives and semiconductor technologies developed.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the radiation hardened electronics market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Honeywell International Inc.

- Advanced Micro Devices, Inc.

- BAE Systems.

- STMicroelectronics

- Infineon Technologies AG

- Texas Instruments Incorporated

- Microchip Technology Inc.

- Renesas Electronics Corporation.

- Teledyne Technologies Incorporated.

- TTM Technologies Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2023, Infineon Technologies AG announced the expansion of its radiation-hardened asynchronous static RAMs range with built-in Error Correction Code (ECC) memory for space and other challenging environments.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the radiation hardened electronics market based on the below-mentioned segments:

Global Radiation Hardened Electronics Market, By Component

- Mixed Signal ICs

- Processors & Controllers

- Memory

- Power Management

Global Radiation Hardened Electronics Market, By Manufacturing Technique

- Radiation Hardening By Design (RHBD)

- Radiation Hardening By Process (RHBP)

Global Radiation Hardened Electronics Market, By Product Type

- Commercial off-the-Shelf

- Custom Made

Global Radiation Hardened Electronics, By Application

- Aerospace & Defense

- Medical

- Nuclear Power Plants

- Space

- Others

Global Radiation Hardened Electronics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?