Global RDX, HMX, and C-4 Market Size, Share, and COVID-19 Impact Analysis, By Type (C-4, RDX (Research Department Explosive), and HMX (High Melting Explosive)) By Application (Construction, Defense & Military, Oil & Gas, Mining and Quarrying, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal RDX, HMX, and C-4 Market Insights Forecasts to 2033

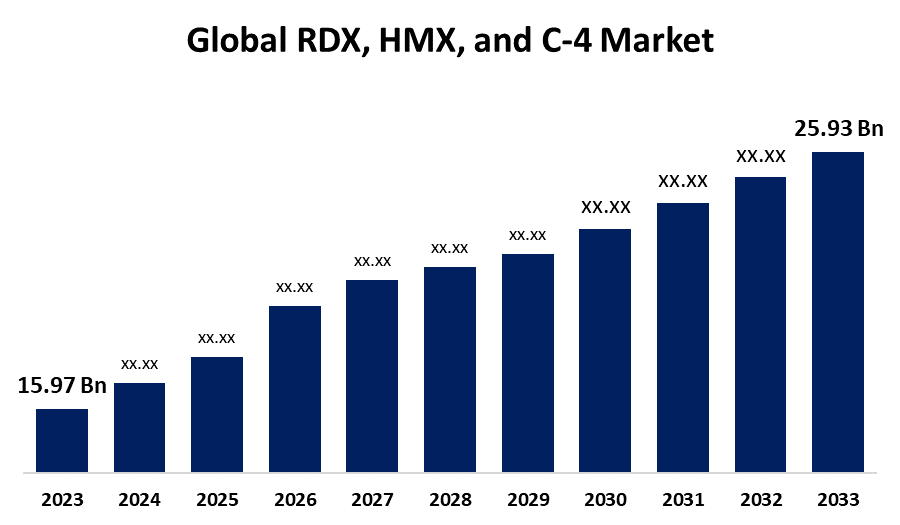

- The Global RDX, HMX, and C-4 Market Size was estimated at USD 15.97 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 4.97% from 2023 to 2033

- The Worldwide RDX, HMX, and C-4 Market Size is Expected to Reach USD 25.93 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global RDX, HMX, and C-4 Market Size is expected to cross USD 25.93 Billion by 2033, Growing at a CAGR of 4.97% from 2023 to 2033.

Market Overview

The RDX, HMX, and C-4 market is referred to as the international trade and application of certain specific high-energy explosive types applicable in mining, construction, demolition, and military uses. RDX and HMX find useful applications in usage for propellants and explosives as they are highly stable and powerful in delivering energy. The global market is dominated by the mining and defense aerospace industries, which have prompted military applications of high explosives like C-4, RDX, and HMX. C-4 is a very stable plastic explosive material widely used in demolition operations by the military. The main driving forces behind the RDX, HMX, and C-4 markets include advancements in explosive technology, an increase in defense expenditure, growing demand in the mining and construction industries, and regulatory concerns affecting the consumption of military and industrial explosives around the world. The main factor driving the rapidly growing RDX, HMX, and C-4 markets is an upsurge in demand from end-users, particularly for defense and military uses. The RDX market is likely to be driven by the growing number of mining activities globally.

Report Coverage

This research report categorizes the RDX, HMX, and C-4 market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the RDX, HMX, and C-4 market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the RDX, HMX, and C-4 market.

Global RDX, HMX, and C-4 Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 15.97 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.97% |

| 2033 Value Projection: | USD 25.93 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 154 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Chemring Group PLC, PT. Dahana, BAE Systems, PRVA ISKRA - NAMENSKA A.D, Austin Powder, Solar Industries India Ltd, Premier Explosives Ltd, NITRO-CHEM S.A, STV Group, Eurenco, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Some of the major growth drivers responsible for the rise of the RDX, HMX, and C-4 market are the vast rises in military spending across the world. To improve their defense, countries continuously spend on advanced explosive materials. The considerable increase in the defense budget is forcing several nations, including the to seek high-performance explosive compounds such as RDX, HMX, and C-4 market. The development of sophisticated weapons and the need for an upgrade to current military armaments are some factors driving the growth of the RDX, HMX and C-4 market.

Restraining Factors

The market for RDX, HMX, and C-4 is restricted by stringent regulations, safety issues, environmental effects, high production costs, and possible limitations on military-grade explosives as a result of international treaties and geopolitical tensions.

Market Segmentation

The RDX, HMX, and C-4 market share are classified into type and application.

- The RDX (research department explosive) segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the RDX, HMX, and C-4 market is divided into C-4, RDX (research department explosive), and HMX. Among these, the RDX (research department explosive) segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. RDX (research development explosive) demand is usually higher in the market. This is due to it is relatively easier to manufacture and has a diversified use, ranging from military explosives to demolition, and even some industrial uses.

- The defense & military segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the RDX, HMX, and C-4 market is divided into construction, defense & military, oil & gas, mining and quarrying, and others. Among these, the defense & military held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. In addition to the growing defense budgets in other regions of the world, the claim is also supported by the growing demand for sophisticated military technology.

Regional Segment Analysis of the RDX, HMX, and C-4 Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the RDX, HMX, and C-4 market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the RDX, HMX, and C-4 market over the predicted timeframe. North American C-4, RDX, and HMX comprise about 29.9% share of global market. North America is the leader in the world when it comes to explosives research and development due to the region’s advanced centers and high defense budget. The United States is the largest contributor to this region. North America spends more on defense and has more sophisticated military equipment compared to other regions, in addition to the demand for explosives from mining and building activities in the region.

Asia Pacific is expected to grow at the fastest CAGR growth of the RDX, HMX, and C-4 market during the forecast period. The rise in terrorist activities leads to an increase in weapon and ammunition procurement by major militaries around the world, primarily in the Asia-Pacific region. Strengthening the arms and ammunitions industry is likely to increase the demand for explosives such as RDX and HMX over the next forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the RDX, HMX, and C-4 market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Chemring Group PLC

- PT. Dahana

- BAE Systems

- PRVA ISKRA - NAMENSKA A.D

- Austin Powder

- Solar Industries India Ltd

- Premier Explosives Ltd

- NITRO-CHEM S.A

- STV Group

- Eurenco

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2023, Solar Industries India agreed to acquire 98.39% of Rajasthan Explosives & Chemicals in a business acquisition agreement. The consideration shall be issued in the form of redeemable preference shares to the existing shareholders of Rajasthan Explosives & Chemicals.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the RDX, HMX, and C-4 market based on the below-mentioned segments:

Global RDX, HMX, and C-4 Market, By Type

- C-4

- RDX (Research Department Explosive)

- HMX (High Melting Explosive)

Global RDX, HMX, and C-4 Market, By Application

- Construction

- Defense & Military

- Oil & Gas

- Mining and Quarrying

- Others

Global RDX, HMX, and C-4 Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the RDX, HMX, and C-4 market over the forecast period?The RDX, HMX, and C-4 market is projected to expand at a CAGR of 4.97% during the forecast period.

-

2. What is the market size of the RDX, HMX, and C-4 market?The Global RDX, HMX, and C-4 Market Size is Expected to Grow from USD 15.97 Billion in 2023 to USD 25.93 Billion by 2033, at a CAGR of 4.97% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the RDX, HMX, and C-4 market?North America is anticipated to hold the largest share of the RDX, HMX, and C-4 market over the predicted timeframe.

Need help to buy this report?