Global Railway Telematics Market Size, Share, and COVID-19 Impact Analysis, By Solution (Fleet Management, Train Tracking & Monitoring, Passenger Information Systems, Safety & Security Systems, Predictive Maintenance), By Railcar (Hoppers, Tank Cars, Well Cars, Boxcars, Reefer Cars), By Train Type (Passenger, Freight), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Railway Telematics Market Insights Forecasts to 2033

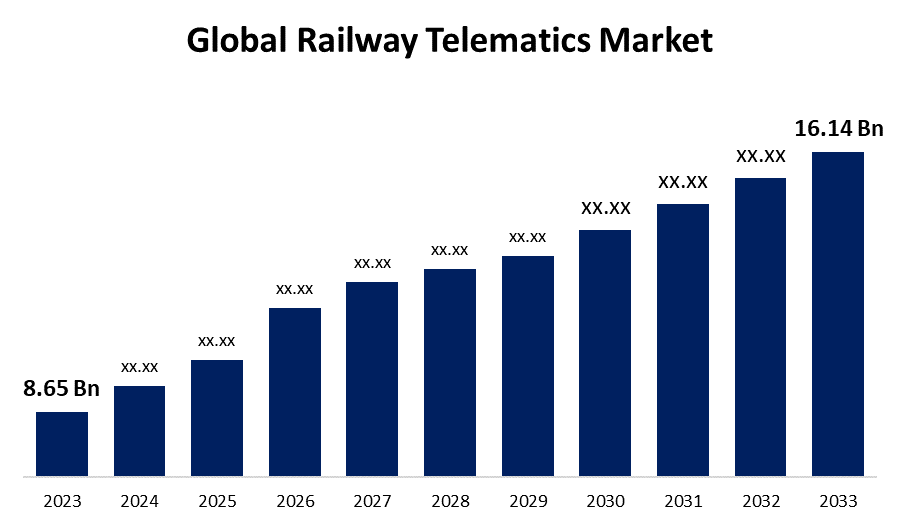

- The Global Railway Telematics Market Size was Valued at USD 8.65 Billion in 2023

- The Market Size is Growing at a CAGR of 6.44% from 2023 to 2033

- The Worldwide Railway Telematics Market Size is Expected to Reach USD 16.14 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Railway Telematics Market Size is Anticipated to Exceed USD 16.14 Billion by 2033, Growing at a CAGR of 6.44% from 2023 to 2033.

Market Overview

Telematics systems enable rail operators to receive real-time information regarding train performance, maintenance requirements, and resource allocations. This allows them to optimize operations, shorten delays, and increase overall production. This emphasis on operational efficiency increases rail companies' profits while also improving passenger service quality. For instance, in November 2022, Alstom SA signed a Long-Term Services Support (LTSS) deal with SBS TRANSIT LTD, a North East Line (NEL) bus operator using Singapore's Urbalis signaling system. This new contract illustrates Alstom's growing reach and ongoing commitment to localizing core competencies in Singapore while ensuring train reliability. The NEL is the world's first entirely automated underground heavy metro system. Alstom will provide technical expertise and on-site maintenance services to the NEL fleet as part of the LTSS beginning in 2023. Telematics have become more important in rail freight and cargo transit. Each year, the world's population grows. Many countries throughout the world face enormous challenges with their transportation infrastructure. Developing countries fall behind in terms of effective goods and transportation services. The worldwide rail sector is constantly changing in terms of technology to improve efficiency and safety.

Report Coverage

This research report categorizes the market for the global railway telematics market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global railway telematics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global railway telematics market.

Global Railway Telematics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 8.65 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 6.44% |

| 023 – 2033 Value Projection: | USD 16.14 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Solution, By Railcar, By Train Type, By Region |

| Companies covered:: | Intermodal Telematics, A1 Digital, Alstom S, Amsted Industries, Hitachi Ltd., IBM Corporation, Intrex Telematics, Knorr-Bremse AG, Norfolk Southern, Railnova SA, Robert Bosch GmbH, Savvy Telematics, Siemens AG, Trinity Industries, Wabtec Corporation, and other key vendors |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The increased budget allocation for railway expansion, as well as the increase in demand for safer, more secure, and efficient transport systems, contribute to the market's global growth. The increasing global urbanization is paving the path for the development of smart cities. Governments throughout the world are considering a variety of smart city projects to improve transport infrastructure and accelerate operational activities in public transit. In addition, the use of multiple sensors in a variety of solutions, including railcar tracing and tracking, collision detection and prevention, and shock detection for accurate threat assessments, is likely to boost the market expansion.

Restraining Factors

High operations and maintenance expenses following deployment are also a major worry for railway authorities. Furthermore, restricted funding for railways limits the deployment of sophisticated railway technologies and solutions by both governments and private companies. As a result, the high initial cost of adopting smart railway solutions and components is likely to slow market growth for railway telematics in the future years.

Market Segmentation

The global railway telematics market share is classified into solution, railcar, and train type.

- The fleet management segment is expected to hold the largest share of the global railway telematics market during the forecast period.

Based on the solution, the global railway telematics market is categorized into fleet management, train tracking & monitoring, passenger information systems, safety & security systems, and predictive maintenance. Among these, the fleet management segment is expected to hold the largest share of the global railway telematics market during the forecast period. There is a growing need for efficient fleet management systems in railway operations to optimize resource utilization and increase operational efficiency. The fleet management technology allows for real-time monitoring of train location and movement, as well as administration of important train activities such as maintenance, fuel consumption, and route optimization.

- The hoppers segment is expected to grow at the fastest CAGR during the forecast period.

Based on the railcar, the global railway telematics market is categorized into hoppers, tank cars, well cars, boxcars, reefer cars. Among these, the hoppers segment is expected to grow at the fastest CAGR during the forecast period. The new GSM and GPS modules have the potential to significantly reduce costs. Interfaces for additional sensors, such as shock detection and digital/analogue inputs/outputs, are included. Furthermore, based on customer requirements, the development of a dependable load detection system for goods cars has begun. This is since most freight cars in use on trains today do not use their full load capacity since there is no cost-effective load monitoring, particularly during the filling-up process, as in the case of bulk freight. The hoppers are innovative solutions that are projected to contribute to the growth of the railway telematics industry.

- The passenger segment is expected to hold a significant share of the global railway telematics market during the forecast period.

Based on the train type, the global railway telematics market is categorized into passenger and freight. Among these, the passenger segment is expected to hold a significant share of the global railway telematics market during the forecast period. Railway operators place a high focus on ensuring passenger safety and security. Telematics technologies offer real-time monitoring, allowing operators to track train locations, analyze passenger flow, and control security systems. Implementing telematics systems allows rail operators to improve safety measures, detect and respond to security risks quickly, and create a safe environment for passengers.

Regional Segment Analysis of the Global Railway Telematics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is projected to hold the largest share of the global railway telematics market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global railway telematics market over the forecast period. Increased penetration of new technology, rising national GDPs, consistent growth, and expanding economies. The APAC region includes some of the potential markets, including China, India, Japan, and the rest of Asia Pacific. China is expected to lead the market in terms of share and growth rate, followed by India, Japan, and the Rest of Asia Pacific countries. For example, in April 2022, the Indian Ministry of Railways reached an agreement with the Centre for Development of Telematics (C-DOT) to modernize operational and safety communications infrastructure. The agreement seeks to establish a cooperative working partnership between the ministry and C-DOT for resource sharing and coordination. C-DOT and the ministry worked together to use LTE-R; a next-generation communications network designed exclusively for railway services.

North America is expected to grow at the fastest CAGR growth of the global railway telematics market during the forecast period. The region has seen an increase in the use of telemetry technologies in passenger and freight train operations. The regional market's growth is driven by factors such as the demand for operational efficiency, safety advancements, and regulatory compliance. Furthermore, government attempts to modernize railways and improve transport networks are fueling the region's use of telematics technologies. The presence of several original equipment manufacturers in the United States is unquestionably one of the primary reasons behind the country's leadership. Manufacturers like Robert Bosch, Amsted Digital, and others are driving the expansion of the railway telematics business in the United States.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global railway telematics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Intermodal Telematics

- A1 Digital

- Alstom S

- Amsted Industries

- Hitachi Ltd.

- IBM Corporation

- Intrex Telematics

- Knorr-Bremse AG

- Norfolk Southern

- Railnova SA

- Robert Bosch GmbH

- Savvy Telematics

- Siemens AG

- Trinity Industries

- Wabtec Corporation

- Others

Key Market Developments

- In April 2024, Thales, a global leader in railway systems, and its partners SISINT and CONECTICABO have announced the successful acquisition of three key contracts, cementing Thales' position as a valued partner in the Portuguese railway's ongoing modernization journey.

- In March 2023, TTX announced plans to install telemetry equipment on its railcars, assisting its railway owners in pushing for efficiency and customer development. Installing GPS devices is simple: weld a bracket to the vehicle and match the device to the car ID. All TTX applications follow the Association of American Railroads' (AAR) remote monitoring equipment installation criteria.

- In February 2022, Siemens AG has launched the Railigent Asset Management System, which is IoT-enabled. This system monitors and manages rail assets in real time using predictive analytics, resulting in increased efficiency, safety, and reliability.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global railway telematics market based on the below-mentioned segments:

Global Railway Telematics Market, By Solution

- Fleet Management

- Train Tracking & Monitoring

- Passenger Information Systems

- Safety & Security Systems

- Predictive Maintenance

Global Railway Telematics Market, By Railcar

- Hoppers

- Tank Cars

- Well Car

- Boxcars

- Reefer Cars

Global Railway Telematics Market, By Train Type

- Passenger

- Freight

Global Railway Telematics Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global railway telematics market over the forecast period?The Global Railway Telematics Market Size is Expected to Grow from USD 8.65 Billion in 2023 to USD 16.14 Billion by 2033, at a CAGR of 6.44% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global railway telematics market?Asia Pacific is projected to hold the largest share of the global railway telematics market over the forecast period.

-

3. Who are the top key players in the railway telematics market?Intermodal Telematics, A1 Digital, Alstom S, Amsted Industries, Hitachi Ltd., IBM Corporation, Intrex Telematics, Knorr-Bremse AG, Norfolk Southern, Railnova SA, Robert Bosch GmbH, Savvy Telematics, Siemens AG, Trinity Industries, Wabtec Corporation, and others.

Need help to buy this report?