Global Radome Market Size, Share, and COVID-19 Impact Analysis, By Offering (Radome Body, Accessories), By Frequency (HF/UHF/VHF-Band, L-Band, S-Band, C-Band, X-Band, KU-Band, KA-Band, and Mutli-Band), By Application (RADAR, SONAR, Communication Antenna), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Radome Market Insights Forecasts to 2033

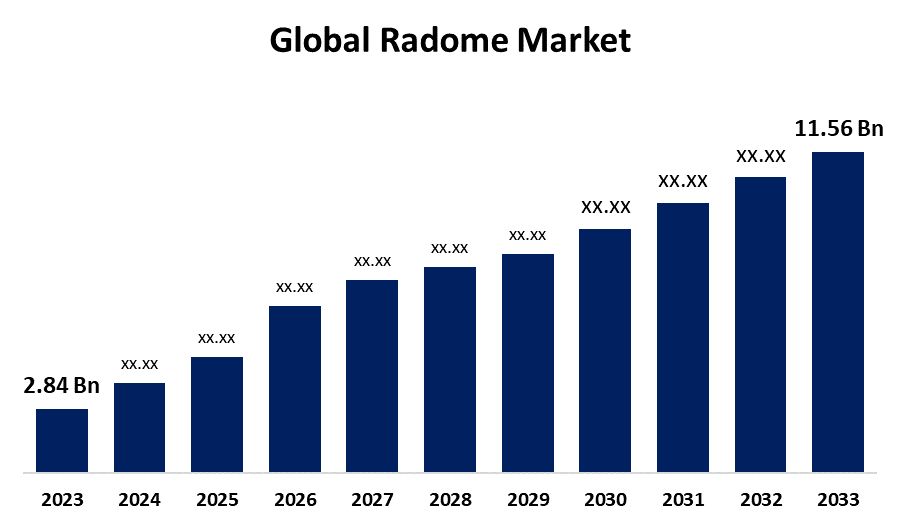

- The Global Radome Market Size was Valued at USD 2.84 Billion in 2023

- The Market Size is Growing at a CAGR of 15.07% from 2023 to 2033

- The Worldwide Radome Market Size is Expected to Reach USD 11.56 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Radome Market Size is Anticipated to Exceed USD 11.56 Billion by 2033, Growing at a CAGR of 15.07% from 2023 to 2033.

Market Overview

A radar antenna is shielded from the elements by a waterproof housing called a radome. The material used to build the radome is radio wave transparent. Radomes shield the antenna from the elements and hide the electrical equipment inside. Radomes are utilized extensively in the aerospace and defense industries. People are shielded from rapidly moving antennas by radars. Increased air travel, telecommunications infrastructure growth, military modernization initiatives, and the necessity for precise weather monitoring and navigation systems are some of the causes driving the market for radome. Innovations in technology have a significant impact on the radome industry. Developments in materials, manufacturing processes, and design methodologies have resulted in the creation of radomes that are radar-transparent, robust, and lightweight. Modern materials such as composites and polymers that transmit radar allow radomes to work at their best even in the most adverse of environments. Therefore, it is anticipated that the market will be driven by the increasing number of antenna installations for communication and surveillance. To shield the antennas from inclement weather, radars are composed of materials with minimal or no signal loss during transmission and reception.

Report Coverage

This research report categorizes the market for the radome market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the radome market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the radome market.

Global Radome Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.84 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 15.07% |

| 2033 Value Projection: | USD 11.56 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Offering, By Frequency, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Lockheed Martin Corporation, Raytheon Technologies, L3harris Technologies, Northrop Grumman Corporation, BAE Systems, Thales Group, Saint-Gobain, General Dynamics Nordam, Comtech Telecommunications, Cobham PLC, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Unmanned systems are integrated with communication antennae and other surveillance equipment to support a number of vital missions. In contrast to other automotive sensors, radar can provide a car with a number of important sensory advantages. Because radars operate at wavelengths between cm and mm, they are highly resistant to inclement weather, including fog, rain, and dust. Additional advantages include exceptional performance in direct sunlight and the ability to record velocity and range simultaneously. Furthermore, unmanned aircraft employ fewer people, lowering the possibility of human casualties.

Restraining Factors

The presence of stringent rules intended to guarantee the safety of aircraft operations is one of the difficulties faced by makers of aircraft radomes. Due to the inherent risks involved in flight operations, the aviation industry is governed by several international regulations.

Market Segmentation

The radome market share is classified into offering, frequency and application.

- The radome body segment is expected to hold the largest share of the radome market during the forecast period.

Based on the offering, the radome market is categorized into radome body, and accessories. Among these, the radome body segment is expected to hold the largest share of the radome market during the forecast period. The market for glass fiber radome bodies is growing as a result of its lightweight design, high strength-to-weight ratio, longevity, adaptability in terms of design, and wide range of applications in various sectors. Technological developments in glass fiber add even more appeal to the material when it comes to building radomes. Because glass fiber is electromagnetic wave transparent, there can be less interference with the underlying radar or communication systems' ability to transmit and receive signals.

- The X-band segment is expected to grow at the fastest CAGR during the forecast period.

Based on the frequency, the radome market is categorized into HF/UHF/VHF-band, L-band, S-band, C-band, X-band, KU-band, KA-band, and mutli-band. Among these, the X-band segment is expected to grow at the fastest CAGR during the forecast period. Aircraft X-band radomes are carefully designed and engineered. The weather radar system's performance might be negatively impacted by even the smallest change in their physical characteristics. For weather monitoring and forecasting, weather radar systems can give high-resolution, precise, and dependable data to the combination of X-band radar technology with radome protection. In order to minimize the influence of ambient circumstances on radar performance and to preserve the operation of sensitive radar equipment, radomes must be used.

- The communication antenna segment is expected to hold a significant share of the radome market during the forecast period.

Based on the application, the radome market is categorized into RADAR, SONAR, and communication antenna. Among these, the communication antenna segment is expected to hold a significant share of the radome market during the forecast period. Numerous important aspects that emphasize the critical function that communication antenna radomes play in guaranteeing dependable and effective communication systems are responsible for the increased demand for these devices. In order to shield the antenna and other integrated components from excessive amounts of ice, water, or other environmental contaminants, radars are used to cover the antenna's exposed surfaces with a weatherproof shell.

Regional Segment Analysis of the Global Radome Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is projected to hold the largest share of the radome market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the radome market over the forecast period. The increasing demand for commercial air travel and growing investments in both commercial and military aviation programs are driving the rapid growth of the Asia Pacific aerospace industry. Radomes are becoming increasingly necessary to safeguard aircraft's delicate radar systems as a result of the aerospace industry's rapid growth. The use of composite materials in the production of radomes is growing in favor because of its excellent qualities, which include a high strength-to-weight ratio, longevity, and resistance to a variety of environmental factors. The market for radomes is being further stimulated by this move toward composite materials.

Europe is expected to grow at the fastest CAGR growth of the radome market during the forecast period. The European aviation industry prioritizes modernization and safety. Radomes are essential parts of commercial aircraft, performing vital tasks like navigation, terrain avoidance, and weather detection. Modern airplanes, especially passenger and cargo aircraft, depend on sophisticated radar systems with protective radomes to operate safely and effectively.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the radome market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lockheed Martin Corporation

- Raytheon Technologies

- L3harris Technologies

- Northrop Grumman Corporation

- BAE Systems

- Thales Group

- Saint-Gobain

- General Dynamics Nordam

- Comtech Telecommunications

- Cobham PLC

- Others

Key Market Developments

- In April 2023, The US Aviation Logistics Center awarded Saint Gobain a contract to repair the nose and radar of an HC-144 aircraft.

- In January 2023, A contract of USD 74.9 million has been given to General Dynamics Corporation's business unit, Mission Systems, by the US Army Contracting Command, Aberdeen Proving Ground, MD, to provide support services for Tactical Network-On the Move systems and equipment.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global radome market based on the below-mentioned segments:

Global Radome Market, By Offering

- Radome body

- Accessories

Global Radome Market, By Frequency

- HF/UHF/VHF-Band

- L-Band

- S-Band

- C-Band

- X-Band

- KU-Band

- KA-Band

- Mutli-Band

Global Radome Market, By Application

- RADAR

- SONAR

- Communication Antenna

Global Radome Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global radome market over the forecast period?The Global Radome Market Size is Expected to Grow from USD 2.84 Billion in 2023 to USD 11.56 Billion by 2033, at a CAGR of 15.07% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global radome market?Asia Pacific is projected to hold the largest share of the radome market over the forecast period.

-

3. Who are the top key players in the radome market?Lockheed Martin Corporation, Raytheon Technologies, L3harris Technologies, Northrop Grumman Corporation, BAE Systems, Thales Group, Saint-Gobain, General Dynamics Nordam, Comtech Telecommunications, Cobham PLC and others.

Need help to buy this report?